Using PDF documents online is easy with our PDF editor. You can fill in 2012 here in a matter of minutes. Our tool is continually evolving to provide the very best user experience possible, and that is because of our dedication to continual development and listening closely to testimonials. All it takes is several easy steps:

Step 1: Access the PDF form in our tool by clicking on the "Get Form Button" at the top of this page.

Step 2: The editor provides you with the capability to customize PDF forms in many different ways. Transform it with your own text, correct original content, and put in a signature - all close at hand!

Pay attention when filling in this form. Make sure each blank is done correctly.

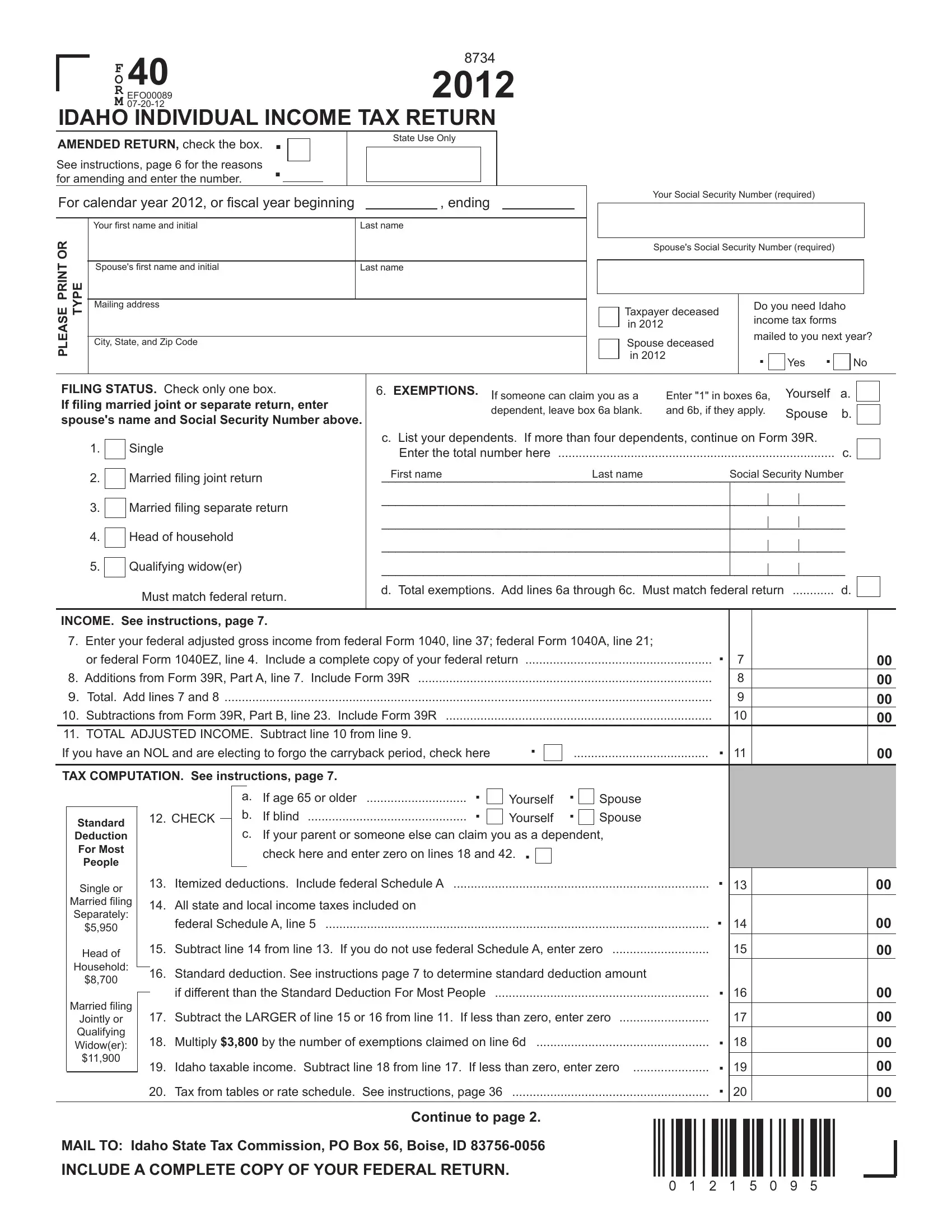

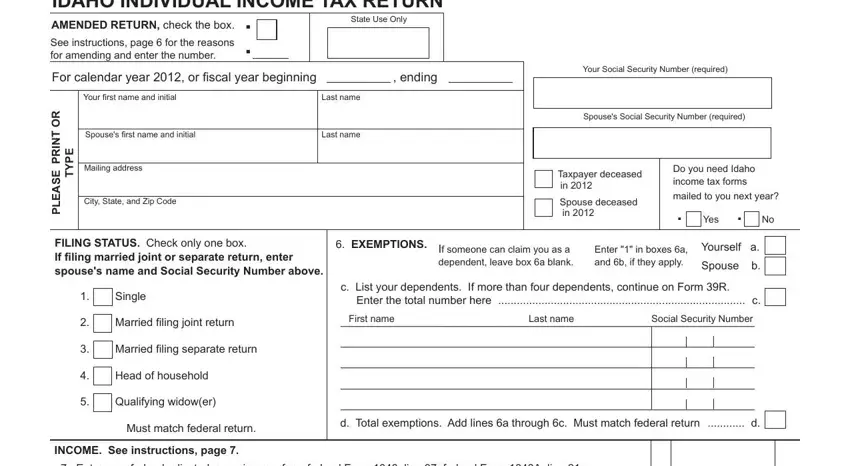

1. When submitting the 2012, be sure to include all of the essential fields within the corresponding area. This will help hasten the process, allowing for your details to be processed fast and properly.

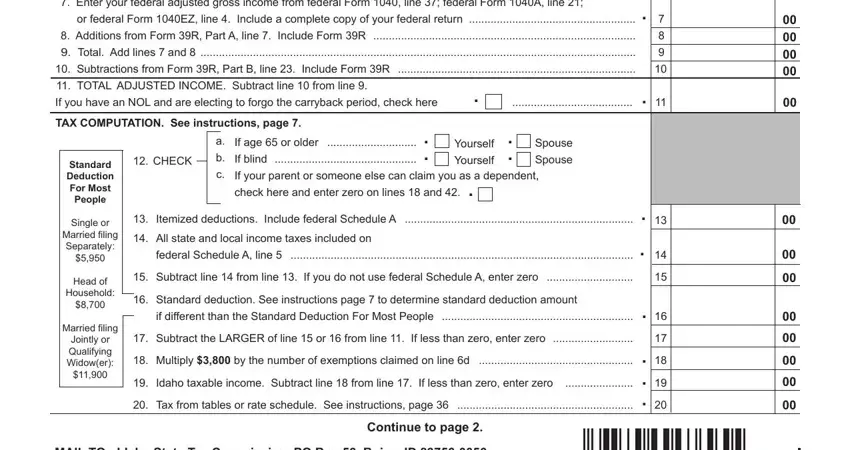

2. Given that the previous part is finished, you have to add the necessary specifics in Enter your federal adjusted gross, or federal Form EZ line Include a, Additions from Form R Part A line, Total Add lines and, Subtractions from Form R Part B, TOTAL ADJUSTED INCOME Subtract, If you have an NOL and are, TAX COMPUTATION See instructions, CHECK, If age or older, If blind, Yourself, Yourself, Spouse, and Spouse so that you can move on to the 3rd stage.

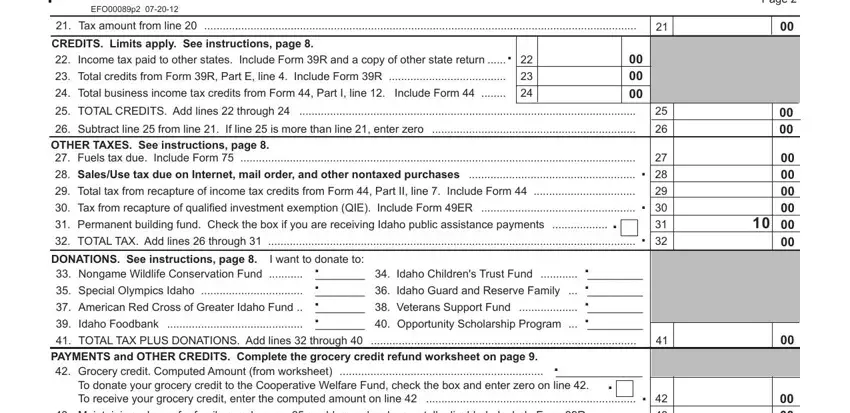

3. The third part is going to be easy - fill in all of the fields in Form EFOp, Tax amount from line, Page, CREDITS Limits apply See, Income tax paid to other states, TOTAL CREDITS Add lines, Total business income tax credits, Subtract line from line If line, SalesUse tax due on Internet mail, Total tax from recapture of, TOTAL TAX Add lines through, DONATIONS See instructions page I, Special Olympics Idaho Idaho, American Red Cross of Greater, and Idaho Foodbank Opportunity to conclude the current step.

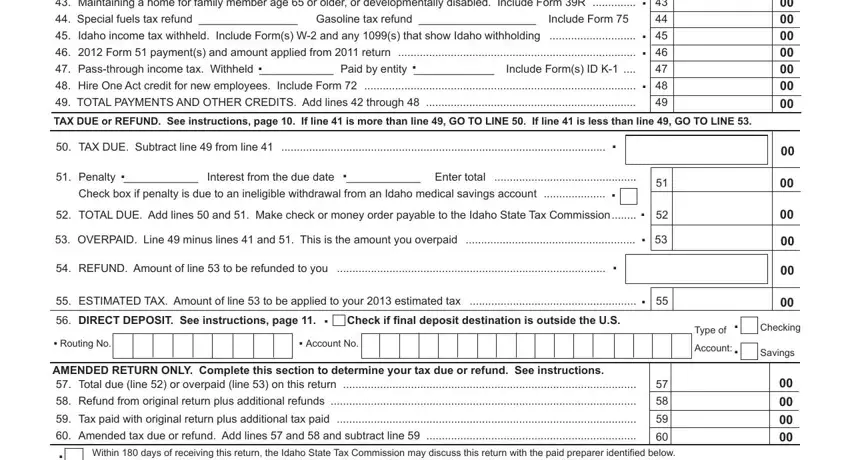

4. It's time to proceed to the next part! Here you'll have these Maintaining a home for family, Special fuels tax refund, Idaho income tax withheld Include, Form payments and amount, Passthrough income tax Withheld, Hire One Act credit for new, TOTAL PAYMENTS AND OTHER CREDITS, TAX DUE or REFUND See instructions, TAX DUE Subtract line from line, Penalty Interest from the due, Check box if penalty is due to an, TOTAL DUE Add lines and Make, OVERPAID Line minus lines and, REFUND Amount of line to be, and ESTIMATED TAX Amount of line to fields to do.

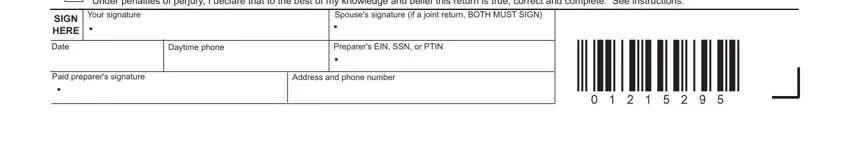

5. To wrap up your form, the final part involves a number of extra blanks. Filling out Tax paid with original return, Within days of receiving this, Spouses signature if a joint, SIGN HERE, Date, Daytime phone, Preparers EIN SSN or PTIN, Paid preparers signature, and Address and phone number will finalize the process and you can be done in a tick!

Always be really mindful while filling in Spouses signature if a joint and Tax paid with original return, as this is the part where many people make mistakes.

Step 3: Proofread all the information you have entered into the form fields and then click the "Done" button. Sign up with FormsPal today and easily gain access to 2012, all set for download. All changes you make are saved , enabling you to change the form at a later stage when required. FormsPal offers protected form tools with no personal information record-keeping or sharing. Feel at ease knowing that your information is safe with us!