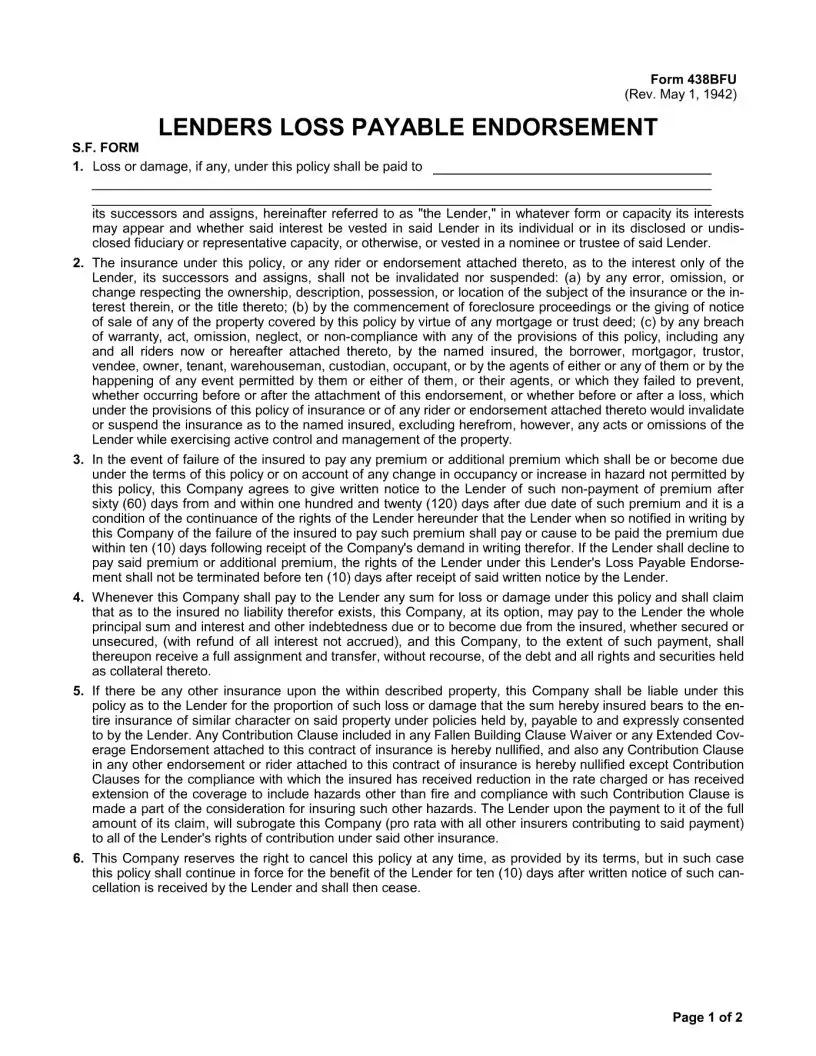

At the heart of navigating complex insurance undertakings, particularly those related to commercial transactions or contractual obligations, lies the 438Bfu form. This crucial document, often overshadowed by more commonly discussed forms, serves as a backbone for establishing a clear understanding and agreement between insurers and the insured. Its primary function is to provide a nuanced framework that outlines the conditions under which the insurer agrees to indemnify the insured party or parties, usually in the context of specific contractual requirements. The form intricately details the kinds of risks covered, the duration of the coverage, and the limits of liability, making it indispensable in the realms of construction, leasing, and various professional services. Moreover, it often acts as a bridge connecting the terms of a contract to the protections provided by an insurance policy, thereby ensuring that all parties have a concrete understanding of their rights and obligations. The importance of this form, though not always in the limelight, cannot be understated; it significantly mitigates risks for businesses by providing clarity and certainty in commercial agreements where substantial financial stakes are involved.

| Question | Answer |

|---|---|

| Form Name | Form 438Bfu |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | lenders loss payable endorsement 438bfu, 438 bfu, form loss endorsement, loss endorsement |