Writing the 33h utah form document is not difficult using our PDF editor. Keep up with these particular actions to get the document ready without delay.

Step 1: Choose the orange "Get Form Now" button on the following website page.

Step 2: Now you are ready to edit 33h utah form. You possess a wide range of options with our multifunctional toolbar - it's possible to add, delete, or change the information, highlight the specified elements, and perform similar commands.

Enter the data demanded by the platform to create the form.

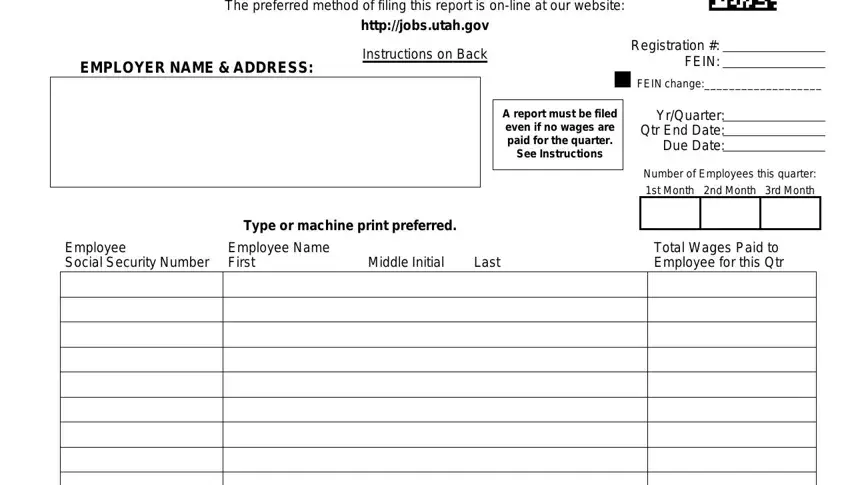

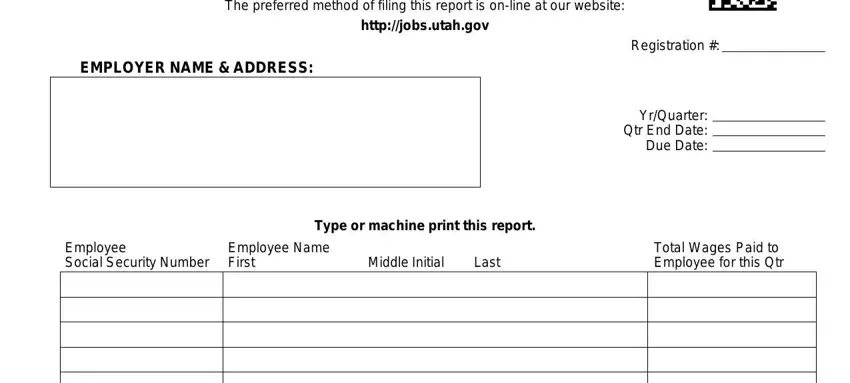

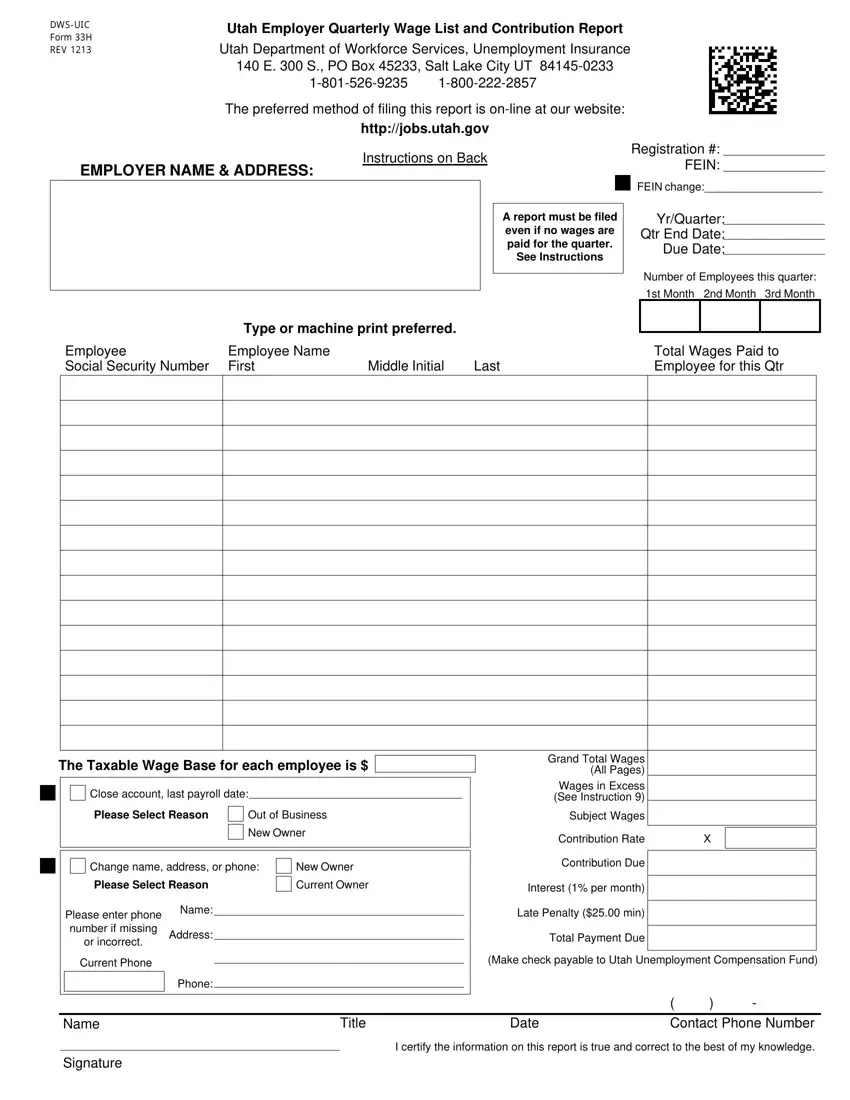

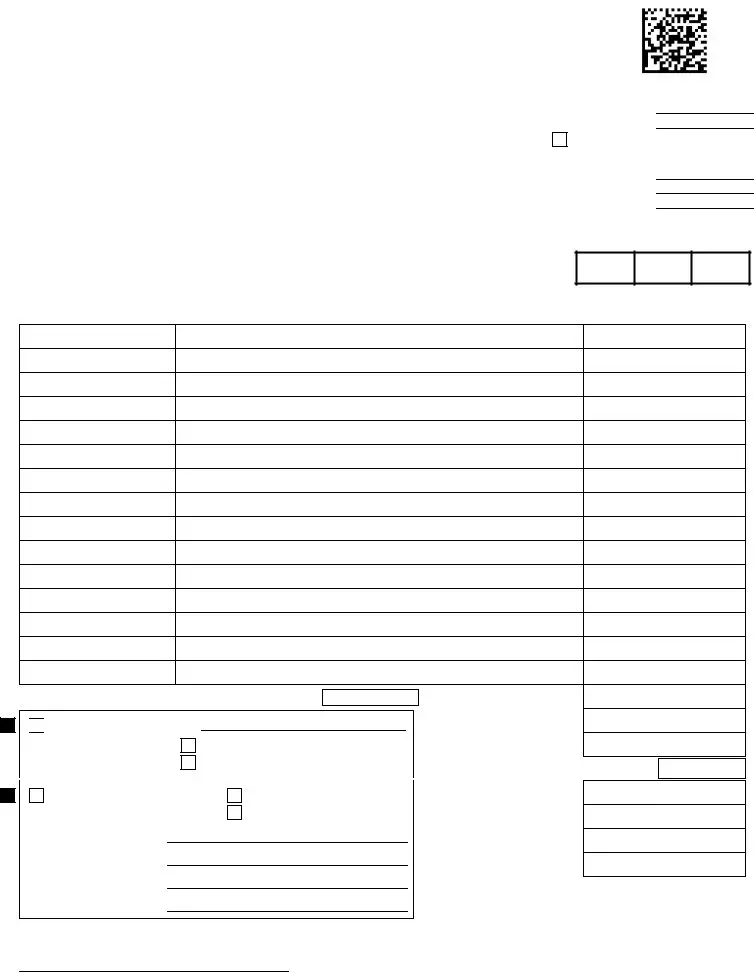

Type in the necessary particulars in the segment The preferred method of filing, EMPLOYER NAME ADDRESS, Registration, YrQuarter Qtr End Date Due Date, Employee Social Security Number, Employee Name First, Middle Initial, Last, Total Wages Paid to Employee for, and Type or machine print this report.

Step 3: Hit the button "Done". Your PDF form can be transferred. It is possible to obtain it to your device or send it by email.

Step 4: To stay away from potential future concerns, make sure you possess up to two or more duplicates of each document.

Close account, last payroll date:

Close account, last payroll date:

(Make check payable to Utah Unemployment Compensation Fund)

(Make check payable to Utah Unemployment Compensation Fund)