Are you a United States citizen or resident alien? Do you have a foreign bank account with at least $10,000 in it? If so, you're required to file Form 4713 each year with the IRS. This form is used to report your foreign financial assets and income. Don't forget to submit it by April 15th! If you need help completing this form, contact a tax professional. They can help make sure everything is filed accurately and on time.

| Question | Answer |

|---|---|

| Form Name | Form 4713 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | volunteer time record, da 4713 pdf, how to form da 4713, da 4713 2013 pdf |

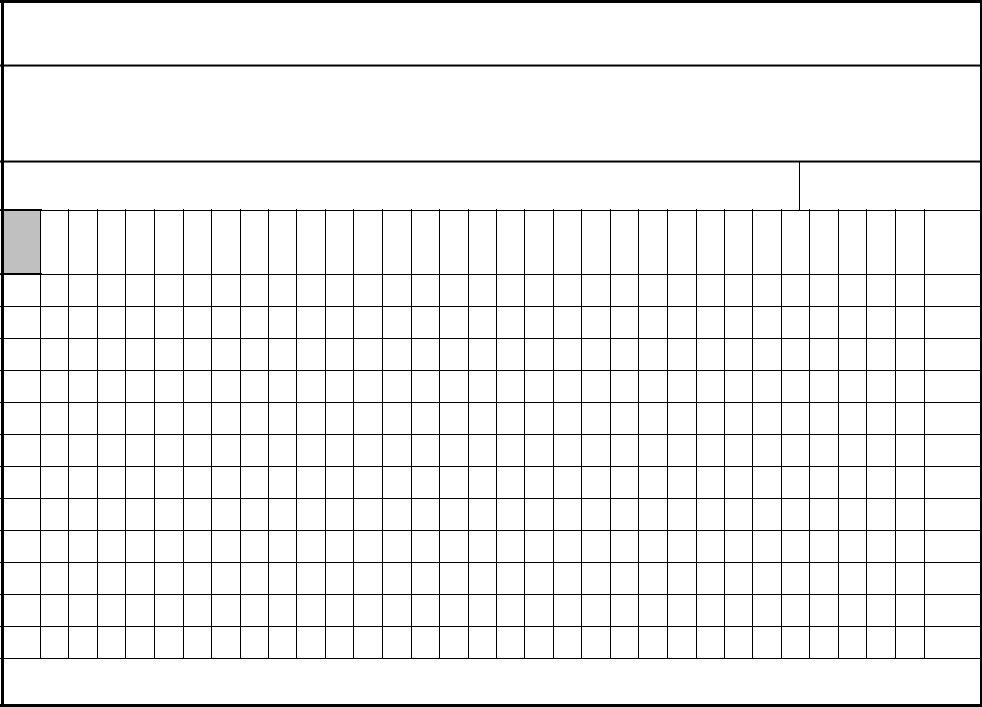

VOLUNTEER DAILY TIME RECORD

For use of this form, see AR

INSTRUCTIONS

Upon resignation, retirement or transfer, the original of this record will be furnished for the personal file of the volunteer and a duplicate will be maintained at the organization for at least three years. In case of transfer, a duplicate record will be furnished to the gaining organization upon request of the volunteer. Upon completion of the calendar year, the annual total will be recorded on DA Form 4162.

NAME

YEAR

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

19 |

20 |

21 |

22 |

23 |

24 |

25 |

26 |

27 |

28 |

29 |

30 |

31 |

TOTAL |

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

TOTAL:

DA FORM 4713, MAR 2013 THIS FORM SUPERSEDES THE PREVIOUS EDITION DATED, JUL 2003 AND REPLACES DA FORM 7493, AUG 2003, WHICH ARE OBSOLETE. |

APD LF v1.00 |