EIN can be completed online with ease. Just make use of FormsPal PDF tool to accomplish the job promptly. In order to make our editor better and easier to use, we continuously work on new features, with our users' suggestions in mind. Getting underway is effortless! Everything you need to do is adhere to the following basic steps directly below:

Step 1: Click the "Get Form" button in the top section of this page to open our PDF tool.

Step 2: This editor grants the opportunity to work with your PDF file in a range of ways. Modify it by adding any text, adjust original content, and place in a signature - all within the reach of a few mouse clicks!

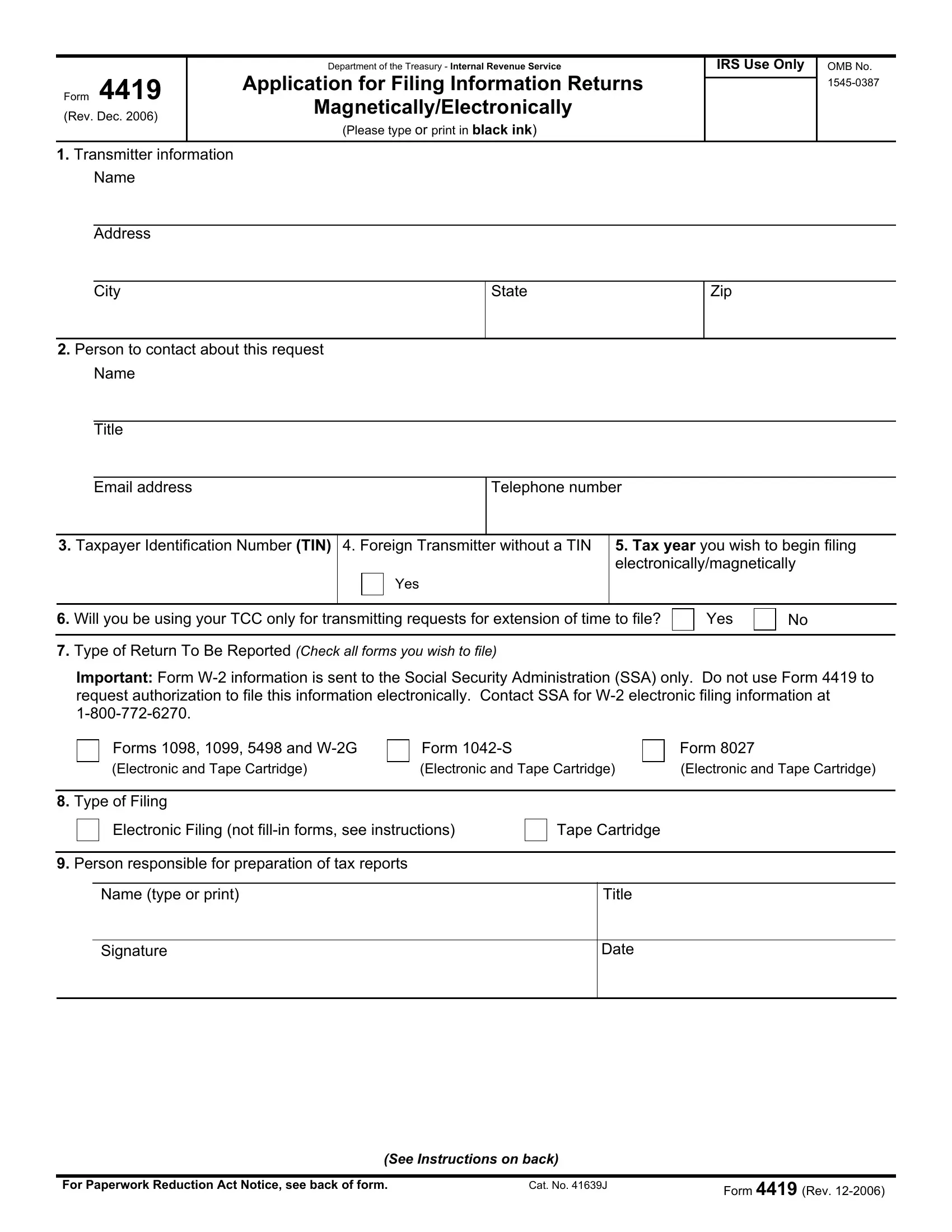

This document will need you to type in specific details; in order to guarantee correctness, please make sure to heed the suggestions down below:

1. First, while filling out the EIN, start out with the area with the subsequent blank fields:

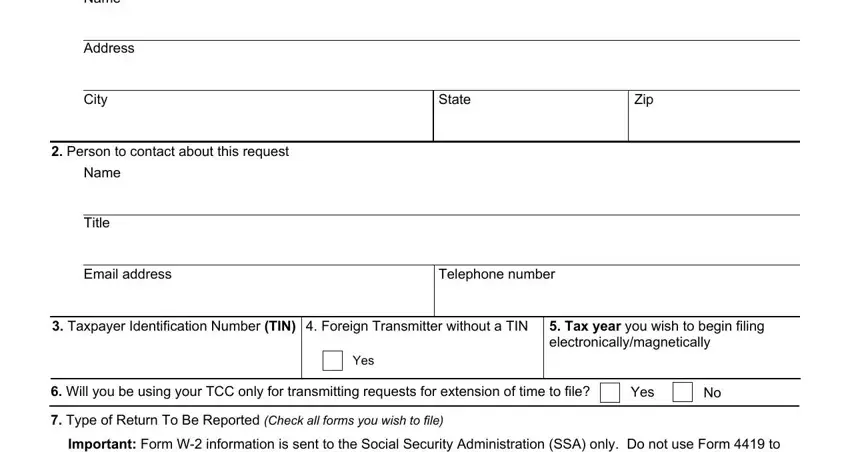

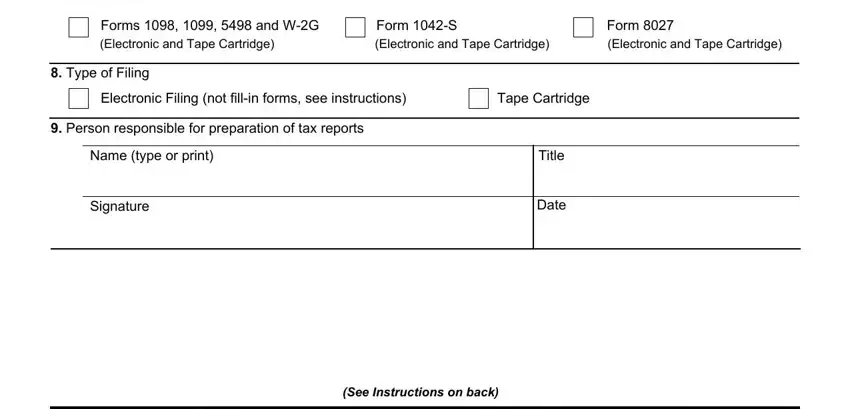

2. Immediately after the prior selection of fields is done, go on to enter the applicable details in these - Important Form W information is, Forms and WG Electronic and, Form S Electronic and Tape, Form Electronic and Tape Cartridge, Type of Filing, Electronic Filing not fillin forms, Tape Cartridge, Person responsible for, Name type or print, Signature, Title, Date, and See Instructions on back.

As to Type of Filing and Person responsible for, be sure that you double-check them here. Both of these are thought to be the most important ones in this document.

Step 3: Prior to getting to the next step, make sure that blanks were filled in the right way. The moment you think it is all fine, click “Done." After setting up afree trial account with us, it will be possible to download EIN or email it promptly. The form will also be readily accessible through your personal account page with your every change. FormsPal guarantees secure form editing with no data recording or sharing. Feel at ease knowing that your data is secure with us!