You could complete 501n form instantly with the help of our PDF editor online. The tool is constantly improved by us, receiving cool functions and becoming greater. To get started on your journey, go through these easy steps:

Step 1: Open the PDF doc inside our editor by clicking the "Get Form Button" above on this page.

Step 2: This tool will give you the ability to customize most PDF files in a range of ways. Modify it by writing personalized text, adjust existing content, and include a signature - all possible in no time!

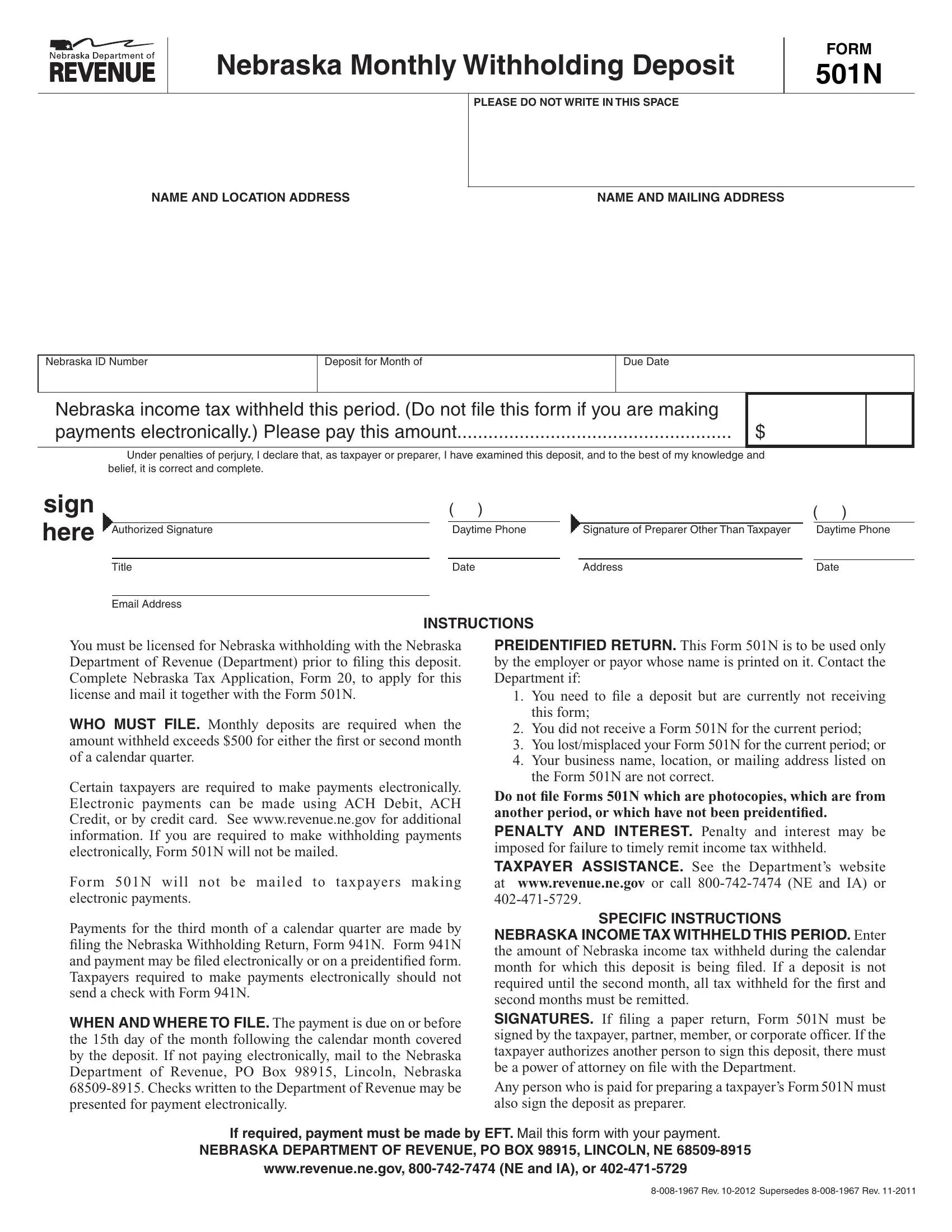

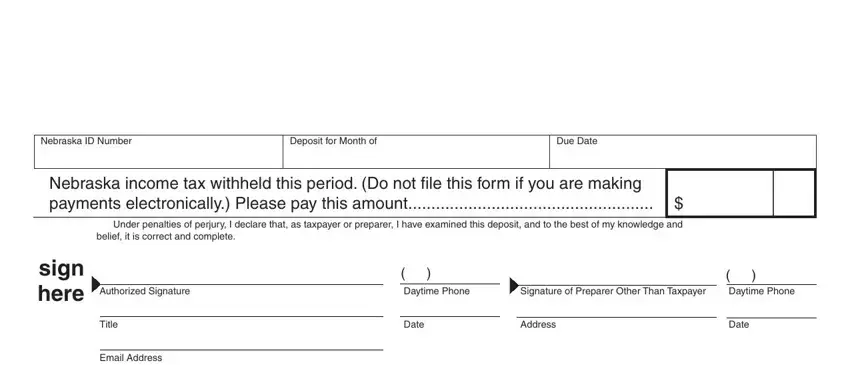

This document requires some specific information; to ensure correctness, please be sure to take note of the subsequent guidelines:

1. Begin completing the 501n form with a selection of necessary blanks. Gather all the information you need and be sure not a single thing left out!

Step 3: Go through everything you've inserted in the blanks and then click on the "Done" button. Try a free trial option with us and acquire immediate access to 501n form - accessible inside your personal account. FormsPal ensures your data confidentiality via a protected system that never records or shares any sort of sensitive information provided. Be assured knowing your documents are kept protected when you use our services!