Navigating the intricacies of legal documentation is a pivotal step in ensuring compliance with United States laws and regulations, especially for matters involving financial disclosures and asset reporting. Among these critical documents, the 5434 A form stands out as a vital tool for individuals and entities required to declare their foreign financial accounts to the Internal Revenue Service (IRS). This requirement is not merely about transparency but serves as a cornerstone for preventing tax evasion and maintaining the integrity of the financial system. The form is a part of the broader framework established under the Bank Secrecy Act (BSA), which aims to detect and prevent money laundering and other financial crimes. Completing the 5434 A form with accuracy is not only about fulfilling a legal obligation; it is also about contributing to a larger effort to ensure financial fairness and security. The process of filing this form involves detailing foreign accounts, including bank accounts, securities, and other financial instruments, that meet the reporting threshold. It is therefore imperative for individuals and organizations to understand the specific criteria, deadlines, and procedures for submission to avoid potential penalties that can arise from non-compliance.

| Question | Answer |

|---|---|

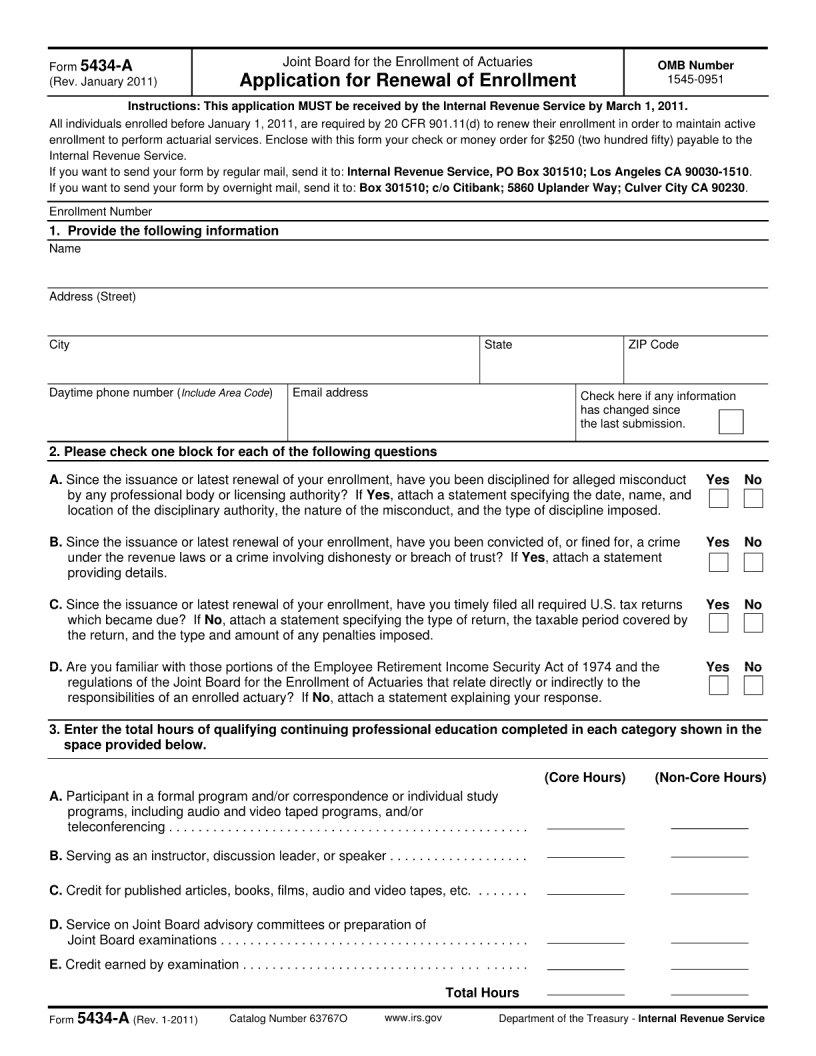

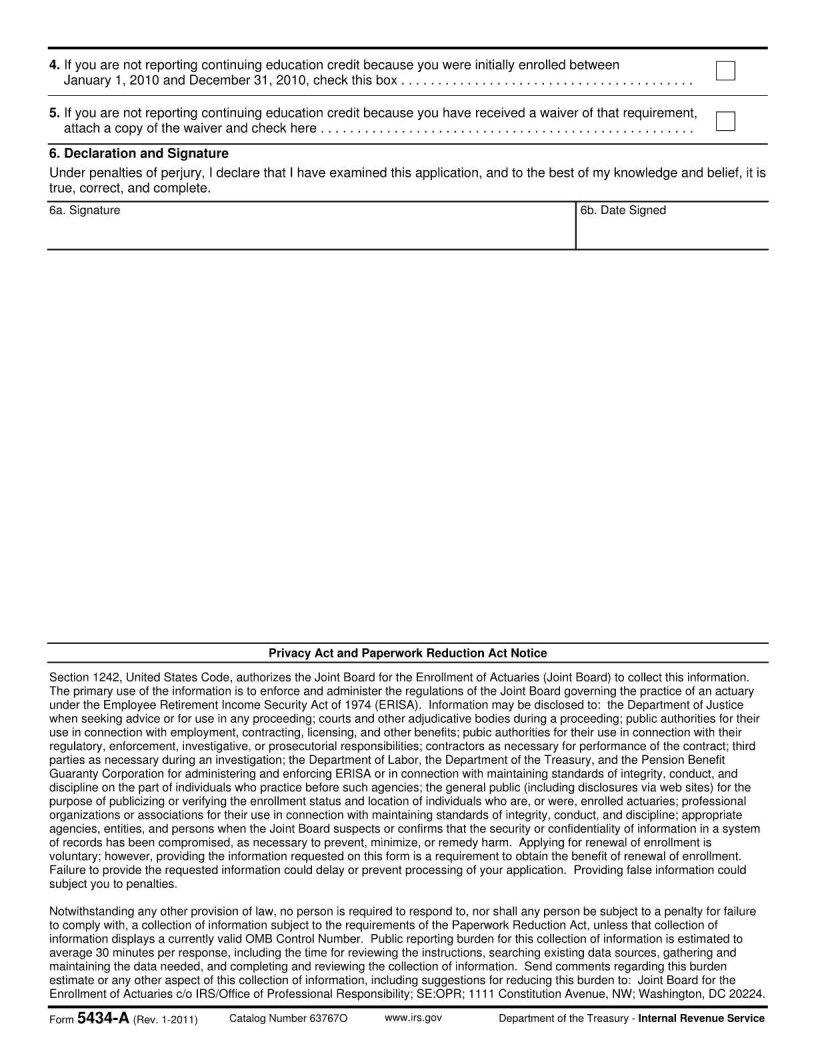

| Form Name | Form 5434 A |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 2011, ERISA, da 5434 jan 2014, teleconferencing |