Working with PDF files online is certainly very simple with this PDF editor. Anyone can fill out tax forms for self employed 2021 here effortlessly. In order to make our tool better and more convenient to use, we continuously develop new features, taking into consideration suggestions coming from our users. Starting is simple! All that you should do is take the following easy steps directly below:

Step 1: Simply hit the "Get Form Button" in the top section of this page to access our pdf editing tool. Here you'll find all that is required to fill out your document.

Step 2: The tool will let you change PDF documents in various ways. Modify it with customized text, adjust what is originally in the file, and put in a signature - all possible within minutes!

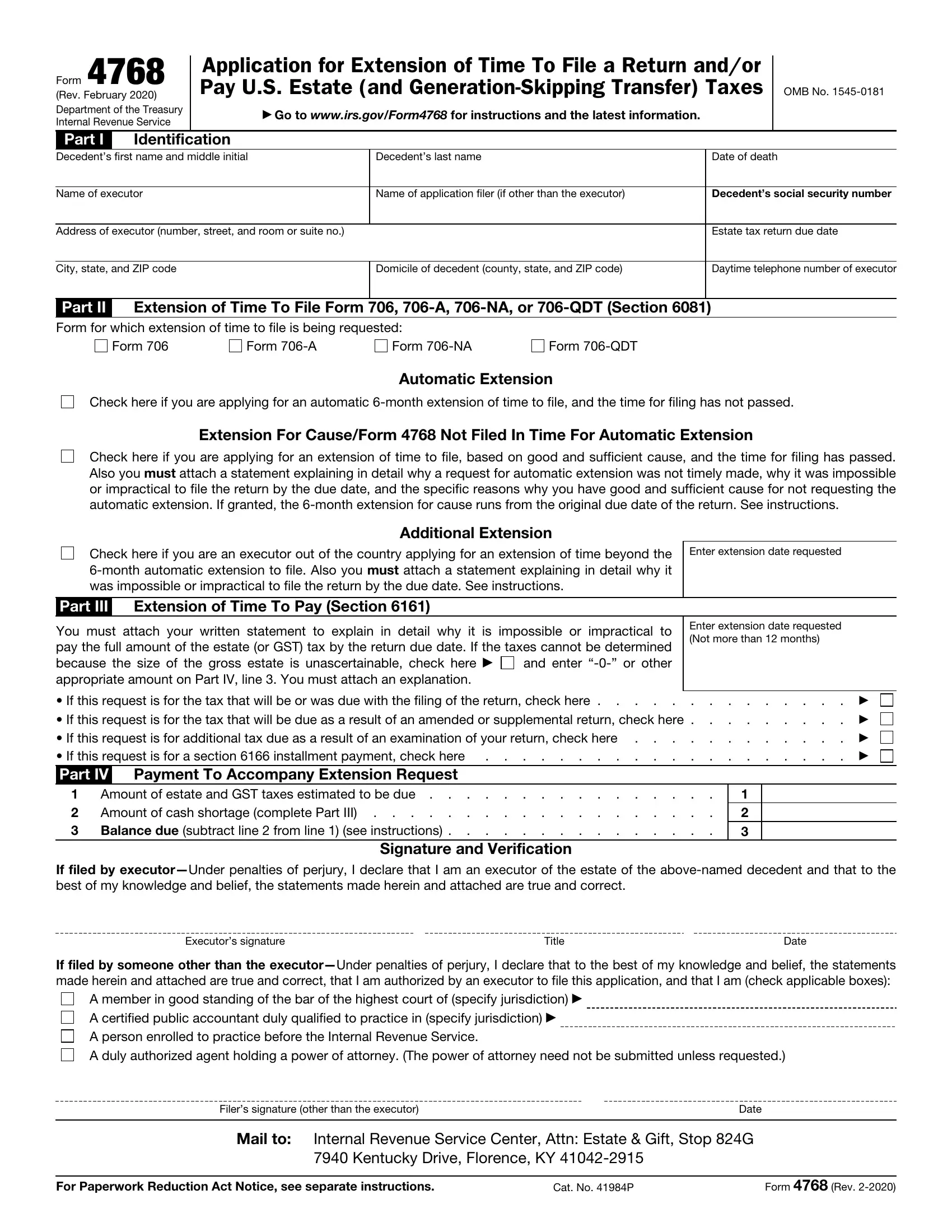

With regards to the fields of this precise document, this is what you need to do:

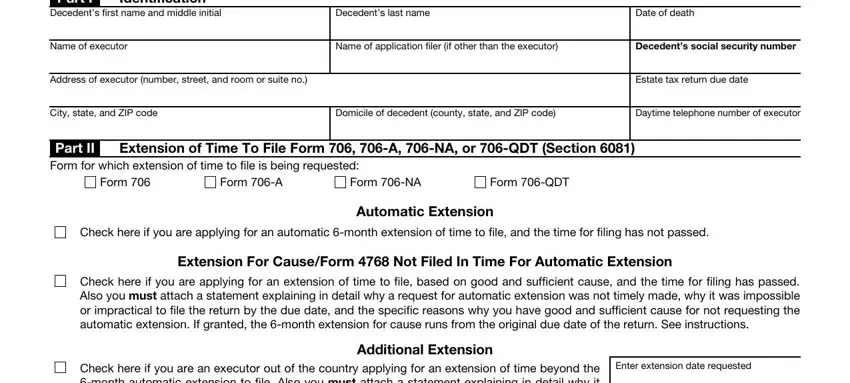

1. Firstly, while completing the tax forms for self employed 2021, beging with the part that has the following blank fields:

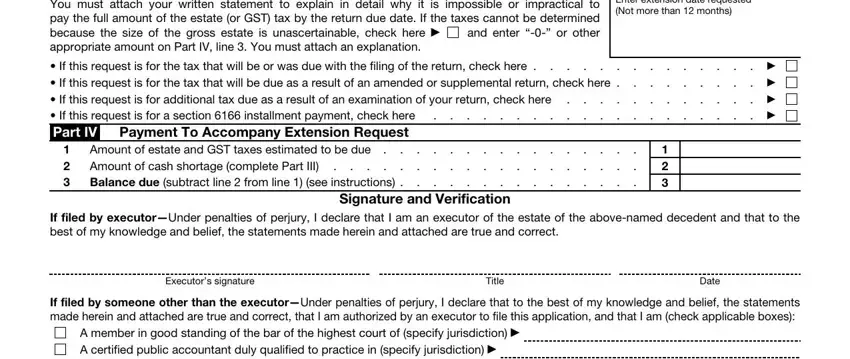

2. Once your current task is complete, take the next step – fill out all of these fields - You must attach your written, Enter extension date requested Not, If this request is for the tax, If this request is for the tax, If this request is for additional, Amount of estate and GST taxes, Amount of cash shortage complete, If filed by executorUnder, Signature and Verification, Executors signature, Title, Date, If filed by someone other than the, and A member in good standing of the with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

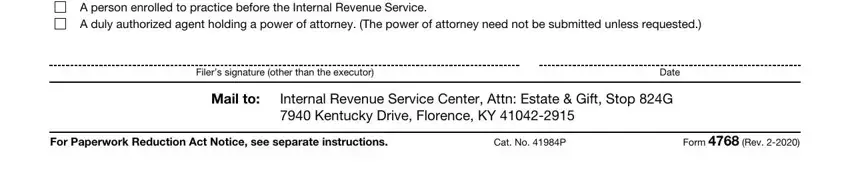

3. This next step is about A person enrolled to practice, A duly authorized agent holding a, Filers signature other than the, Date, Mail to, Internal Revenue Service Center, For Paperwork Reduction Act Notice, Cat No P, and Form Rev - type in every one of these blanks.

Always be very mindful while filling out Date and Form Rev, since this is where a lot of people make mistakes.

Step 3: Proofread all the details you have typed into the blanks and then click the "Done" button. Get hold of the tax forms for self employed 2021 after you register online for a free trial. Immediately access the form within your personal cabinet, along with any modifications and adjustments all synced! FormsPal is invested in the personal privacy of all our users; we ensure that all personal information used in our system is kept secure.