Through the online PDF tool by FormsPal, you can fill in or change Net Operation Loss (NOL) Computation and NOL ... right here. In order to make our tool better and less complicated to utilize, we constantly work on new features, considering suggestions from our users. All it requires is just a few simple steps:

Step 1: Firstly, access the pdf tool by clicking the "Get Form Button" in the top section of this page.

Step 2: As soon as you access the online editor, you will get the document all set to be filled in. In addition to filling out various fields, you may as well perform various other things with the Document, including writing your own text, editing the original textual content, adding graphics, signing the document, and a lot more.

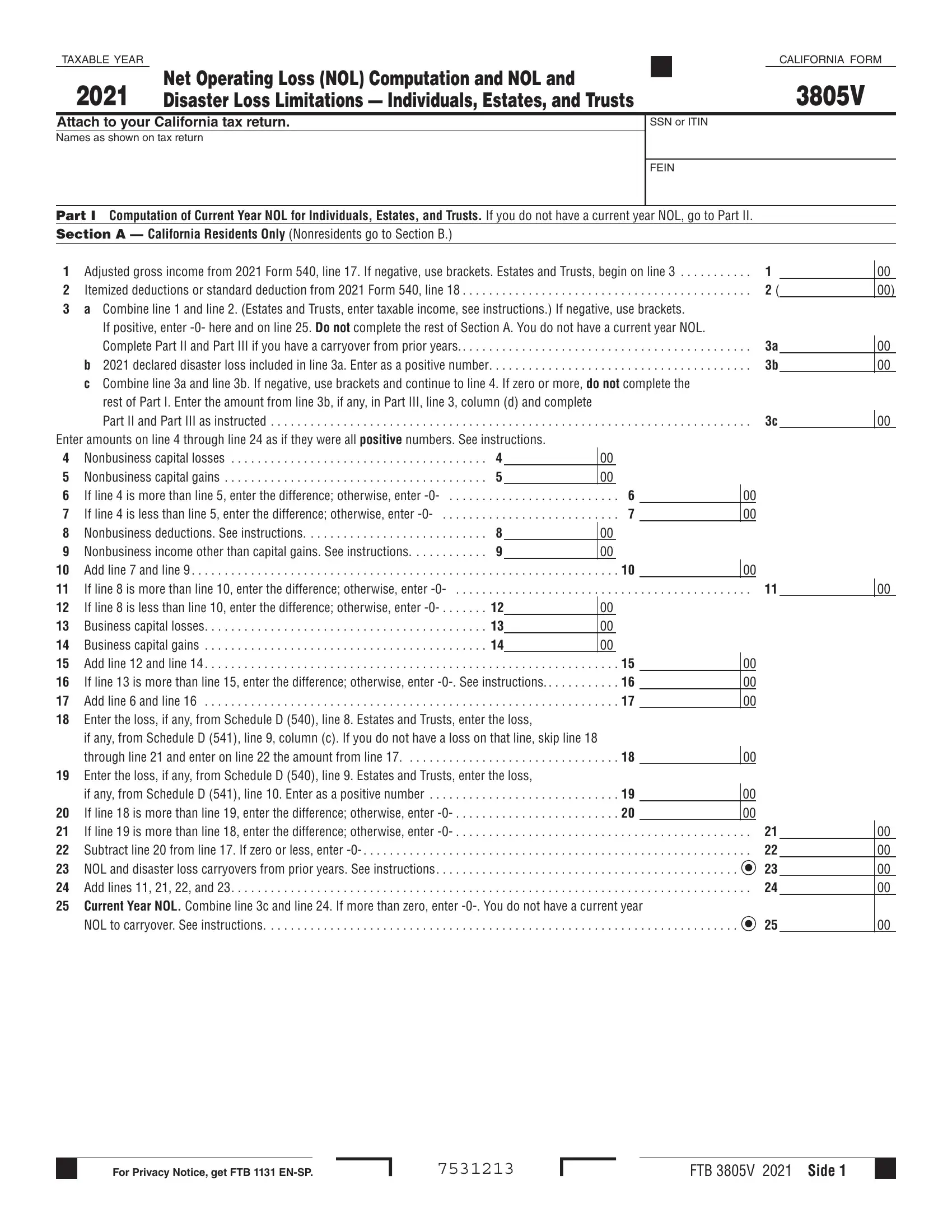

As for the blank fields of this particular PDF, here is what you need to do:

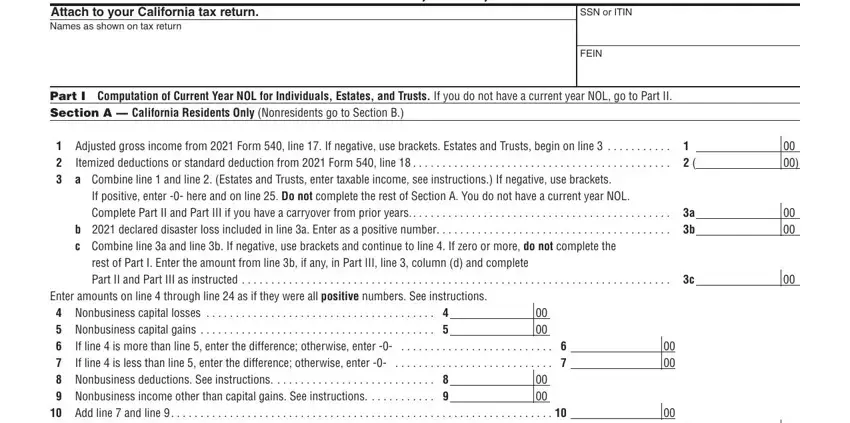

1. Firstly, while filling in the Net Operation Loss (NOL) Computation and NOL ..., start in the part that contains the following blanks:

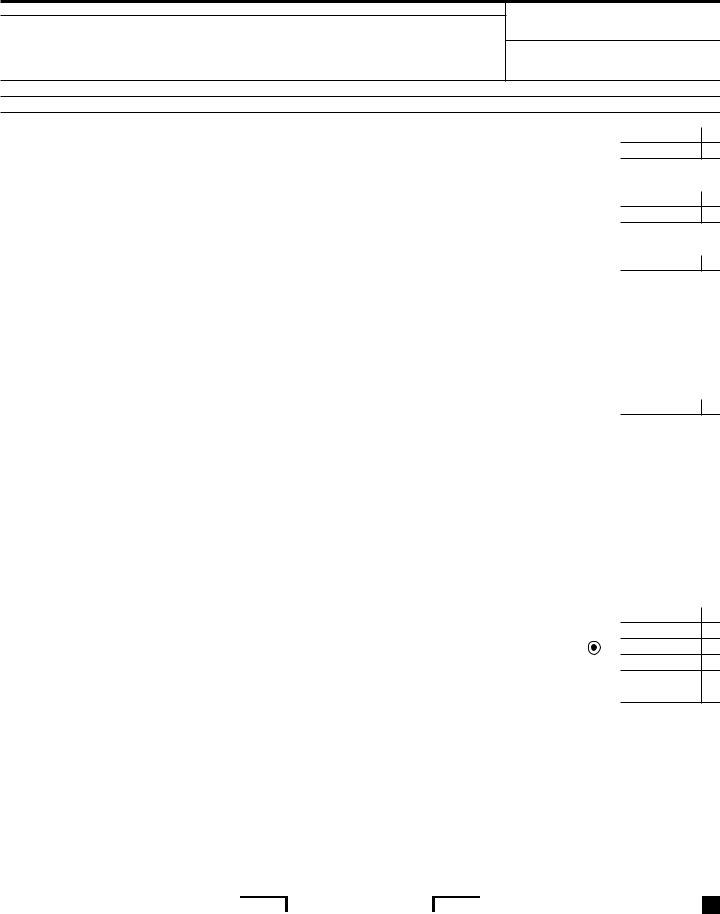

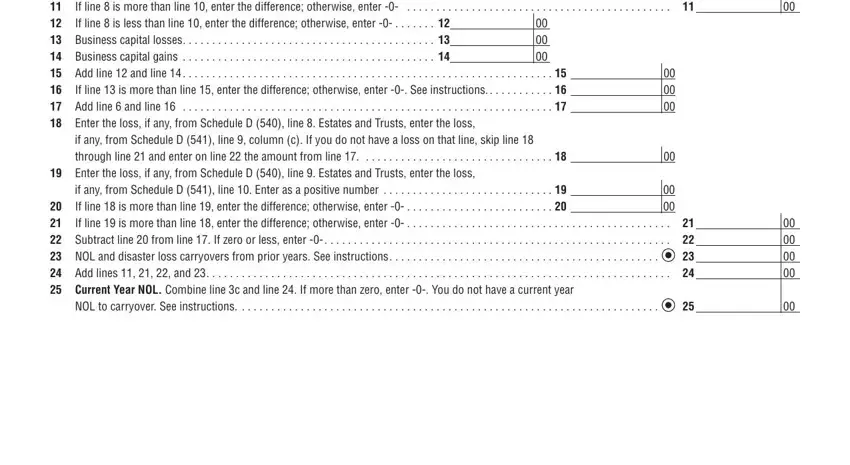

2. Once this array of blank fields is filled out, go on to enter the relevant information in these: Enter amounts on line through, If line is more than line enter, If line is more than line enter, if any from Schedule D line, Enter the loss if any from, if any from Schedule D line, Subtract line from line If, and NOL to carryover See instructions.

Always be really mindful when completing Subtract line from line If and Enter the loss if any from, as this is the part where most people make some mistakes.

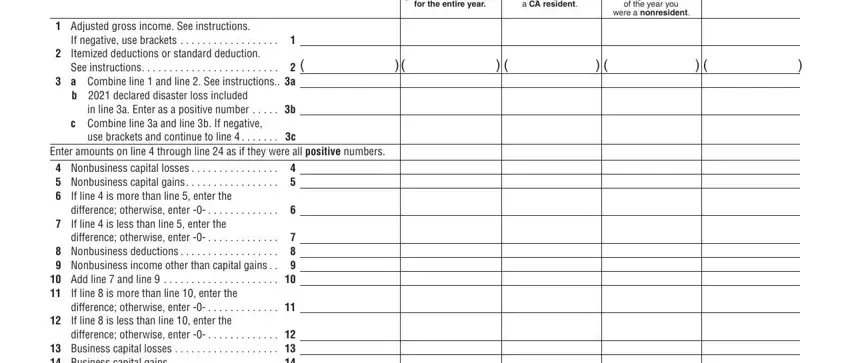

3. Within this stage, check out Adjusted gross income See, entire year, you were a nonresident, of the year you were, for the entire year, a CA resident, earned or received from CA sources, of the year you, were a nonresident, If negative use brackets Itemized, a Combine line and line See, b declared disaster loss included, c Combine line a and line b If, use brackets and continue to line, and Enter amounts on line through. These should be filled in with highest accuracy.

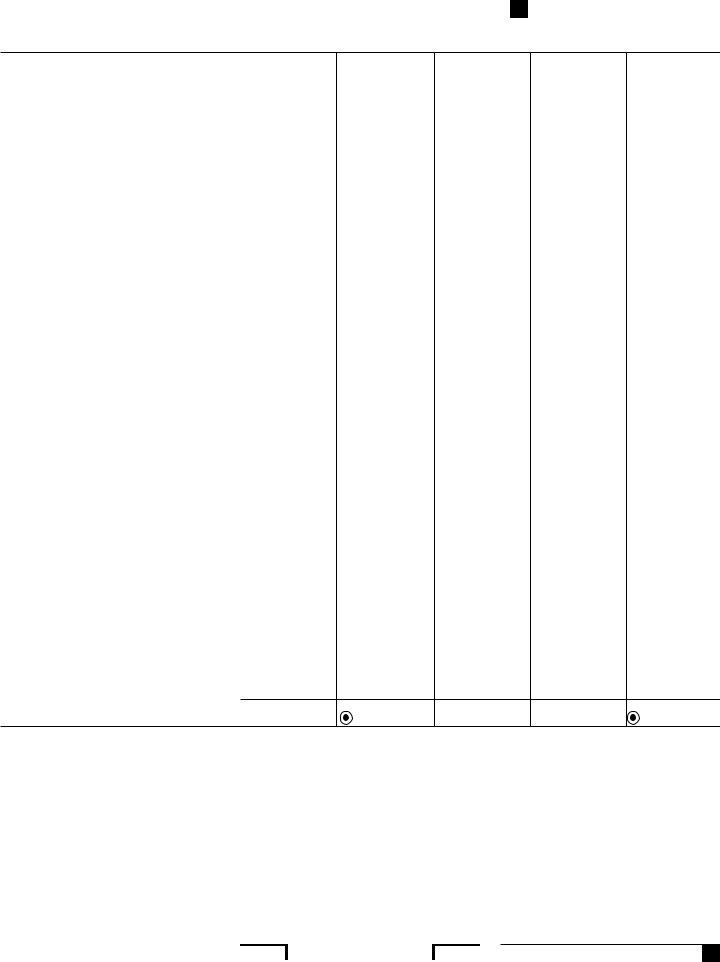

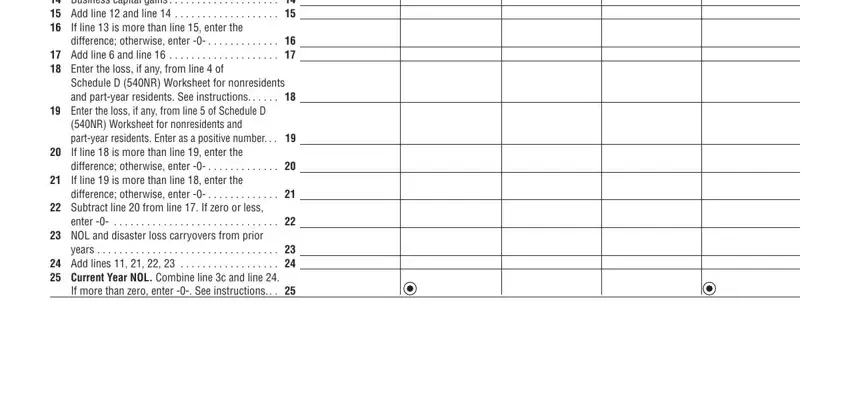

4. It's time to start working on this fourth form section! Here you'll have all these Business capital losses Business, If line is more than line enter, Add line and line Enter the, Schedule D NR Worksheet for, Enter the loss if any from line, NR Worksheet for nonresidents and, Subtract line from line If zero, enter, NOL and disaster loss carryovers, years, Add lines Current Year NOL, and If more than zero enter See empty form fields to do.

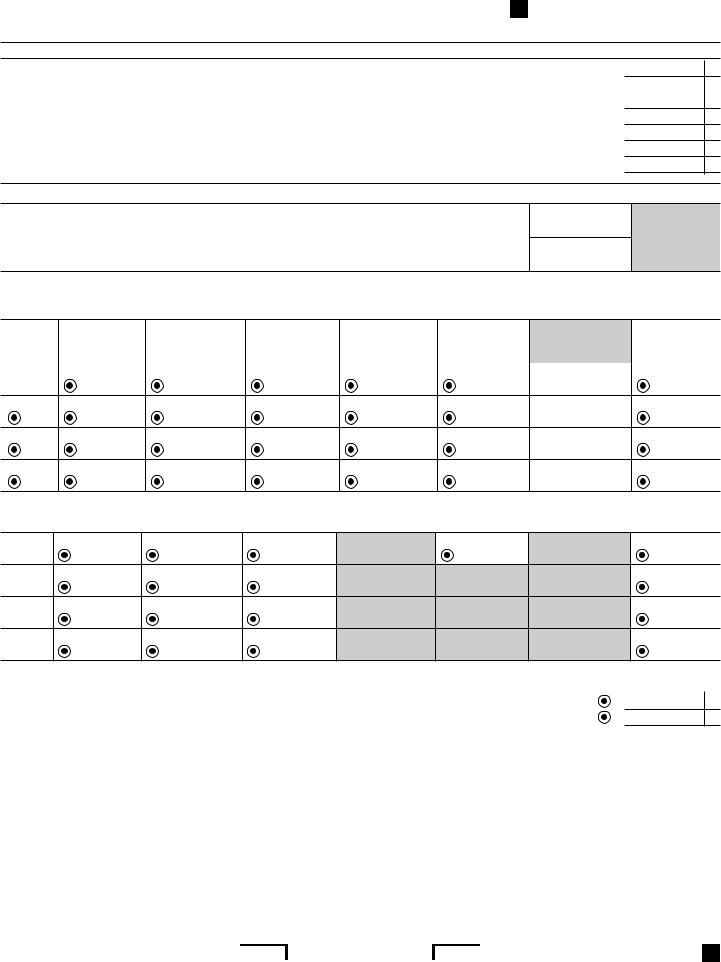

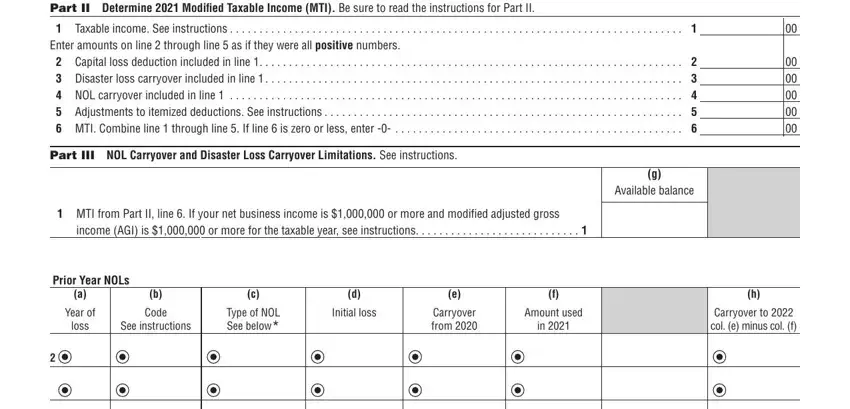

5. When you come near to the completion of the form, there are a couple more requirements that should be met. Particularly, Part II Determine Modified, Taxable income See instructions, Part III NOL Carryover and, Available balance, MTI from Part II line If your, income AGI is or more for the, Prior Year NOLs, Year of, loss, b Code, See instructions, Type of NOL See below, Initial loss, Carryover from, and Amount used should all be done.

Step 3: Soon after proofreading the fields you've filled out, press "Done" and you're good to go! Get hold of your Net Operation Loss (NOL) Computation and NOL ... as soon as you sign up at FormsPal for a free trial. Readily view the pdf inside your personal account, with any modifications and changes automatically kept! At FormsPal.com, we strive to be sure that all of your details are kept secure.