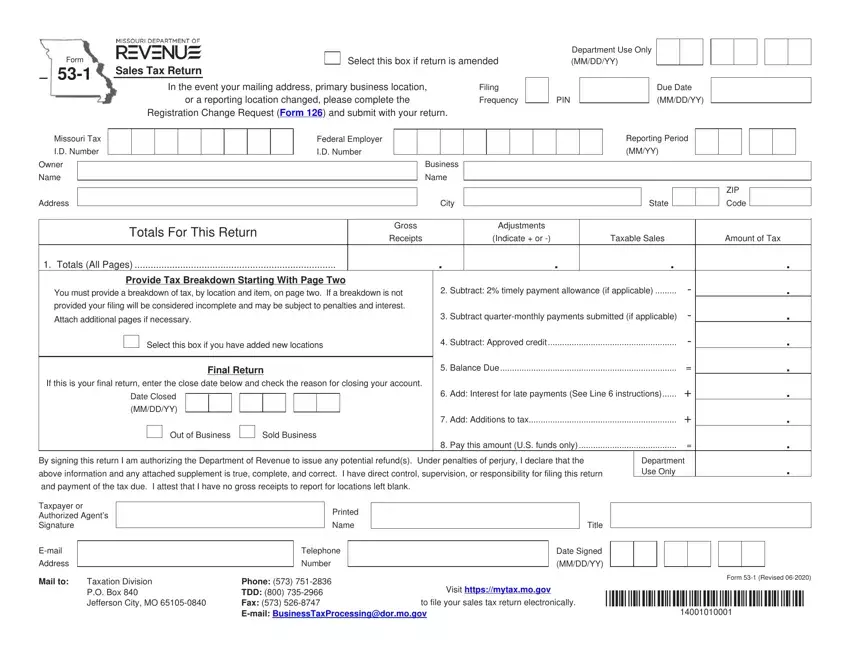

Sales Tax Return (Form 53-1) Instructions

Important: This return must be filed for the reporting period even though you have no tax to report.

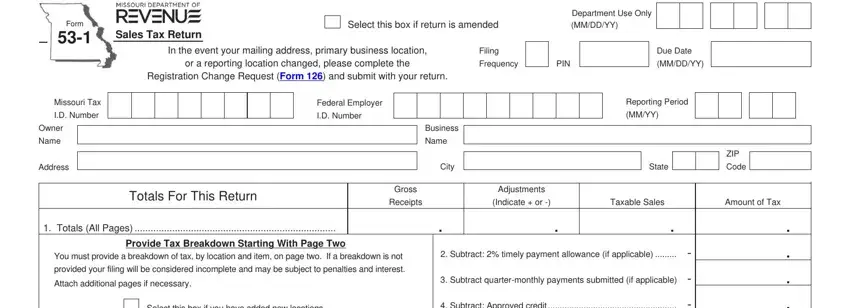

Amended Return Check Box - This box should be checked to correct a previously filed return to show an increase or decrease in the amount of tax liability. A separate return must be filed for each period being amended. If the return and payment are being submitted after the period(s) due date, interest and penalty will apply to the additional amount being reported.

Please note if an overpayment has been authorized, the overpayment is subject to be used as an offset towards any debt. In addition, to receive a refund of the overpayment attach a Seller’s Claim for Sales or Use Tax Refund or Credit (Form 472S).

Filing Frequency – This is the frequency in which you are required to file your returns. Not a required field. If unknown leave blank.

PIN – This is a unique four digit number that is issued to you by the Department of Revenue. Not a required field. If unknown leave blank.

Due Date – Visit http://dor.mo.gov/taxcalendar/ for a list of due dates.

Missouri Tax I.D. Number – This is an eight digit number issued by the Missouri Department of Revenue to identify your business. If you have not registered with the Department, complete the Missouri Tax Registration Application (Form 2643) or complete your registration online by going to https://dors.mo.gov/tax/coreg/index.jsp. If you have misplaced your Missouri Tax I.D Number, you can call (573) 751-5860.

Federal Employer I.D. Number – This is a nine digit identification number issued by the Internal Revenue Service to identify your business.

Reporting Period – This is the tax period you are required to file based on your filing frequency.

Owner and Business Name, Address, City, State and ZIP Code – Enter the name, address, city, state and ZIP code. Note: In the event your mailing address, primary business location, or a reporting location has changed you will need to complete the Missouri Registration Change Request (Form 126) and submit it with your return.

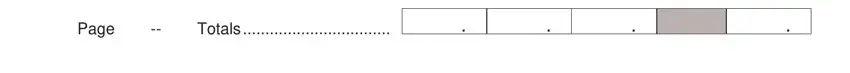

Line 1- Totals (All Pages) – Enter the total gross receipts, adjustments, taxable sales, and tax due for all pages.

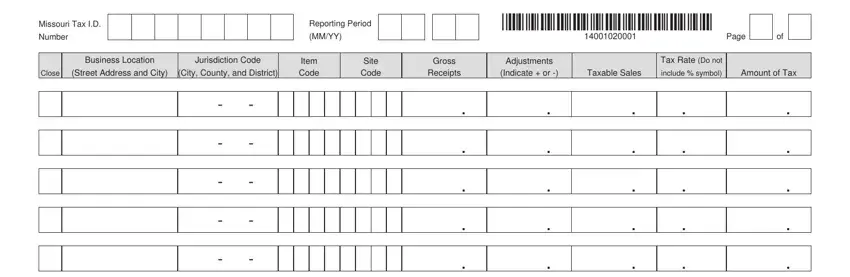

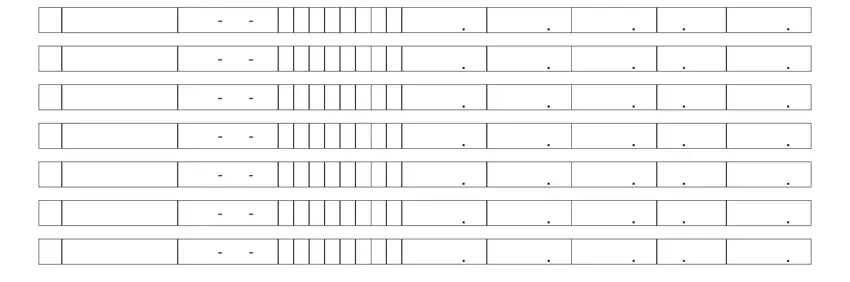

Each page must have a breakdown per business location identifying the item code, site code, gross receipts, adjustment, taxable sales, and amount of tax. See the page two instructions for more information. If a breakdown is not provided, your filing will be considered incomplete and may be subject to penalties and interest. Attach additional pages if

necessary.

Adding New Locations – This box should be checked when adding a new business location(s). The location information (street address and city) on page two or subsequent pages must be completed when this box is checked. A breakdown per location which identifies the item code, gross receipts, adjustments, taxable sales, and amount of tax must also be

provided. See page two instructions for more information.

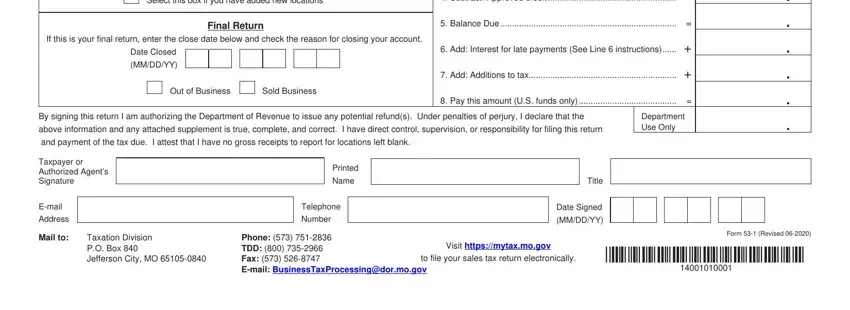

Final Return – If this is your final return, enter the close date and check the reason for closing your account. Missouri law requires any person selling or discontinuing business to make a final sales tax return within 15 days of the sale or closing.

Line 2 – Subtract: 2% Timely Payment Allowance – Multiply total amount of tax by 2% and enter the amount on this line. If the return is late the discount is not allowed.

Line 3 – Subtract: Quarter-Monthly Payments Submitted – If you are a quarter-monthly filer and have made payment(s) on the period, enter amount of payment(s) that have been made. If you are a registered user of the Missouri Portal you can access the amount of payments made under your tax account.

Line 4 – Subtract: Approved Credit – This is a credit that has been approved by the Department of Revenue.

Line 5 – Balance Due – Amount of Tax from line 1 minus line 2, 3 and 4 (if applicable).

Line 6 – Add Interest for Late Payments – If tax is not paid by the due date, (A) multiply Line 5 by the daily interest rate*. Then (B) multiply this amount by the number of days late. See example below. Note: The number of days late is counted from the due date to the postmark date.

For example, if the due date is March 20, and the postmark date is April 9, the payment is 20 days late. The example below is based on an annual interest rate of 4% and a daily rate of .0001096.

Example: Line 5 is $480

(A)$480 x .0001096 = .05261

(B). 05261 x 20 days late = 1.05 1.05 is the interest for late payment

*14000000001*