Form 3903 can be filled out in no time. Simply use FormsPal PDF editing tool to accomplish the job right away. FormsPal team is relentlessly working to expand the tool and make it much easier for clients with its handy functions. Take full advantage of today's progressive prospects, and find a heap of new experiences! To get the process started, consider these simple steps:

Step 1: Hit the orange "Get Form" button above. It is going to open our pdf tool so that you can begin completing your form.

Step 2: With this state-of-the-art PDF file editor, you are able to do more than simply fill out blank form fields. Express yourself and make your docs seem great with custom textual content added in, or optimize the file's original content to excellence - all that backed up by an ability to incorporate your personal photos and sign the document off.

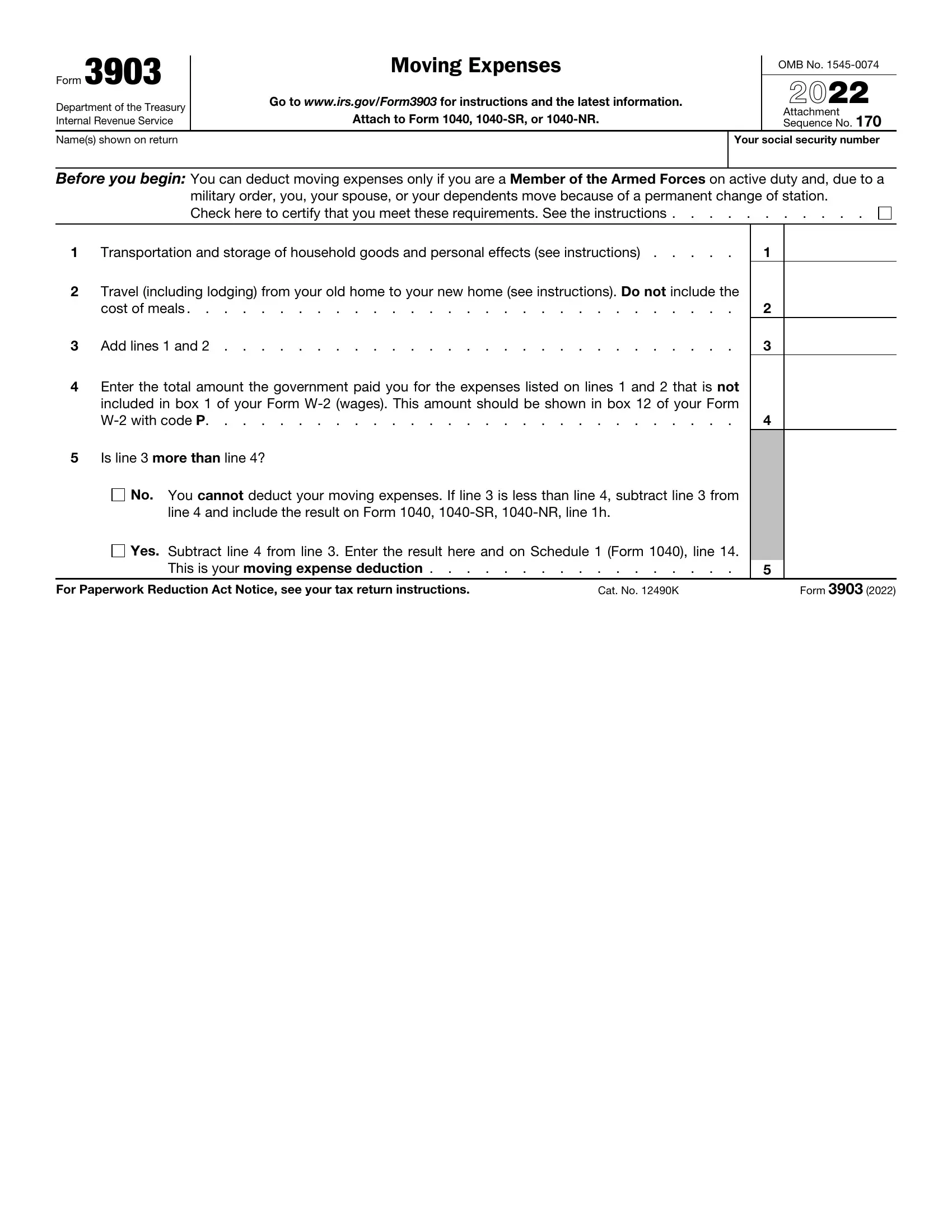

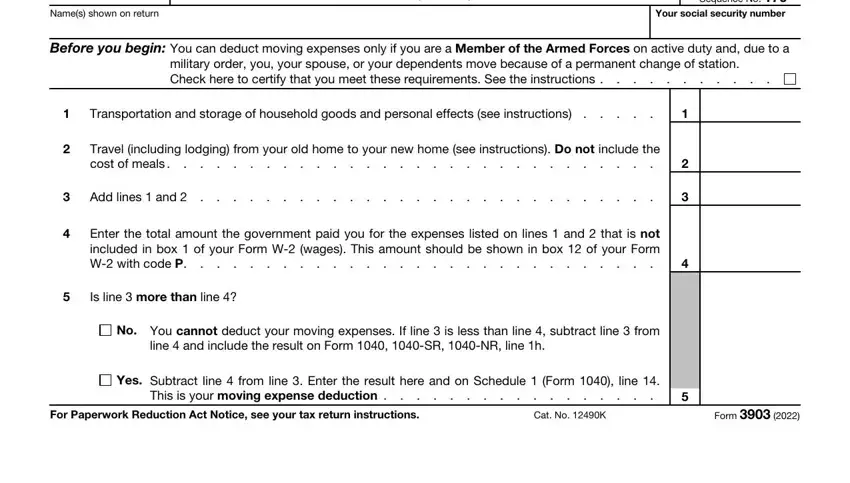

This form requires particular info to be filled in, so be certain to take your time to provide what is requested:

1. Begin completing your Form 3903 with a selection of essential blanks. Get all the important information and ensure there's nothing omitted!

Step 3: Always make sure that the details are correct and then just click "Done" to progress further. Join FormsPal today and instantly access Form 3903, all set for downloading. All modifications made by you are preserved , letting you modify the document later if required. We do not share or sell any information that you enter when filling out documents at our website.