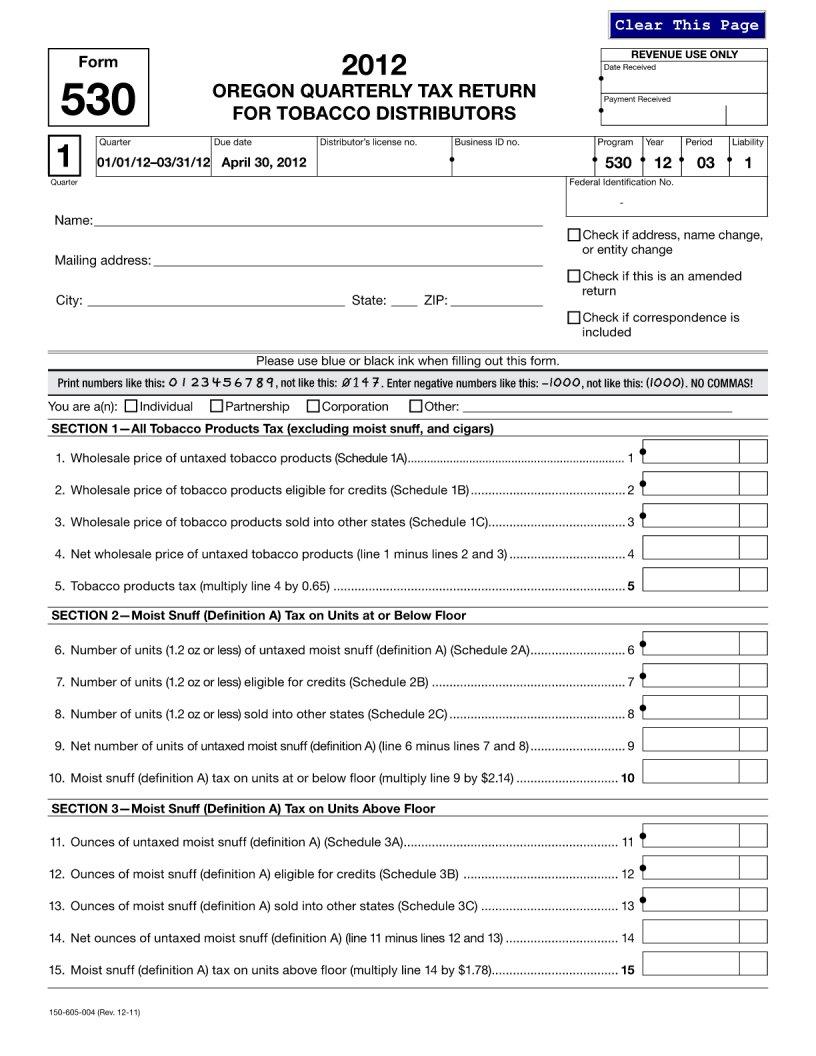

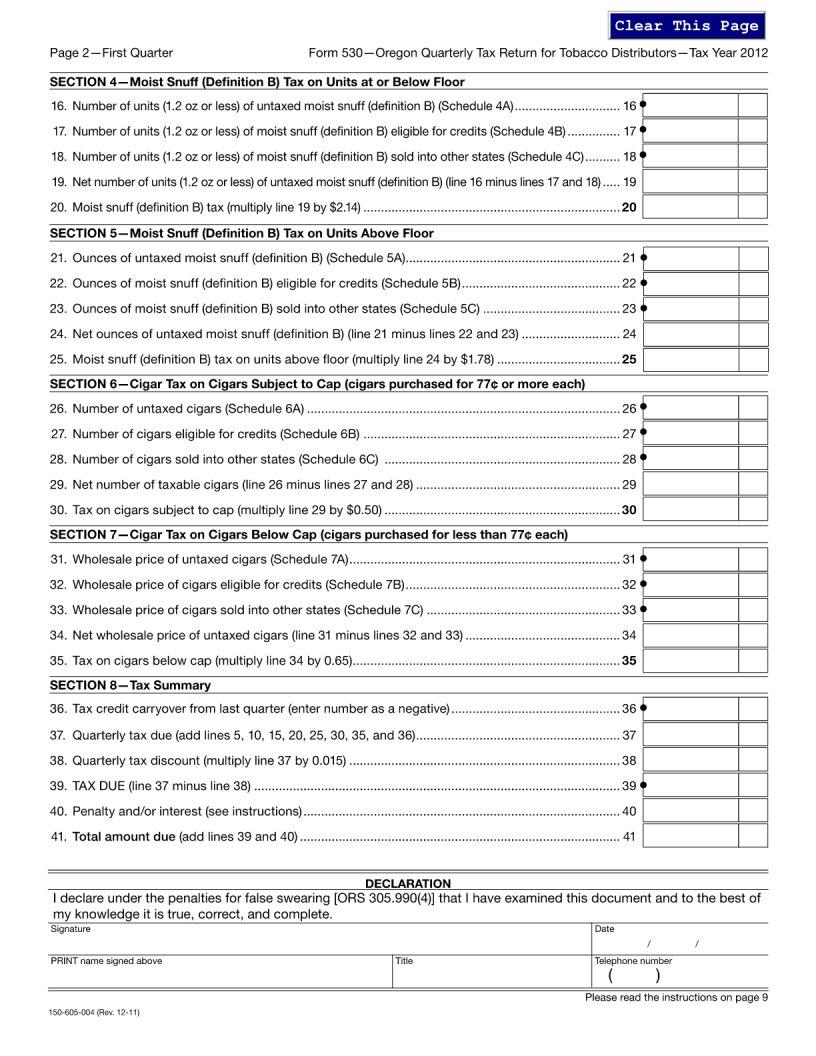

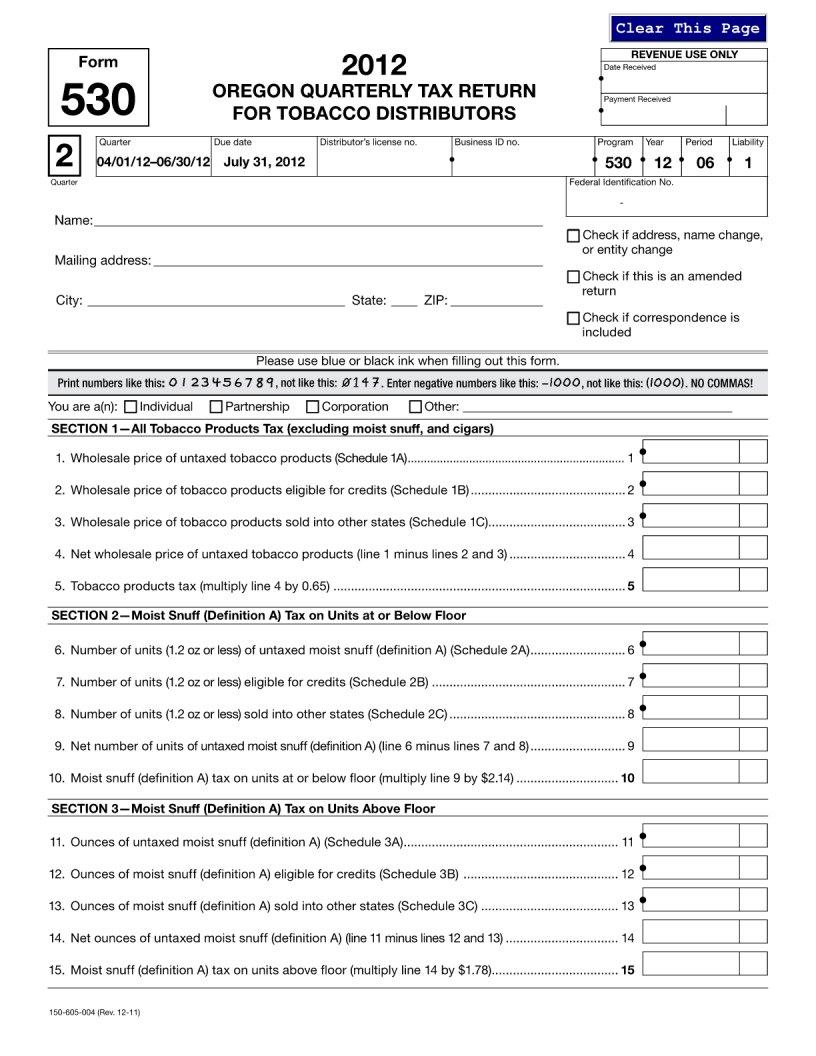

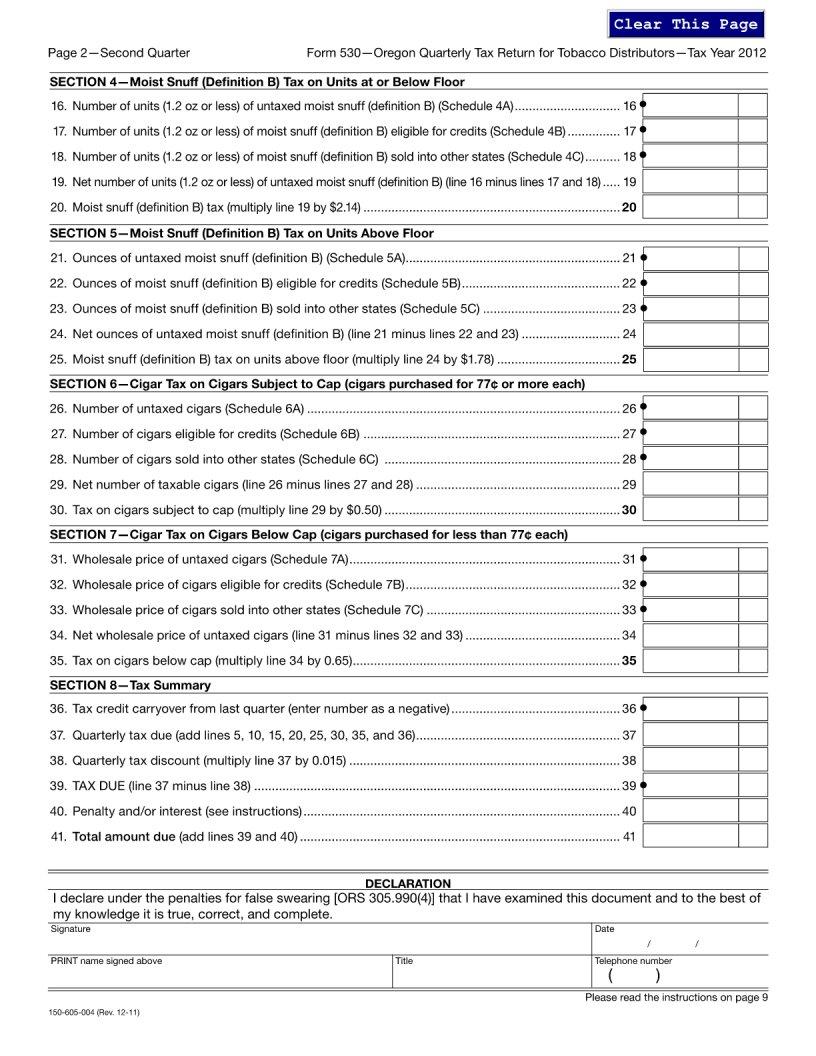

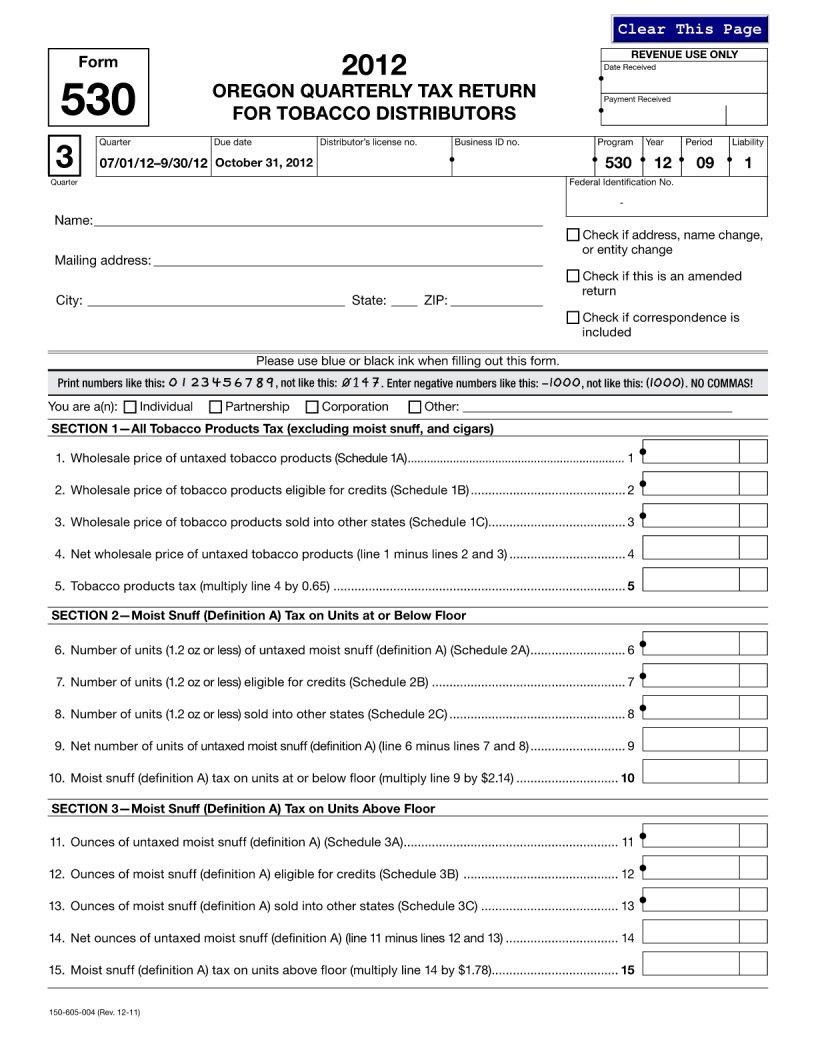

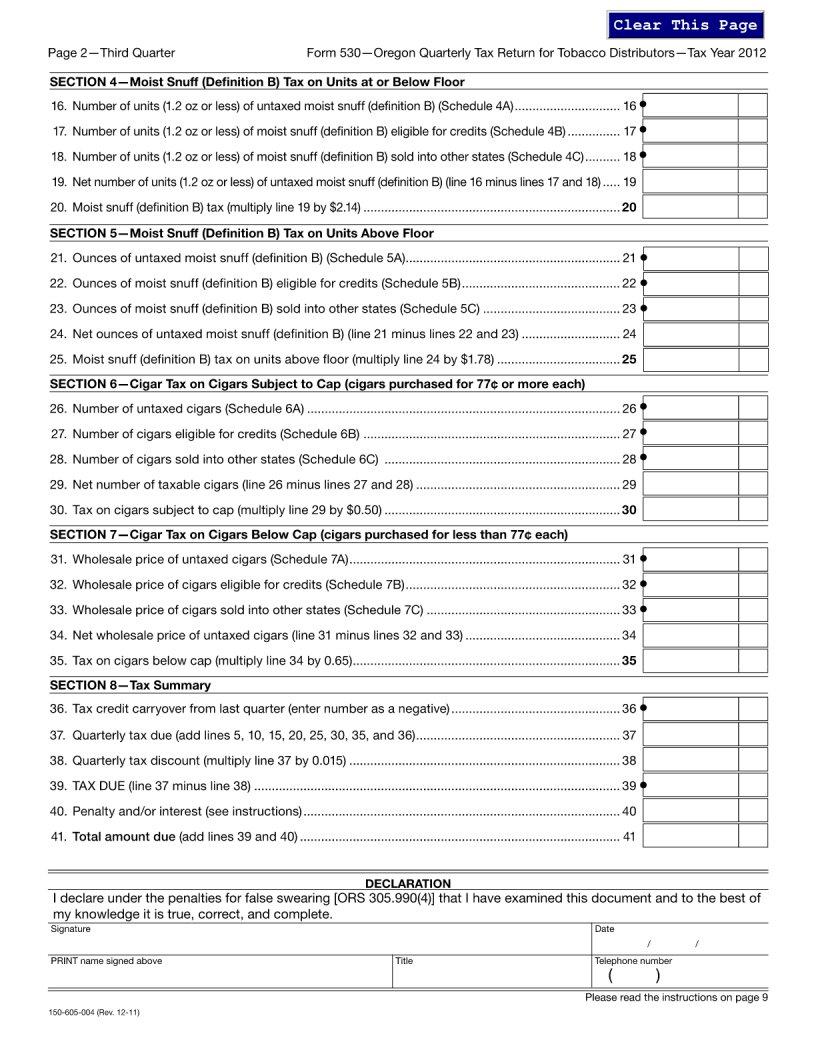

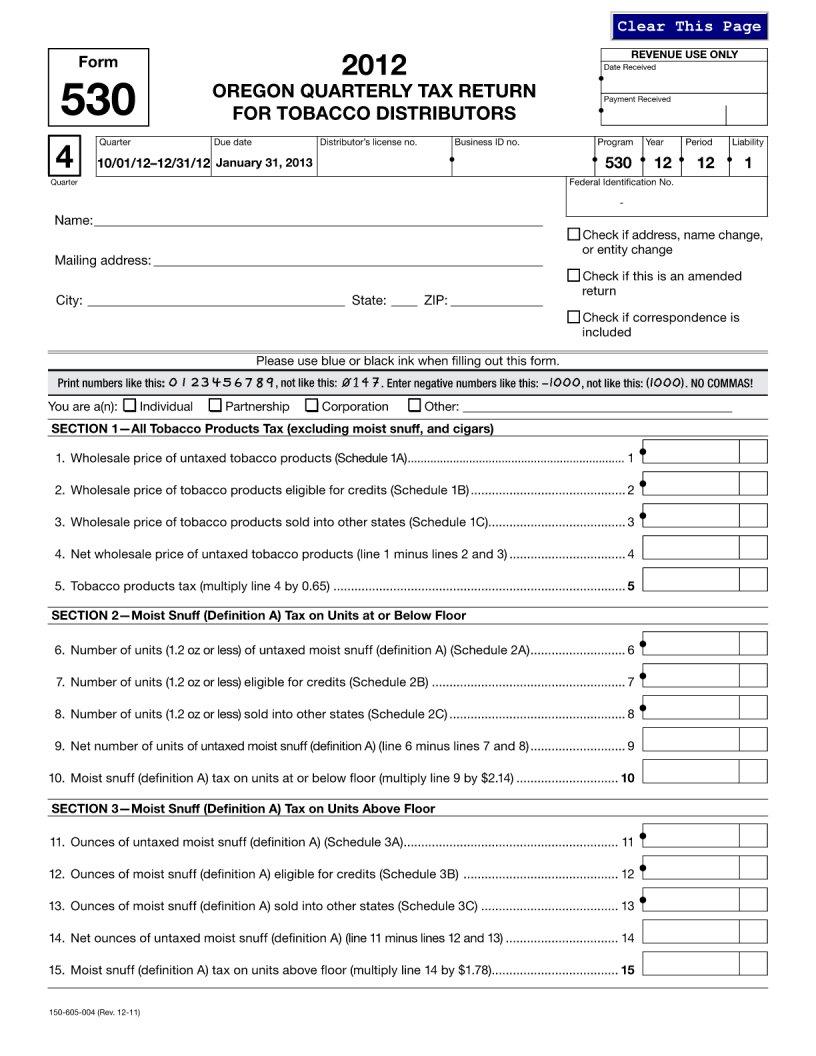

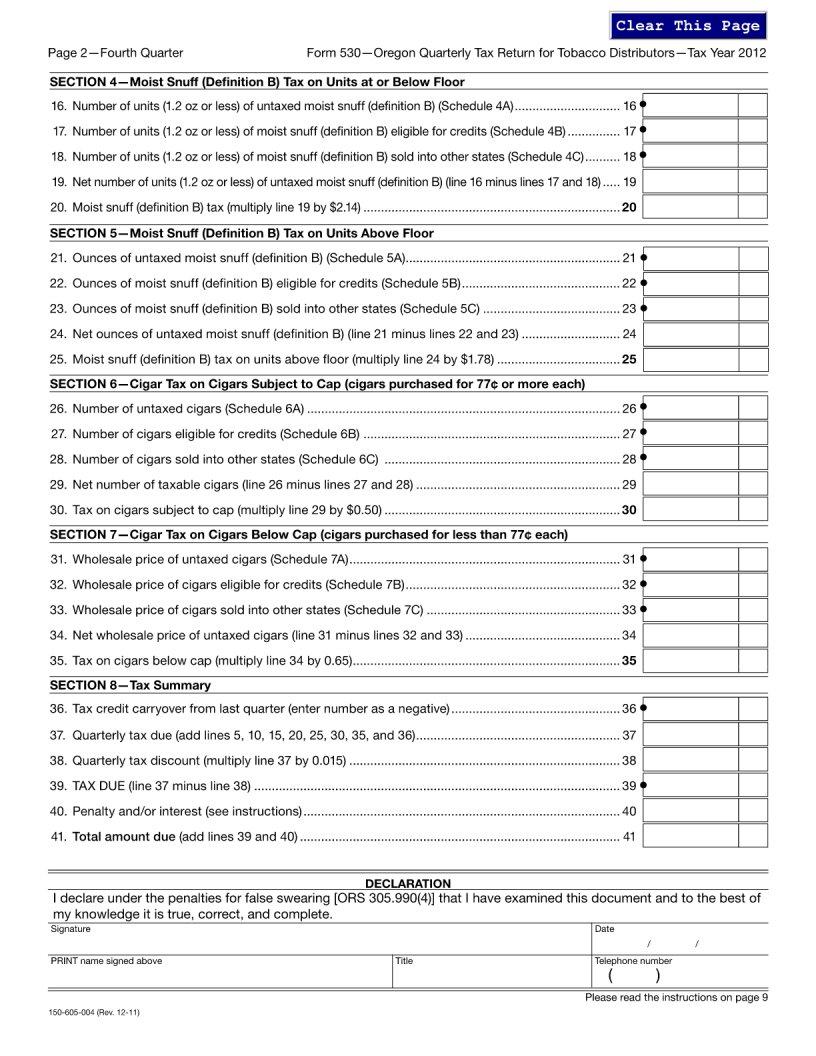

In the landscape of state taxes, numerous forms and documents play pivotal roles, each tailoring to specific needs, circumstances, and regulatory requirements that both individuals and businesses must navigate. Among these, the 530 Oregon form emerges as a noteworthy document, designed to address particular tax-related functions within the state of Oregon. This form, integral to the state's tax administration, encapsulates a variety of purposes, from reporting and calculating taxes due to claiming refunds or adjustments on previously filed returns. Its significance cannot be overstated, acting as a bridge between taxpayers and the state's taxation authorities, ensuring compliance, and facilitating the efficient management of tax obligations. As we delve into the complexities and nuances of the 530 Oregon form, it's essential to understand its role within the broader tax framework, its impact on taxpayers, and the specific scenarios under which it becomes relevant. This foundational knowledge not only demystifies the form itself but also enhances the comprehension of Oregon's tax system as a whole, providing valuable insights for both residents and tax professionals navigating this sphere.

| Question | Answer |

|---|---|

| Form Name | Form 530 Oregon |

| Form Length | 9 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 15 sec |

| Other names | oregon quarterly tax form, false, 2--Moist, 7--Cigar |