In the intricate landscape of agricultural operations and rural development, navigating the bureaucratic processes can feel daunting. At the heart of these processes is the Form RD 465-1, a crucial document for borrowers working with the United States Department of Agriculture (USDA) Rural Development and the Farm Service Agency. This form serves a pivotal role in enabling agency borrowers to seek government consent for various actions that impact their loan terms or property status. Whether it's for obtaining partial release from the constraints of real estate securities, subordinating to new financial obligations, or consenting to transactions that alter the estate's lien structure, the RD 465-1 form is an essential mechanism for managing these changes. It meticulously captures details ranging from the borrower's identity and the property description to the specifics of prior liens and the intended use of the property post-transaction. Moreover, the form outlines the procedural steps for preparation, including borrower and approval official signatures, distribution copies specifics, and the due documentation for proposed transactions. This streamlined yet comprehensive approach ensures that borrowers can effectively communicate their needs while adhering to regulatory requirements, making it a linchpin in the broader goal of fostering sustainable rural development and agricultural success.

| Question | Answer |

|---|---|

| Form Name | Form 465 1 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | usda form rd465 1, usda form rd 465 1, rd form 465 1 application for partial release subordination or consent, rd form 465 1 |

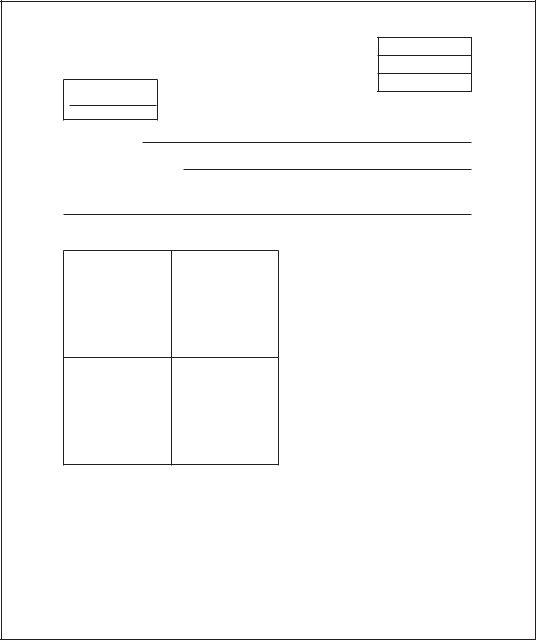

FORMS MANUAL INSERT

FORM RD

TYPE OF LOAN

(SPECIFY)

The undersigned

Position 5

UNITED STATES DEPARTMENT OF AGRICULTURE

RURAL DEVELOPMENT

FARM SERVICE AGENCY

APPLICATION FOR PARTIAL RELEASE,

SUBORDINATION, OR CONSENT

(1)

FORM APPROVED

OMB NO.

STATE

COUNTY

CASE NO.

Used by Agency borrowers to obtain the consent of the Government to perform certain functions, to permit Junior leins or to request partial release from the terms of real estate security

(Names of Borrower and

(1)

whose address (Including ZIP Code) is

in accordance with the terms of the security instruments held by Rural Development or the Farm Service Agency (hereafter referred to as “Agency”) on their property, apply for release or subordination of the liens of said security instruments or consent to the following

transaction.

(2)

instruments.

(Description)

1. Plot of Property: |

(3) |

|

N |

W

2. Prior lienholders listed in order:

(4)

3.The prior lien to which subordination is requested is to be held by:

(5)

E

4. The property to be leased or conveyed to:

(6)

S

5. Description of property to be covered by the release, subordination, or consent:

(7)

6. The use to be made of the property covered by this application is:

(8)

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

(SEE REVERSE)

|

|

|

PROCEDURE FOR PREPARATION |

: |

|

|

|

FSA Transferred Instructions |

PREPARED BY |

: |

Loan Approval Official. |

NUMBER OF COPIES |

: Original and one except that an extra copy will be prepared when |

|

|

|

lender for insured Farm Ownership loan is mortgagee and consent of |

|

|

mortgagee or a formal release is required. |

SIGNATURES REQUIRED |

: |

When Loan Approval Official is authorized to approve: All copies by |

|

|

borrower and by Loan Approval Official. |

|

|

When State Official’s approval is required: All copies by borrower |

|

|

and by Loan Approval Official; original by State Approval Official. |

DISTRIBUTION COPIES |

: When Form has been processed and approved in accordance with |

|

|

|

appropriate instructions and: |

1. A formal release is not requested: Original to borrower, copy in Loan Approval Office case folder, and a copy to lender if he/she is mortgagee and consent is required.

2. A formal release is requested: Copy to borrower, original to Loan Approval Office case folder, and when lender is mortgagee, copy to lender.

INSTRUCTIONS FOR PREPARATION

(1)Insert the name(s) and address of the borrower(s) as shown on the security instrument(s).

(2)State the purpose of which release, subordination, or consent is required, such as sale of portion of property, lease of property, sale or lease of mineral rights, purchase of additional land, and so forth.

(3)Draw a sketch of the property showing location of buildings, roads,

(4)Itemize the Prior or Junior Lienholders in order and the amounts of each lien prior to the proposed transaction.

(5)Complete the section if applicable by inserting the name and address (including ZIP CODE) of the prior lienholder. Attach a conformed copy of the proposed security instrument as it will read if the transaction is approved.

(6)Complete the section if applicable by inserting the name and address (including ZIP CODE) of the proposed leasee or purchaser. If the lease is for nonagricultural purposes or the lease of surplus buildings, attach a conformed copy of the proposed lease. If the lease is for agricultural purposes, summarize the terms of the lease.

(7)Insert the legal description of the land to be used in the transaction; attach rider if necessary. However, if a lease of a portion of the farm or nonfarm tract is involved and a legal description would not be necessary, other means of describing the acreage may be used.

(8)Insert a statement showing what use is to be made of the property covered by the application.

(9)Insert the amount of initial payment and any subsequent payments, if applicable. Insert a statement explaining other considerations.

(10)Also show the amount of the Prior lien after the proposed transaction. Itemize all proceeds from the transaction.

(11)To be completed by borrower.

PAGE 2 OF FORM RD

7. The anticipated proceeds from this transaction are: |

Initial payment $ |

|

|

|

Subsequent payment(s) $ |

|

|

Other considerations: (9)

If the borrower obtains a loan from another lender as a result of any subordination covered by this application, the lender must incorporate in the borrower’s note a statement that the loan will be in default should any proceeds of the loan funds obtained as a result of this subordination be used for a purpose that will contribute to excessive erosion of highly erodible land or to the conversion of wetlands to produce an agricultural commodity.

8. Subject to the provisions of Paragraph 7 it is proposed to use the proceeds as follows:

(10)

9.Have you or any member, stockholder, partner or joint operator of the entity borrower been convicted under Federal or State law of planting, cultivating, growing, producing, harvesting, or storing a controlled substance since December 23, 1985?

Yes |

No (11) |

If yes, provide date of conviction and details on a separate sheet.

10.If this application is approved, the undersigned borrower(s) agree to comply with such terms as may be prescribed by Agency and to disposition of the proceeds as required by Agency pursuant to its regulations, including the method of applying payments to the borrower(s)’ loan accounts. It is expressly understood that unless a separate written instrument of subordination or partial release is executed and delivered by Agency pursuant to this application, approval by Agency of this application will merely constitute and evidence its consent, as lienholder, to the proposed transaction without in any way subordinating its lien, releasing any of its security, modifying the payment terms of the loan, or otherwise affecting any rights of Agency.

The borrower(s) agrees that none of the funds obtained as a result of any subordination covered by this application will be used for a purpose that will contribute to excessive erosion of highly erodible land or to the conversion of wetlands to produce an agricultural commodity, as explained in Exhibit M of subpart G of part 1940 of title 7 of the Code of Federal Regulations.

|

(12) |

||

Date |

|

Signed |

|

(12) |

(Borrower) |

|

|

|

(12)Borrower(s) will sign the application as their name(s) appear on the security instrument(s). If the borrower is an organization, its authorized representative will sign and the representative’s title will be shown after or below the signature.

(13)Insert the dollar figures of the present market value of the property both before and after the transaction and show the present market value of the property to be disposed of, if applicable.

(14)Describe how the proposed transaction will affect the property physically and from an operating and salability standpoint, including kinds and estimated dollar amounts of damages and benefits.

PAGE 3 OF FORM RD

1. The proposed transaction:

WILL |

WILLNOTprevent or make more difficult the successful operation of this property. |

WILL |

WILLNOTreduce the efficiency of the property. |

2.The proposed transaction will affect the value of this property as security for the loan as follows: Present Market Value

(a) |

Value of Real Estate Before |

|

|

(13) |

|

(b) Value of Real Estate After |

|

|

|||

|

|

||||

(c) |

Value of Real Estate Disposed of |

|

|

||

3. The following |

damages |

benefits will result to this property from the transaction: |

|||

|

(14) |

|

|

|

|

I hereby recommend that this application be approved and that the proceeds be applied or released as follows:

INITIALPAYMENT |

SUBSEQUENTPAYMENTS: |

|

|

|

||||||||||

$ |

|

To extra payment on Agency loan |

$ |

|

or |

|

|

% To extra payment on Agency loan |

||||||

$ |

|

To regular payment on Agency loan |

$ |

|

or |

|

% To regular payment on Agency loan |

|||||||

$ |

|

To borrower as regular income |

$ |

|

or |

|

|

% To borrower as regular income |

||||||

$ |

|

To prior lien(s) |

$ |

|

or |

|

|

% To prior lien(s) |

||||||

$ |

|

Other (specify) |

|

|

$ |

|

Other (specify) |

|

|

|

||||

Date |

|

|

|

Recommended by |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

(Title) |

Date |

|

|

|

Approved |

Disapproved by |

|

(Title)

UNITEDSTATESDEPARTMENTOFAGRICULTURE

|