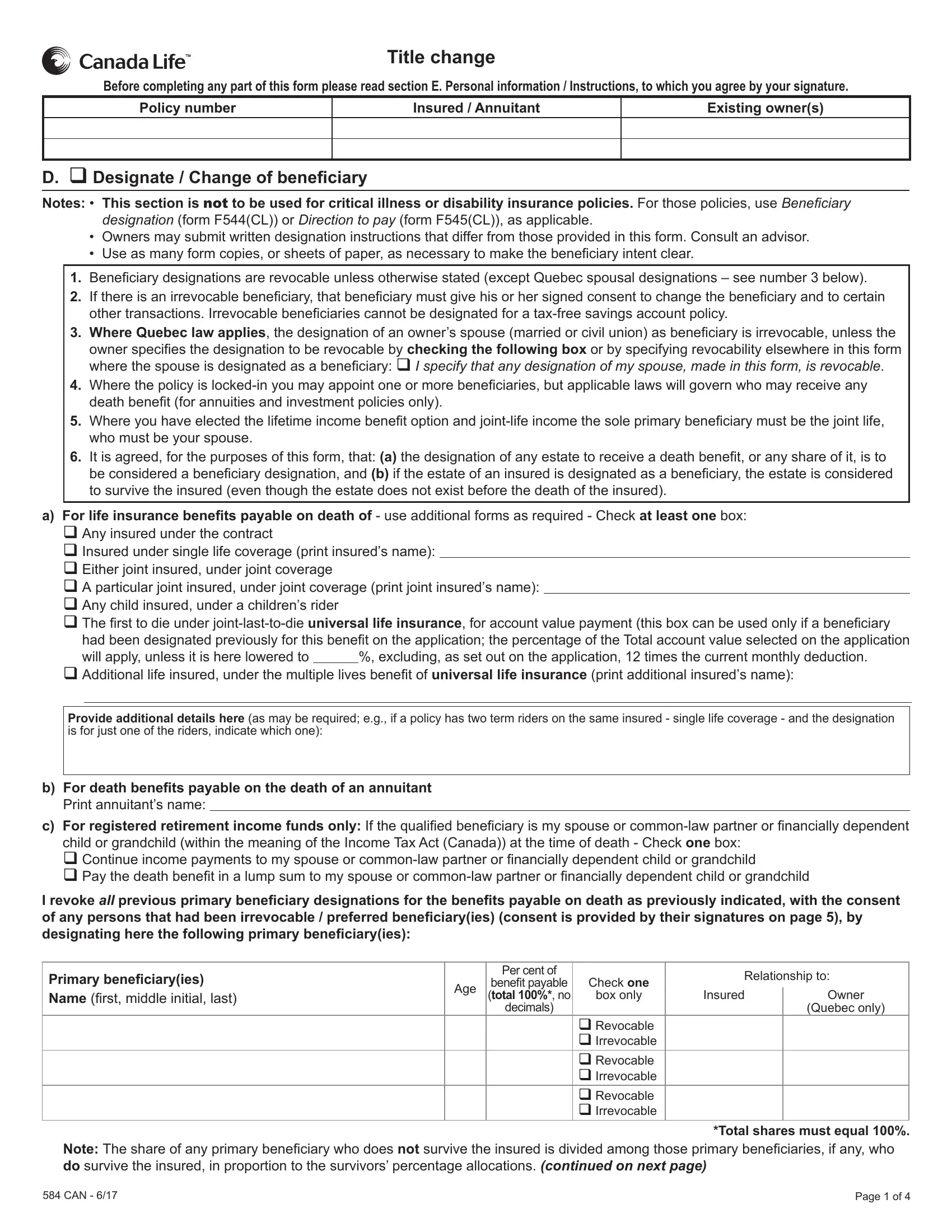

Title change

Before completing any part of this form please read section E. Personal information / Instructions, to which you agree by your signature.

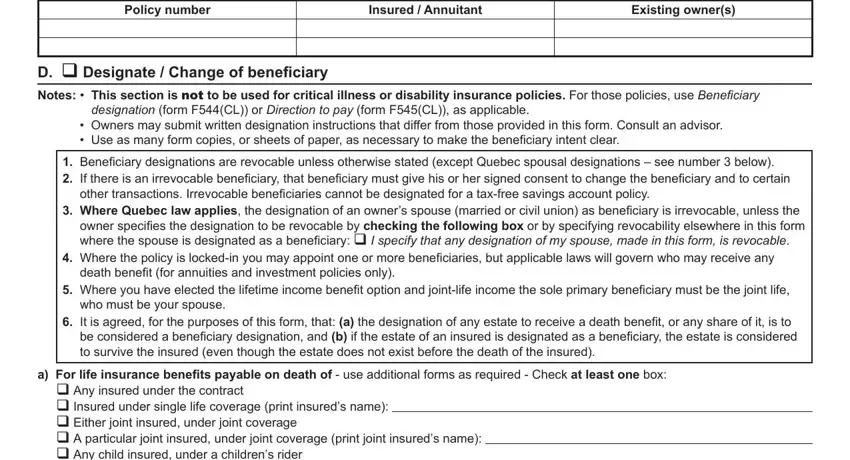

D.q Designate / Change of beneiciary

Notes: • This section is NOT to be used for critical illness or disability insurance policies. For those policies, use Beneiciary designation (form F544(CL)) or Direction to pay (form F545(CL)), as applicable.

•Owners may submit written designation instructions that differ from those provided in this form. Consult an advisor.

•Useasmanyformcopies,orsheetsofpaper,asnecessarytomakethebeneiciaryintentclear.

1.Beneiciarydesignationsarerevocableunlessotherwisestated(exceptQuebecspousaldesignations–seenumber3below).

2.Ifthereisanirrevocablebeneiciary,thatbeneiciarymustgivehisorhersignedconsenttochangethebeneiciaryandtocertain

othertransactions.Irrevocablebeneiciariescannotbedesignatedforatax-freesavingsaccountpolicy.

3.Where Quebec law applies,thedesignationofanowner’sspouse(marriedorcivilunion)asbeneiciaryisirrevocable,unlessthe ownerspeciiesthedesignationtoberevocablebychecking the following box or by specifying revocability elsewhere in this form wherethespouseisdesignatedasabeneiciary:q I specify that any designation of my spouse, made in this form, is revocable.

4.Wherethepolicyislocked-inyoumayappointoneormorebeneiciaries,butapplicablelawswillgovernwhomayreceiveany deathbeneit(forannuitiesandinvestmentpoliciesonly).

5.Whereyouhaveelectedthelifetimeincomebeneitoptionandjoint-lifeincomethesoleprimarybeneiciarymustbethejointlife, who must be your spouse.

6.Itisagreed,forthepurposesofthisform,that:(a)thedesignationofanyestatetoreceiveadeathbeneit,oranyshareofit,isto beconsideredabeneiciarydesignation,and(b)iftheestateofaninsuredisdesignatedasabeneiciary,theestateisconsidered tosurvivetheinsured(eventhoughtheestatedoesnotexistbeforethedeathoftheinsured).

a)For life insurance beneits payable on death of -useadditionalformsasrequired-Checkat least onebox: q Any insured under the contract qInsuredundersinglelifecoverage(printinsured’sname): qEitherjointinsured,underjointcoverage qAparticularjointinsured,underjointcoverage(printjointinsured’sname):

q Any child insured, under a children’s rider

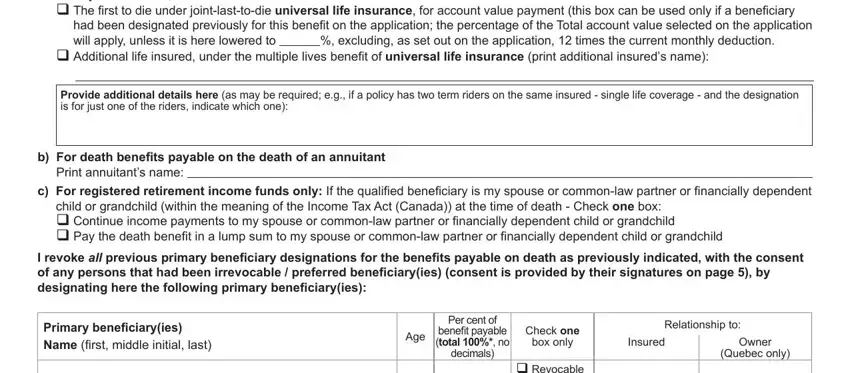

q Theirsttodieunderjoint-last-to-dieuniversal life insurance,foraccountvaluepayment(thisboxcanbeusedonlyifabeneiciary

hadbeendesignatedpreviouslyforthisbeneitontheapplication;thepercentageoftheTotalaccountvalueselectedontheapplication

will apply, unless it is here lowered to |

|

%,excluding,assetoutontheapplication,12timesthecurrentmonthlydeduction. |

qAdditionallifeinsured,underthemultiplelivesbeneitofuniversal life insurance(printadditionalinsured’sname):

Provide additional details here (asmayberequired;e.g.,ifapolicyhastwotermridersonthesameinsured-singlelifecoverage-andthedesignation isforjustoneoftheriders,indicatewhichone):

b)For death beneits payable on the death of an annuitant

Printannuitant’sname:

c)For registered retirement income funds only:Ifthequaliiedbeneiciaryismyspouseorcommon-lawpartnerorinanciallydependent childorgrandchild(withinthemeaningoftheIncomeTaxAct(Canada))atthetimeofdeath-Checkonebox: qContinueincomepaymentstomyspouseorcommon-lawpartnerorinanciallydependentchildorgrandchild qPaythedeathbeneitinalumpsumtomyspouseorcommon-lawpartnerorinanciallydependentchildorgrandchild

I revoke all previous primary beneiciary designations for the beneits payable on death as previously indicated, with the consent of any persons that had been irrevocable / preferred beneiciary(ies) (consent is provided by their signatures on page 5), by designating here the following primary beneiciary(ies):

Primary beneiciary(ies) |

|

Per cent of |

|

Relationshipto: |

Age |

beneitpayable |

Check one |

Name(irst,middleinitial,last) |

(total 100%*, no |

boxonly |

Insured |

Owner |

|

|

decimals) |

|

|

(Quebeconly) |

|

|

|

q Revocable |

|

|

|

|

|

q Irrevocable |

|

|

|

|

|

q Revocable |

|

|

|

|

|

q Irrevocable |

|

|

|

|

|

q Revocable |

|

|

|

|

|

q Irrevocable |

|

|

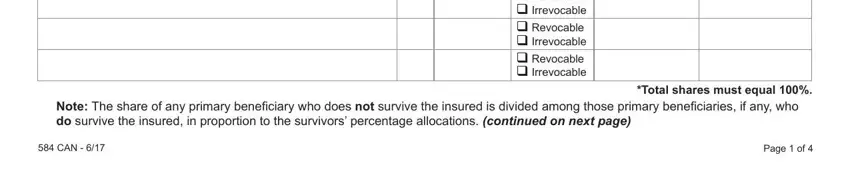

*Total shares must equal 100%.

Note: Theshareofanyprimarybeneiciarywhodoesnotsurvivetheinsuredisdividedamongthoseprimarybeneiciaries,ifany,who

do survive the insured, in proportion to the survivors’ percentage allocations. (continued on next page)

584 CAN - 6/17 |

Page 1 of 4 |

Title change

Before completing any part of this form please read section E. Personal information / Instructions, to which you agree by your signature.

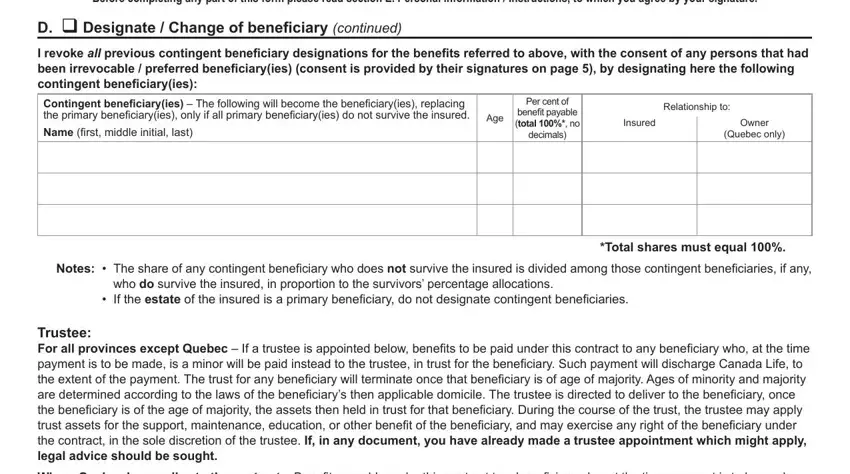

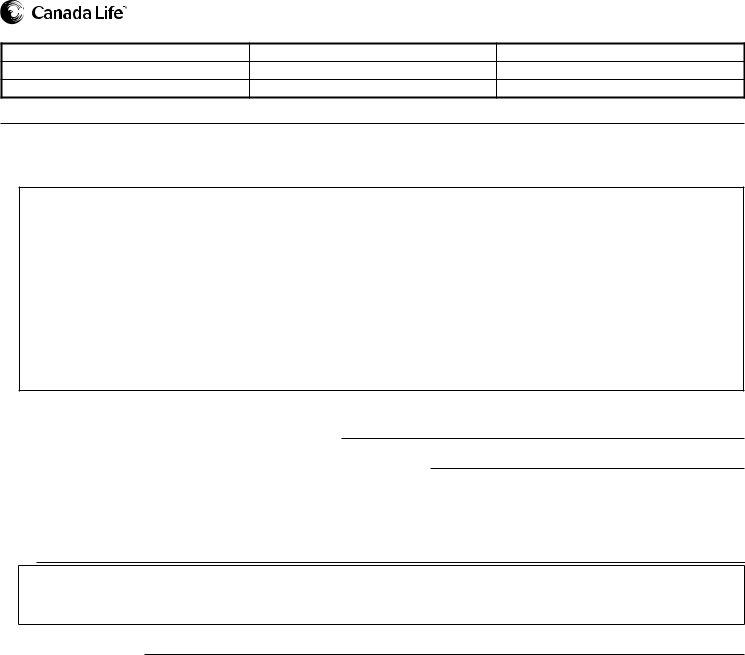

D.q Designate / Change of beneiciary (continued)

I revoke all previous contingent beneiciary designations for the beneits referred to above, with the consent of any persons that had been irrevocable / preferred beneiciary(ies) (consent is provided by their signatures on page 5), by designating here the following contingent beneiciary(ies):

Contingent beneiciary(ies)–Thefollowingwillbecomethebeneiciary(ies),replacing theprimarybeneiciary(ies),onlyifallprimarybeneiciary(ies)donotsurvivetheinsured.

Name(irst,middleinitial,last)

Per cent of

beneitpayable

(total 100%*, no

decimals)

Relationshipto:

Insured |

Owner |

|

(Quebeconly) |

|

|

*Total shares must equal 100%.

Notes: • Theshareofanycontingentbeneiciarywhodoesnotsurvivetheinsuredisdividedamongthosecontingentbeneiciaries,ifany,

who do survive the insured, in proportion to the survivors’ percentage allocations.

•If the estateoftheinsuredisaprimarybeneiciary,donotdesignatecontingentbeneiciaries.

Trustee:

For all provinces except Quebec–Ifatrusteeisappointedbelow,beneitstobepaidunderthiscontracttoanybeneiciarywho,atthetime paymentistobemade,isaminorwillbepaidinsteadtothetrustee,intrustforthebeneiciary.SuchpaymentwilldischargeCanadaLife,to theextentofthepayment.Thetrustforanybeneiciarywillterminateoncethatbeneiciaryisofageofmajority.Agesofminorityandmajority aredeterminedaccordingtothelawsofthebeneiciary’sthenapplicabledomicile.Thetrusteeisdirectedtodelivertothebeneiciary,once thebeneiciaryisoftheageofmajority,theassetsthenheldintrustforthatbeneiciary.Duringthecourseofthetrust,thetrusteemayapply trustassetsforthesupport,maintenance,education,orotherbeneitofthebeneiciary,andmayexerciseanyrightofthebeneiciaryunder the contract, in the sole discretion of the trustee. If, in any document, you have already made a trustee appointment which might apply, legal advice should be sought.

Where Quebec law applies to the contract –Beneitspayableunderthiscontracttoabeneiciarywho,atthetimepaymentistobemade, isaminor,willbepaidtohis/hertutor(s)orasotherwiseprovidedbylaw,unlessavalidtrusthasbeenestablishedforthebeneitofthe minor,byWillorbyseparatecontract,toreceivethebeneitsandCanadaLifehasbeenprovidednoticeofthetrust.Ifsuchatrusthasalready beenestablished,designatethetrustasthebeneiciaryabove(asapplicable),andprovidethenameofthetrusteebelow.If a trust is to be

designated, legal advice should be sought.

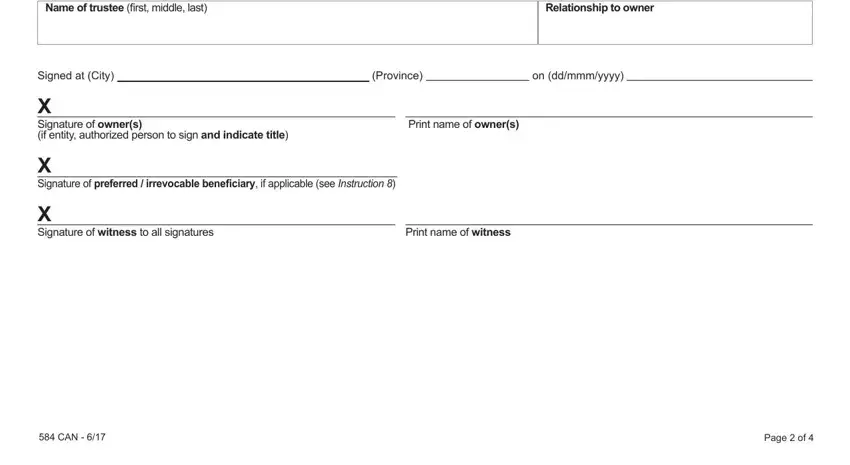

Name of trustee(irst,middle,last)

Signedat(City)(Province)on (dd/mmm/yyyy)

X

Signatureofowner(s) |

|

Print name of owner(s) |

(if entity, authorized person to sign and indicate title) |

|

|

X

Signatureofpreferred / irrevocable beneiciary, if applicable (see Instruction 8)

X

Signatureofwitness to all signatures |

|

Print name of witness |

Title change

E. Personal information / Instructions

Personal information

Insured means life / person(s) insured or annuitant(s). WE, our, and us refer to Canada Life. You and your refer to any person whose personal informationiscollectedonthisform,exceptwhere,incontext,itrefersonlytotheowner.

TheilecontainingyourpersonalinformationiskeptintheoficesofCanadaLifeorofthird-partiesweauthorize.Directlyorthroughothers,in orfromCanadaorelsewhere,wehandleyourpersonalinformation–i.e.,collect,store,use,access,anddiscloseit–to,asapplicable,provide youwithinancialproductsandservices,respondtoclaims,helpyouplanforinancialobjectives,andotherwiseaslegallyrequiredorallowed, orasyouhaveauthorized.Welimitaccesstotheinformationinyouriletoourstaffandothers,includingyouradvisorandotherservice

providers, who need it to perform their duties. This includes our reinsurers. In some cases, we may engage service providers outside of Canada toassistuswiththehandlingofyourpersonalinformation.Insuchcasesyourpersonalinformationwillbesubjecttothelaws,includingpublic authorityaccesslaws,ofothercountries.Ifyou’dliketoreviewandcorrectyourpersonalinformationinourile,orifyouhavefurtherquestions

about how we handle and protect your personal information, including with regard to service providers, and would like a copy of our privacy guidelines,pleasewritetous,totheattentionofourChiefComplianceOficer,attheappropriateaddress(seeInstruction 13 below).

Instructions

1.Wage loss replacement plans

Ifthetransferrequestrelatestoawagelossreplacementplan(sometimesreferredtoassalarycontinuationplans),completethe

Application for changes to Wage Loss Replacement Plans(formF525(CL)),insteadofthisform.

2.Using this form for more than one policy

This form may be used to make identical changes under more than one policy, but only if the insured / annuitant and the owner are the same for each policy. Otherwise, a separate form must be used for each policy.

3.Changes to form

Anychangemadetothepre-printedtextoftheformmustbeinitialedbytheowner(s)(i.e.,existingandnew,asapplicable)andbythe witness to the owner’s(s’) signature(s), but no change is binding on Canada Life unless agreed to in writing by Canada Life.

4.Ownership transfers – tax considerations on life insurance and annuities and investment policies only

TransferofownershipisadispositionforCanadianincometaxpurposes(however,ifcertainconditionsaremeta“rollover”may apply,makingthetransfera‘non-taxable’eventforCanadianincometaxpurposes;seebelow).Thecalculationoftheproceedsof thedispositionandresultingtaximplicationsdependonsuchfactorsasfairmarketvalueoftheconsiderationpaid,typeofcontract transferred,andtherelationshipbetweentheexistingandnewowners.Forarm’slengthtransfersandnon-arm’slengthtransfers,the proceedsofthedispositionwillbe:

a)the fair market value of what the new owner paid for the policy (e.g. if something other than cash were used to pay, its fair market cashvalue;ifcashitselfwerepaid,itwouldjustbethecashamount),or

b)the cash surrender value of the policy, whichever of a) and b) is the greater amount.

Theownerisresponsibleforthetaxpayable,post-transferconsiderations,andtheirunderstandingofthemeaningofcertainwords ortermsfortaxpurposesinrespectofthistransaction.Questionsregardingthistransactionshouldbediscussedwiththetaxation authoritiesoryourtaxprofessional.

Note on rollovers:SubjecttoCanadianincometaxlawandthenecessaryinformationdeclaredinthisform,thetransferwillbe processedonarolloverbasisifeither:

a)Life insurance and annuities & investment policies: thetransferistotheexistingowner’sspouseorcommon-lawpartner(within themeaningoftheIncomeTaxAct(Canada)),providedbothpersonsareresidentsofCanadaforincometaxpurposes;or,

b)Life insurance policies only: thetransferistoachildorgrandchildoftheexistingowner,whiletheownerisalive,providedachild orgrandchildoftheexistingowneristheonlylifeinsured,andthepricepaidforthetransferiszero.

Rollovers may apply in other limited cases. If the parties to a transfer believe a rollover is available but we have not applied it, they should inform us immediately.

5.Ownership transfers – identiication information

a)In all cases where ownership of a universal life insurance policy, a non-registered annuity, or an investment policy is being transferred, then in addition to completing this form also complete the Owner and third party identiication for transfer of ownership for universal life insurance and non-registered individual and retirement investment service policies(form17-8348).

• Ifthenewownerisanincorporatedornon-incorporatedentity,theninadditiontoform17-8348,alsocompletetheQuestionnaire for applicants / owners that are entities(form17-8295).

• Ifthenewownerisanincorporatedornon-incorporatedentity,otherthansoleproprietorships,alsocompletetheInternational tax classiication for an entity(form17-8945).

• Iftheadvisordidnotmeetwiththenewowner,theninadditiontoform17-8348,andifapplicableform17-8295,alsocompletethe Non-photo owner identiication (form46-10771).

b)In all cases where ownership of a participating insurance policyisbeingtransferredtoanewownerthatisanincorporatedornon- incorporated entity, other than sole proprietorships, also complete the International tax classiication for an entity(form17-8945).

Title change

E. Personal information / Instructions (continued)

6.Irrevocable / preferred beneiciary

Ifthepolicycurrentlyhasanirrevocableorapreferredbeneiciary,thebeneiciarymustsigntheformwhereindicatedtotransfer

ownership.Ontransfer,thebeneiciarywillceasetobethebeneiciary.

7.Quebec and insurable interest

WheretheCivilCodeofQuebecapplies,thenewownermusthaveaninsurableinterestinthelifeoftheinsured/annuitant,unless the insured / annuitant consents to the transfer. In the absence of insurable interest or consent, the transfer is void at law. If there is

uncertainty as to insurable interest, the insured / annuitant should sign, thereby evidencing consent to the transfer. If the insured / annuitantisaminor,thesignatureoftheparent/tutorisrequired.

8.Assignment / hypothecation as security

Upontransferofownership,thepolicycontinuestobesubjecttoanyexistingassignment/hypothecationassecurity.

9.Existing pre-authorized debit plan

Paymentswillcontinueunderanyexistingpre-authorizeddebitplan,unless the new owner or bank account holder completes the appropriate form(s).

10.Signatures

a)Corporation-thefullnameofthecorporationmustbeprintedandauthorizedpersonsaretosignandindicatetitles.

b)Sole Proprietorship -theformmustbesignedbythesoleproprietorwiththewords“SoleProprietor”followingthesignature.

c)Firm or Partnership-thefullnameoftheFirmorPartnershipmustbeprintedwiththesignatureofallthepartners.

CanadaLifereservestherighttorequirethataNotarialdeclarationbecompletedtocertifythevalidityandauthorityofanysignature.

CanadaLifeassumesnoresponsibilityforobtaininganysuchdeclarationorforanyrelatedexpenses.

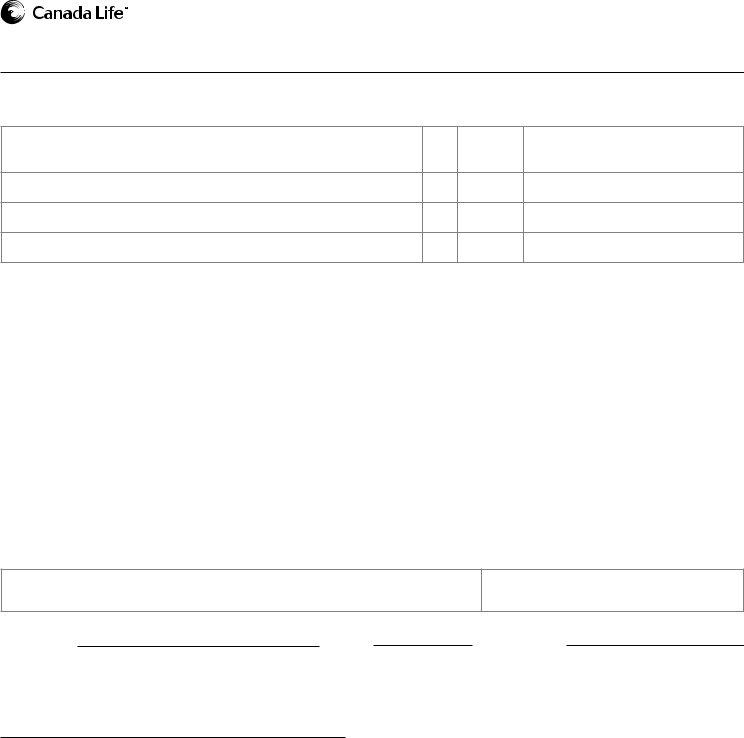

11.Mailing information – mailtotheappropriateaddressbelowbasedontypeofpolicyandregion:

For individual life insurance policies: |

For Quebec and Atlantic Canada life insurance policies: |

The Canada Life Assurance Company |

The Canada Life Assurance Company |

IndividualLifeClientService |

IndividualLifeClientService |

1901ScarthStreet |

2001Robert-BourassaBoulevard,Suite430 |

Regina,SKS4P4L4 |

Montreal,QCH3A1T9 |

For annuities and investment policies: |

For Quebec annuities and investment policies: |

The Canada Life Assurance Company |

The Canada Life Assurance Company |

IndividualRetirement&InvestmentServices |

IndividualRetirement&InvestmentServices,R5301 |

Administration,T-424 |

2001Robert-BourassaBoulevard,Suite540 |

255DufferinAvenue |

Montreal,QCH3A1T9 |

London,ONN6A4K1 |

|

For critical illness and disability insurance policies: |

|

The Canada Life Assurance Company |

|

LivingBeneitsClientService |

|

60OsborneStreetNorth,POBox6000 |

|

Winnipeg,MBR3C3A5 |

|

584 CAN - 6/17 |

Canada Life and design are trademarks of The Canada Life Assurance Company. |

Page 4 of 4 |