Making use of the online editor for PDFs by FormsPal, it is possible to fill in or edit Form 5471 Schedule O here and now. In order to make our tool better and easier to work with, we continuously develop new features, considering suggestions coming from our users. Here is what you would need to do to start:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" above on this site.

Step 2: Using this handy PDF tool, you are able to accomplish more than just fill out blank fields. Express yourself and make your docs seem great with customized textual content added, or tweak the file's original content to excellence - all that comes along with an ability to insert any type of pictures and sign the file off.

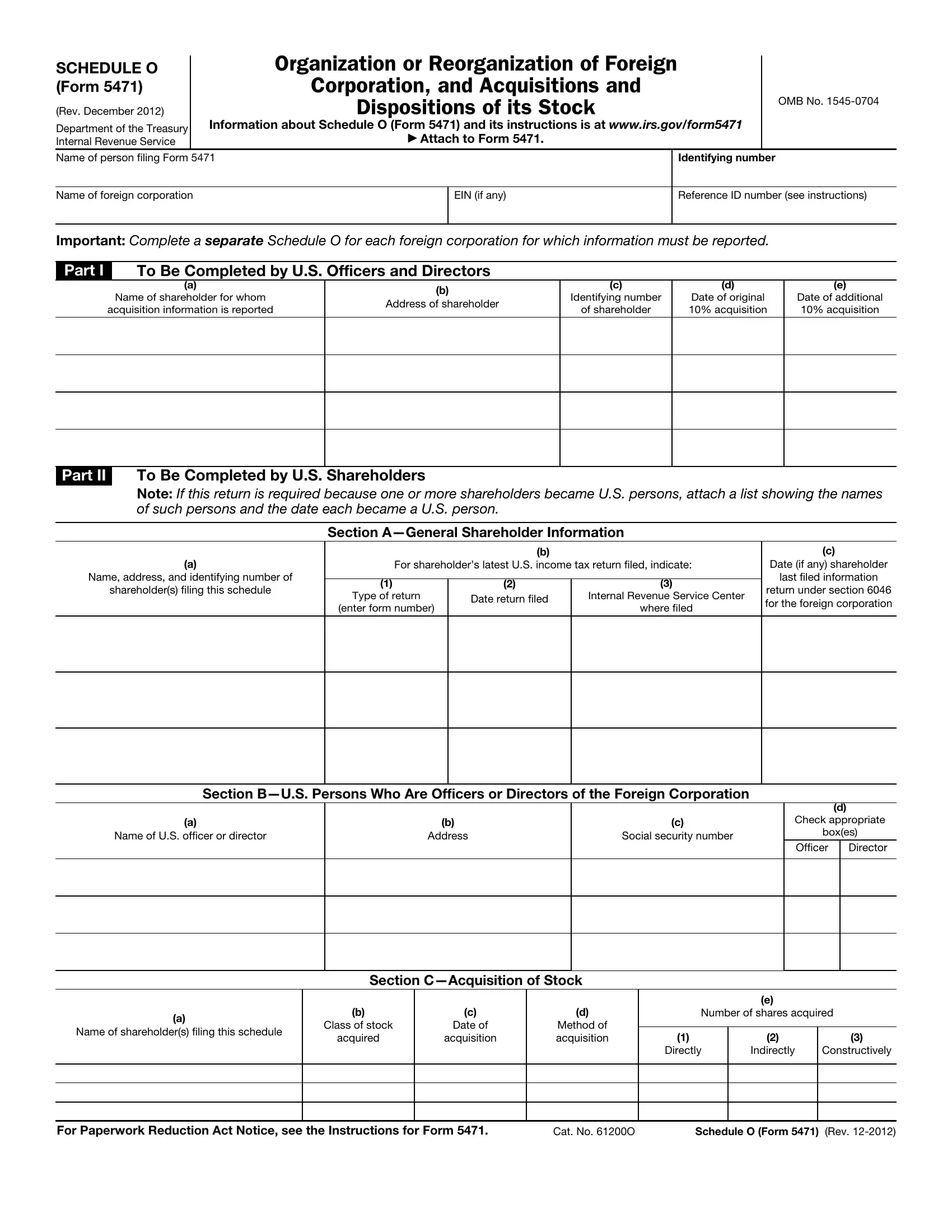

This form requires particular data to be typed in, therefore be sure you take the time to type in what is requested:

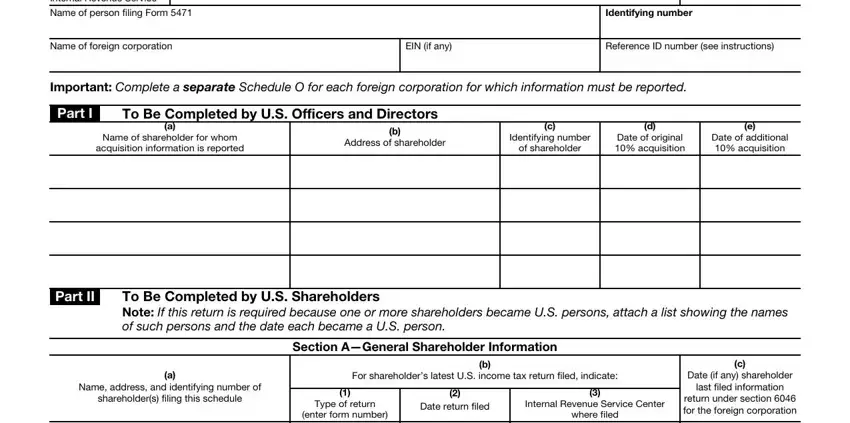

1. You need to complete the Form 5471 Schedule O properly, thus be mindful when working with the parts including these fields:

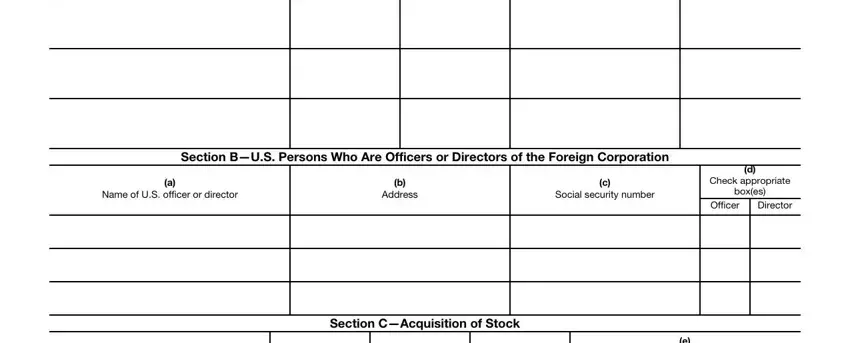

2. The subsequent stage would be to fill in these particular fields: Section BUS Persons Who Are, Name of US officer or director, Address, Social security number, Check appropriate, boxes, Officer, Director, and Section CAcquisition of Stock.

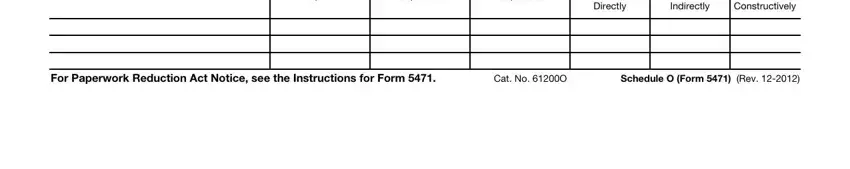

3. In this part, review acquired, acquisition, Method of acquisition, Directly, Indirectly, Constructively, For Paperwork Reduction Act Notice, Cat No O, and Schedule O Form Rev. These have to be completed with highest precision.

Always be really careful while filling in Method of acquisition and Cat No O, as this is the part where most users make a few mistakes.

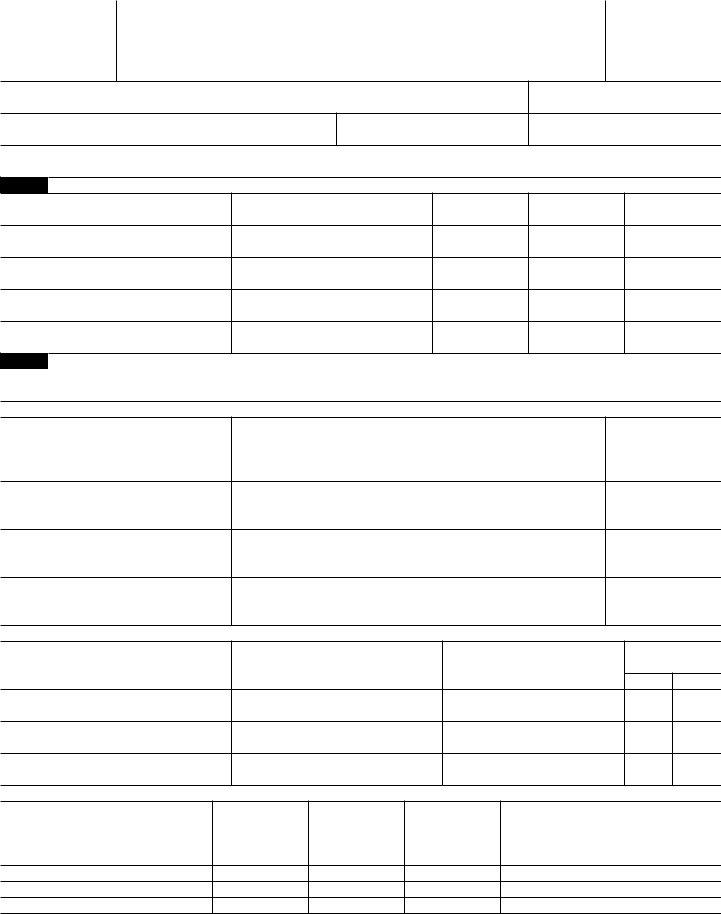

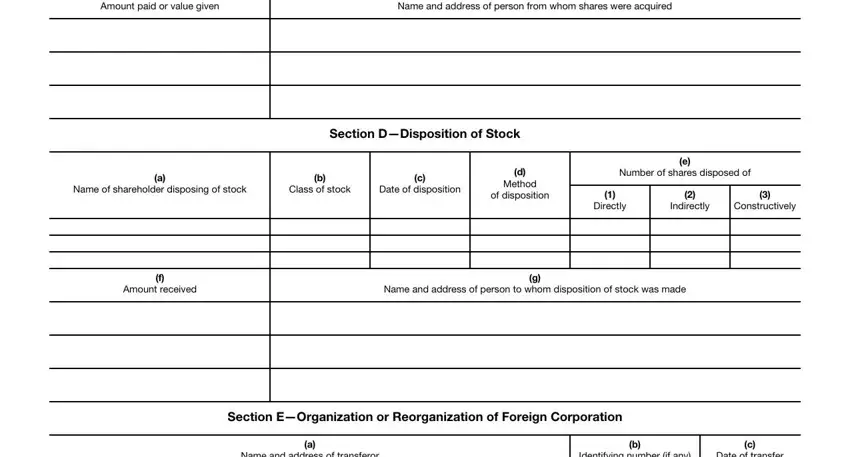

4. All set to proceed to the next segment! Here you will have these Amount paid or value given, Name and address of person from, Section DDisposition of Stock, Name of shareholder disposing of, Class of stock, Date of disposition, Method, of disposition, Number of shares disposed of, Directly, Indirectly, Constructively, Amount received, Name and address of person to whom, and Section EOrganization or fields to complete.

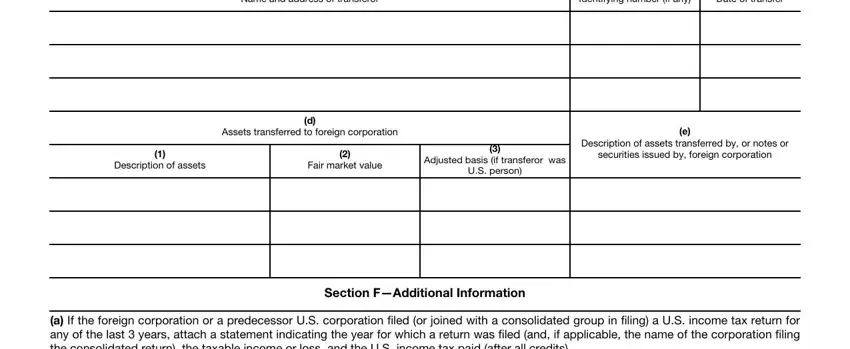

5. To finish your document, this final part features a few extra fields. Completing Name and address of transferor, Identifying number if any, Date of transfer, Assets transferred to foreign, Description of assets, Fair market value, Adjusted basis if transferor was, US person, Description of assets transferred, securities issued by foreign, Section FAdditional Information, and a If the foreign corporation or a should conclude everything and you'll be done in no time!

Step 3: Confirm that your information is accurate and then click on "Done" to progress further. Sign up with us right now and immediately gain access to Form 5471 Schedule O, ready for downloading. Every change you make is conveniently saved , meaning you can modify the pdf further as needed. At FormsPal.com, we do our utmost to make sure all of your information is stored protected.