When you intend to fill out nj form 500 instructions, you won't have to install any kind of applications - simply use our PDF editor. Our editor is continually developing to grant the very best user experience possible, and that is thanks to our commitment to constant enhancement and listening closely to testimonials. Starting is effortless! All you should do is adhere to the following simple steps directly below:

Step 1: Click on the "Get Form" button at the top of this page to get into our editor.

Step 2: When you launch the file editor, you will get the form prepared to be completed. In addition to filling out various blanks, you can also do many other actions with the PDF, specifically writing any textual content, changing the initial textual content, adding images, affixing your signature to the PDF, and much more.

Be mindful when filling out this document. Make certain all mandatory fields are done correctly.

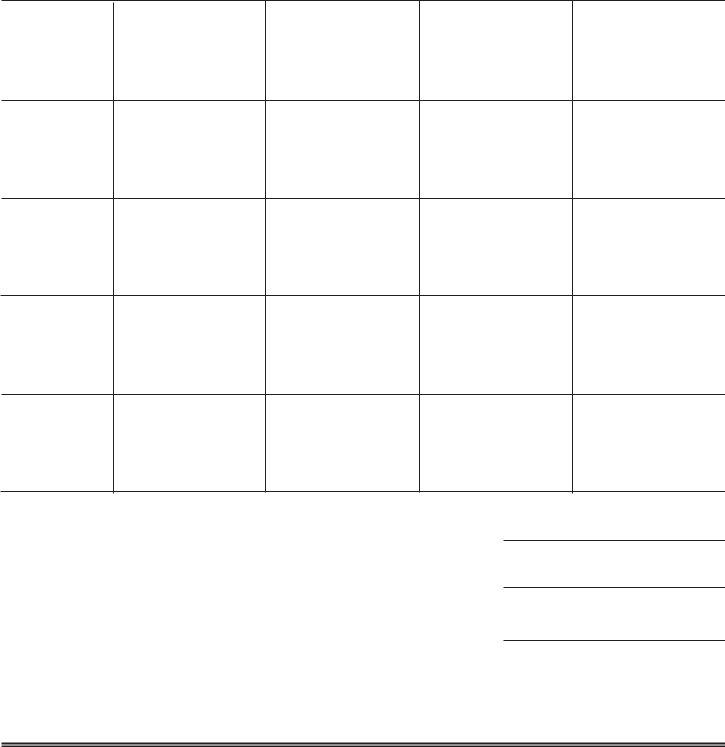

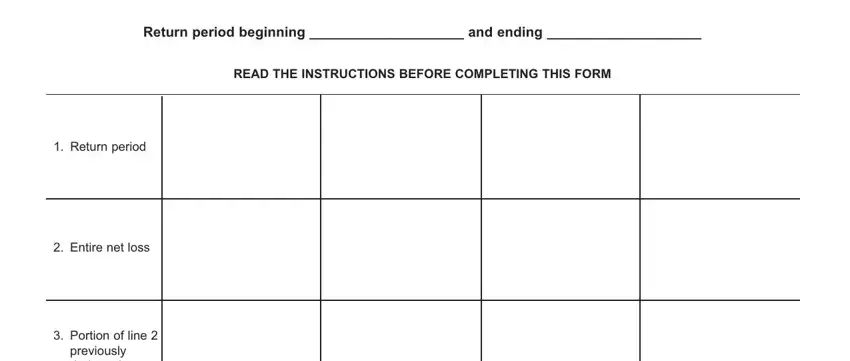

1. It's essential to fill out the nj form 500 instructions properly, hence be attentive while filling out the parts including these blanks:

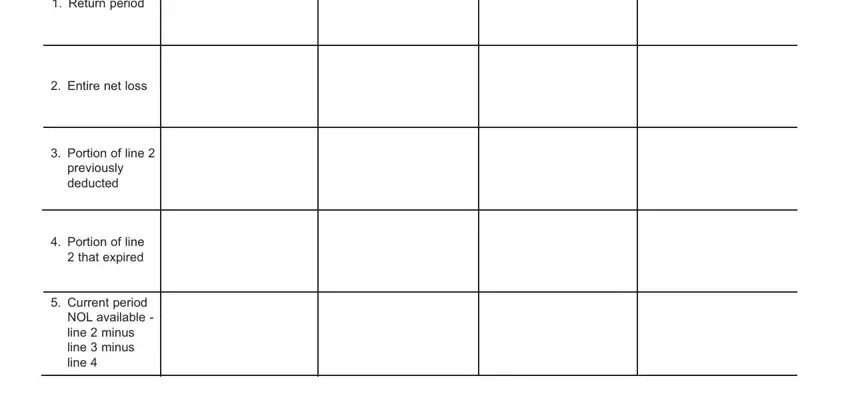

2. Now that this array of fields is done, you have to add the necessary specifics in previously deducted, Portion of line that expired, Current period, NOL available line minus line, Total of the amounts reported on, Enter the current periods entire, and Current periods NOL deduction so you can move on to the third stage.

It's simple to make an error when filling in your Current periods NOL deduction, so make sure you go through it again before you decide to send it in.

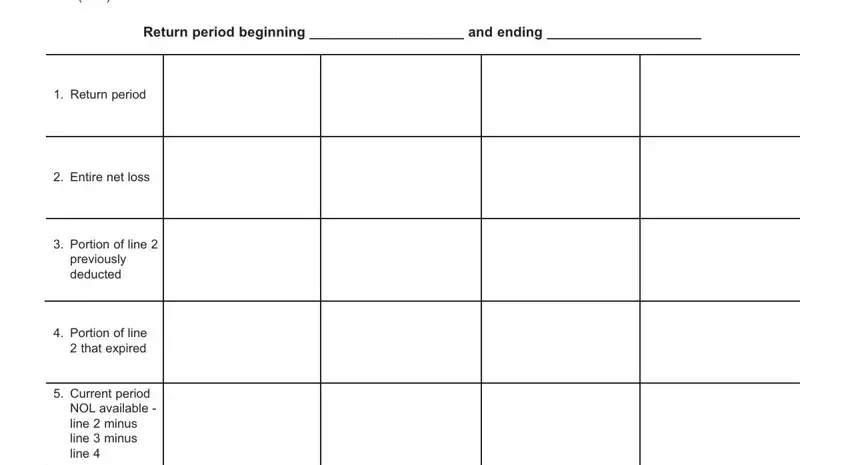

3. The following step is about Return period beginning and, Return period, Entire net loss, Portion of line, previously deducted, Portion of line that expired, Current period, and NOL available line minus line - type in each of these blanks.

4. This next section requires some additional information. Ensure you complete all the necessary fields - Return period, Entire net loss, Portion of line, previously deducted, Portion of line that expired, Current period, and NOL available line minus line - to proceed further in your process!

Step 3: Immediately after double-checking your fields you've filled in, press "Done" and you're all set! After getting afree trial account with us, you'll be able to download nj form 500 instructions or email it directly. The document will also be at your disposal via your personal account page with all your adjustments. FormsPal is focused on the privacy of our users; we make certain that all personal data going through our tool continues to be secure.