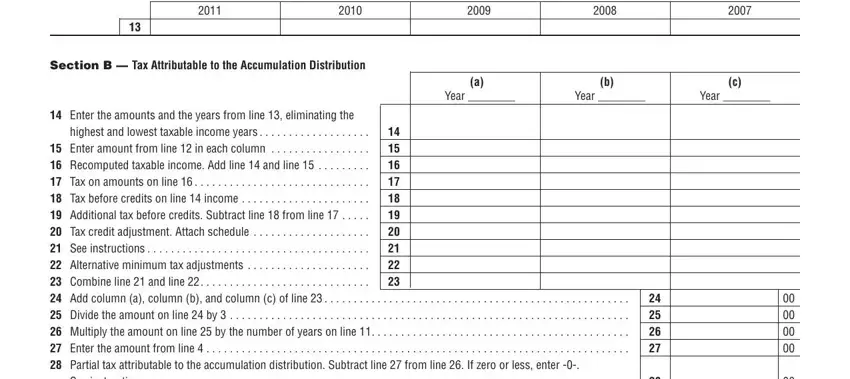

Line 20 – Include on line 20 only the net change in nonrefundable credits, such as exemption credit, etc. For example, to the extent the tax on line 18 is less than the allowable exemption credit, only the excess exemption credit is to be included on line 20.

Line 21 – If the net change results in an increase in allowable credits, subtract line 20 from line 19. If the net change results in a decrease in allowable credits, add line 20 and line 19.

Line 22 – Complete and attach a separate Schedule P (100, 100W, 540, 540NR, or 541), Alternative Minimum Tax and Credit Limitations, to recompute the alternative minimum tax (AMT) for each earlier year and show any change to those taxes in the bottom margin of the form. Enter the adjustment on line 22.

Line 28 – Individuals – Enter the amount from line 28 on Form 540, line 34 or Long Form 540NR, line 41. Check the box labeled “FTB 5870A.”

Estates and trusts – Include the amount from line 28 on Form 541, line 21b. Write “FTB 5870A” on that line.

Other filers – Add the amount on line 28 to the total tax liability before credits on your tax return for the year of the accumulation distribution. Attach form FTB 5870A to the back of your tax return.

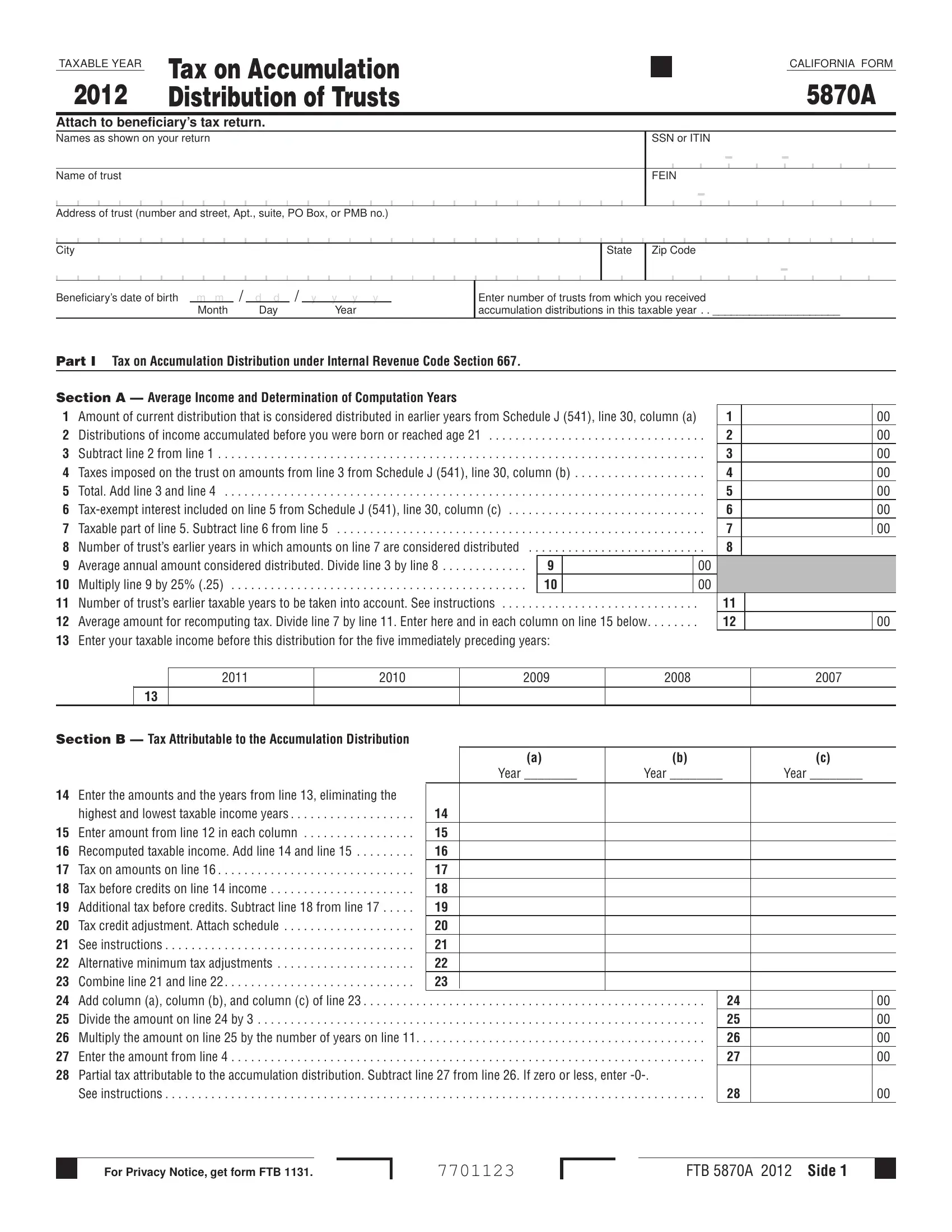

Part II

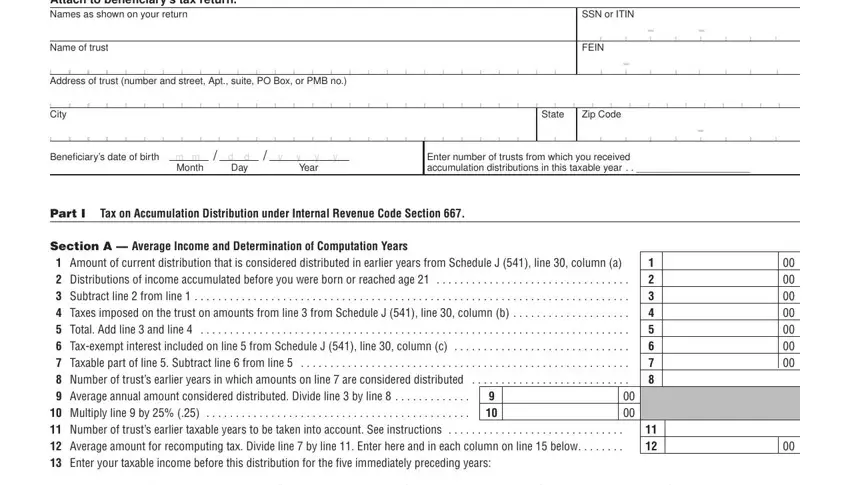

If you did not receive a Schedule J (541), you must contact the trustee to get the information you will need to complete form FTB 5870A. The trustee must provide the:

•Total number of years that the trust income was accumulated.

•Total amount of the accumulation distribution.

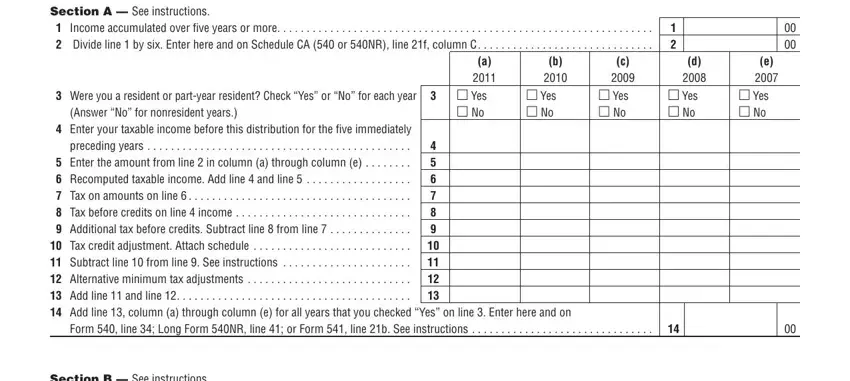

If the total number of years that the trust income was accumulated is five or more, complete Section A to determine your tax due.

If the total number of years that the trust income was accumulated is less than five years, complete Section B to determine your tax due.

Section A

Complete this section to compute your additional tax due on a trust distribution accumulated over a period of five years or more. If the accumulation period was less than five years, skip this section and complete Section B.

Line 1 – Enter the amount of your accumulation distribution.

Line 2 – Divide the amount on line 1 by the number six and enter that amount here and on Schedule CA (540 or 540NR), line 21f, column C. This is the amount to be included in the current year. The balance of this schedule will be used to compute the tax on the portion of the distribution attributable to prior years.

Line 3 – Check “Yes” in each column for the years that you were either a California resident or part-year resident. Check “No” for the years that you were a nonresident. If the taxpayer was a resident during any portion of the time the trust accumulated the income being distributed in the current year, and left the state for any period of time beginning within 12 months of the date of the current distribution and returned to the state within 12 months of the date the current distribution was made, the taxpayer is presumed to have continued to be a resident throughout the time of distribution.

Line 4 – Enter your taxable income from taxable years 2007 through 2011. Use the taxable income as originally reported, amended, or as changed by the FTB.

Line 7 – Compute the tax (not including any AMT) on the income on line 6 using the tax rates in effect for the earlier year shown in each of the five columns. Use the California tax tables included in the personal income tax booklets for prior years.

Line 8 – Enter your tax (not including any AMT) as originally reported, amended, or as changed by the FTB before reduction for any credits for the particular earlier year shown in each of the five columns.

Line 10 – Include on line 10 only the net change in nonrefundable credits, such as exemption credit, etc. For example, to the extent the tax on line 8 is less than the allowable exemption credit, only the excess exemption credit is included on line 10.

Line 11 – If the net change results in a decrease in allowable credits, add line 9 and line 10.

Line 12 – Complete and attach a separate Schedule P (100, 100W, 540, 540NR, or 541) to recompute the AMT for each earlier year and show any change in those taxes in the bottom margin of the forms. Enter the adjustments on line 12.

Line 14 – Add line 13, column (a) through column (e) for all years that you checked “Yes” on line 3. Do not include any amounts for any year that you checked “No.”

Individuals – Enter the amount from line 14 on Form 540, line 34 or Long Form 540NR, line 41. Check the box labeled “FTB 5870A.”

Estates and trusts – Enter the amount from line 14 on Form 541, line 21b. Write “FTB 5870A” on that line.

Other filers – Add the amount on line 14 to the total tax liability before credits on your tax return for the year of the accumulation distribution. Attach form FTB 5870A to the back of your tax return.

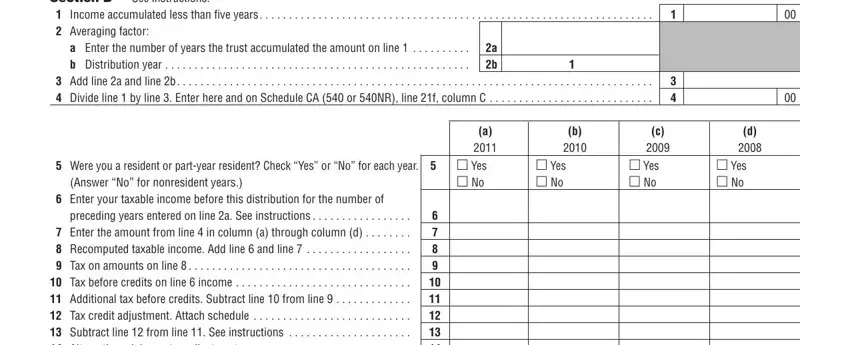

Section B

Complete this section to compute your additional tax due on a trust distribution accumulated over a period of less than five years. If the accumulation period was five years or more, do not complete this section. Complete Section A.

Complete the entries for all columns corresponding to the number of years entered on line 2a. If the number entered on line 2a is:

•1 – Complete only column (a).

•2 – Complete only column (a) and column (b).

•3 – Complete only column (a) through column (c).

•4 – Complete all columns.

Line 1 – Enter the amount of your accumulation distribution.

Line 2a – Do not enter a number more than 4. If the total accumulation years is more than 4, do not complete this section. Go to Section A.

Line 4 – Enter the amount from line 4 on Schedule CA (540 or 540NR), line 21f, column C. This is the amount to be included in the current year. The rest of this section will be used to compute the tax on the portion of the distribution attributable to prior years.

Line 5 – Check “Yes” in each column for the years that you were either a California resident or part-year resident. Check “No” for the years that you were a nonresident. If the taxpayer was a resident during any portion of the time the trust accumulated the income being distributed in the current year, and

left the state for any period of time beginning within 12 months of the date of the current distribution and returned to the state within 12 months of the date the current distribution was made, the taxpayer is presumed to have continued to be a resident throughout the time of distribution.

Line 6 – Enter your taxable income from taxable years 2008 through 2011. Use the taxable income as originally reported, amended, or as changed by the FTB.

Line 9 – Compute the tax (not including any AMT) on the income on line 8 using the tax rates in effect for the earlier year shown in each of the four columns. See Part II, Section A, line 7 instructions.

Line 10 – Enter your tax (not including any AMT) as originally reported, amended, or as changed by the FTB before reduction for any credits for the particular earlier year shown in each of the four columns.

Line 12 – Include on line 12 only the net change in nonrefundable credits such as exemption credit, etc. For example, to the extent the tax on line 10 is less than the allowable exemption credit, only the excess exemption credit is included on line 12.

Line 13 – If the net change results in a decrease in allowable credits, add line 11 and line 12.

Line 14 – Complete and attach a separate Schedule P (100, 100W, 540, 540NR, or 541) to recompute the AMT for each earlier year and show any change in those taxes in the bottom margin of the form. Enter the adjustment on line 14.

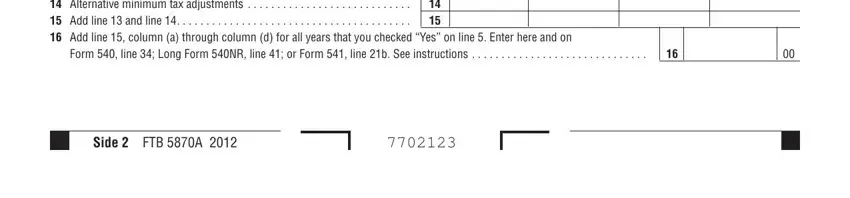

Line 16 – Add line 15, column (a) through

column (d), for all years that you checked “Yes” on line 5. Do not include any amounts for any year that you checked “No.”

Individuals – Enter the amount from line 16 on Form 540, line 34 or Long Form 540NR, line 41. Check the box labeled “FTB 5870A.”

Estates and trusts – Enter the amount from line 16 on Form 541, line 21b. Write “FTB 5870A” on that line.

Other filers – Add the amount on line 16 to the total tax liability before credits on your tax return for the year of the accumulation distribution. Attach form FTB 5870A to the back of your tax return.

Internet and Telephone Assistance

Telephone assistance is available year-round from 7 a.m. to 5 p.m. Monday through Friday, except holidays. Hours subject to change.

Website: |

ftb.ca.gov |

Telephone: |

800.852.5711 from within the |

|

United States |

|

916.845.6500 from outside the |

|

United States |

TTY/TDD: |

800.822.6268 for persons with hearing |

|

or speech impairments |

Asistencia Por Internet y Teléfono

Asistencia telefónica está disponible todo el año durante las 7 a.m. y las 5 p.m. lunes a viernes, excepto días festivos. Las horas están sujetas a cambios.

Sitio web: |

ftb.ca.gov |

Teléfono: |

800.852.5711 dentro de los |

|

Estados Unidos |

|

916.845.6500 fuera de los |

|

Estados Unidos |

TTY/TDD: |

800.822.6268 personas con |

|

discapacidades auditivas y del habla |