The intricacies of compliance with tax regulations are exemplified by the requirement for companies to complete and submit the Form 46G (Company) Return of Third Party Information, a critical document aimed at ensuring transparency and accountability in financial transactions. This form, specifically designed for the fiscal year ending on 31 December 2008, plays a pivotal role by obligating companies to disclose payments made to individuals or entities for provided services, including fees, commissions, and copyright payments. With a threshold set for reporting amounts exceeding €6,000, the form is a testament to the stringent measures employed to prevent tax evasion and encourage ethical business practices. Additionally, it outlines conditions for VAT inclusion or exclusion in reported figures, thereby accommodating diverse corporate accounting practices. The deadline set for submission, no later than nine months following the accounting period's end, emphasizes the importance of timely compliance, while provisions for electronic submissions reflect a modern approach to tax administration. Moreover, the form's potential to be audited by Revenue underscores the seriousness with which this information is regarded, and the extensive list of service categories covered illustrates the comprehensive nature of this reporting requirement. Companies are urged to familiarize themselves with the detailed explanatory notes provided, ensuring accurate completion and submission of the Form 46G. Through this meticulous process, the form serves as both a tool for governance and a reflection of the broader commitment to maintaining the integrity of the financial system.

| Question | Answer |

|---|---|

| Form Name | Form 46G |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | form 46, form 46g revenue pdf, 46g return, form 46g |

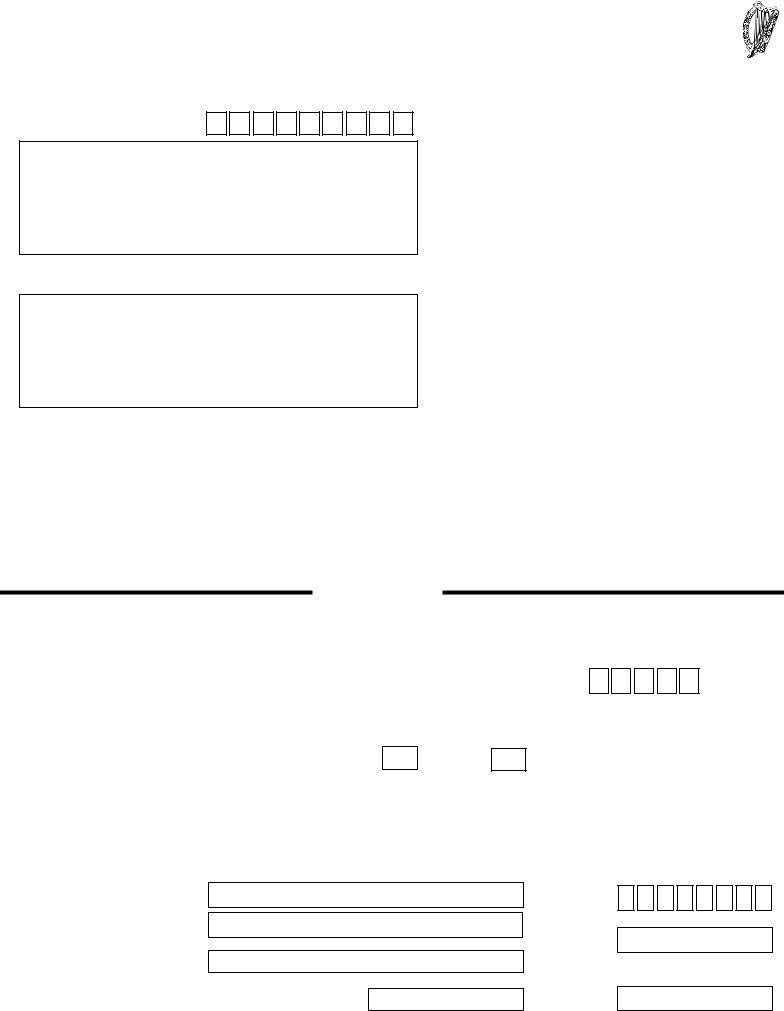

FORM 46G (Company)

Return of Third Party Information for the year ended 31 December 2008

Tax Reference Number |

GCD |

TAIN |

|

|

Remember to quote this number in all correspondence or when calling at your Revenue office

Return Address

Use any envelope and write “Freepost” above the address

NO STAMP REQUIRED

Read the explanatory notes on page 4 before completing this form.

You can submit the return electronically if you wish - see explanatory note on page 4.

RETURN BY ANY COMPANY MAKING PAYMENTS TO ANY PERSON FOR SERVICES PROVIDED INCLUDING FEES, COMMISSIONS AND PAYMENTS FOR COPYRIGHT

NOTICE

In accordance with the requirements of Sections 889 and 894 Taxes Consolidation Act 1997 this return should be completed and returned to the above address not later than nine months after the end of the accounting period.

[DD/MM/YYYY][DD/MM/YYYY]

COMPANY ACCOUNTING PERIOD: FROM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

|

|

|

|

|

|

|

If you did not make any payments for the accounting period, enter “NONE” here, |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||

below and return the form to the Return Address above. |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||

complete the declaration

Are the figures enclosed VAT inclusive? |

YES |

NO

(Tick ˛ appropriate box)

YOU MUST SIGN THIS DECLARATION

I DECLARE that, to the best of my knowledge and belief, all the particulars given on this form are correctly stated.

Signature of Secretary (or other authorised person)

Capacity of Signatory

Name of Company

Agent’s Details: |

Tax Adviser Identification No. (TAIN) |

Date

[DD/MM/YYYY]

Telephone

Number

Client’s Ref.

INT. VERSION 2008

Tax Reference Number

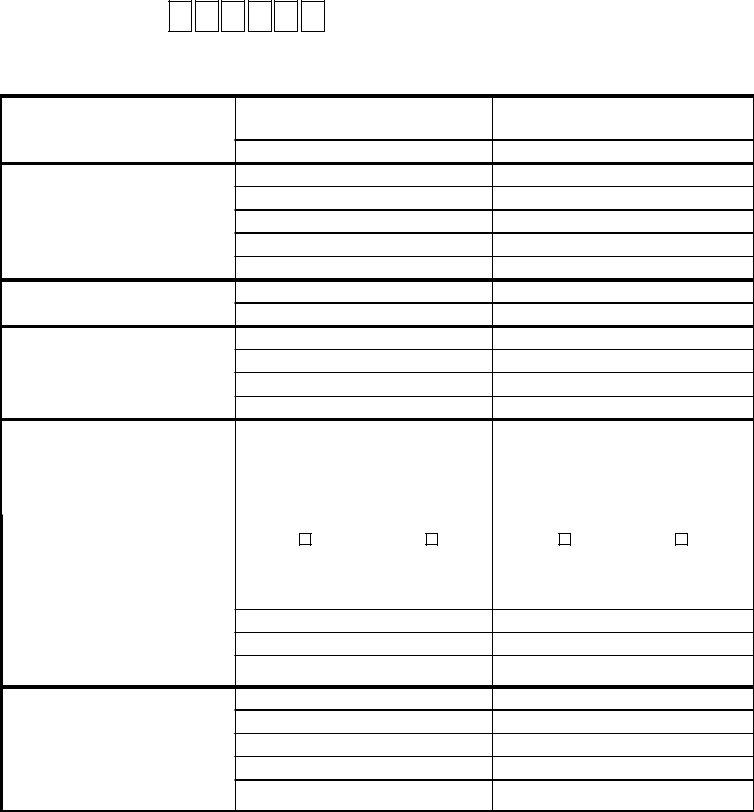

COMPLETE IN BLOCK LETTERS

|

|

|

Return of Payments where the total amount for the year exceeds 6,000to any |

|

|

|

person for services provided including fees, commissions and payments for |

|

|

|

copyright. |

|

|

|

Please read the notes on page 4 before completing this form |

|

|

|

|

PAYEE |

PAYEE |

||

Surname or full title of company, firm etc.

First Name (if individual)

Private Address

Business Name (if any)

Business Address

PAYEE’S Tax Reference Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total amount of payments made |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Value of Consideration |

€ |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

.00 |

|

|

€ |

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

.00 |

|

|

|

||||||||

given |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Was VAT charged in this |

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

transaction? Tick ˛ box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nature of Consideration, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if not money |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nature of Services or Rights provided

FORM 46G (COMPANY) 2008

PAGE 2