In case you would like to fill out arizona form 5005 fillable, you won't have to download and install any applications - just use our PDF editor. The tool is constantly upgraded by us, getting additional features and becoming better. Getting underway is simple! All you have to do is stick to the following basic steps down below:

Step 1: Click on the "Get Form" button above. It's going to open up our tool so that you can start completing your form.

Step 2: Using this advanced PDF editing tool, it is easy to do more than just fill in blank form fields. Try each of the features and make your forms look great with customized textual content incorporated, or optimize the original content to perfection - all that comes with an ability to insert just about any images and sign the PDF off.

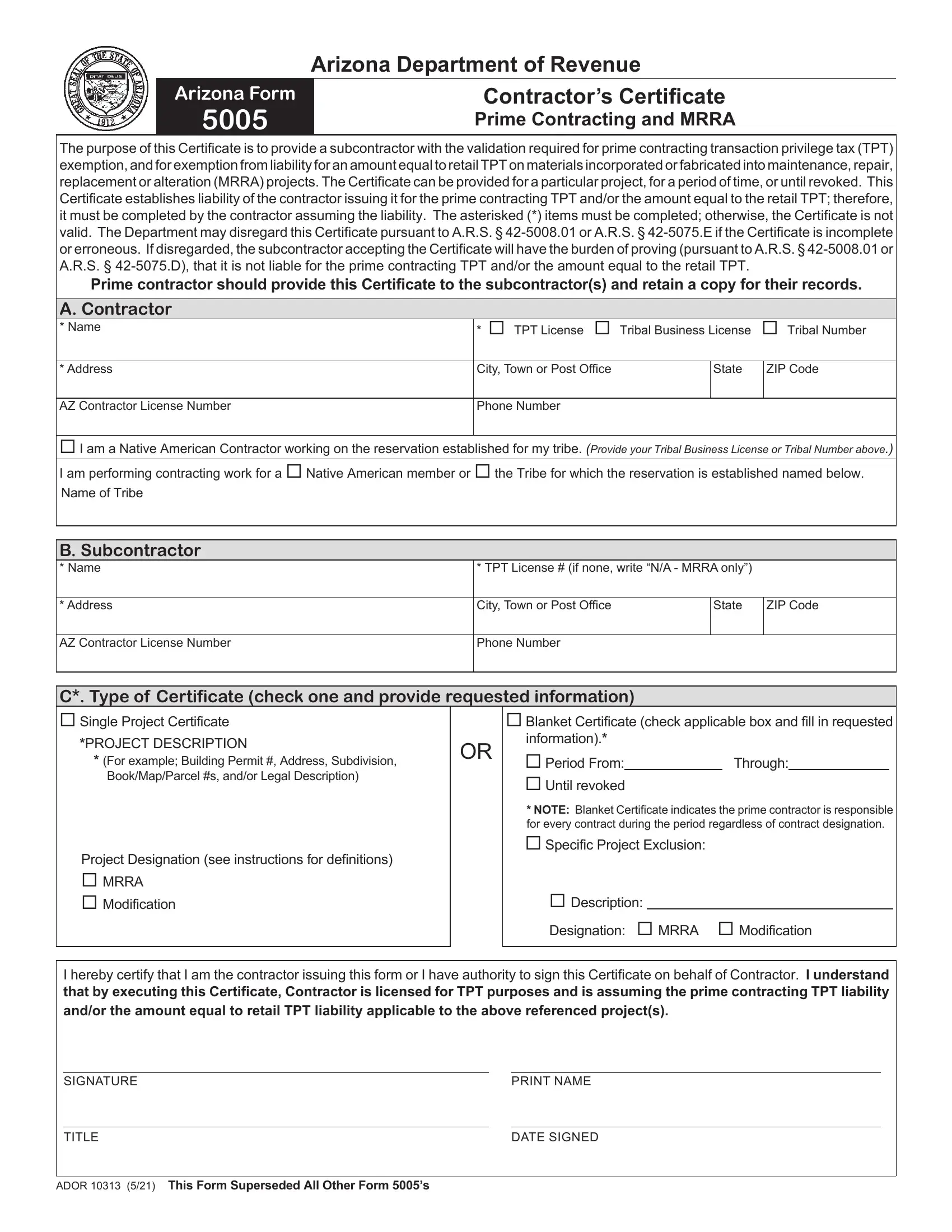

If you want to fill out this form, make sure you provide the required details in every single blank:

1. When filling out the arizona form 5005 fillable, be sure to include all of the important blanks within its relevant part. This will help speed up the work, making it possible for your details to be handled efficiently and properly.

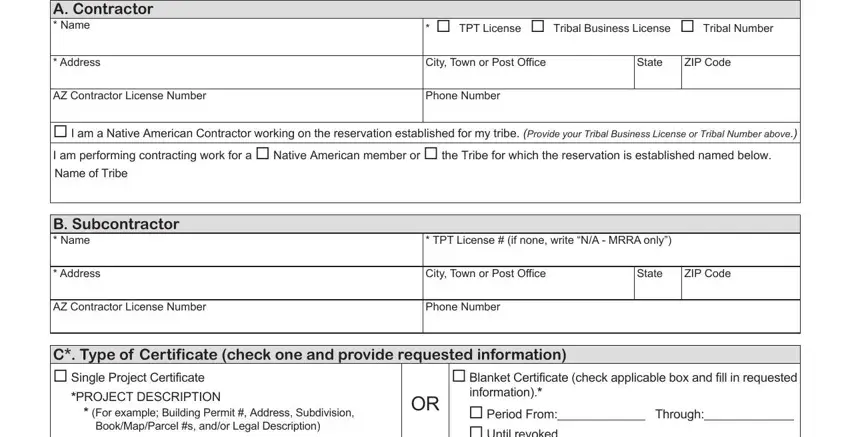

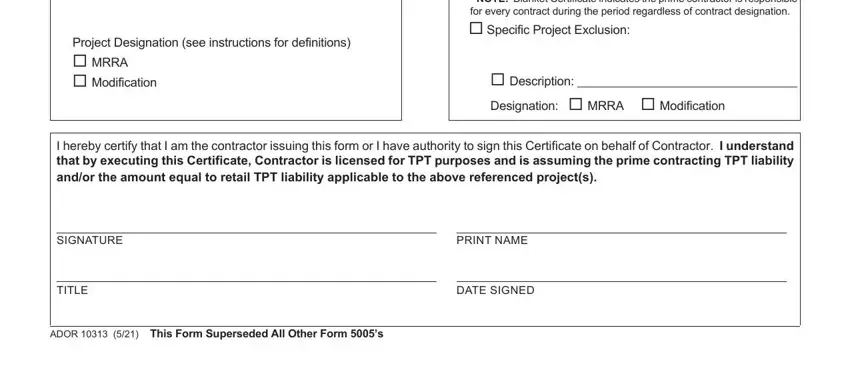

2. Once your current task is complete, take the next step – fill out all of these fields - Project Designation see, NOTE Blanket Certificate, Description Designation MRRA, I hereby certify that I am the, SIGNATURE, TITLE, PRINT NAME, DATE SIGNED, and ADOR This Form Superseded All with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

When it comes to Description Designation MRRA and I hereby certify that I am the, ensure you double-check them here. Those two are surely the most significant fields in this file.

Step 3: Go through everything you have entered into the blanks and press the "Done" button. Sign up with us now and immediately use arizona form 5005 fillable, ready for download. Every modification made is handily preserved , so that you can edit the pdf at a later stage as needed. We don't sell or share the details you use whenever working with forms at our site.