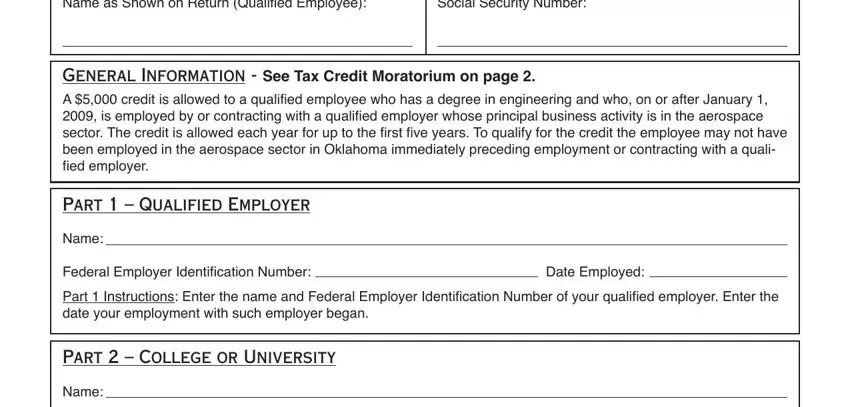

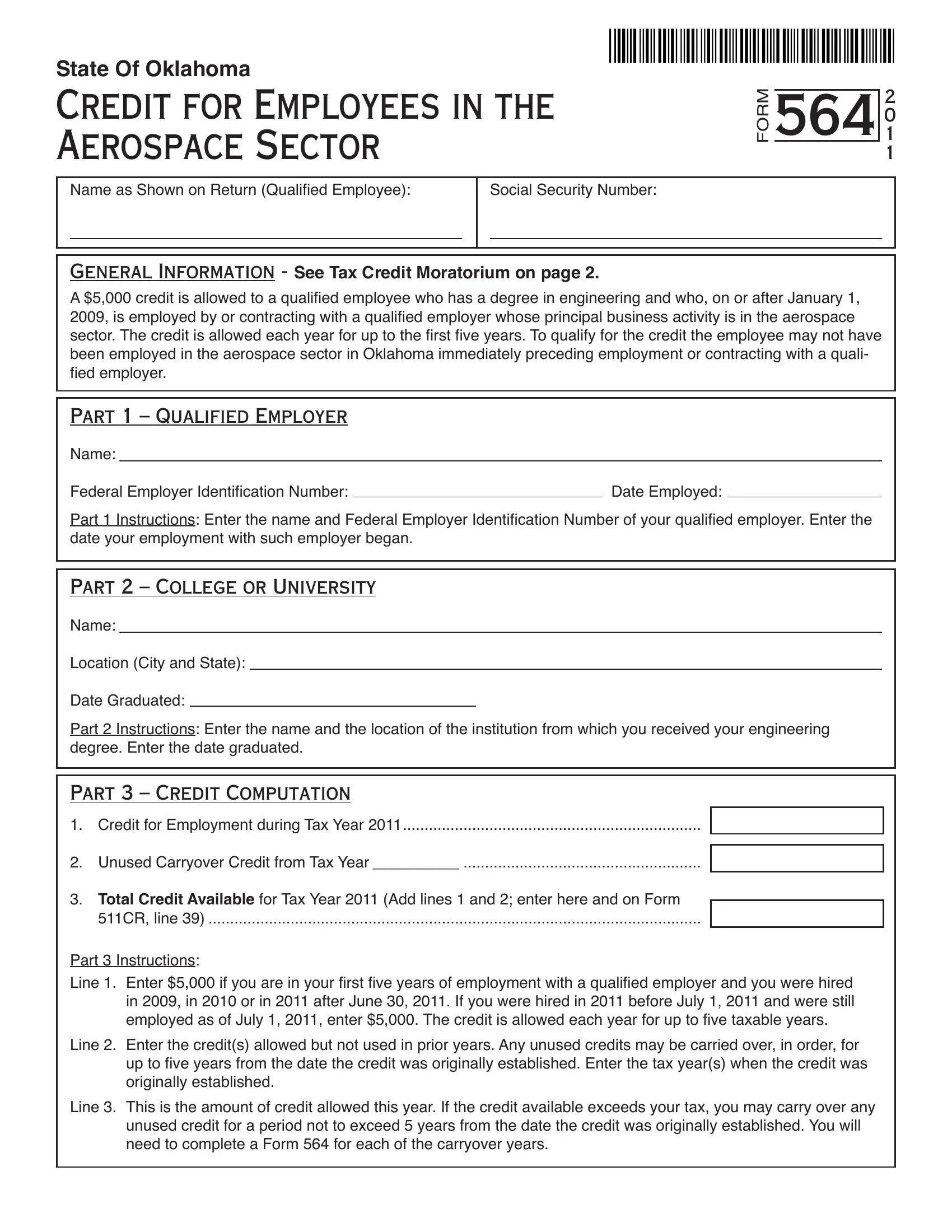

State Of Oklahoma

CREDIT FOR EMPLOYEES IN THE AEROSPACE SECTOR

Name as Shown on Return (Qualiied Employee): |

Social Security Number: |

|

|

|

|

|

|

GENERAL INFORMATION - See Tax Credit Moratorium on page 2.

A $5,000 credit is allowed to a qualiied employee who has a degree in engineering and who, on or after January 1, 2009, is employed by or contracting with a qualiied employer whose principal business activity is in the aerospace sector. The credit is allowed each year for up to the irst ive years. To qualify for the credit the employee may not have been employed in the aerospace sector in Oklahoma immediately preceding employment or contracting with a quali- ied employer.

PART 1 – QUALIFIED EMPLOYER

Name:

Federal Employer Identiication Number: |

|

Date Employed: |

Part 1 Instructions: Enter the name and Federal Employer Identiication Number of your qualiied employer. Enter the date your employment with such employer began.

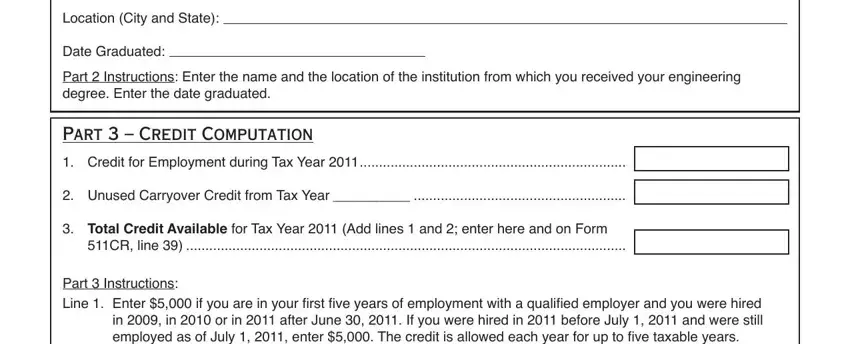

PART 2 – COLLEGE OR UNIVERSITY

Name:

Location (City and State):

Date Graduated:

Part 2 Instructions: Enter the name and the location of the institution from which you received your engineering degree. Enter the date graduated.

PART 3 – CREDIT COMPUTATION

1. Credit for Employment during Tax Year 2011.....................................................................

2. Unused Carryover Credit from Tax Year __________ .......................................................

3.Total Credit Available for Tax Year 2011 (Add lines 1 and 2; enter here and on Form 511CR, line 39) ..................................................................................................................

Part 3 Instructions:

Line 1. Enter $5,000 if you are in your irst ive years of employment with a qualiied employer and you were hired in 2009, in 2010 or in 2011 after June 30, 2011. If you were hired in 2011 before July 1, 2011 and were still employed as of July 1, 2011, enter $5,000. The credit is allowed each year for up to ive taxable years.

Line 2. Enter the credit(s) allowed but not used in prior years. Any unused credits may be carried over, in order, for up to ive years from the date the credit was originally established. Enter the tax year(s) when the credit was originally established.

Line 3. This is the amount of credit allowed this year. If the credit available exceeds your tax, you may carry over any unused credit for a period not to exceed 5 years from the date the credit was originally established. You will need to complete a Form 564 for each of the carryover years.

2011 Form 564 - page 2

CREDIT FOR EMPLOYEES IN THE AEROSPACE SECTOR

68 OKLAHOMA STATUTES SEC. 2357.301 AND 2357.304 AND RULE 710:50-15-109

TAX CREDIT MORATORIUM

No credit may be claimed by a qualiied employee for the period of July 1, 2010 through June 30, 2011, for which the credit would otherwise be allowable. For example:

A)You are a qualiied employee who was hired by a qualiied employer on or after January 1, 2009 and before July 1, 2010 and will continue employment for at least ive years. You are entitled to receive the credit each year of the ive-year period. You are not affected by the tax credit moratorium.

B)You are a qualiied employee who was hired by a qualiied employer on or after July 1, 2010 and before

January 1, 2011 and will continue employment through at least 2014. You may receive the credit for tax years 2011, 2012, 2013 and 2014. You were not entitled to receive the credit for tax year 2010 due to the tax credit

MORATORIUM.

C)You are a qualiied employee who was hired by a qualiied employer in 2011 and will continue employment through at least 2015. You may receive the credit for tax years 2011, 2012, 2013, 2014 and 2015. If you were hired on or after January 1, 2011 and before July 1, 2011 but were no longer employed as of July 1, 2011, you will not receive the credit for tax year 2011 due to the tax credit moratorium.

DEFINITIONS

“Aerospace Sector” means a private or public organization engaged in the manufacture of aerospace or defense hardware or software, aerospace maintenance, aerospace repair and overhaul, supply of parts to the aerospace industry, provision of services and support relating to the aerospace industry, research and development of aerospace technology and systems, and the education and training of aerospace personnel.

“Institution” means an institution within The Oklahoma State System of Higher Education or any other public or private college or university that is accredited by a national accrediting body.

“Qualiied Employer” means a sole proprietor, general partnership, limited partnership, limited liability company, corporation, other legally recognized business entity, or public entity whose principal business activity involves the aerospace sector.

“Qualiied Employee” means any person newly employed by or contracting with a qualiied employer on or after January 1, 2009. This individual must have been awarded an undergraduate or graduate degree from a qualiied program by an institution and was not employed in the aerospace sector in Oklahoma immediately preceding employment or contracting with a qualiied employer.

“Qualiied Program” means a program that has been accredited by the Engineering Accreditation Commission of the Accreditation Board for Engineering and Technology (ABET) and awards an undergraduate or graduate degree.