If you're like most American taxpayers, you dread tax season. The long hours spent poring over spreadsheets and the seemingly endless paperwork can be overwhelming. But what if there was a way to make tax season a little less daunting? Believe it or not, there is – with Form 3805P. This form is specifically designed to help taxpayers claim the Foreign Tax Credit, and it's easier than you might think. So if you're looking for a little assistance when it comes to filing your taxes, look no further than Form 3805P.

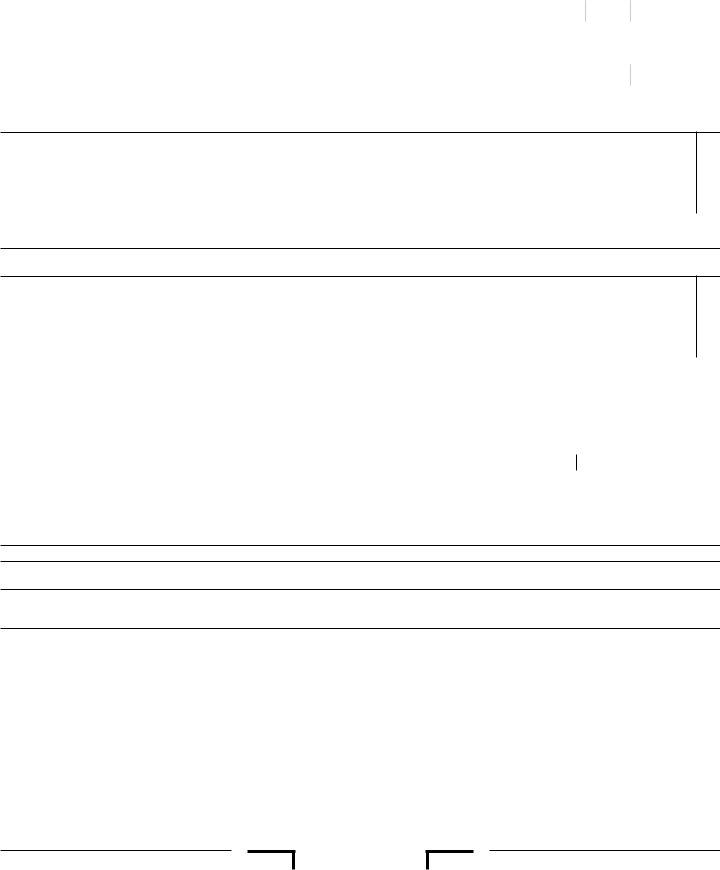

| Question | Answer |

|---|---|

| Form Name | Form 3805P |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | 2000, FTB, 540NR, MSA |

|

YEAR |

Additional Taxes Attributable to IRAs, Other Qualified Retirement |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

CALIFORNIA FORM |

|

|

|||||||||||||||||||||||||||||||||||||||||||||

2 0 0 0 |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Plans, Annuities, Modified Endowment Contracts, and MSAs |

|

3 8 0 5 P |

||||||||||||||||||||||||||||||||||||||||||

For calendar year 2000 or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

fiscal year beginning month________ day________ year 2000, and ending month________ day________ year________ . |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

First name |

|

|

|

|

|

Initial |

Last name |

|

|

|

|

|

|

|

|

|

Your social security number |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Present home address (number and street or rural route) |

PMB no. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check this box if this |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

is an amemded return |

|

|||||||||||

City, town, or post office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Part I Tax on Early Distributions – Complete this part if a taxable distribution was made from your qualified retirement plan (including an IRA other than an education (Ed) IRA), annuity contract, or modified endowment contract before you reached age 59½ (or was incorrectly indicated as such on your Form

1 |

Early distributions included in gross income. See instructions |

1 |

_________________ |

2 |

Distributions excepted from additional tax. See instructions. Enter exception number from instructions |

2 |

_________________ |

3 |

Amount subject to additional tax. Subtract line 2 from line 1 |

3 |

_________________ |

4Tax due. Multiply line 3 by 2½% (.025). Enter here and on Form 540, line 36 or Form 540NR, line 45. If you are not

required to file a California income tax return, sign this form below and refer to the instructions |

4 _________________ |

Caution: If any part of the amount on line 3 was a distribution from a SIMPLE retirement plan, you may have to include 6% (.06) of that amount on line 4 instead of 2½% (.025). See instructions.

Part II Tax on Distributions from Ed IRAs Not Used for Educational Expenses – Complete this part if a distribution was made from your Ed IRA and was not used for educational expenses.

5 |

Taxable amount from federal Form 8606, line 30. See instructions |

5 |

_________________ |

6 |

Distributions excepted from additional tax. See instructions |

6 |

_________________ |

7 |

Amount subject to additional tax. Subtract line 6 from line 5 |

7 |

_________________ |

8Tax due. Multiply line 7 by 2½% (.025). Enter here and on Form 540, line 36 or Form 540NR, line 45. If you are not

|

required to file a California income tax return, sign this form below and refer to the instructions |

. . . . . 8 |

_________________ |

|

Part III Tax on Distributions from Medical Savings Accounts (MSAs) – Complete this part if you reported a taxable distribution from an MSA on |

||||

|

federal Form 8853. |

|

|

|

|

|

|

|

|

9 |

Taxable MSA distribution from federal Form 8853, line 10 |

. . . . . . 9 |

_________________ |

|

10 |

. . . . . . . . . . . . . . . . . . . .a If you meet any of the exceptions to the 10% tax (see instructions), check here |

10a |

|

|

bOtherwise, multiply line 9 by 10% (.10). Enter the result here and include it in the total on Form 540, line 36, or Form 540NR, line 45. If you are not required to file a California income

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .tax return, sign this form below and refer to the instructions |

10b _________________ |

11Additional tax due from Medicare+Choice MSA distributions. Enter the amount from federal Form 8853, line 15b on this line. Also include this amount in the total on Form 540, line 36, or Form 540NR, line 45. If you are not required to file a California

. . . . . . . . . . . . . . . . .income tax return, sign this form below and refer to the instructions. Form 540NR filers, see instructions |

11_________________ |

|

Signature. Complete only if you are filing this form by itself and not with your tax return.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. It is unlawful to forge a spouse’s signature.

Your signatureDate

X

Signature of paid preparer (declaration of preparer is based on all information of which preparer has any knowledge.) |

Paid preparer’s SSN/FEIN/PTIN |

|

|

Firm’s name (or yours if |

Date |

|

|

For Privacy Act Notice, get form FTB 1131.

3805P00109

FTB 3805P C1 2000

Instructions for Form FTB 3805P

Additional Taxes Attributable to IRAs, Other Qualified Retirement Plans, Annuities, Modified Endowment Contracts, and MSAs

General Information

In general, California tax law conforms to the Internal Revenue Code (IRC) as of January 1, 1998. However, there are continuing differences between California and federal tax law. California has not conformed to most of the changes made to the IRC by the federal Internal Revenue Service (IRS) Restructuring and Reform Act of 1998 (Public Law

A Purpose

Use this form to report any additional tax you may owe on an early distribution from an IRA, other qualified retirement plan, annuity, a modified endowment contract, or a medical savings account (MSA).

B Who Must File

You must file form FTB 3805P if you:

•Received an early taxable distribution from a qualified retirement plan and a distribution code other than 2, 3, or 4 is shown in box 7 of federal Form

•Owe the tax on early distributions from your IRA, other qualified retirement plan, annuity, or modified endowment contract and you incorrectly have an exception code in box 7 of Form

•Owe a tax because you received distributions from an Ed IRA in excess of amounts you spent for educational expenses (complete Part II);

•Received taxable distributions from an MSA; or

•Meet an exception to the tax on early distributions and distribution code 2, 3, or 4 is NOT shown or is incorrect on Form

You do not have to file form FTB 3805P if you:

•Rolled over the taxable part of all distributions you received during the year into another qualified plan within 60 days of receipt; or

•Received an early distribution from your plan but meet an exception to the tax (distribution code 2, 3, or 4 must be correctly shown on federal Form

California and federal laws are the same for the tax on early distributions except for the rate of tax assessed. However, the amount of an IRA or Keogh distribution included in income may differ for state and federal tax purposes. Also, California does not have taxes similar to the excess contributions tax on traditional IRAs, tax on excess contributions to Roth IRAs, tax on excess contributions to Ed IRAs, tax on excess contributions to MSAs, or tax on excess accumulation in qualified retirement plans.

Such federal taxes are figured on federal Form 5329, Additional Taxes Attributable to IRAs, Other Qualified Retirement Plans, Annuities, Modified Endowment Contracts, and MSAs.

Joint Returns. Each spouse must complete a separate form FTB 3805P for taxes attributable to his or her distribution from a qualified retirement plan as described above. If both spouses owe a tax on early distributions, enter the combined tax from both forms on Form 540, line 36 or Form 540NR, line 45.

IRA Contributions. Do not file form FTB 3805P to report a deduction for contributions to your IRA or Keogh plan. See the instructions for Schedule CA (540), California Adjustments — Residents, or Schedule CA (540NR), California Adjustments — Nonresidents or

If you made a nondeductible IRA or Keogh contribution in prior years, refer to FTB Pub. 1005, Pension and Annuity Guidelines, for information on how to compute the taxable portion of your IRA distribution subject to the additional tax.

C When and Where to File

If you are required to file a 2000 Form 540, California Resident Income Tax Return, or Form 540NR, California Nonresident or

Income Tax Return, you must attach your 2000 form FTB 3805P to your return.

If you do not have to file Form 540 or Form 540NR, but owe a tax on form FTB 3805P or otherwise have to file form FTB 3805P as described in General Information B, Who Must File, you must still complete and file this form with the Franchise Tax Board (FTB) by the due date for filing

Form 540 or Form 540NR. Send your completed form FTB 3805P and your check or money order payable to the “Franchise Tax Board” for the total of any taxes due. Write your social security number and “2000 FTB 3805P” on your check or money order.

Mail to: FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA

If you are paying tax for a previous year, you must complete that tax year’s version of form FTB 3805P. If you have filed your Form 540 or Form 540NR for the prior year and you have no adjustments to income that require you to file Form 540X, Amended Individual Income Tax Return, file only form FTB 3805P.

If you are filing form FTB 3805P separately from Form 540, Form 540NR, or Form 540X, you must sign form FTB 3805P. Include a check or money order payable to the “Franchise Tax Board” for the total amount of any tax due. Write your social security number and “FTB 3805P” on your check or money order.

D Definitions

Qualified Retirement Plan – A qualified retirement plan includes:

•A qualified pension,

•A qualified annuity plan;

•A

•An individual retirement account or an individual retirement annuity.

Note: Ed IRAs and MSAs are not qualified retirement plans.

Traditional IRA – An individual retirement account or an individual retirement annuity described in IRC Sections 408(a) and (b), including a simplified employee pension (SEP) IRA, but not including a SIMPLE IRA or a Roth IRA.

SEP IRA – An

SIMPLE Retirement Plan – A written arrangement established under IRC Section 408(p) that provides a simplified

Roth IRA – An IRA that meets the requirements of IRC Section 408A. Generally, for purposes of this form, the same rules that apply to traditional IRAs apply to Roth IRAs. For additional information about Roth IRAs, see federal Pub. 590, Individual Retirement Arrangements (IRAs), federal Form 8606, Nondeductible IRAs, and FTB Pub. 1005, Pension and Annuity Guidelines.

Early Distributions – Generally, any distribution from your qualified retirement plan, annuity, or modified endowment contract that you receive before you reach age 59½ is an early distribution. The portion of the early distribution that is included in income is subject to an additional 2½% tax. (If the early distribution is from a SIMPLE retirement plan received during the first

Rollover – A

FTB 3805P Instructions 2000 Page 1

be included in income and may be subject to an additional 2½% tax. Refer to federal Pub. 590 for details.

Tax on Early Distributions. The tax on early distributions from qualified retirement plans does not apply to:

•2000 IRA contributions withdrawn during the year or 1999 excess contributions withdrawn in 2000 before the filing date (including extensions) of your 1999 income tax return;

•Excess IRA contributions for years before 1999 that were withdrawn in 2000, and 1999 excess contributions withdrawn after the due date (including extensions) of your 1999 income tax return, if no deduction was allowed for the excess contributions, and the total IRA contribu- tions for the tax year for which the excess contributions were made were not more than $2,000 (or if the total contributions for the year included employer contributions to a SEP, $2,000 increased by the smaller amount of the employer contributions to the SEP or $30,000);

•The part of your IRA distributions that represents a return of nonde- ductible IRA contributions figured on federal Form 8606;

•The part of your IRA distribution that represents a return of nondeduct- ible contributions made before 1987 or annual contributions (not rollover contributions from

•Distributions from a traditional IRA that are converted to a Roth IRA;

•Distributions rolled over to another retirement arrangement or plan;

•Distributions of excess contributions from a qualified cash or deferred arrangement;

•Distributions of excess aggregate contributions to meet nondiscrimina- tion requirements for employer matching and employee contributions;

•Distributions of excess deferrals; and

•Amounts distributed from unfunded deferred compensation plans of

See the instructions for line 2 for other distributions that are excepted from the tax.

Education (Ed) IRA – A trust or custodial account described in IRC Section 530 that is created or organized in the United States exclusively for the purpose of paying the qualified higher education expenses of the desig- nated beneficiary of the account.

Taxpayers may deposit up to $500 per year into an Ed IRA for a child under age 18. The total contributions (by all taxpayers) for the child during the tax year may not exceed $500 and each contributor is subject to the contributions limit of IRC Section 530(c) based on adjusted gross income.

Distributions from an Ed IRA that exceed the child’s qualified higher education expenses in a tax year are generally subject to income tax and to an additional tax of 2½% (figured in Part II of form FTB 3805P).

For additional information, see federal Form 8606.

A Medical Savings Account (MSA) – A

Federal Form 8853 is used to report general information about new MSAs, to figure your MSA deduction, and to figure your taxable distribution for MSAs. California law is the same as federal law regarding MSA contribu- tions and deductions but is different regarding the amount of additional tax on MSA distributions not used for qualified medical expenses. The additional tax is 10% for California.

Therefore, for California purposes, there is no separate form to file to report general information about new MSAs or to figure your MSA deduction. However, if you have a taxable MSA distribution, you must file form FTB 3805P to figure the additional tax.

Specific Line Instructions

Part I — Tax on Early Distributions

Line 1 – Early Distributions Included in Gross Income

Qualified Retirement Plans (including IRAs). Enter the amount of distributions included in gross income you received from a qualified retirement plan, including traditional IRAs and Roth IRAs (and income earned on excess contributions to your IRAs), before you reached age

59½. The amount of the early distributions you must include in gross income for California purposes may differ from the amount reported on your federal return if the amount of contributions you deducted for California was different than the federal amount or if you were a nonresi- dent when you made IRA contributions. You must report the difference on Schedule CA (540) or Schedule CA (540NR).

For Form 540NR filers, the amount entered on line 1 is the taxable amount of early distributions reported on Schedule CA (540NR), line 15, column E, or Schedule CA (540NR), line 16, column E.

Annuity contracts. If you receive any amounts under an annuity contract from distributions made before reaching age 59½, such amounts may also be subject to an additional 2½% tax on the portion which is includible in gross income. Refer to IRC Section 72(q) and IRS Publication 575, Pension and Annuity Income, for details. Enter on line 1 the distribution included in gross income.

Modified endowment contracts. In general, if you received any amounts under a modified endowment contract (as defined in IRC Section 7702A), entered into after June 20, 1988, from distributions before reaching age 59½, such amounts are also subject to an additional 2½% tax on the part of the distribution that is includible in gross income. Enter on line 1 the distribution included in gross income.

Prohibited Transactions. If you engaged in a prohibited transaction, such as borrowing from your individual retirement account or annuity, or pledging your individual retirement annuity as security for a loan, your account or annuity no longer qualified as an IRA on the first day of the tax year in which you did the borrowing or pledging. You are considered to have received a distribution of the entire value of your account or annuity at that time. Using your IRA as a basis for obtaining a benefit is also a prohibited transaction. If you were under age 59½ on the first day of the taxable year, enter on line 1 the entire value of the account that represents taxable income.

Pledging of Account. If, during your taxable year, you use any part of your individual retirement account as security for a loan, that part is considered distributed to you at the time pledged. If you were under age 59½ at the time of the pledge, enter the amount pledged on line 1.

Collectibles. If your IRA trustee invested your funds in collectibles, you are considered to have received a distribution equal to the cost of any “collectible.” Collectibles include works of art, rugs, antiques, metals, gems, stamps, coins, alcoholic beverages, and certain other tangible personal property. The cost of any collectible in which you invested funds of your IRA in 2000 is deemed to be a distribution to you in 2000. If you were under age 59½ when the funds were invested, enter on line 1 the cost of the collectible included in gross income.

Exception. Your IRA may invest in U.S. one,

Roth IRA Distributions

If you received a Roth IRA distribution, you must generally include on line 1 of form FTB 3805P the amount from your 2000 federal Form 8606, line 19, even if you were age 59 ½. However, the amount to include on line 1 of form FTB 3805P may be smaller if you have an amount on line 16c of your 1998 FTB Pub. 1005A or on line 18c of the Roth IRA Worksheet on page 8 of your 1999 or 2000 FTB Pub. 1005.

In this case, you must recompute the amount to include on line 1 of form FTB 3805P by allocating the amount on your 2000 federal Form 8606,

line 19. The amount on your 2000 federal Form 8606, line 19 is allocable to the amounts shown on the following lines, in the order shown (to the extent the amount was not allocable to a distribution from your 1998 federal Form 8606, line 20, or your 1999 federal Form 8606, line 19).

•Your 1998 FTB Pub. 1005A, line 17.

•Your 1998 FTB Pub. 1005A, line 16c.

•Your 1999 FTB Pub. 1005, page 8, line 19.

•Your 1999 FTB Pub. 1005, page 8, line 18c.

•Your 2000 FTB Pub. 1005, page 8, line 19.

•Your 2000 FTB Pub. 1005, page 8, line 18c.

•Your 2000 federal Form 8606, line 26 (completed using California amounts).

(continued on page 3)

Page 2 FTB 3805P Instructions 2000

Any portion of your 2000 federal Form 8606, line 19, allocable to an amount on any of the lines below is subject to the penalty and must be included on line 1 of form FTB 3805P:

•Your 1998 FTB Pub. 1005A, line 17.

•Your 1999 FTB Pub. 1005, page 8, line 19.

•Your 2000 FTB Pub. 1005, page 8, line 19.

•Your 2000 federal Form 8606, line 26 (completed using California amounts).

Line 2 – Distributions Excepted From Additional Tax

The additional tax does not apply to certain distributions specifically excepted by the IRC. Enter on line 2 the excepted amount. In the boxes on line 2, enter the applicable exception number (01 – 11) from the following list.

Form 540NR Filers: Enter the portion of the taxable distribution (Schedule CA (540NR), line 15 or line 16) that qualifies for an exception.

No. Exception

01Distribution due to separation from service in or after the year of reaching 55 (applies only to qualified employee plans).

02Distribution made as part of a series of substantially equal periodic payments (made at least annually) for your life (or life expectancy) or the joint lives (or joint life expectancies) of you and your designated

beneficiary (if from a qualified employee plan, payments must begin after separation from service).

03Distribution due to total and permanent disability.

04Distributions due to death (does not apply to modified endowment contracts).

05Distribution to the extent you have deductible medical expenses that

can be claimed on line 4 of federal Schedule A (Form 1040) (does not apply to annuity or modified endowment contracts).

06Distributions made to an alternate payee under a qualified domestic

relations order (applies only to qualified employee plans).

07Distributions made to unemployed individuals for health insurance premiums (applies only to IRAs).

08Distributions made for higher education expenses (applies only to IRAs).

09Distributions made for purchase of a first home, up to $10,000 (applies only to IRAs).

10Distributions due to an IRS levy.

11Other (see instructions below).

Other exceptions. In addition to the exceptions listed, the tax does not apply to any distributions from a plan maintained by an employer if:

•You separated from service by March 1, 1986;

•As of March 1, 1986, your entire interest was in pay status under a written election that provides a specific schedule for distribution of the entire interest; and

•The distribution is actually being made under the written election.

Also, distributions from annuity contracts are not subject to the additional tax on early distributions to the extent that the distributions are allocable to an investment in the contract before August 14, 1982.

Distributions that are dividends paid with respect to stock described in IRC Section 404(k) are not subject to the additional tax.

Distributions due to an FTB notice to withhold on a qualified retirement plan are not subject to the additional tax.

If any of these exceptions apply, enter the distribution amount on line 2 and exception number 11 in the boxes provided. For additional exceptions applicable to annuity contracts, see IRC Section 72(q)(2) and IRS

Pub. 575.

Also enter on line 2 the amount of a distribution you received when you were age 59½ or older, if you received federal Form

Line 3 – Subtract the amount of distributions excepted from tax on line 2 from the amount of early distributions included on line 1. Enter the result on line 3. This is the amount of your distribution subject to tax.

Line 4 – Multiply line 3 by 2½% (.025). However, if any amount on line 3 was a distribution from a SIMPLE retirement plan received within 2 years from the date you first participated in the plan, you must multiply that amount by 6% (.06) instead of 2½% (.025). SIMPLE distributions are

included in box 1 and box 2a of federal Form

Enter the total on line 4 and on Form 540, line 36, or Form 540NR, line 45. If you are not required to file Form 540 or Form 540NR, see General Information C, When and Where to File.

Part II — Tax on Distributions from Ed IRAs Not Used for Educational Expenses

Line 5 – Enter the amount from federal Form 8606, line 30.

Form 540NR Filers: Enter the taxable amount of Ed IRA distributions included on Schedule CA (540NR), line 15, column E.

Line 6 – Enter on line 6 the total amount that can be excepted.

The 2½% (.025) additional tax does not apply to distributions that are:

•Due to the death or disability of the beneficiary;

•Made on account of a scholarship, allowance, or payment described in IRC Section 25A(g)(2); and,

•Taxable solely because you chose to waive any exclusion you may be entitled to for your 1999 qualified higher education expenses. (This election was made by checking the box on federal Form 8606, line 29.)

If you are not required to file Form 540 or Form 540NR, see General Information C, When and Where to File.

Form 540NR Filers: Enter the portion of the taxable Ed IRA (Schedule CA (540NR), line 15, column E) that qualifies for the exception.

Line 8 – If you are not required to file Form 540 or Form 540NR, see General Information C, When and Where to File.

Part III — Medical Savings Account (MSA) Distributions

MSA Distributions

California law is the same as federal law regarding taxable distributions from MSAs, except the additional tax on distributions not used for qualified medical expenses is 10% for California. Complete federal Form 8853 before completing this part. You need to complete line 9 and line 10 only if you have an amount on federal Form 8853, line 10.

Line 9 – Enter the amount from federal Form 8853, line 10.

Form 540NR Filers: Enter the taxable amount of MSA distributions that was included on Schedule CA (540NR), line 21, column E.

Line 10a – Check this box if you checked the box on federal Form 8853, line 11a.

Any distribution amount that is excepted from the additional tax for federal purposes is also excepted from the additional tax for California. Refer to the instructions for federal Form 8853, line 11a.

Form 540NR Filers: To figure the amount of the distribution that is subject to the additional 10% tax, do not include any portion of the taxable MSA (Schedule CA (540NR), line 21, column E) distributions that qualifies for an exception.

Line 10b – If you are not required to file Form 540 or Form 540NR, see General Information C, When and Where to File.

Medicare+Choice MSA Distributions

California law is the same as federal law regarding distribution from Medicare+Choice MSAs. Any distribution that is subject to the 50% tax under IRC Section 138(c)(2) is also subject to a 50% tax for California purposes. Refer to the instructions for 2000 federal Form 8853, Section B, for more information.

Line 11 – Enter the same amount you entered on your 2000 federal Form 8853, line 15b.

Form 540NR Filers: Enter 50% of the portion of the amount that you included on line 14 of your 2000 federal Form 8853 (that does not qualify for any of the exceptions to the 50% tax) that was reported on Schedule CA (540NR), line 21, column E.

FTB 3805P Instructions 2000 Page 3