Entity can be filled out in no time. Just make use of FormsPal PDF tool to finish the job quickly. Our tool is continually developing to provide the very best user experience possible, and that's because of our dedication to continuous improvement and listening closely to user feedback. To get the process started, take these simple steps:

Step 1: Hit the "Get Form" button above on this page to open our tool.

Step 2: With our advanced PDF editor, you are able to do more than simply fill out blanks. Try all the functions and make your documents appear professional with custom textual content added, or adjust the file's original content to perfection - all that comes with an ability to add any type of photos and sign it off.

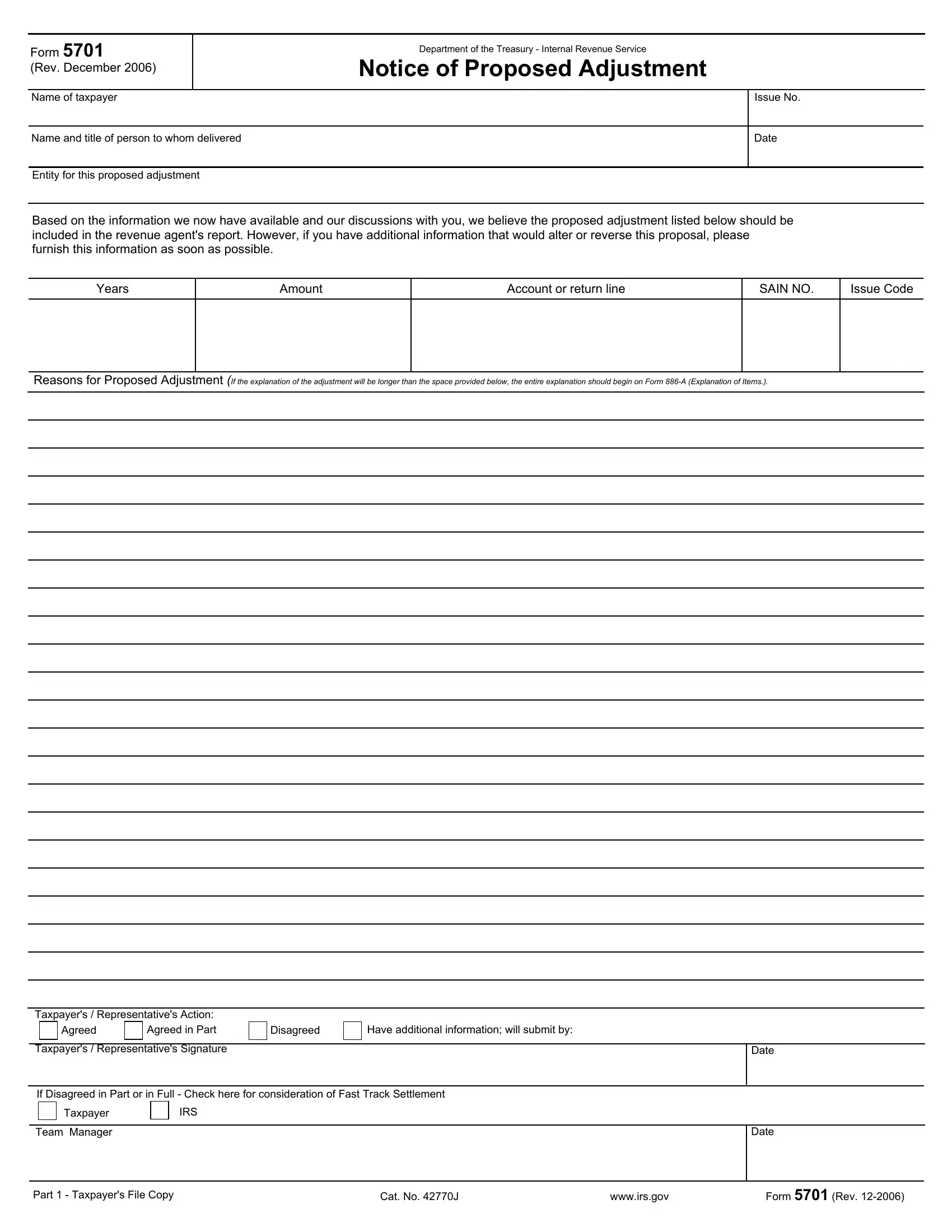

For you to finalize this form, ensure that you type in the required information in every blank field:

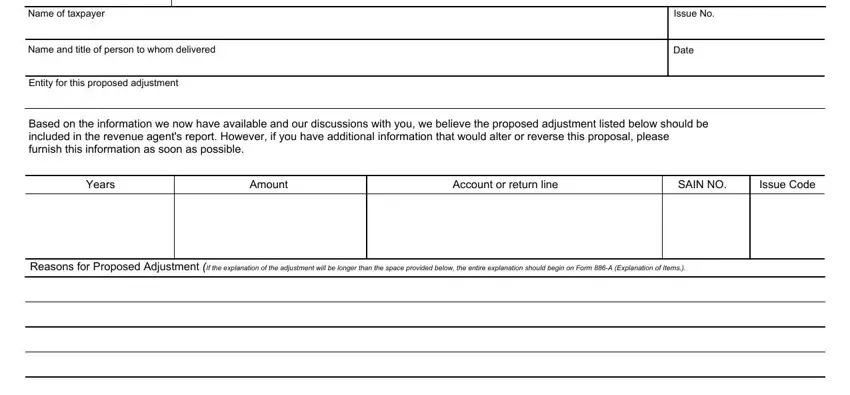

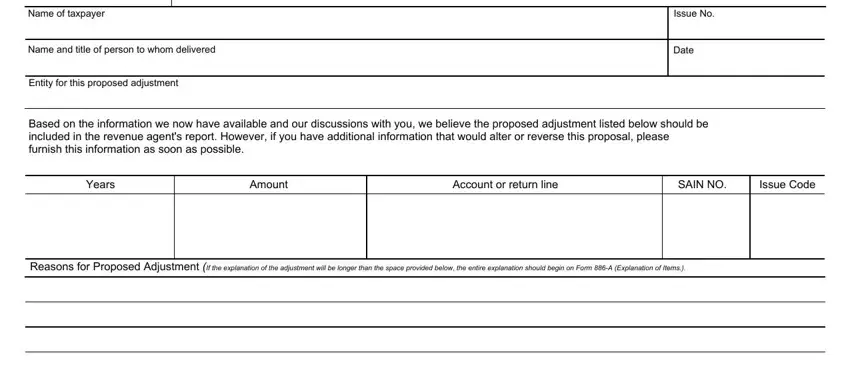

1. The Entity requires particular details to be inserted. Be sure the subsequent blanks are filled out:

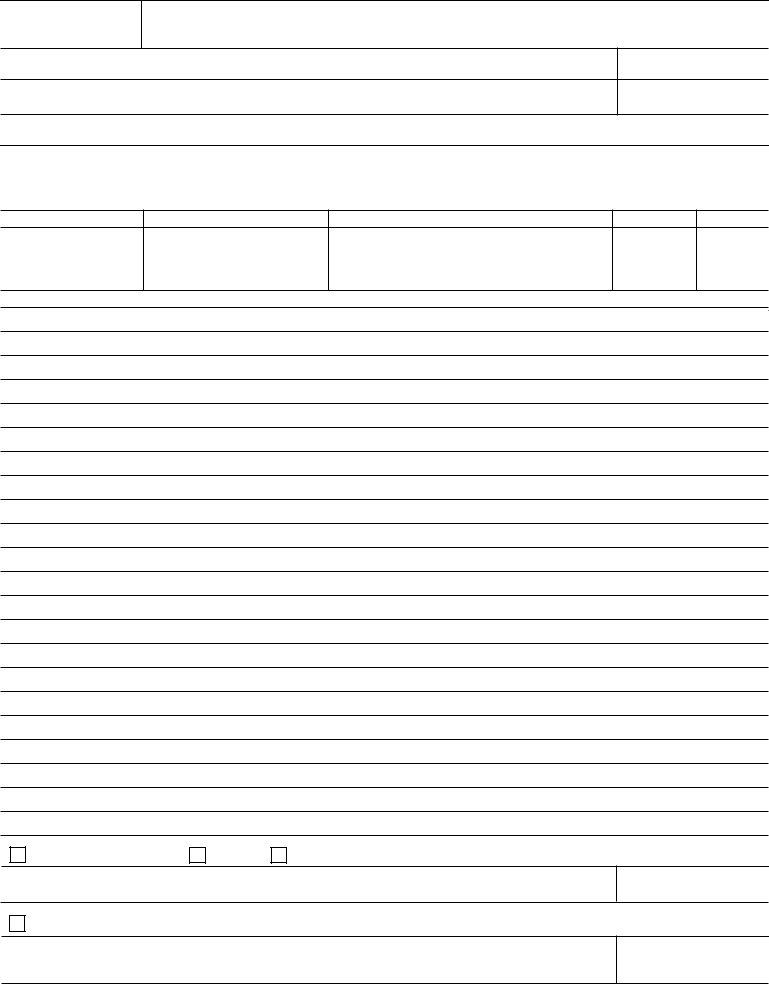

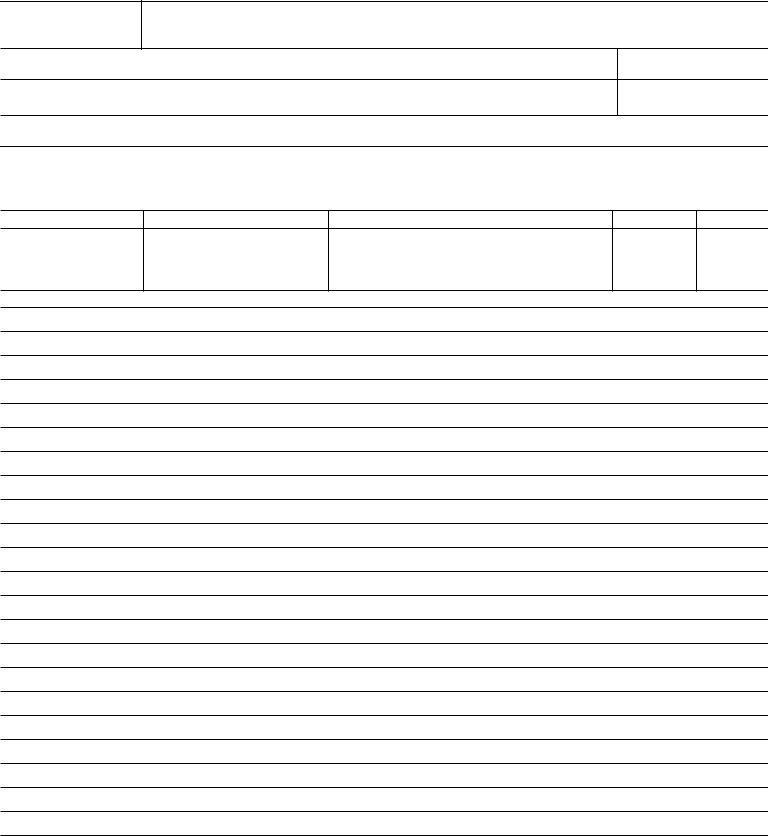

2. Once this section is done, you should put in the needed particulars in in order to move on to the third part.

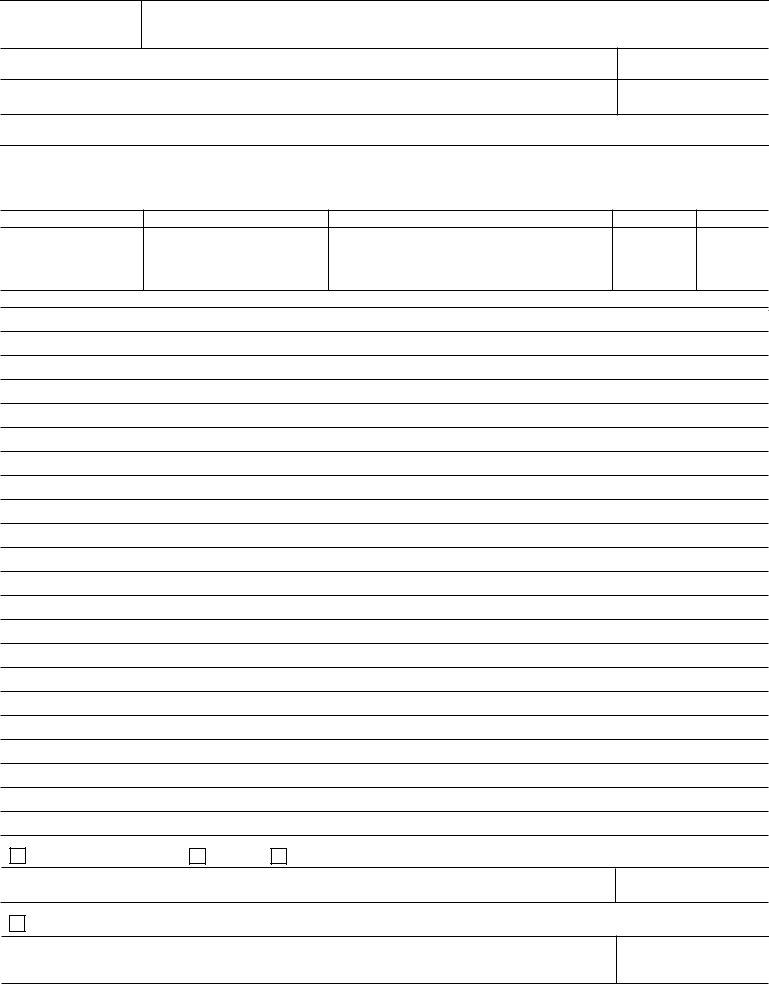

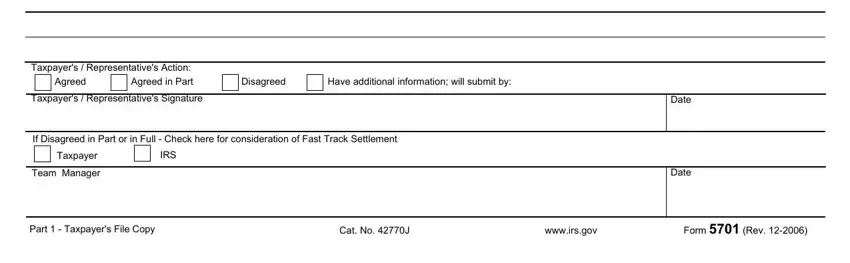

3. This subsequent segment is fairly straightforward, Taxpayers Representatives Action, Agreed, Taxpayers Representatives, Disagreed, Have additional information will, If Disagreed in Part or in Full, Taxpayer, IRS, Team Manager, Date, Date, Part Taxpayers File Copy, and Cat No J wwwirsgov Form Rev - these form fields will need to be filled in here.

4. Filling out Name of taxpayer, Name and title of person to whom, Entity for this proposed adjustment, Issue No, Date, Based on the information we now, Years, Amount, Account or return line, SAIN NO, Issue Code, and Reasons for Proposed Adjustment If is paramount in this stage - ensure to devote some time and be mindful with each blank!

Be really attentive when filling out Account or return line and Amount, because this is where most people make a few mistakes.

5. To finish your document, this last part involves a few extra blanks. Typing in should finalize everything and you will be done very fast!

Step 3: Confirm that your details are right and simply click "Done" to complete the task. After registering a7-day free trial account with us, you will be able to download Entity or send it via email right off. The PDF will also be accessible via your personal account with all your changes. FormsPal is focused on the confidentiality of all our users; we make certain that all personal information coming through our system remains secure.