It is possible to fill in IRS effortlessly using our PDFinity® editor. Our team is dedicated to making sure you have the best possible experience with our editor by constantly releasing new features and upgrades. Our editor has become much more user-friendly with the most recent updates! At this point, editing PDF forms is easier and faster than ever before. With a few easy steps, you are able to begin your PDF journey:

Step 1: Open the PDF file inside our tool by clicking on the "Get Form Button" above on this webpage.

Step 2: When you launch the PDF editor, you'll see the document all set to be filled in. Besides filling out different blanks, it's also possible to perform various other actions with the Document, namely putting on any textual content, editing the initial text, inserting illustrations or photos, placing your signature to the PDF, and much more.

This PDF doc will need some specific details; in order to guarantee accuracy and reliability, make sure you take into account the recommendations further on:

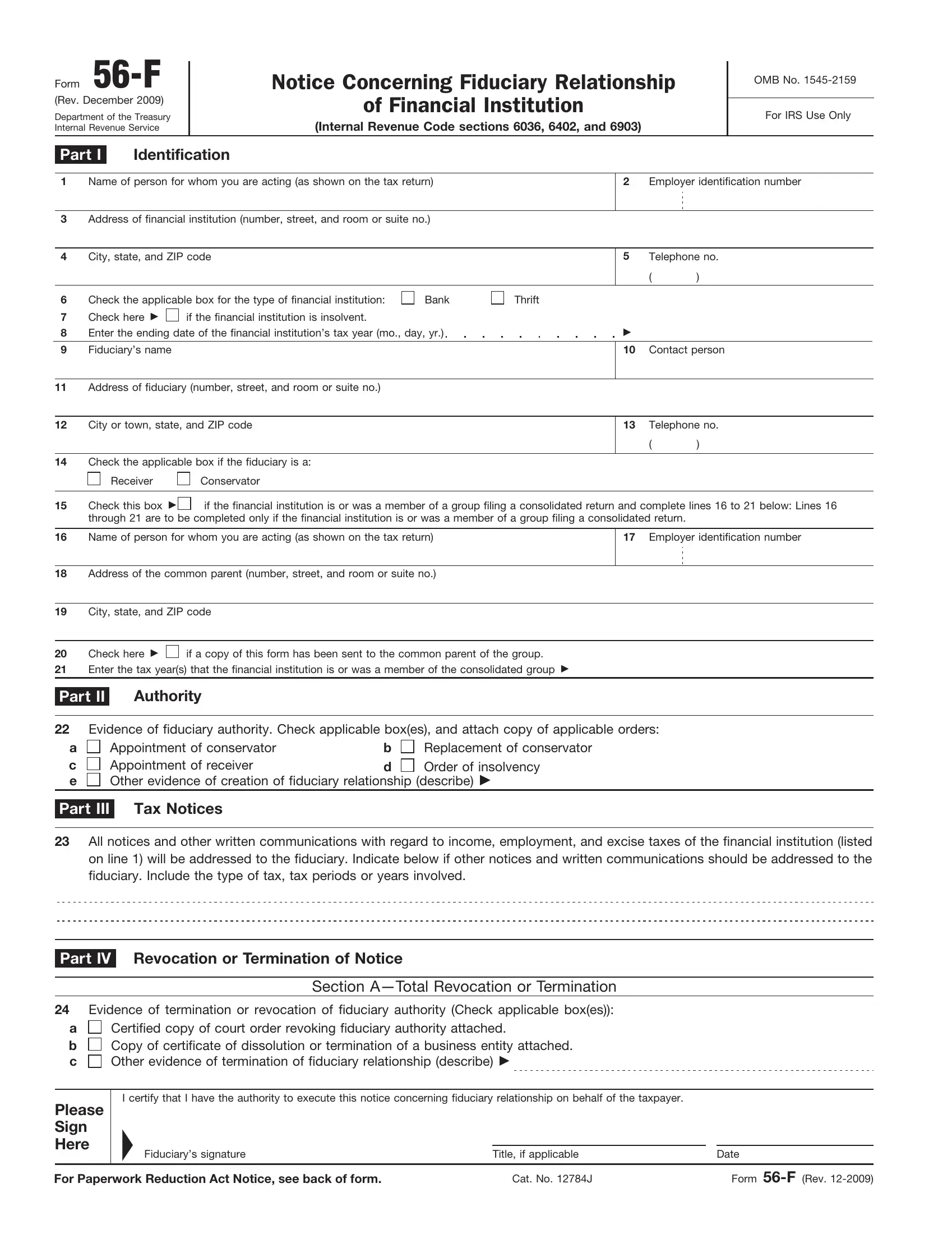

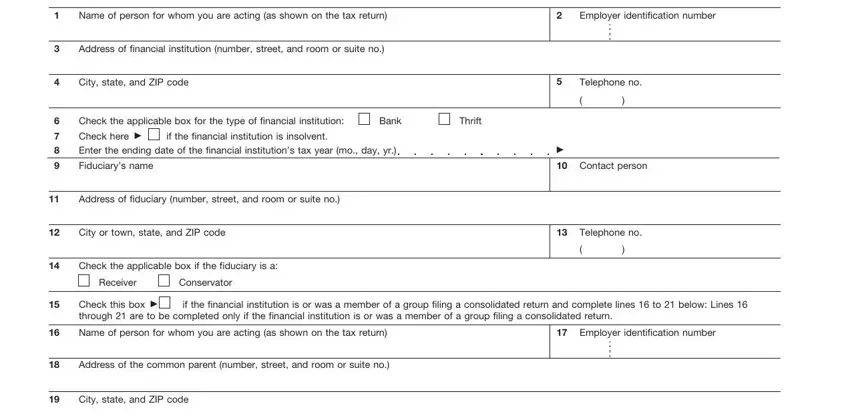

1. You will need to fill out the IRS accurately, hence pay close attention while filling out the segments containing these particular blanks:

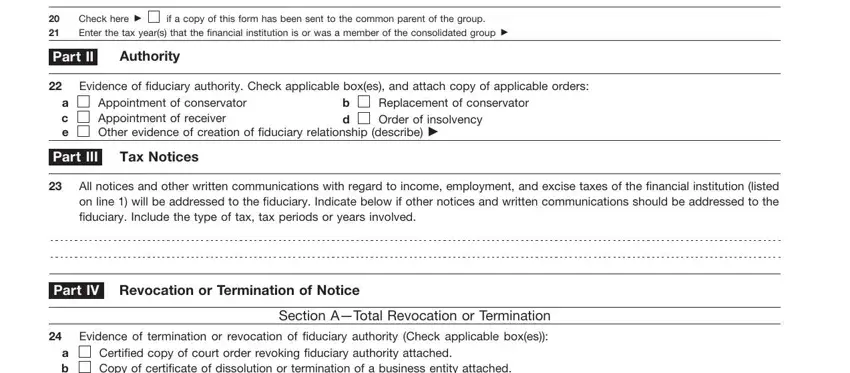

2. Once your current task is complete, take the next step – fill out all of these fields - Check here, if a copy of this form has been, Enter the tax years that the, Part II, Authority, Evidence of fiduciary authority, a c e, Appointment of conservator, Order of insolvency, Replacement of conservator, Part III, Tax Notices, All notices and other written, Part IV, and Revocation or Termination of Notice with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

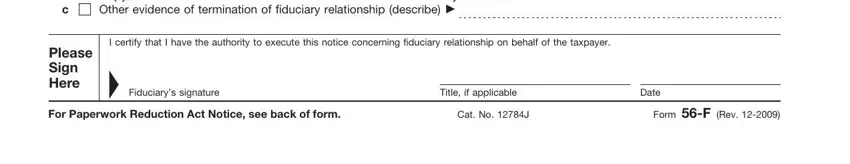

3. Throughout this part, review a b c, Certified copy of court order, Please Sign Here, I certify that I have the, Fiduciarys signature, Title if applicable, Date, For Paperwork Reduction Act Notice, Cat No J, and Form F Rev. Each of these need to be taken care of with highest attention to detail.

People who use this PDF generally get some points incorrect when completing Form F Rev in this area. Ensure that you go over what you enter right here.

Step 3: Make sure the details are correct and click "Done" to finish the project. Go for a 7-day free trial subscription at FormsPal and gain immediate access to IRS - download, email, or change in your FormsPal cabinet. FormsPal offers protected form editor without data recording or distributing. Feel comfortable knowing that your information is in good hands with us!