You can complete the 14a document with this PDF editor. These steps can help you easily create your document.

Step 1: The first task would be to pick the orange "Get Form Now" button.

Step 2: At the moment, you can begin modifying the 14a. The multifunctional toolbar is available to you - add, erase, modify, highlight, and carry out various other commands with the content in the document.

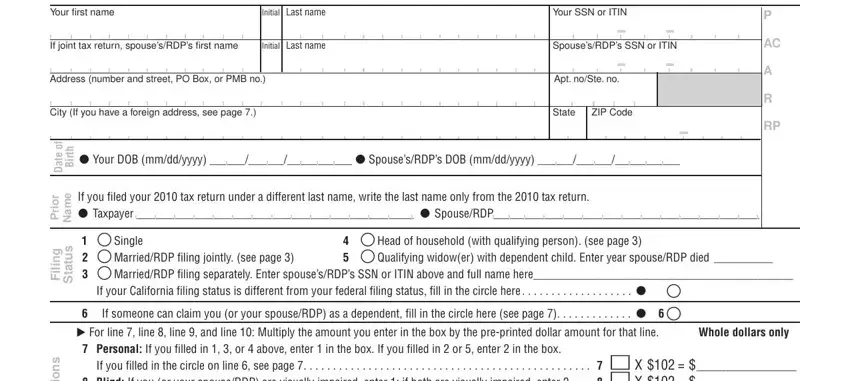

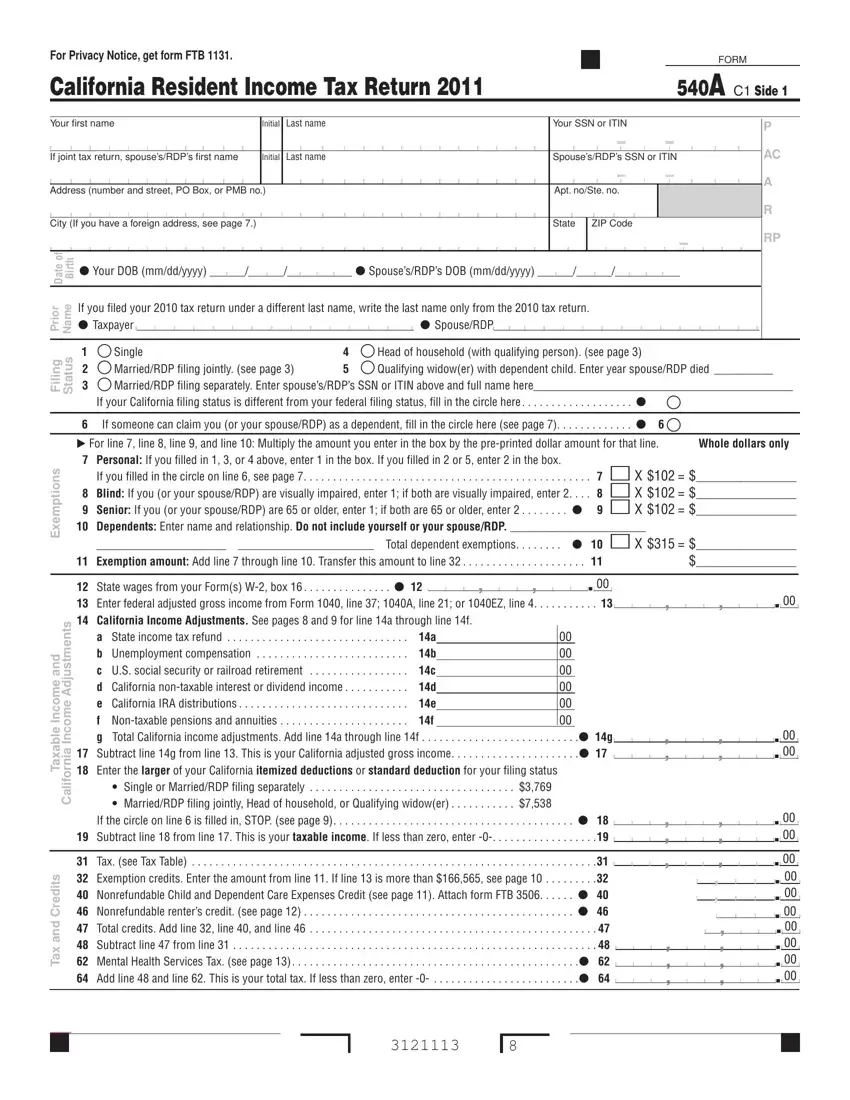

You need to provide the next information so that you create the file:

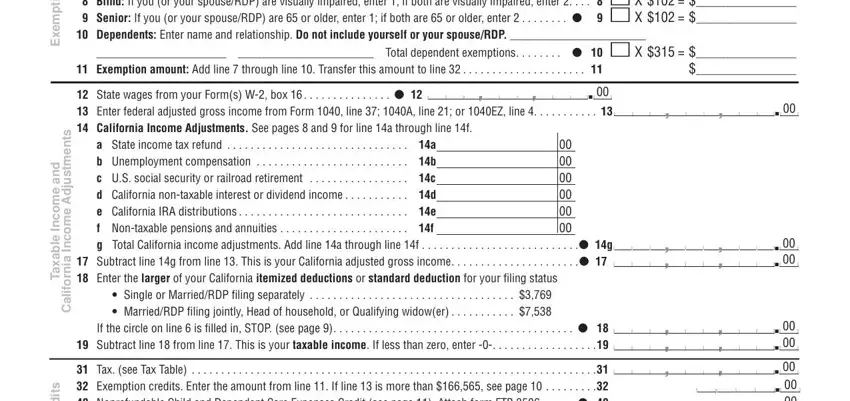

Include the expected details in the s n o i t p m e x E, d n a, e m o c n, I e l b a x a T, s t n e m t s u d A e m o c n, a i n r o f i l a C, If you filled in the circle on line, Total dependent exemptions, Exemption amount Add line, a State income tax refund, If the circle on line is filled in, s t i d e r C d n a x a T, and Tax see Tax Table area.

The program will request for more information in order to easily fill in the box s t i d e r C d n a x a T, and Tax see Tax Table.

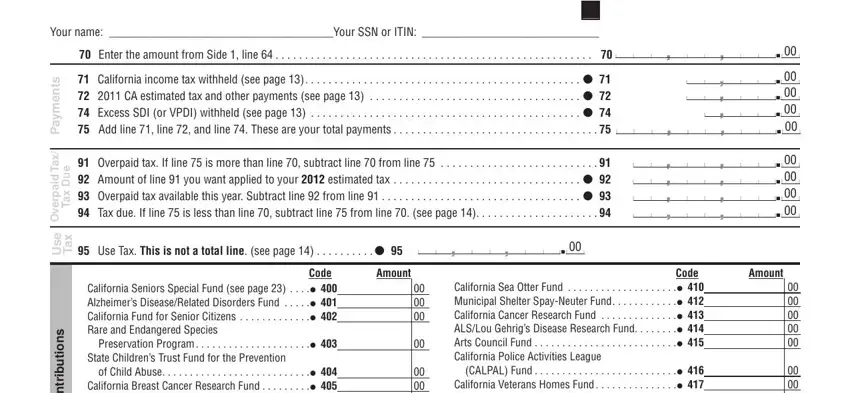

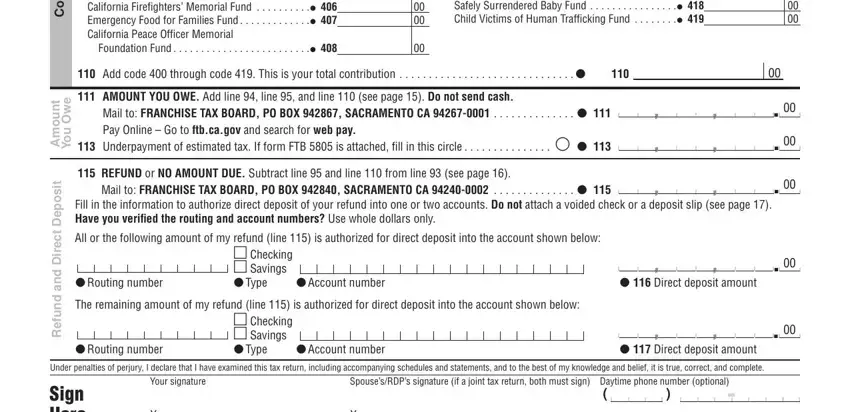

The s t n e m y a P, x a T d i a p r e v O, e u D x a T, e s U, x a T, s n o i t u b i r t n o C, Your name Your SSN or ITIN, Enter the amount from Side line, Overpaid tax If line is more, Use Tax This is not a total line, Code California Sea Otter Fund, Code California Seniors Special, CALPAL Fund, and Amount area is the place to place the rights and responsibilities of each side.

Look at the fields s n o i t u b i r t n o C, t n u o m A, e w O u o Y, t i s o p e D, t c e r i D d n a d n u f e R, Code California Seniors Special, CALPAL Fund, Mail to FRANCHISE TAX BOARD PO BOX, Underpayment of estimated tax If, REFUND or NO AMOUNT DUE Subtract, Mail to FRANCHISE TAX BOARD PO BOX, Fill in the information to, All or the following amount of my, Routing number The remaining, and Account number and next fill them out.

Step 3: Press "Done". Now you may transfer your PDF form.

Step 4: Produce a copy of each single file. It's going to save you time and make it easier to remain away from misunderstandings later on. Also, your information isn't going to be shared or analyzed by us.

,

,