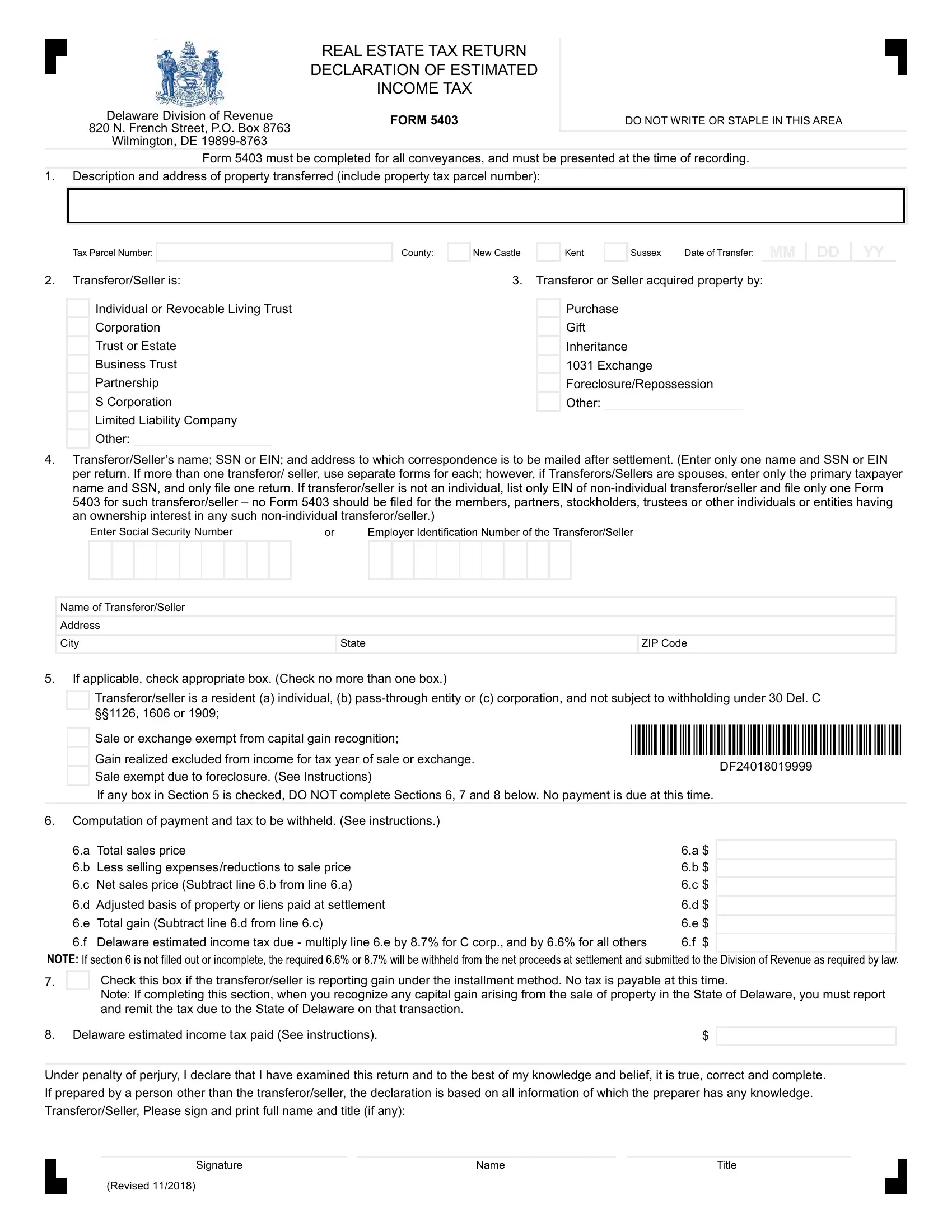

INSTRUCTIONS FORM 5403

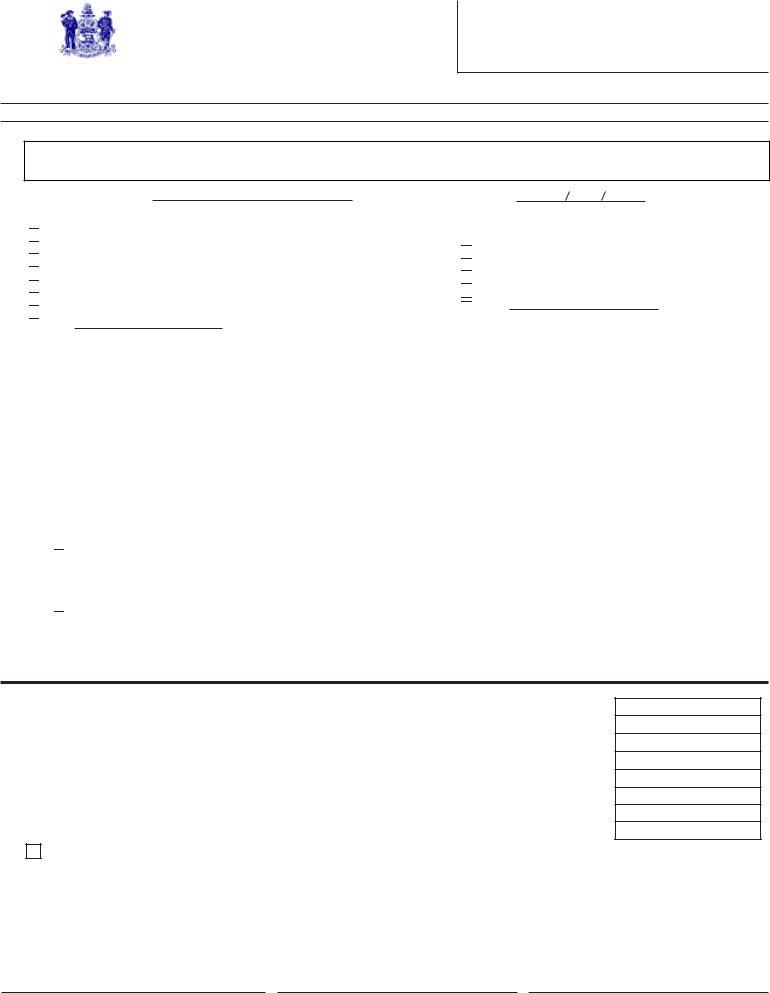

REAL ESTATE TAX RETURN REALTY TRANSFER TAX RETURN

Every non-resident individual, pass through entity or corporation who makes, executes, delivers, accepts, or presents for recording any document, except those exemptions defined or described in Sections 1126, 1606 and 1909 of Title 30, or in whose behalf any document is made, executed, delivered, accepted or presented for recording, shall be subject to pay for and in respect to the transaction or any part thereof, a Real Estate Tax at the rate of 6.75% of the value of the gain on the property sold as represented by such document, which tax shall be payable at the time of making, execution, delivery, acceptance or presenting of such document for recording. Said tax is to be paid by the Transferor(s)/Seller(s).

SPECIFIC INSTRUCTIONS

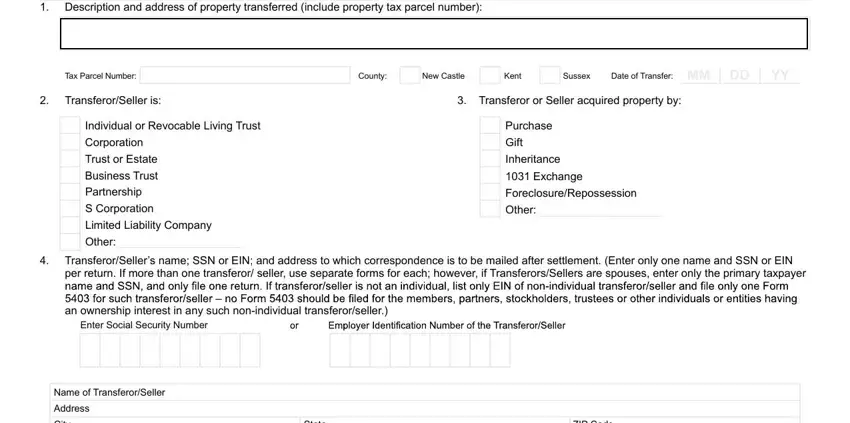

Line 1. Enter a description and address of the property transferred/ sold, including the tax parcel number and date of transfer. If you need to describe transfer issues please do so here.

Line 2. Check the appropriate box to indicate whether the Transferor/Seller is an Individual or Revocable Living Trust, a Corporation, Trust or Estate, Business Trust, Partnership, S Corporation, Limited Liability Company, or Other, such as a Government Agency or Non-Profit Corporation.

Line 3. Check the appropriate box to indicate how the transferor/ seller acquired the property.

Line 4. Enter the Transferor/Seller’s name; SSN or EIN; and address to which correspondence is to be mailed after settlement. (Enter only one name and SSN or EIN per return. If more than one transferor/ seller, use separate forms for each; however, if Transferors/Sellers are husband and wife, enter only the primary taxpayer name and SSN, and only file one return. If transferor/seller is not an individual, list only EIN of non-individual transferor/seller and file only one Form 5403 for such transferor/seller – no Form 5403 should be filed for the members, partners, stockholders, trustees or other individuals or entities having an ownership interest in any such non-individual transferor/seller.)

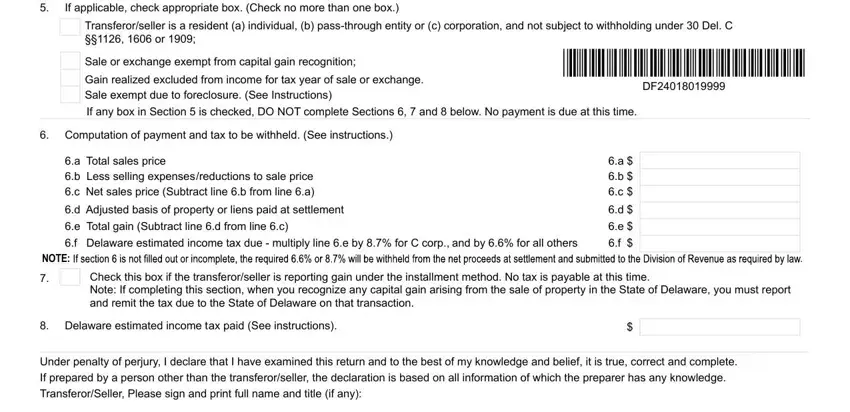

Line 5. Check the appropriate box to indicate if the transferor(s)/ seller(s) are resident individuals, pass-through entities or corporations that are not subject to real estate tax capital gain withholding; the sale or exchange is exempt from capital gain recognition because of either Federal or Delaware exemption; the gain realized will be excluded from income for tax year of sale or exchange; the sale or exchange occurred on or before December 31, 2010; or the transferor(s)/seller(s) has/ have insufficient information to determine if sale or exchange is subject to withholding. By checking the last box, the transferor(s)/seller(s) understands that, once sufficient information is available, payment of tax may be due and the appropriate return must be timely filed. If any of the above boxes in Section 5 are checked, stop here, do not complete Sections 6, 7 and 8 below, and no payment is due at this time. Be sure to only check one box.

Line 6. On line “a” enter the ‘Total Sales Price’.

On line “b” enter the ‘Selling Expenses’.

On line “c” enter the ‘Net Sales Price’ by subtracting line “b” from line “a”.

On line “d” enter the ‘Adjusted Basis’. “Adjusted basis,” includes mortgages used to buy, construct or substantially improve the real estate, liens as well as the taxpayer’s investment in the property.

On line “e” enter the ‘Total Gain’ by subtracting line “d” from line “c”. This is the transferor’s/ seller’s capital gain for both Federal and Delaware State tax purposes.

On line “f” enter the total Cash Paid at the time of transfer or sale, not including any cash payments reported on line b.

On line “g” enter the ‘Net Cash Received’ by subtracting line f from line c.

The transferor/ seller may elect either Line e or Line g to calculate the ‘Delaware Tax Due’.

On line “h” enter the ‘Delaware Tax Due’ by multiplying either line “e” or line “g” by 6.75%. This is the amount of real estate tax payment due to the Delaware Division of Revenue that you must remit with this form unless line 7 is completed. If you elected line g to make the calculation the transferor(s)/seller(s) may owe additional Delaware Income Tax. If owed this tax is due at the time the next Quarterly Estimated Tax Payment is due.

Line 7. If the transferor(s)/seller(s) is/ are reporting gain under the installment method no payment is due at this time, but by law you must report and remit any capital gain tax to the State of Delaware when any capital gain as a result of the sale of this property is recognized for Federal Tax Purposes.

Line 8. Enter the amount of Delaware Tax Due from Line 6(h), unless you completed Section 7. This is the amount payable to the Delaware Division of Revenue.

The Transferor/Seller must sign Form 5403, print their full name and title, if any. This form and the estimated income tax, if any, reported due and payable on this form must be remitted with the deed to the Recorder’s Office before the Recorder shall record a deed conveying title in Delaware real estate. The tax returns or reports and the amounts of tax collected pursuant to Title 30 of the Delaware Code, Sections 1126, 1606 or 1909, and the Recorder’s Office and its employees or agents, shall be subject to the secrecy provisions and penalties of Title 30 of the Delaware Code, Section 368.”