SECTION 142.824 — (MOTOR FUEL TAX LAW)

PROVIDES THE FOLLOWING REQUIREMENTS

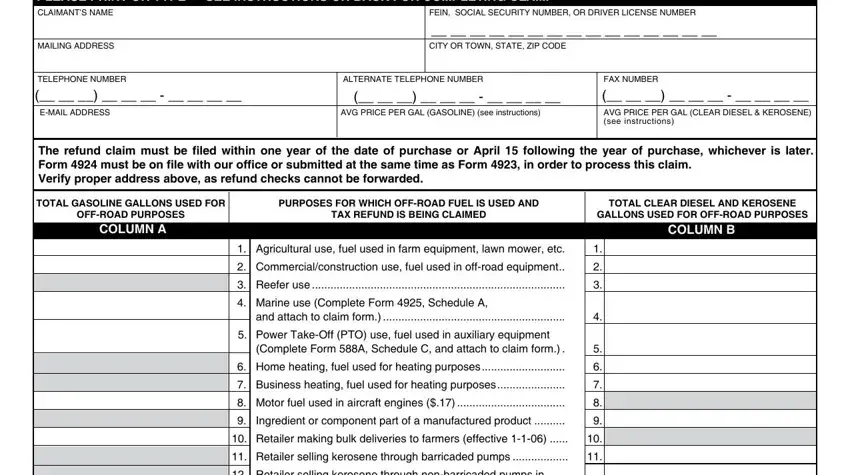

To claim a refund, the ultimate consumer or retailer must file the claim within one year of the date of purchase or April 15th following the year of purchase, whichever is later. The claim form must be supported by “original” invoices, sales slips, or other documentation if pre-approved by the department. The invoices must be marked paid by the seller and contain the date of sale, name and address of the purchaser and seller, number of gallons purchased and price per gallon, Missouri fuel tax and sales tax, if applicable, as separate items. FORM 4924,

MOTOR FUEL TAX REFUND APPLICATION, MUST BE ON FILE WITH OUR OFFICE BEFORE WE CAN PROCESS THIS CLAIM. FORM 4924 CAN BE SUBMITTED AT THE SAME TIME AS FORM 4923.

INSTRUCTIONS FOR COMPLETING FORM

Group together all invoices by product type (gas, diesel, kerosene, etc). Attach calculator tapes of the total quantity and the total dollar amount paid for each product type. Claims received without attached original invoices, sales slips or pre-approved printouts will be returned.

CLAIMANT’S NAME AND PHYSICAL ADDRESS: Enter claimant’s name, mailing address, city, state, and zip code.

FEDERAL IDENTIFICATION, SOCIAL SECURITY NUMBER, OR DRIVER LICENSE NUMBER: List your Federal Identification Number (FEIN), Social Security Number, or Driver License Number.

PHONE NUMBER/ALTERNATE PHONE NUMBER/E-MAIL ADDRESS/FAX NUMBER: Enter the appropriate information in each box.

AVERAGE PRICE PER GALLON: Enter the average price per gallon paid for Gasoline, Clear Diesel, and Kerosene. Important: Subtract the federal and state taxes before calculating the average price paid, in order to deduct the appropriate state sales tax from your refund claim.

ROUND ALL GALLONS TO NEAREST GALLON.

LINE 1: Enter total gallons of fuel used in farm equipment for agricultural purposes, or fuel used in residential/personal off-road equipment (residential lawn mowers, ATV’s, chain saws, weed eaters, etc.) under Column A (gasoline) and/or Column B (clear diesel/kerosene).

LINE 2: Enter total gallons of fuel used in off-road equipment under Column A (gasoline) and/or Column B (diesel).

LINE 3: Enter total gallons of fuel used in reefer units under Column B.

LINE 4: Enter total gallons of fuel used in watercraft under Column A (gasoline) and/or Column B (diesel). Attach a completed Form 4925, Schedule A.

LINE 5: Enter total gallons of fuel used in the operation of PTO equipment under Column B. Attach a completed Form 588A, Schedule C.

LINE 6: Enter total gallons of fuel used for home heating purposes under Column B.

LINE 7: Enter total gallons of fuel used for business heating purposes under Column B.

LINE 8: Enter total gallons of gasoline used in aircraft under Column A.

LINE 9: Enter total gallons of fuel used as an ingredient or component part of the finished product under Column B.

LINE 10: Retailers, enter the bulk sales of one hundred gallons or more of gasoline delivered to farmers under Column A. Attach a completed Form 5085, Bulk Deliveries of Agricultural Gasoline.

LINE 11: Retailers, enter the total gallons of kerosene sold through barricaded pumps under Column B.

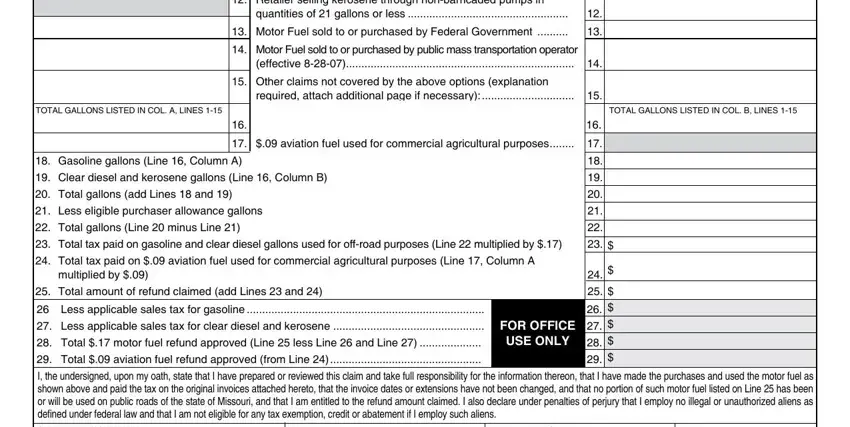

LINE 12: Retailers, under Column B, enter the total number of gallons of kerosene sold in quantities of 21 gallons or less through non-barri- caded pumps.

LINE 13: Enter the total number of gallons of fuel sold to or purchased by the Federal Government under Columns A and/or B.

LINE 14: Enter the total number of gallons of fuel sold to or purchased by the public mass transportation operator under Columns A and/or B.

LINE 15: Enter total gallons of fuel used for other off-road purposes under appropriate columns. Explain how the fuel is used for off-road purposes.

LINE 16: Add figures entered in each column and list total in appropriate box.

LINE 17: Enter total gallons of $.09 aviation fuel under Column A.

LINE 18: Enter total gasoline gallons (Line 16, Column A).

LINE 19: Enter total clear diesel gallons (Line 16, Column B).

LINE 20: Enter total gallons subject to a refund (Add Lines 18 and 19).

LINE 21: Enter gallons of eligible purchaser allowace. Motor fuel distributor claimants only.

LINE 22: Enter total gallons (Line 20 minus Line 21).

LINE 23: Enter total motor fuel tax paid on gallons used for off-road purposes (Line 22 multiplied by $.17).

LINE 24: Enter total $.09 aviation fuel tax paid on gallons used for commercial agricultural purposes (Line 17, column A, multiplied by $.09).

LINE 25: Enter total amount of motor fuel tax refund claimed (Add Lines 23 and 24).

LINES 26 THROUGH 29: For office use only. The Missouri Department of Revenue will calculate, if applicable.

REMEMBER TO SIGN AND DATE THE FORM.

CLAIMS RECEIVED UNSIGNED WILL BE RETURNED.

If you have questions or need assistance in completing this form, please call this office at (573) 751-7671 (TDD (800) 735-2966) or e-mail this office at: excise@dor.mo.gov. You may also access a copy of this form on the Department’s web site:

http://dor.mo.gov/tax/forms/index.php?category=18.