2011 can be filled out online with ease. Just open FormsPal PDF tool to do the job without delay. Our tool is constantly evolving to give the best user experience possible, and that is thanks to our dedication to continual development and listening closely to feedback from customers. If you are seeking to begin, here's what it takes:

Step 1: Hit the "Get Form" button in the top section of this page to access our editor.

Step 2: After you start the editor, you will see the form made ready to be filled out. In addition to filling out various fields, you can also perform several other actions with the form, that is adding any words, editing the initial text, adding graphics, putting your signature on the form, and much more.

Pay close attention while filling in this pdf. Ensure all necessary blanks are completed accurately.

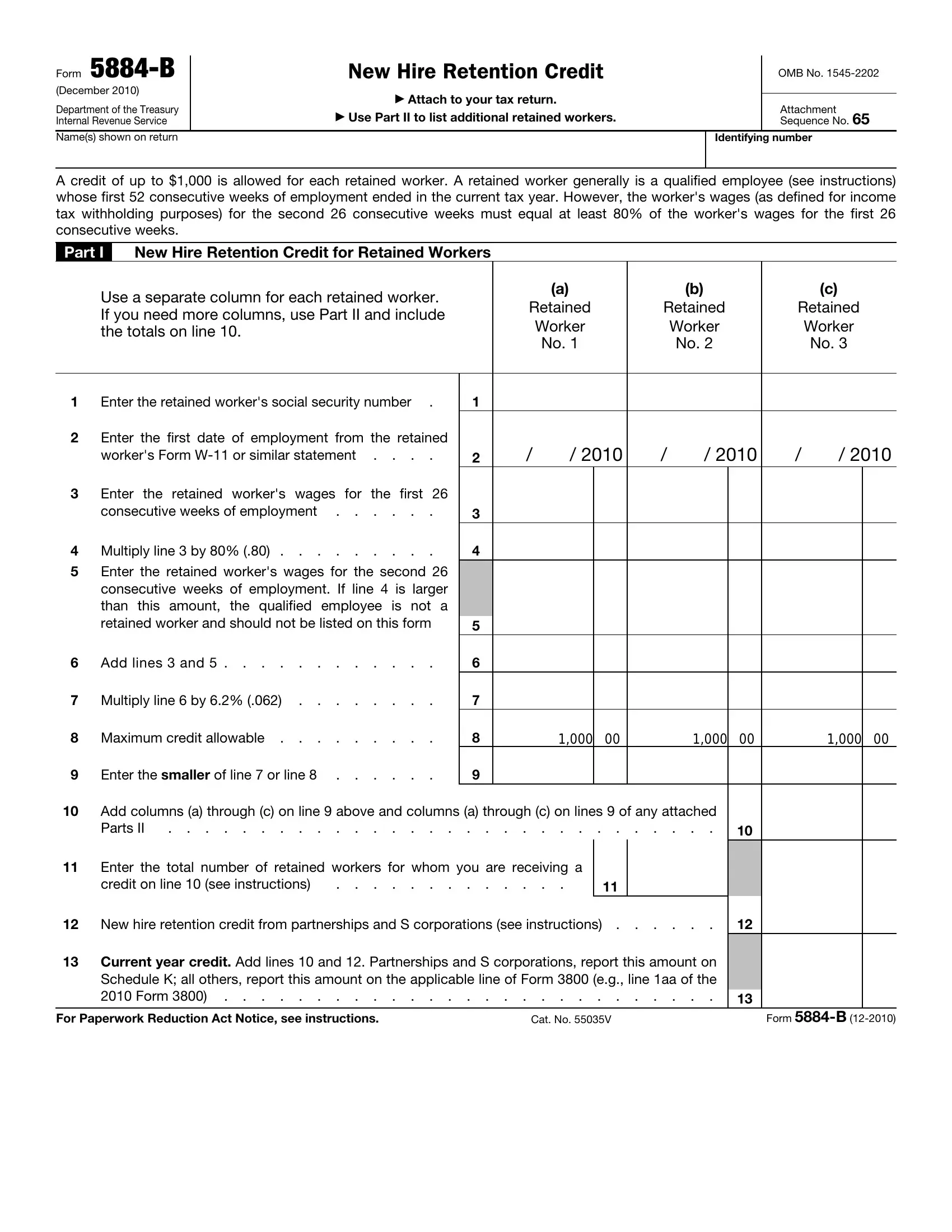

1. You need to complete the 2011 correctly, so be attentive while working with the segments comprising all of these blank fields:

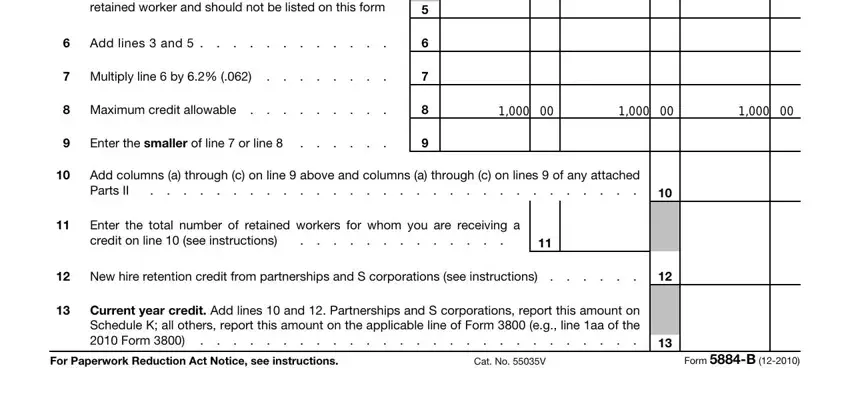

2. Once your current task is complete, take the next step – fill out all of these fields - Enter the retained workers wages, Add lines and, Multiply line by, Maximum credit allowable, Enter the smaller of line or line, Add columns a through c on line, Enter the total number of retained, New hire retention credit from, Current year credit Add lines and, For Paperwork Reduction Act Notice, Cat No V, and Form B with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

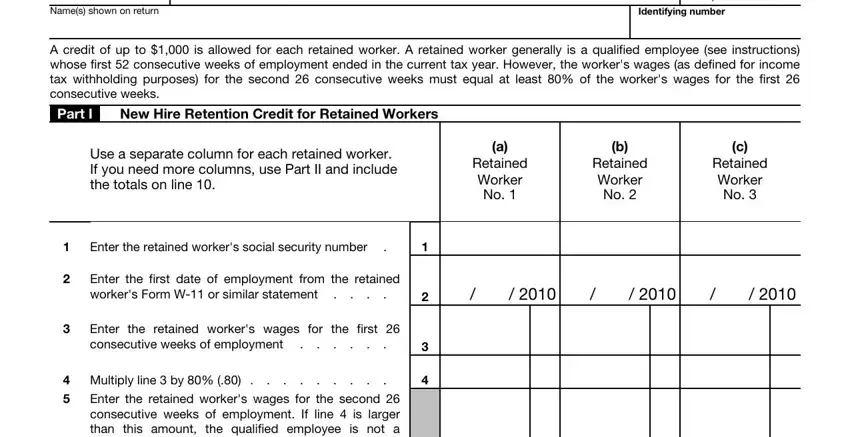

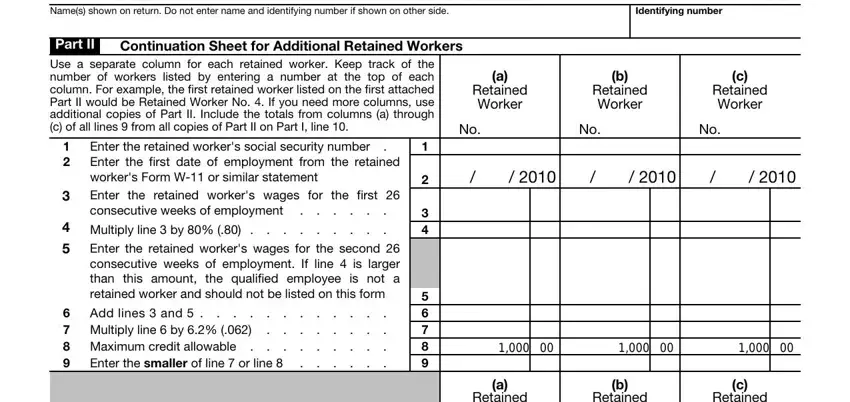

3. Through this stage, check out Form B, Attachment Sequence No, Page, Names shown on return Do not enter, Identifying number, Part II, Continuation Sheet for Additional, Use a separate column for each, Retained Worker, Retained Worker, Retained Worker, Enter the retained workers social, Multiply line by, Enter the retained workers wages, and Add lines and. These will have to be completed with greatest precision.

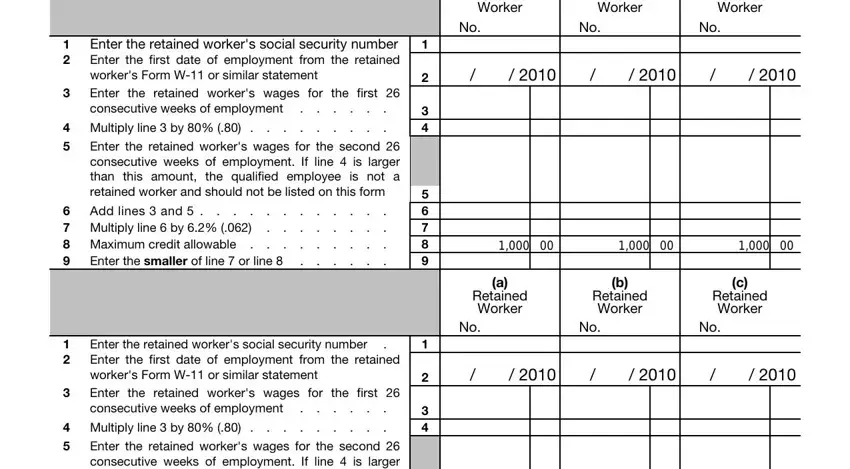

4. This fourth section arrives with all of the following blank fields to look at: Enter the retained workers social, Multiply line by, Enter the retained workers wages, Add lines and, Multiply line by Maximum, Enter the smaller of line or, Enter the retained workers social, Multiply line by, Enter the retained workers wages, Retained Worker, Retained Worker, Retained Worker, Retained Worker, Retained Worker, and Retained Worker.

In terms of Add lines and and Retained Worker, ensure that you get them right here. Those two are the most significant fields in this file.

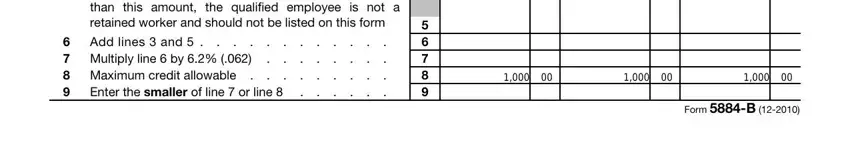

5. The pdf should be completed by filling out this segment. Further there can be found a full set of form fields that require correct information to allow your document usage to be complete: Enter the retained workers wages, Add lines and, Multiply line by Maximum, Enter the smaller of line or, and Form B.

Step 3: Prior to moving forward, make sure that form fields were filled in as intended. Once you think it's all fine, press “Done." Try a 7-day free trial option with us and get direct access to 2011 - which you may then work with as you wish in your personal account. FormsPal is invested in the privacy of our users; we make certain that all personal data processed by our editor is kept secure.