It is possible to fill in oregon forms 40x without difficulty using our PDFinity® editor. To retain our editor on the leading edge of efficiency, we aim to implement user-driven features and enhancements regularly. We're at all times looking for feedback - play a pivotal role in reshaping PDF editing. If you're seeking to get going, here is what it takes:

Step 1: Just click the "Get Form Button" at the top of this page to start up our form editor. There you'll find all that is needed to fill out your file.

Step 2: After you open the file editor, you will see the document ready to be filled out. Besides filling in different blanks, you can also perform some other things with the PDF, particularly adding any textual content, modifying the initial text, adding illustrations or photos, putting your signature on the document, and a lot more.

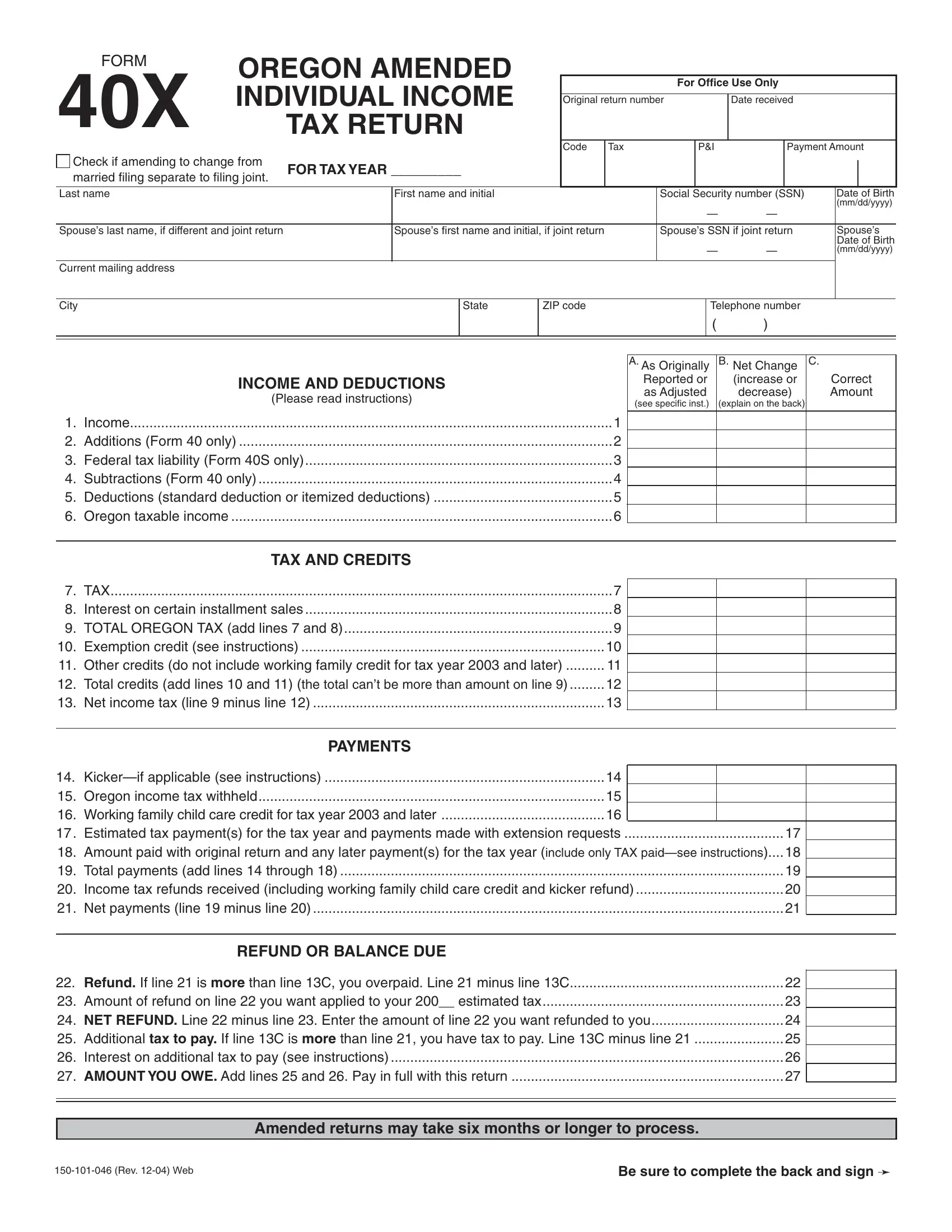

This PDF requires specific details to be entered, so you must take some time to enter what is requested:

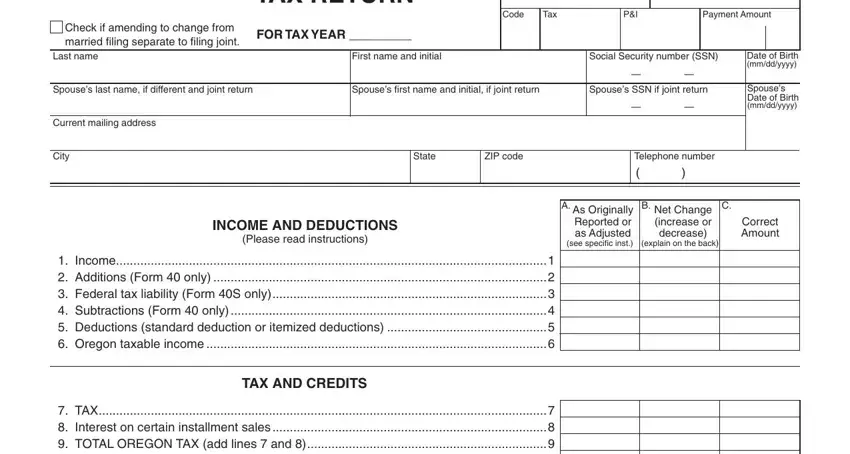

1. Begin completing your oregon forms 40x with a number of essential blanks. Collect all the necessary information and make certain absolutely nothing is left out!

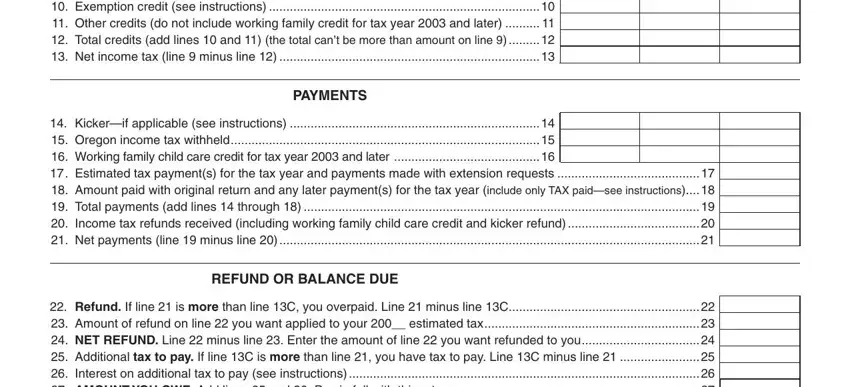

2. Once the last section is done, you'll want to insert the needed details in TAX Interest on certain, PAYMENTS, Kickerif applicable see, REFUND OR BALANCE DUE, and Refund If line is more than line so you can proceed further.

It's very easy to make an error when filling out the PAYMENTS, so be sure you reread it prior to deciding to finalize the form.

3. The next part is generally hassle-free - complete every one of the empty fields in Explanation of adjustments made in order to complete the current step.

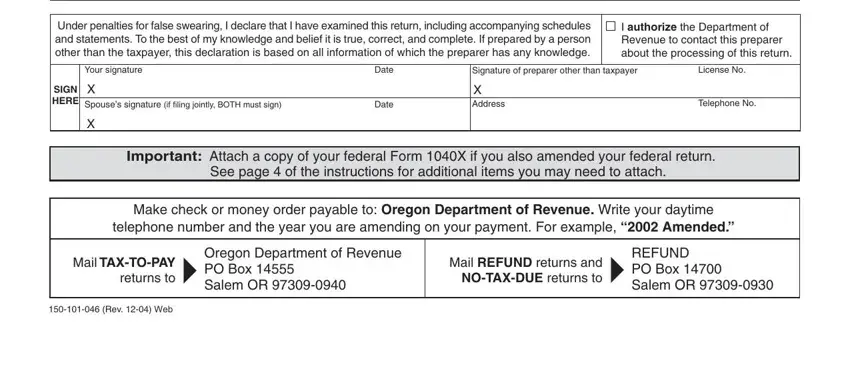

4. This particular paragraph comes with these particular form blanks to fill out: Under penalties for false swearing, I authorize the Department of, Revenue to contact this preparer, Your signature, SIGN HERE, X Spouses signature if fi ling, Date, Date, Signature of preparer other than, License No, X Address, Telephone No, Important Attach a copy of your, Make check or money order payable, and telephone number and the year you.

Step 3: Proofread everything you've typed into the blanks and press the "Done" button. Create a free trial plan with us and obtain direct access to oregon forms 40x - download, email, or change from your personal cabinet. When using FormsPal, it is simple to complete forms without having to be concerned about information leaks or records getting shared. Our secure software makes sure that your private data is maintained safe.