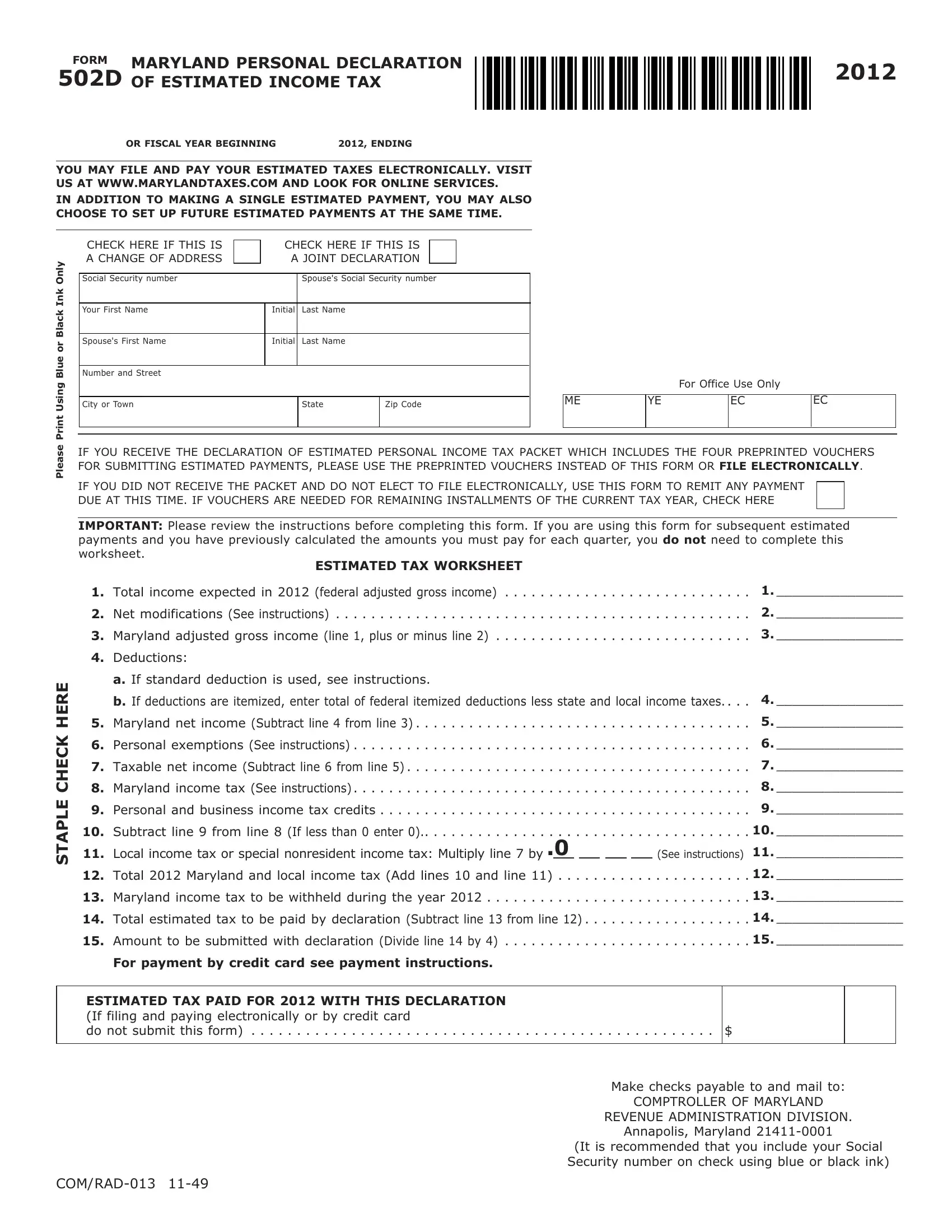

Purpose of declaration The filing of a declaration of estimated Maryland income tax is a part of the pay-as-you-go plan of income tax collection adopted by the State. If you have any income such as pensions, business income, lottery, capital gains, interest, dividends, etc., from which no tax is withheld, or wages from which not enough Maryland tax is withheld, you may have to pay estimated taxes. The law is similar to the federal law.

Who must file a declaration You must file a declaration of estimated tax if you are required to file a Maryland income tax return AND your gross income would be expected to develop a tax of more than $500 in excess of your Maryland withholding.

You must file a declaration with payment in full within 60 days of receiving $500 or more of income from awards, prizes, lotteries or raffles, whether paid in cash or property if Maryland tax has not been withheld. A husband and wife may file a joint declaration.

When to file a declaration You must pay at least one-fourth of the total estimated tax on line 14 of this form on or before April 15, 2012. The remaining quarterly payments are due June 15, 2012, September 15, 2012 and January 15, 2013. You may pay the total estimated tax with your first payment, if you wish. If you are filing on a fiscal year basis, each payment is due by the 15th day of the 4th, 6th, 9th and 13th months following the beginning of the fiscal year.

Overpayment of tax If you overpaid your 2011 income tax (Form 502 or 505) you may apply all or part of the overpayment to your 2012 estimated tax. If the overpayment applied equals or exceeds the estimated tax liability for the first quarterly payment, you are not required to file the declaration. If the overpayment applied is less than the estimated tax liability, you should file the declaration and pay the balance of the first installment. Preprinted vouchers will be mailed to you for the remaining payments.

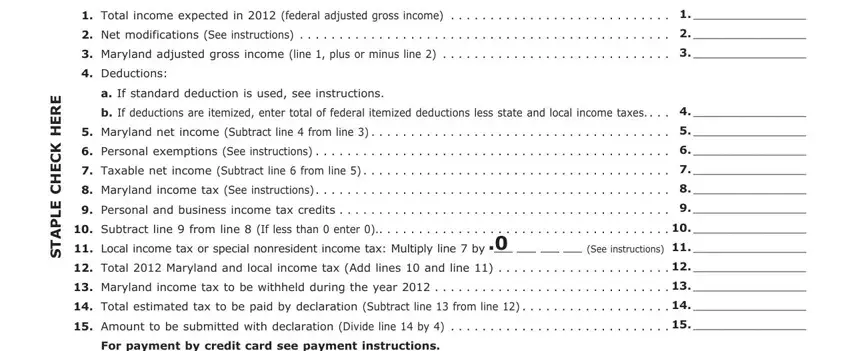

How to estimate your 2012 tax The worksheet on page 1 is designed to develop an estimate of your 2012 Maryland and local income tax. Be as accurate as you can in forecasting your 2012 income. You may use your 2011 income and tax as a guide, but if you will receive more income than you did in 2011, you must pay at least 110% of your prior year tax to avoid interest for underpayment of estimated tax. For the purpose of estimating, rounding all amounts to the nearest dollar is recommended.

Nonresidents may use the Nonresident Estimated Tax Calculator at www.marylandtaxes.com.

Specific Instructions:

Line 1. Total income expected in 2012 is your estimated federal adjusted gross income.

Line 2. Net modifications. You must add certain items to your federal adjusted gross income. See Instruction 12 of the tax booklet. You may subtract certain items from federal adjusted gross income. See Instruction 13 of the tax booklet. Enter on this line the net result of additions and subtractions.

Line 4. Deductions. You may compute your tax using the standard deduction method or the itemized deduction method.

Standard deduction. Compute 15% of line 3.

For Filing Status 1, 3, 6: if the amount computed is less than $1,500, enter $1,500; if the amount is between $1,500 and $2,000, enter that amount; if the amount is more than $2,000, enter $2,000.

For Filing Status 2, 4, 5: if the amount computed is less than $3,000, enter $3,000; if the amount is between $3,000 and $4,000, enter that amount; if the amount is more than $4,000, enter $4,000.

Itemized deductions. Enter the total of federal itemized deductions less state and local income taxes.

Line 6. Personal exemptions. If your FAGI will be $100,000 or less, you are allowed:

a. $3,200 each for taxpayer and spouse.

b. $1,000 each for taxpayer and spouse if age 65 or over and/or blind.

c. $3,200 for each allowable dependent, other than taxpayer and spouse. The amount is doubled for allowable dependents age 65 or over.

If your AGI will be more than $100,000, see chart below to determine the amount of exemption you can claim for items a and c above.

|

|

|

If you will ile your tax return |

|

|

|

|

|

|

|

|

Single or |

Joint, Head of |

|

If Your federal AGI is |

Household |

|

Married Filing |

|

|

|

or Qualifying |

|

|

|

Separately |

|

|

|

Widow(er) |

|

|

|

Your |

|

|

|

Your |

|

|

|

Exemption is |

|

|

|

Exemption is |

|

|

|

|

|

|

$100,000 or less |

$3,200 |

$3,200 |

|

|

|

|

|

|

Over |

But not |

|

|

|

over |

|

|

|

|

|

|

|

|

|

|

|

|

$100,000 |

$125,000 |

$1,600 |

$3,200 |

|

|

|

|

|

|

$125,000 |

$150,000 |

$800 |

$3,200 |

|

|

|

|

|

|

$150,000 |

$175,000 |

$0 |

$1,600 |

|

|

|

|

|

|

$175,000 |

$200,000 |

$0 |

$800 |

|

|

|

|

|

|

In excess of $200,000 |

$0 |

$0 |

|

|

|

|

|

Line 8. Maryland income tax. Use the tax rate schedules below to compute your tax on the amount on line 7.

For taxpayers filing as Single, Married Filing Separately, or as Dependent Taxpayers. This rate is also used for taxpayers filing as Fiduciaries.

Tax Rate Schedule I

If taxable net income is: |

Maryland Tax is: |

At least: |

but not over: |

|

|

|

|

$0 |

$1,000 |

|

|

2.00% |

of taxable net income |

$1,000 |

$2,000 |

$20.00 |

plus |

3.00% |

of excess over $1,000 |

$2,000 |

$3,000 |

$50.00 |

plus |

4.00% |

of excess over $2,000 |

$3,000 |

$100,000 |

$90.00 |

plus |

4.75% |

of excess over $3000 |

$100,000 |

$125,000 |

$4,697.50 |

plus |

5.00% |

of excess over $100,000 |

$125,000 |

$150,000 |

$5,947.50 |

plus |

5.25% |

of excess over $125,000 |

$150,000 |

$250,000 |

$7,260.00 |

plus |

5.50% |

of excess over $150,000 |

$250,000 |

-- |

$12,760.00 |

plus |

5.75% |

of excess over $250,000 |

For taxpayers iling Joint Returns, Head of Household, or for Qualifying Widows/Widowers.

Tax Rate Schedule II

If taxable net income is: |

Maryland Tax is: |

At least: |

but not over: |

|

|

|

|

$0 |

$1,000 |

|

|

2.00% |

of taxable net income |

$1,000 |

$2,000 |

$20.00 |

plus |

3.00% |

of excess over $1,000 |

$2,000 |

$3,000 |

$50.00 |

plus |

4.00% |

of excess over $2,000 |

$3,000 |

$150,000 |

$90.00 |

plus |

4.75% |

of excess over $3000 |

$150,000 |

$175,000 |

$7,072.50 |

plus |

5.00% |

of excess over $150,000 |

$175,000 |

$225,000 |

$8,322.50 |

plus |

5.25% |

of excess over $175,000 |

$225,000 |

$300,000 |

$10,947.50 |

plus |

5.50% |

of excess over $225,000 |

$300,000 |

-- |

$15,072.50 |

plus |

5.75% |

of excess over $300,000 |