Once you open the online PDF editor by FormsPal, it is easy to fill in or modify sheltered workshop tax credit here and now. FormsPal is committed to providing you the best possible experience with our editor by consistently adding new functions and upgrades. With these improvements, working with our editor becomes better than ever! For anyone who is seeking to begin, this is what it requires:

Step 1: Just click on the "Get Form Button" above on this webpage to get into our pdf form editor. There you'll find all that is required to work with your document.

Step 2: This tool offers you the capability to customize your PDF document in many different ways. Improve it with any text, correct existing content, and put in a signature - all at your convenience!

This PDF form will need specific details; in order to guarantee accuracy and reliability, make sure you consider the suggestions further on:

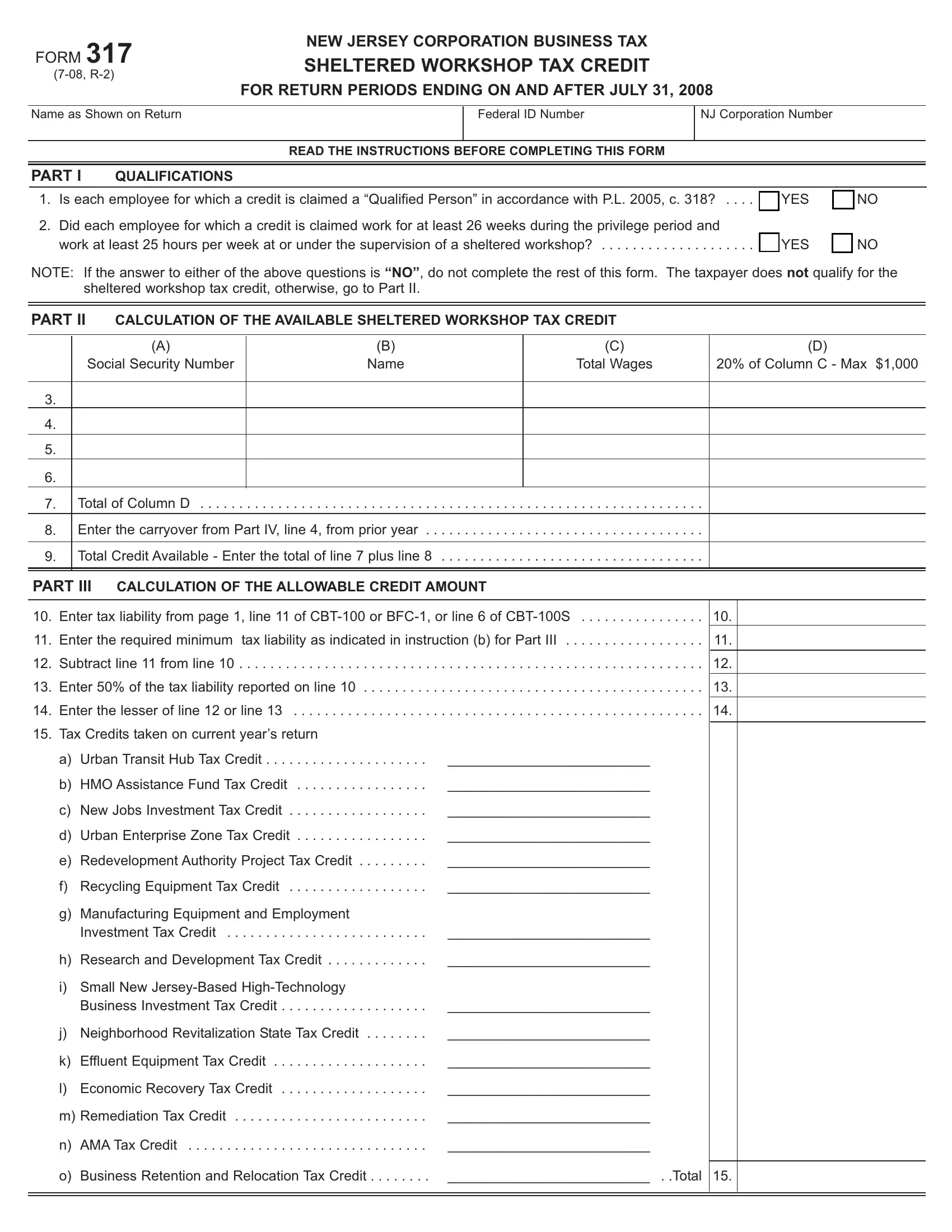

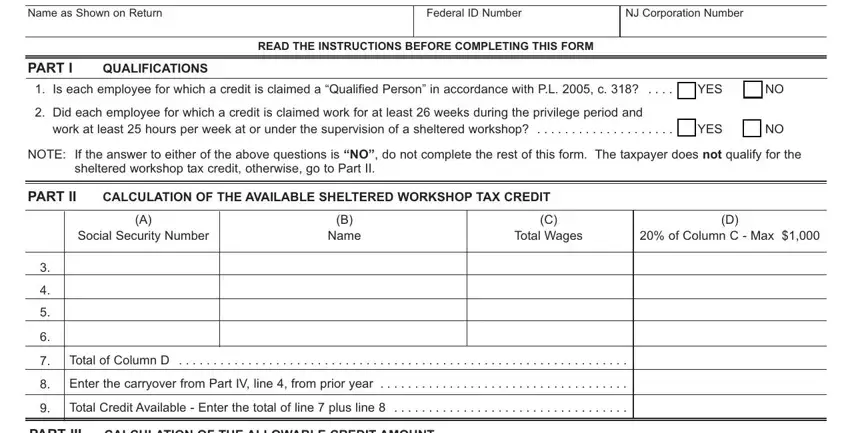

1. While filling out the sheltered workshop tax credit, make sure to complete all of the important blanks within the relevant section. It will help to facilitate the work, which allows your information to be processed quickly and correctly.

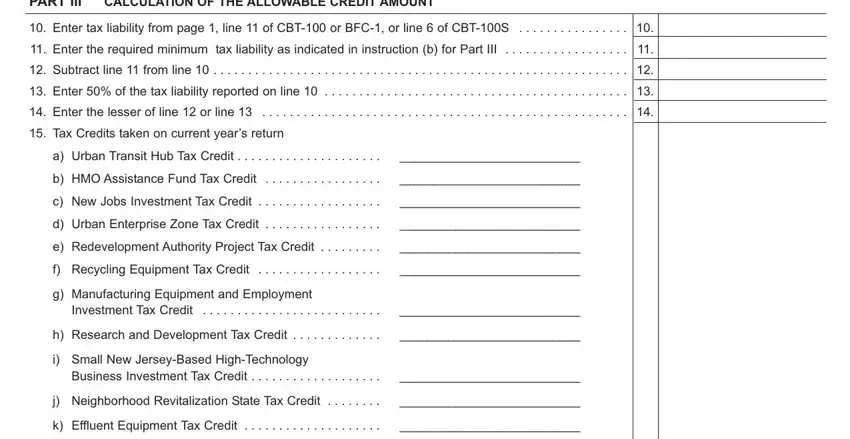

2. Just after this section is completed, go to type in the relevant information in all these: PART III, CALCULATION OF THE ALLOWABLE, Enter tax liability from page, Enter the required minimum tax, Subtract line from line, Enter of the tax liability, Enter the lesser of line or line, Tax Credits taken on current, a Urban Transit Hub Tax Credit, b HMO Assistance Fund Tax Credit, c New Jobs Investment Tax Credit, d Urban Enterprise Zone Tax Credit, e Redevelopment Authority Project, f Recycling Equipment Tax Credit, and g Manufacturing Equipment and.

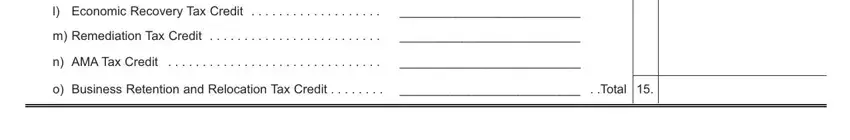

3. The next segment is generally relatively straightforward, l Economic Recovery Tax Credit, m Remediation Tax Credit, n AMA Tax Credit, o Business Retention and, and Total - all these blanks has to be filled in here.

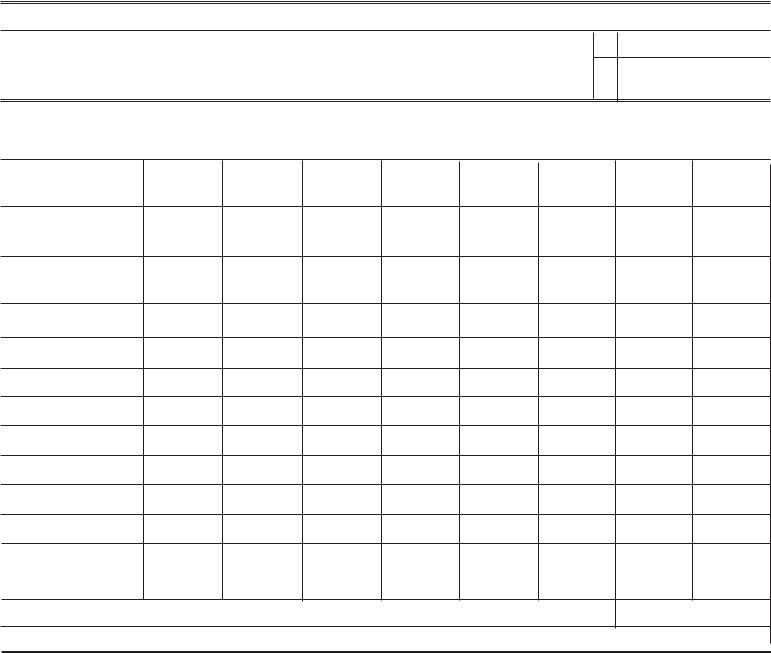

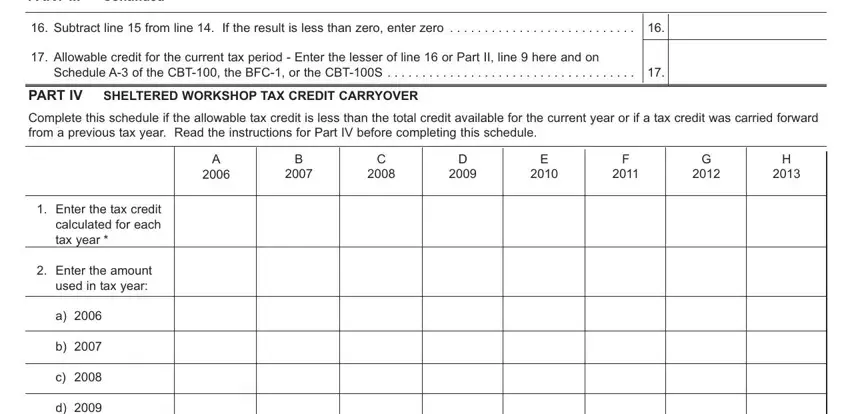

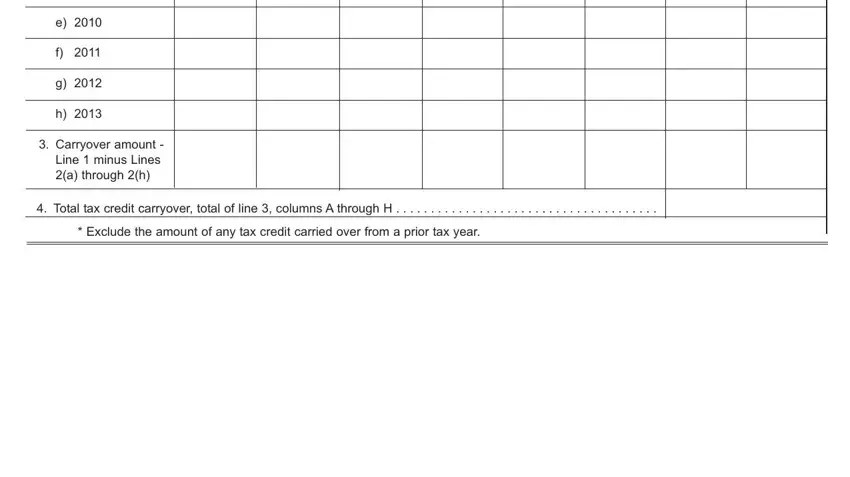

4. Filling in PART III, Continued, Subtract line from line If the, Allowable credit for the current, Schedule A of the CBT the BFC or, PART IV, SHELTERED WORKSHOP TAX CREDIT, Complete this schedule if the, Enter the tax credit calculated, and Enter the amount used in tax year is vital in this step - don't forget to take the time and fill in every blank!

You can certainly make an error when filling out the Enter the amount used in tax year, thus ensure that you reread it before you decide to finalize the form.

5. The last point to submit this form is integral. Ensure you fill in the mandatory blank fields, for instance Carryover amount Line minus, Total tax credit carryover total, and Exclude the amount of any tax, before using the document. Failing to do so can contribute to an incomplete and probably invalid paper!

Step 3: Prior to finishing this document, you should make sure that blanks have been filled out the right way. When you’re satisfied with it, click “Done." Download the sheltered workshop tax credit when you sign up at FormsPal for a free trial. Instantly access the pdf form in your FormsPal cabinet, together with any edits and adjustments automatically kept! FormsPal is committed to the personal privacy of all our users; we make sure all information entered into our editor remains secure.