This PDF editor enables you to fill in forms. You should not undertake much to update form 409 documents. Merely adhere to these actions.

Step 1: Choose the "Get Form Here" button.

Step 2: After you have entered the sars 409 declaration form edit page, you'll discover all functions you may undertake regarding your document within the upper menu.

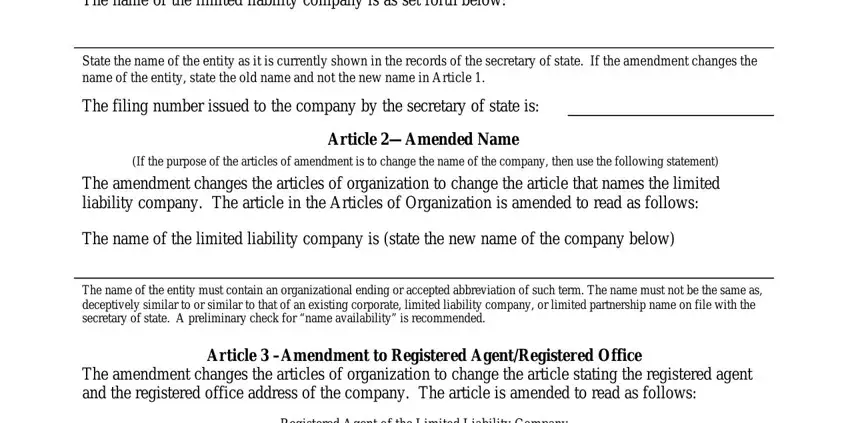

Get the sars 409 declaration form PDF and type in the content for every single segment:

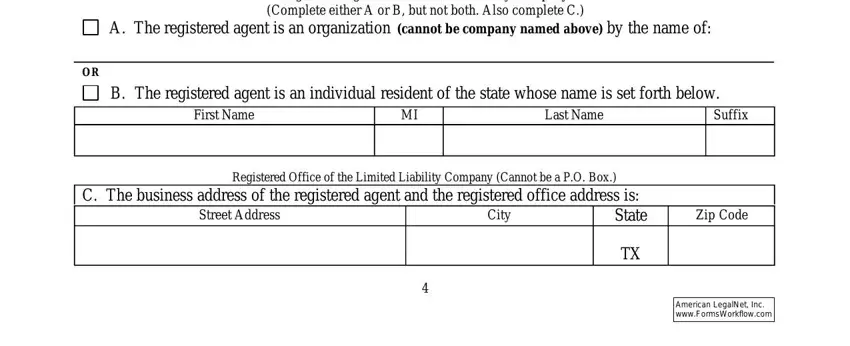

Fill out the A The registered agent is an, Registered Agent of the Limited, B The registered agent is an, First Name, Last Name, Suffix, Registered Office of the Limited, C The business address of the, Street Address, City, Zip Code, and American LegalNet Inc section with all the details asked by the platform.

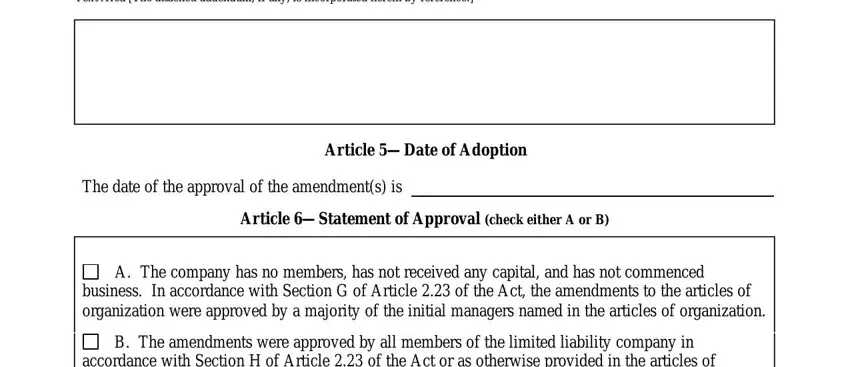

In the Text Area The attached addendum if, Article Date of Adoption, The date of the approval of the, Article Statement of Approval, A The company has no members has, business In accordance with, and B The amendments were approved by area, identify the key details.

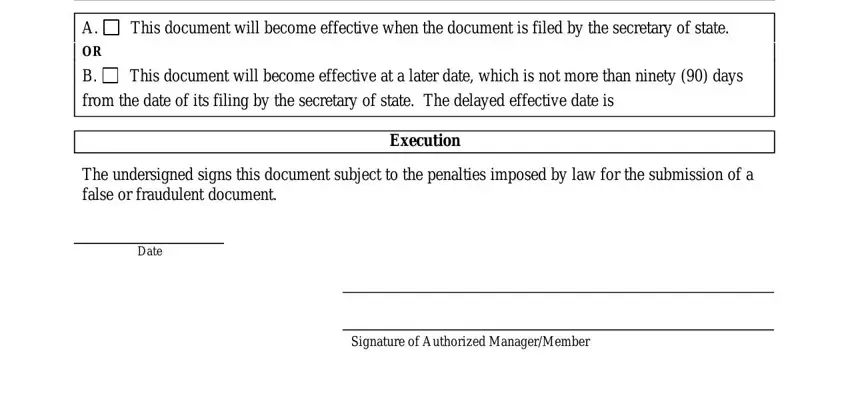

In the section This document will become, This document will become, from the date of its filing by the, The undersigned signs this, Execution, Date, and Signature of Authorized, record the rights and obligations of the sides.

Step 3: Hit the button "Done". Your PDF form can be transferred. You can upload it to your device or email it.

Step 4: To protect yourself from different problems in the foreseeable future, try to get a minimum of a couple of copies of your form.

A. The company has no members, has not received any capital, and has not commenced business. In accordance with Section G of Article 2.23 of the Act, the amendments to the articles of organization were approved by a majority of the initial managers named in the articles of organization.

A. The company has no members, has not received any capital, and has not commenced business. In accordance with Section G of Article 2.23 of the Act, the amendments to the articles of organization were approved by a majority of the initial managers named in the articles of organization.

B. The amendments were approved by all members of the limited liability company in accordance with Section H of Article 2.23 of the Act or as otherwise provided in the articles of organization or the regulations of the company.

B. The amendments were approved by all members of the limited liability company in accordance with Section H of Article 2.23 of the Act or as otherwise provided in the articles of organization or the regulations of the company.