Working with PDF files online is definitely quite easy with our PDF editor. Anyone can fill out notice of protest form here effortlessly. FormsPal team is always working to improve the tool and help it become much faster for people with its multiple functions. Enjoy an ever-improving experience today! Getting underway is easy! Everything you should do is adhere to the next basic steps down below:

Step 1: Simply click on the "Get Form Button" at the top of this page to get into our pdf editor. This way, you'll find everything that is required to fill out your document.

Step 2: With the help of this advanced PDF editing tool, it is easy to accomplish more than just fill in blank fields. Edit away and make your docs look perfect with custom text put in, or modify the file's original content to excellence - all that accompanied by an ability to incorporate stunning photos and sign the PDF off.

This PDF doc requires some specific details; in order to guarantee correctness, remember to take note of the recommendations just below:

1. To begin with, once filling out the notice of protest form, start in the page that includes the subsequent fields:

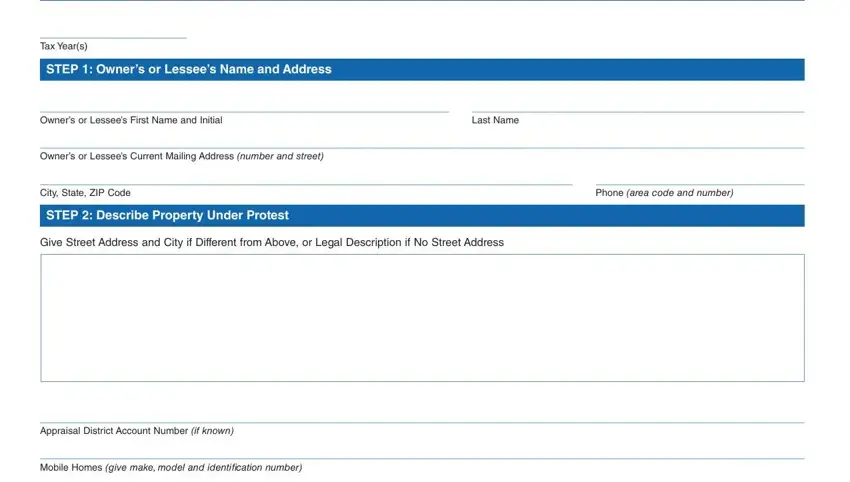

2. The third stage is to complete these fields: Tax Years, STEP Owners or Lessees Name and, Owners or Lessees First Name and, Last Name, Owners or Lessees Current Mailing, City State ZIP Code, Phone area code and number, STEP Describe Property Under, Give Street Address and City if, Appraisal District Account Number, and Mobile Homes give make model and.

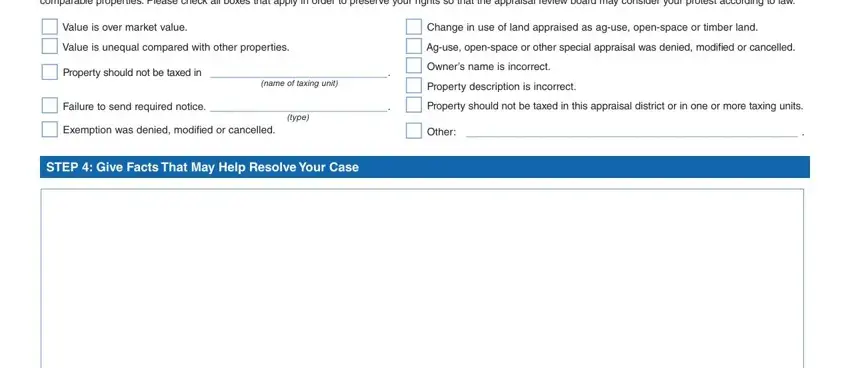

3. This subsequent section should also be quite straightforward, Failure to check a box may result, Value is over market value Value, name of taxing unit, type, Change in use of land appraised, and STEP Give Facts That May Help - every one of these form fields will need to be filled out here.

4. The next subsection needs your involvement in the subsequent places: What do you think your propertys, STEP Check to Receive ARB Hearing, If your protest goes to a hearing, STEP Signature, Print Name, Signature, Date, and For more information visit our. Ensure you fill in all of the needed information to move forward.

Those who work with this document frequently make errors when completing What do you think your propertys in this part. Ensure you double-check whatever you type in here.

Step 3: When you have looked over the details in the file's blanks, press "Done" to finalize your document generation. Make a 7-day free trial account with us and get direct access to notice of protest form - download or modify inside your FormsPal account page. We do not sell or share the information you use while filling out documents at our website.