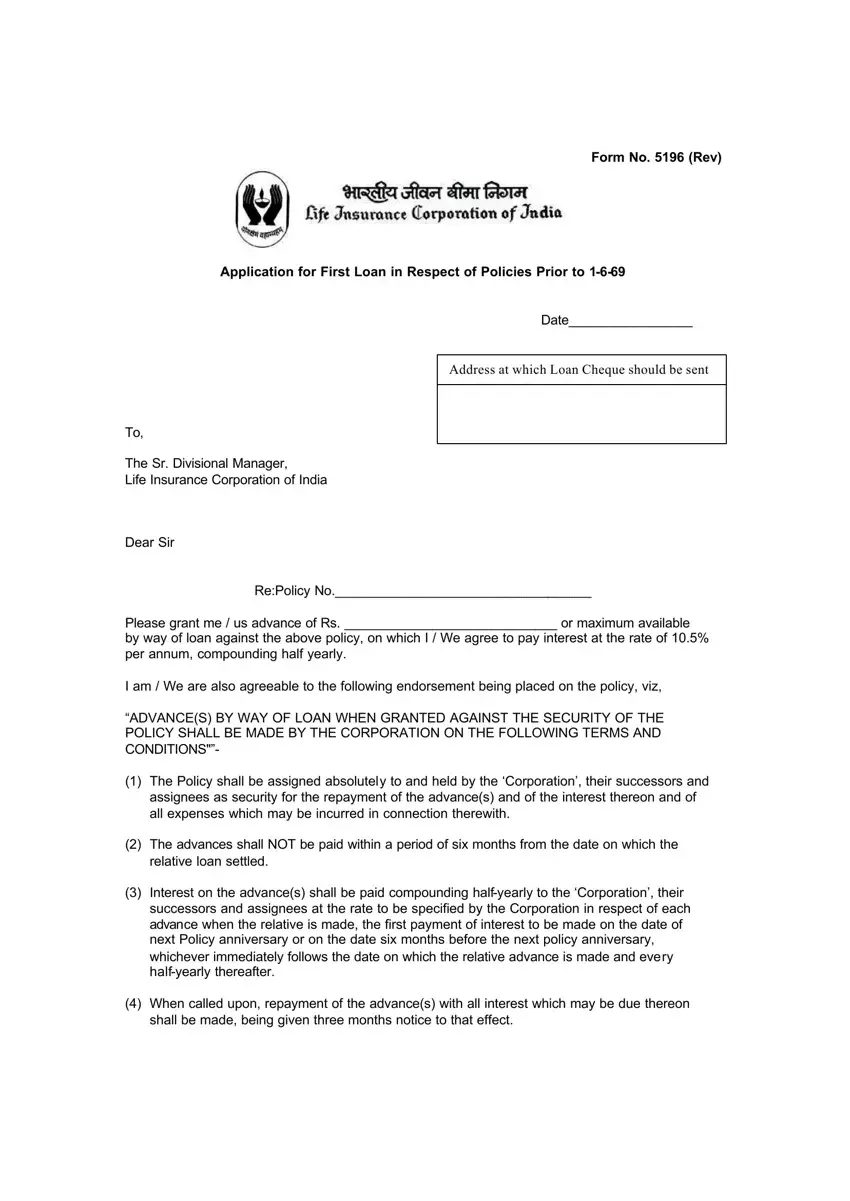

Form No. 5196 (Rev)

Application for First Loan in Respect of Policies Prior to 1-6-69

To,

The Sr. Divisional Manager,

Life Insurance Corporation of India

Date_________________

Address at which Loan Cheque should be sent

Dear Sir

Re:Policy No.___________________________________

Please grant me / us advance of Rs. _____________________________ or maximum available

by way of loan against the above policy, on which I / We agree to pay interest at the rate of 10.5% per annum, compounding half yearly.

I am / We are also agreeable to the following endorsement being placed on the policy, viz,

“ADVANCE(S) BY WAY OF LOAN WHEN GRANTED AGAINST THE SECURITY OF THE POLICY SHALL BE MADE BY THE CORPORATION ON THE FOLLOWING TERMS AND CONDITIONS"”-

(1)The Policy shall be assigned absolutely to and held by the ‘Corporation’, their successors and assignees as security for the repayment of the advance(s) and of the interest thereon and of all expenses which may be incurred in connection therewith.

(2)The advances shall NOT be paid within a period of six months from the date on which the relative loan settled.

(3)Interest on the advance(s) shall be paid compounding half-yearly to the ‘Corporation’, their successors and assignees at the rate to be specified by the Corporation in respect of each advance when the relative is made, the first payment of interest to be made on the date of next Policy anniversary or on the date six months before the next policy anniversary, whichever immediately follows the date on which the relative advance is made and every half-yearly thereafter.

(4)When called upon, repayment of the advance(s) with all interest which may be due thereon shall be made, being given three months notice to that effect.

(5)The Corporation, their successors and assignees shall not be bound to accept payment of any of the advance(s) unless tendered in full.

(6)In the event of failure to repay the advance(s) to repay the advance(s) when required or to pay interest on the date as hereinbefore mentioned or within one calendar month after each due date respectively the Policy shall be held without the necessity of any notice being given to be forfeited to the Corporation, their successors and assignees, and Corporation, shall be entitled to apply the Surrender Value allowable in respect of the Policy in terms of their Regulation and condition in payment of the advance(s) interest and expenses, the balance only shall become due and payable under the policy.

(7)In case the policy shall mature or become a claim by death when the amount of the advance(S) or any Portion there of shall remain outstanding, the Corporation shall be entitled to deduct such amount together with all interest upto the date of maturity or of death as the case may be from the policy moneys and the balance due and payable under the policy.

The Policy duly assigned in your favour, the receipt for the loan amount andn declaration regarding assignment duly completed are sent herewith.

|

Yours faithfully |

(1) |

_________________________________ |

(2) |

_________________________________ |

|

Signature(s) |

APPLICATION FOR LOAN AS UNDER WHERE THE POLICY ALREADY BEARS THE ENDORSEMENT OF TERMS AND CONDITIONS OF LOAN OR WHERE THE POLICY HAS BEEN ISSUED ON OR AFTER 1-6-1969

(1)Fresh loan where previous loan is subsisting.

(2)Further loan where previous loan granted at 6% or 7 ½ % or 9% is subsisting.

The Sr. Divisional Manager,

Life Insurance Corporation of India.

Date __________________2000

Dear Sir,

Re : Policy No. __________________________________

(1)Please grant me / us an advance of Rs. _____________________ (Rupees ___________ __

_____________________________________________________________________________

_____________________________________________________________________________

in words) or maximum aailable by way of loan against above policy on which I / We agree to pay interest at the rate of 10.5% per annum payable every half year.

(2)I / am / We are aware of the terms and conditions on which the loan will be advanced. I / am / We are also aware that said terms and conditions:-

* have already been endorsed on the Policy.

**will those as contained in the clause headed “Loans” appearing in the Conditions and Privileges printed in the Policy.

The receipt for the loan amount along with the assignment declaration slip is returned herewith duly completed.

*** The policy duly assigned in your favour is also endorsed.

Yours faithfully

(1)__________________________________

(2)_________________________________

Signature(s)

*Strike out in respect of the Poliies issued on or after 1-6-1969. **Strike out in respect of Policies issued prior to 1-6-69.

***Delete where previous loan is subsisting.

_____________________________________________________________________________

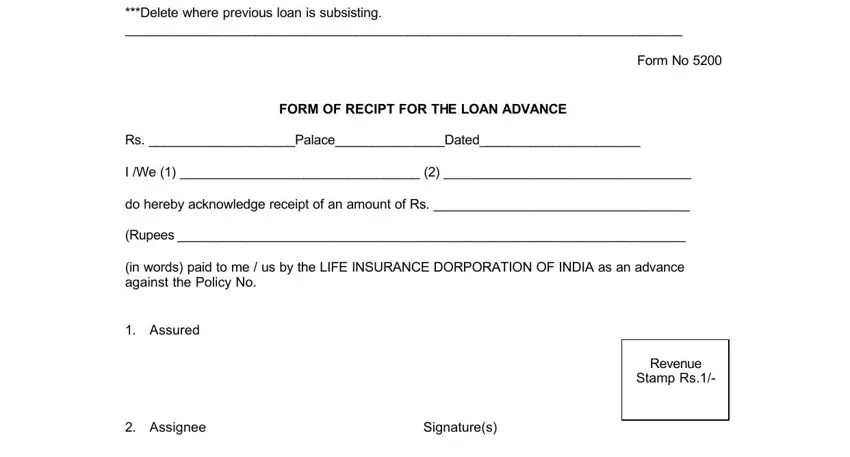

Form No 5200

FORM OF RECIPT FOR THE LOAN ADVANCE

Rs. ____________________Palace_______________Dated______________________

I /We (1) _________________________________ (2) __________________________________

do hereby acknowledge receipt of an amount of Rs. ___________________________________

(Rupees ______________________________________________________________________

(in words) paid to me / us by the LIFE INSURANCE DORPORATION OF INDIA as an advance against the Policy No.

1.Assured

Revenue

Stamp Rs.1/-

3.Trustee

DECLARATION TO BE COMPLETED WHEN BORROWER/S CANNOT READ ENGLISH

I hereby declare that the contents of the above APPLICATION FOR LOAN (Form No. 5196/5205) and the FORM OF RECEIPT FOR THE LOAN ADVANCE (Form No. 5200) have been translated and explained by me to

(1)______________________________________and (2) _______________________________

and further declare that he / she they fully understand(s) the meaning there of.

_______________________________

Signature of the declarant

________________________________________________________________

INSTRUCTIONS :-

If either or both the borrowers be non-English knowing or illiterate, an English knowing person should be requested to complete the above declarations as also to give the English rendering of the signature. Where however, either of both the borrowers be illiterate the declarant should certify that the thumb impression is of the person mentioned in the Declaration and that same was obtained in his/her presence.

NOTE OF AUTHORITY

If the within receipt is signed by more than one person and payment is desired to be made to one of the signatories or to third party, the following Note of Authority should be completed and signed by all of them.

Mark |

|

Place_________________________ |

Date _____________________ |

I/We hereby authorise the Life Insurance Corporation of India to pay the within mentioned loan amount of Rs. _________/out of within mentioned loan, a sum of Rs. __________to __________

________________Signature

________________Signature

and he/she/they has/have agreed to payment to _______________________________________

be made to the party or parties authorised.

(Signature of the Declarant)

INSTRUCTION :

If either or both the persons completing the Note of Authority be non-English knowing, the declaration at foot of the Note of Authority should be completed by an English knowing person who should also give the English rendering of the signature/s. When, however either or both of them be illiterate, the declarant should be a Magistrate or a Special Executive Magistrate or a Block Development Officer or a Gazetted Officer or a Principal/Headmaster of Local High School or Secondary School run by the Government or an Agent of a Nationalised Bank or a Class 1 Offcer of the Corporation or a Development Officer of the Corporation with atleast 5 years’ service provided he/she is fully satisfied about the identify of the person(s) executing the note of authority and the declarant should, in addition to completing the Declaration, certify that the thumb mark/s is/are of the person/s executing the Note of Authority and that the same was/were obtained in his/her presence, where the loan is over Rs. 500/ -. When the loan is Rs. 500/ - or less the declarant may be event a Talathi, Revenue Officer, the President of Union Board of Gram Panchayat.

TO BE COMPLETED IN CASE OF MULTI PURPOSE POLICIES) ( Table Nos. 33 and 34)

|

Place__________________ |

The Sr. Divisional Manager, |

|

Life Insurance Corporation of India, |

Date __________________ |

Re: Policy No.__________________________

Dear Sir,

With reference to my application for the loan to meet the___________________premium and for

private purpose under the above Policy which has been issued under the Corporation’s Multi Purpose Plan, I hereby agree that in the event of my death during the selected term of the Policy the Corporation may immediately on my death occuring, call for the repayment of the loan with interest there on giving the claimant/s however, the option to have the loan and interest duly repaid, in the first instance, out of the lump sum payment of 10% of the Sum Assured of instalments and if both these are not sufficient to meet the repayment, the balance from the remainder i.e. 90% of the sum assured when payable or a alternative option to have the benefits Reduced to such an extent as would provide for liquidation of the loan.

|

|

Yours faithfully |

_____________________ |

|

|

_____________________ |

Assignee/s |

|

_____________________ |

|

(Signature of Assured) |

|

|

Please detach it from here and paste it on the Policy. |

Form No. 5198 |

FORM OF ASSIGNMENT OF THE POLICY BY THE POLICY HOLDER IN FAVOUR OF

THE CORPORATION FOR THE PURPOSE OF LOAN AGAINST THE POLICY

I, the undersigned _________________(full name) the life assured and ____________________

(Conditional Assignee) under the within Policy of Assurance and the moneys thereby secured and all the benefits attached thereto to the Life Insurance Corporation of India, their successors and assignees absolutely for value received and which may be received hereafter.

Dated this __________________day of __________ |

(Signature of Assured) |

Witness____________________ |

|

Signature___________________

Full name__________________

Designation_________________

Address ___________________

(Signature of Assignee)

Certified that the contents of the above assignment were explained by me to the Assignor in Vernacular and that he/she affixed his/her signature/thumb impression thereto in my presence after thoroughly understanding the same.

(INSTRUCTIONS OVERLEAF) |

(Signature of witness) |

(TO BE COMPLETED IN CASE OF ANTICIPATED ENDOWMENT POLICIES)

(Table Nos. 24, 25 and 26)

Place________________

The Sr. Divisional Manager,

Life Insurance Corporation of India,

Date ________________

Re : Policy No. __________________________

Dear Sir,

With reference to my application dated___________ for a loan under the above Policy, which has

been issued under with Profits Anticipated Endowement Assurance Scheme, I hereby agree that in the event of (1) my surviving ______________ years from the date of commencement of the

Policy and (2) surviving ____________years from the dated of commencement of the Policy, the

Corporation may adjust the Instalment of sum assured then payable towards repayment of the loan outstanding under the Policy, provided however, if any balance of the aforesaid instalment of sum assured is left over after the entire outstanding loan is liquidated by such adjustment such balance should be payable to me.

|

Yours faithfully |

__________________ |

|

__________________ |

|

__________________ Assignee/s |

(Signature of Assured) |

_____________________________________________________________________________

Please detach it from here

INSTRUCTIONS

1.The form of Assignment on the reverse should be detached along the perforation and should be pasted over blank space on the back of the Policy and then completed in which case no Stamp Duty will be payable. If the assignement is executed on a separate paper, the wordings should be copied out on a stamp paper (special adhesive or non-judicial) of the appropriate value. The Assignor should satisfy himself before forwarding the Deed of Assignment as regards proper stamp duty having been paid theron:

2.The Assignor must affix his/her signature to the assignment in the presence of a witness. If the Assignor is not conversant with English, he/she must sign the assignment before an English Knowing person and if he/she be illiterate he/she must affix his/her thumb impression to the assignment before a Magistrate, Special Executive Magistrate or Gazetted Officer. The witness in such case should certify as follows : "he/she affixed his/her signature/left thumb impression thereto in my presence after thoroughly understanding the same."

3.Signature of any other matter written in vernacular should have the English translation thereof written beneath the same.

NOTE : In case of dispute in respect of interpretation of terms the English version shall stand valid.