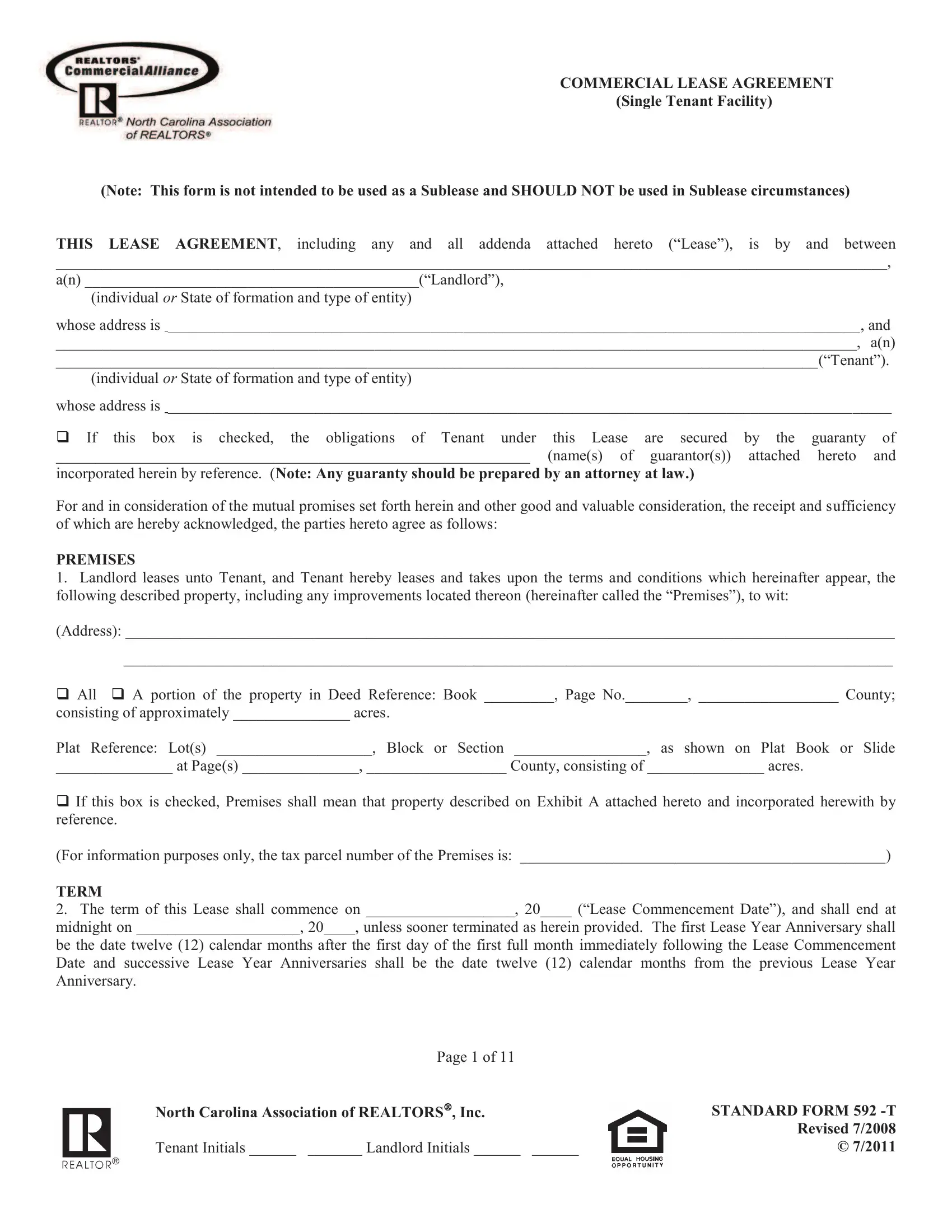

COMMERCIAL LEASE AGREEMENT

(Single Tenant Facility)

(Note: This form is not intended to be used as a Sublease and SHOULD NOT be used in Sublease circumstances)

THIS LEASE AGREEMENT, including any and all addenda attached hereto (“Lease”), is by and between

___________________________________________________________________________________________________________,

a(n) ___________________________________________(“Landlord”),

(individual or State of formation and type of entity)

whose address is _________________________________________________________________________________________, and

_______________________________________________________________________________________________________, a(n)

__________________________________________________________________________________________________(“Tenant”).

(individual or State of formation and type of entity)

whose address is _____________________________________________________________________________________________

q If this box is checked, the obligations of Tenant under this Lease are secured by the guaranty of

_____________________________________________________________ (name(s) of guarantor(s)) attached hereto and

incorporated herein by reference. (Note: Any guaranty should be prepared by an attorney at law.)

For and in consideration of the mutual promises set forth herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

PREMISES

1.Landlord leases unto Tenant, and Tenant hereby leases and takes upon the terms and conditions which hereinafter appear, the following described property, including any improvements located thereon (hereinafter called the “Premises”), to wit:

(Address): ___________________________________________________________________________________________________

___________________________________________________________________________________________________

q All q A portion of the property in Deed Reference: Book _________, Page No.________, __________________ County;

consisting of approximately _______________ acres.

Plat Reference: Lot(s) ____________________, Block or Section _________________, as shown on Plat Book or Slide

_______________ at Page(s) _______________, __________________ County, consisting of _______________ acres.

q If this box is checked, Premises shall mean that property described on Exhibit A attached hereto and incorporated herewith by reference.

(For information purposes only, the tax parcel number of the Premises is: _______________________________________________)

TERM

2.The term of this Lease shall commence on ___________________, 20____ (“Lease Commencement Date”), and shall end at midnight on _____________________, 20____, unless sooner terminated as herein provided. The first Lease Year Anniversary shall be the date twelve (12) calendar months after the first day of the first full month immediately following the Lease Commencement Date and successive Lease Year Anniversaries shall be the date twelve (12) calendar months from the previous Lease Year Anniversary.

Page 1 of 11 |

|

North Carolina Association of REALTORS®, Inc. |

STANDARD FORM 592 -T |

|

Revised 7/2008 |

Tenant Initials ______ _______ Landlord Initials ______ ______ |

© 7/2011 |

qIf this box is checked, Tenant shall have the option of renewing this Lease, upon written notice given to Landlord at least

days prior to the end of the then expiring term of this Lease, for additional term(s) of years each.

q Option to Lease- If this box is checked, Tenant, upon the payment of the sum of $______________________________________

(which sum is not rental or security deposit hereunder, but is consideration for this Option to Lease and is non-refundable under any

circumstances) shall have a period ofdays prior to the Lease Commencement Date (“Option Period”) in which to

inspect the Premises and make inquiry regarding such sign regulations, zoning regulations, utility availability, private restrictions or permits or other regulatory requirements as Tenant may deem appropriate to satisfy itself as to the use of the Premises for Tenant’s

intended purposes. Tenant shall conduct all such on-site inspections, examinations, inquiries and other review of the Premises in a good and workmanlike manner, shall repair any damage to the Premises caused by Tenant's entry and on-site inspections and shall conduct same in a manner that does not unreasonably interfere with Landlord’s or any tenant's use and enjoyment of the Premises. In that respect, Tenant shall make reasonable efforts to undertake on-site inspections outside of the hours any tenant's business is open to the public and shall give prior notice to any tenants of any entry onto any tenant's portion of the Premises for the purpose of conducting inspections. Upon Landlord’s request, Tenant shall provide to Landlord evidence of general liability insurance. Tenant shall also have a right to review and inspect all contracts or other agreements affecting or related directly to the Premises and shall be entitled to review such books and records of Landlord that relate directly to the operation and maintenance of the Premises, provided, however, that Tenant shall not disclose any information regarding the Premises (or any tenant therein) unless required by law and the same shall be regarded as confidential, to any person, except to its attorneys, accountants, lenders and other professional advisors, in which case Tenant shall obtain their agreement to maintain such confidentiality. Tenant assumes all responsibility for the acts of itself, its agents or representatives in exercising its rights under this Option to Lease and agrees to indemnify and hold Seller harmless from any damages resulting therefrom. This indemnification obligation of Tenant shall survive the termination of this Option to Lease or this Lease. Tenant shall, at Tenant’s expense, promptly repair any damage to the Premises caused by Tenant's entry and on-site inspections. IF TENANT CHOOSES NOT TO LEASE THE PREMISES, FOR ANY REASON OR NO REASON, AND

PROVIDES WRITTEN NOTICE TO LANDLORD THEREOF PRIOR TO THE EXPIRATION OF THE OPTION PERIOD, THEN THIS LEASE SHALL TERMINATE AND NEITHER PARTY SHALL HAVE ANY FURTHER OBLIGATIONS HEREUNDER AND LANDLORD SHALL RETURN TO TENANT ANY RENTAL OR SECURITY DEPOSIT PAID TO LANDLORD HEREUNDER. Tenant shall be deemed to have exercised its Option to Lease and to be bound under the terms of this Lease if (i) Tenant shall occupy the Premises prior to the expiration of the Option Period, whereupon the date of occupancy shall be deemed the Lease Commencement Date, or (ii) Tenant shall not provide written notice to Landlord of its termination of this Lease prior to the expiration of the Option Period.

RENTAL |

|

3. Beginning on |

(“Rent Commencement Date”), Tenant agrees to pay Landlord (or its |

Agent as directed by Landlord), without notice, demand, deduction or set off, an annual rental of $_______________________,

payable in equal monthly installments of $______________________________, in advance on the first day of each calendar month

during the term hereof. Upon execution of this Lease, Tenant shall pay to Landlord the first monthly installment of rent due hereunder. Rental for any period during the term hereof which is less than one month shall be the pro-rated portion of the monthly installment of rental due, based upon a 30 day month.

qIf this box is checked, the annual rental payable hereunder (and accordingly the monthly installments) shall be adjusted every

_______ Lease Year Anniversary by % over the amount then payable hereunder. In the event renewal of this Lease is

provided for in paragraph 2 hereof and effectively exercised by Tenant, the rental adjustments provided herein shall apply to the term of the Lease so renewed, or

qIf this box is checked, the annual rental payable hereunder (and accordingly the monthly installments) shall be adjusted every

_______ Lease Year Anniversary by $_________________ over the amount then payable hereunder. In the event renewal of this Lease is provided for in paragraph 2 hereof and effectively exercised by Tenant, the rental adjustments provided herein shall apply to the term of the Lease so renewed,

qIf this box is checked, Tenant shall pay all rental to Landlord’s Agent at the following address:

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Page 2 of 11 |

|

|

STANDARD FORM 592-T |

Tenant Initials ______ _______ Landlord Initials ______ ______ |

Revised 7/2008 |

|

© 7/2011 |

LATE CHARGES

4.If Landlord fails to receive full rental payment within ___________________ days after it becomes due, Tenant shall pay Landlord, as additional rental, a late charge equal to________________ percent________________(%) of the overdue amount or $____________________ whichever is greater, plus any actual bank fees incurred for dishonored payments. The parties agree that such a late charge represents a fair and reasonable estimate of the cost Landlord will incur by reason of such late payment.

SECURITY DEPOSIT

5.Upon the execution of this Lease, Tenant shall deposit with Landlord the sum of $________________________ as a security deposit which shall be held by Landlord as security for the full and faithful performance by Tenant of each and every term, covenant and condition of this Lease. The security deposit does not represent payment of and Tenant shall not presume application of same as payment of the last monthly installment of rental due under this Lease. Landlord shall have no obligation to segregate or otherwise account for the security deposit except as provided in this paragraph 5. If any of the rental or other charges or sums payable by Tenant shall be over-due and unpaid or should payments be made by Landlord on behalf of Tenant, or should Tenant fail to perform any of the terms of this Lease, then Landlord may, at its option, appropriate and apply the security deposit, or so much thereof as may be necessary, to compensate toward the payment of the rents, charges or other sums due from Tenant, or towards any loss, damage or expense sustained by Landlord resulting from such default on the part of the Tenant; and in such event Tenant upon demand shall restore the security deposit to the amount set forth above in this paragraph 5. In the event Tenant furnishes Landlord with proof that all utility bills and other bills of Tenant related to the Premises have been paid through the date of Lease termination, and performs all of Tenant’s other obligations under this Lease, the security deposit shall be returned to Tenant within sixty (60) days after the date of the expiration or sooner termination of the term of this Lease and the surrender of the Premises by Tenant in compliance with the provisions of this Lease.

qIf this box is checked, Agent shall hold the security deposit in trust and shall be entitled to the interest, if any, thereon.

UTILITY BILLS/SERVICE CONTRACTS

6.Landlord and Tenant agree that utility bills and service contracts (“Service Obligations”) for the Premises shall be paid by the party indicated below as to each Service Obligation. In each instance, the party undertaking responsibility for payment of a Service Obligation covenants that they will pay the applicable Service Obligations prior to delinquency. The responsibility to pay for a Service Obligation shall include all metering, hook-up fees or other miscellaneous charges associated with establishing, installing and maintaining such utility or contract in said party’s name. Within thirty (30) days of the Lease Commencement Date, Tenant shall provide Landlord with a copy of any requested Tenant Service Obligation information.

Service Obligation |

Landlord |

|

Tenant |

Not Applicable |

|

|

|

|

|

|

|

Sewer/Septic |

q |

|

q |

q |

|

Water |

q |

|

q |

q |

|

Electric |

q |

|

q |

q |

|

Gas |

q |

|

q |

q |

|

Telephone |

q |

|

q |

q |

|

HVAC (maintenance/service contract) |

q |

|

q |

q |

|

Elevator (including phone line) |

q |

|

q |

q |

|

Security System |

q |

|

q |

q |

|

Fiber Optic |

q |

|

q |

q |

|

Janitor/Cleaning |

q |

|

q |

q |

|

Trash/Dumpster |

q |

|

q |

q |

|

Landscaping/Maintenance |

q |

|

q |

q |

|

Sprinkler System (including phone line) |

q |

|

q |

q |

|

Pest Control |

q |

|

q |

q |

|

|

q |

|

q |

q |

|

|

|

|

|

|

|

|

q |

|

q |

q |

|

|

|

|

|

|

|

|

q |

|

q |

q |

|

|

|

|

|

|

|

|

q |

|

q |

q |

|

|

|

|

|

|

|

|

Page 3 of 11 |

|

|

|

|

|

|

|

|

STANDARD FORM 592-T |

Tenant Initials ______ _______ Landlord Initials ______ |

______ |

Revised 7/2008 |

|

|

|

|

© 7/2011 |

Landlord shall not be liable for injury to Tenant’s business or loss of income therefrom or for damage that may be sustained by the person, merchandise or personal property of Tenant, its employees, agents, invitees or contractors or any other person in or about the Premises, caused by or resulting from fire, steam, electricity, gas, water or rain, which may leak or flow from or into any part of the Premises, or from the breakage, leakage, obstruction or other defects of any utility installations, air conditioning system or other components of the Premises, except to the extent that such damage or loss is caused by Landlord’s gross negligence or willful misconduct. Landlord makes no representations or warranties with respect to the heating, ventilation and air conditioning system(s) or utility installations existing as of the date hereof or in the future. Subject to the provisions of this paragraph 6, Landlord shall not be liable in damages or otherwise for any discontinuance, failure or interruption of service to the Premises of utilities or the heating, ventilation and air conditioning system(s) and Tenant shall have no right to terminate this Lease or withhold rental because of the same.

RULES AND REGULATIONS

7.The rules and regulations, if any, attached hereto (“Rules and Regulations”) are made a part of this Lease. Tenant agrees to comply with any Rules and Regulations of Landlord in connection with the Premises which are in effect at the time of the execution of the Lease or which may be from time to time promulgated by Landlord in its reasonable discretion, provided such Rules and Regulations are in writing and are not in conflict with the terms and conditions of the Lease.

PERMITTED USES

8. The permitted use of the Premises shall be:

(“Permitted Use”). The Premises shall be used and wholly occupied by Tenant solely for the purposes of conducting the Permitted Use, and the Premises shall not be used for any other purposes unless Tenant obtains Landlord’s prior written approval of any change in use. Landlord makes no representation or warranty regarding the suitability of the Premises for or the legality (under zoning or other applicable ordinances) of the Permitted Use for the Premises, provided however, that Landlord does represent that it has no contractual obligations with other parties which will materially interfere with or prohibit the Permitted Use of Tenant at the Premises. At Tenant’s sole expense, Tenant shall procure, maintain and make available for Landlord’s inspection from time to time any governmental license(s) or permit(s) required for the proper and lawful conduct of Tenant’s business in the Premises. Tenant shall not cause or permit any waste to occur in the Premises and shall not overload the floor, or any mechanical, electrical, plumbing or utility systems serving the Premises. Tenant shall keep the Premises, and every part thereof, in a clean and wholesome condition, free from any objectionable noises, loud music, objectionable odors or nuisances.

TAXES AND INSURANCE

9.Landlord shall pay all taxes (including but not limited to, ad valorem taxes, special assessments and any other governmental charges) on the Premises and shall procure and pay for such commercial general liability, broad form fire and extended and special perils insurance with respect to the Premises as Landlord in its reasonable discretion may deem appropriate. Tenant shall reimburse Landlord for all taxes and insurance as provided herein within fifteen (15) days after receipt of notice from Landlord as to the amount due. Tenant shall be solely responsible for insuring Tenant’s personal and business property and for paying any taxes or governmental assessments levied thereon. Tenant shall reimburse Landlord for taxes and insurance during the term of this Lease, and any extension or renewal thereof; as follows:

Taxes

qThe amount by which all taxes (including but not limited to, ad valorem taxes, special assessments and any other governmental charges) on the Premises for each tax year exceed all taxes on the Premises for the tax year __________; or

qAll taxes (including but not limited to, ad valorem taxes, special assessments and any other governmental charges) on the Premises for each tax year.

If the final Lease Year of the term fails to coincide with the tax year, then any excess for the tax year during which the term ends shall be reduced by the pro rata part of such tax year beyond the Lease term. If such taxes for the year in which the Lease terminates are not ascertainable before payment of the last month’s rental, then the amount of such taxes assessed against the Premises for the previous tax year shall be used as a basis for determining the pro rata share, if any, to be paid by Tenant for that portion of the last Lease Year.

qIf this box is checked, Tenant shall reimburse Landlord for taxes by paying to Landlord, beginning on the Rent Commencement Date and on the first day of each calendar month during the term hereof, an amount equal to one- twelfth (1/12) of the then current tax payments for the Premises. Upon receipt of bills, statements or other evidence

Page 4 of 11 |

|

|

STANDARD FORM 592-T |

Tenant Initials ______ _______ Landlord Initials ______ ______ |

Revised 7/2008 |

|

© 7/2011 |

of taxes due, Landlord shall pay or cause to be paid the taxes. If at any time the reimbursement payments by Tenant hereunder do not equal the amount of taxes paid by Landlord, Tenant shall upon demand pay to Landlord an amount equal to the deficiency or Landlord shall refund to Tenant any overpayment (as applicable) as documented by Landlord. Landlord shall have no obligation to segregate or otherwise account for the tax reimbursements paid hereunder except as provided in this paragraph 9.

Insurance

qthe excess cost of commercial general liability, broad form fire and extended and special perils insurance with respect to the Premises over the cost of the first year of the Lease term for each subsequent year during the term of this Lease; or

qthe cost of all commercial general liability, broad form fire and extended and special perils insurance with respect to the Premises.

Provided, however, that in the event Tenant’s use of the Premises results in an increase in the rate of insurance on the Premises, Tenant also shall pay to Landlord, upon demand and as additional rental, the amount of any such increase.

qIf this box is checked, Tenant shall reimburse Landlord for insurance by paying to Landlord, beginning on the Rent Commencement Date and on the first day of each calendar month during the term hereof, an amount equal to one- twelfth (1/12) of the then current insurance premiums for the Premises. Upon receipt of bills, statements or other evidence of insurance premiums due, Landlord shall pay or cause to be paid the insurance premiums. If at any time the reimbursement payments by Tenant hereunder do not equal the amount of insurance premiums paid by Landlord, Tenant shall upon demand pay to Landlord an amount equal to the deficiency or Landlord shall refund to Tenant any overpayment (as applicable) as documented by Landlord. Landlord shall have no obligation to segregate or otherwise account for the insurance premium reimbursements paid hereunder except as provided in this paragraph 9.

(Note: The following box should only be checked if there are no boxes checked above in this paragraph 9.)

q If this box is checked, Tenant shall have no responsibility to reimburse Landlord for taxes or insurance.

INSURANCE; WAIVER; INDEMNITY

10.(a) During the term of this Lease, Tenant shall maintain commercial general liability insurance coverage (occurrence coverage) with broad form contractual liability coverage and with coverage limits of not less than

combined single limit, per occurrence, specifically including liquor liability insurance covering consumption of alcoholic beverages by customers of Tenant should Tenant choose to sell alcoholic beverages. Such policy shall insure Tenant’s performance of the indemnity provisions of this Lease, but the amount of such insurance shall not limit Tenant’s liability nor relieve Tenant of any obligation hereunder. All policies of insurance provided for herein shall name as “additional insureds” Landlord, Landlord’s Agent, all mortgagees of Landlord and such other individuals or entities as Landlord may from time to time designate upon written notice to Tenant. Tenant shall provide to Landlord, at least thirty (30) days prior to expiration, certificates of insurance to evidence any renewal or additional insurance procured by Tenant. Tenant shall provide evidence of all insurance required under this Lease to Landlord prior to the Lease Commencement Date.

(b)Landlord (for itself and its insurer) waives any rights, including rights of subrogation, and Tenant (for itself and its insurer) waives any rights, including rights of subrogation, each may have against the other for compensation of any loss or damage occasioned to Landlord or Tenant arising from any risk generally covered by the “all risks” insurance required to be carried by Landlord and Tenant. The foregoing waivers of subrogation shall be operative only so long as available in the State of North Carolina. The foregoing waivers shall be effective whether or not the parties maintain the insurance required to be carried pursuant to this Lease.

(c)Except as otherwise provided in paragraph 10(b), Tenant indemnifies Landlord for damages proximately caused by the negligence or wrongful conduct of Tenant and Tenant’s employees, agents, invitees or contractors. Except as otherwise provided in paragraph 10(b), Landlord indemnifies Tenant for damages proximately caused by the negligence or wrongful conduct of Landlord and Landlord’s employees, agents, invitees or contractors. The indemnity provisions in this paragraph 10 cover personal injury and property damage and shall bind the employees, agents, invitees or contractors of Landlord and Tenant (as the case may be). The indemnity obligations in this paragraph 10 shall survive the expiration or earlier termination of this Lease.

Page 5 of 11 |

|

|

STANDARD FORM 592-T |

Tenant Initials ______ _______ Landlord Initials ______ ______ |

Revised 7/2008 |

|

© 7/2011 |

REPAIRS BY LANDLORD

11.Landlord agrees to keep in good repair the roof, foundation, structural supports and exterior walls of the Premises (exclusive of all glass and exclusive of all exterior doors), except repairs rendered necessary by the negligence or intentional wrongful acts of Tenant, its employees, agents, invitees or contractors. Tenant shall promptly report in writing to Landlord any defective condition known to it which Landlord is required to repair and failure to report such conditions shall make Tenant responsible to Landlord for any liability incurred by Landlord by reason of such conditions.

REPAIRS BY TENANT

12.Tenant accepts the Premises in their present condition and as suited for the Permitted Use and Tenant’s intended purposes. Tenant, throughout the initial term of this Lease, and any extension or renewal thereof, at its expense, shall maintain in good order and repair the Premises, including any building and other improvements located thereon, except those repairs expressly required to be made by Landlord hereunder. Tenant further agrees to care for the grounds around the building, including the mowing of grass, care of shrubs and general landscaping.

(a)Tenant, at its expense, also shall maintain in good order and repair the heating, ventilation and air conditioning equipment, including but not limited to replacement of parts, compressors, air handling units and heating units; provided that, as to

|

|

|

|

|

|

|

|

|

repair or replacement expenses for heating, ventilation and air conditioning equipment in excess of $ |

|

|

(per |

occurrence) or $ |

|

(annually), Landlord |

shall reimburse Tenant for the amount in excess of the |

stated amount, |

provided that Tenant has obtained Landlord’s prior written approval of the contractor and the repair or replacement. |

|

|

(b) Tenant shall use only licensed contractors for repairs where such license is required. Landlord shall have the right to |

approve the contractor as to any repairs in excess of $ |

|

|

. |

|

|

|

Tenant agrees to return the Premises to Landlord at the expiration or prior termination of this Lease, in as good condition and repair as on the Lease Commencement Date, natural wear and tear, damage by storm, fire, lightning, earthquake or other casualty alone excepted. Tenant, Tenant’s employees, agents, invitees or contractors shall take no action which may void any manufacturers or installers warranty with relation to the Premises. Tenant shall indemnify and hold Landlord harmless from any liability, claim, demand or cause of action arising on account of Tenant’s breach of the provisions of this paragraph 12.

ALTERATIONS

13.Tenant shall not make any alterations, additions, or improvements to the Premises without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Tenant shall promptly remove any alterations, additions, or improvements constructed in violation of this paragraph 13 upon Landlord’s written request. All approved alterations, additions, and improvements will be accomplished in a good and workmanlike manner, in conformity with all applicable laws and regulations, and by a contractor approved by Landlord, free of any liens or encumbrances. Landlord may require Tenant to remove any alterations, additions or improvements (whether or not made with Landlord’s consent) at the termination of the Lease and to restore the Premises to its prior condition, all at Tenant’s expense. All alterations, additions and improvements which Landlord has not required Tenant to remove shall become Landlord’s property and shall be surrendered to Landlord upon the termination of this Lease, except that Tenant may remove any of Tenant’s machinery, equipment or trade fixtures which can be removed without material damage to the Premises.

Tenant shall repair, at Tenant’s expense, any damage to the Premises caused by the removal of any such machinery, equipment or trade fixtures.

DESTRUCTION OF OR DAMAGE TO PREMISES

14.(a) If the Premises are totally destroyed by storm, fire, lightning, earthquake or other casualty, Landlord shall have the right to terminate this Lease on written notice to Tenant within thirty (30) days after such destruction and this Lease shall terminate as of the date of such destruction and rental shall be accounted for as between Landlord and Tenant as of that date.

(b)If the Premises are damaged but not wholly destroyed by any such casualties or if the Landlord does not elect to terminate the Lease under paragraph 14(a) above, Landlord shall commence (or shall cause to be commenced) reconstruction of the Premises within one hundred twenty (120) days after such occurrence and prosecute the same diligently to completion, not to exceed two hundred seventy (270) days from the date upon which Landlord receives applicable permits and insurance proceeds. In the event Landlord shall fail to substantially complete reconstruction of the Premises within said two hundred seventy (270) day period,

Tenant’s sole remedy shall be to terminate this Lease.

Page 6 of 11 |

|

|

STANDARD FORM 592-T |

Tenant Initials ______ _______ Landlord Initials ______ ______ |

Revised 7/2008 |

|

© 7/2011 |

(c)In the event of any casualty at the Premises during the last one (1) year of the Lease Term, Landlord and Tenant each shall have the option to terminate this Lease on written notice to the other of exercise thereof within sixty (60) days after such occurrence.

(d)In the event of reconstruction of the Premises, Tenant shall continue the operation of its business in the Premises during any such period to the extent reasonably practicable from the standpoint of prudent business management, and the obligation of Tenant to pay annual rental and any other sums due under this Lease shall remain in full force and effect during the period of reconstruction. The annual rental and other sums due under this Lease shall be abated proportionately with the degree to which

Tenant’s use of the Premises is impaired, commencing from the date of destruction and continuing during the period of such reconstruction. Tenant shall not be entitled to any compensation or damages from Landlord for loss of use of the whole or any part of the Premises, Tenant’s personal property, or any inconvenience or annoyance occasioned by such damage, reconstruction or replacement.

(e)In the event of the termination of this Lease under any of the provisions of this paragraph 14, both Landlord and Tenant shall be released from any liability or obligation under this Lease arising after the date of termination, except as otherwise provided for in this Lease.

GOVERNMENTAL ORDERS

15.Tenant, at its own expense, agrees to comply with: (a) any law, statute, ordinance, regulation, rule, requirement, order, court decision or procedural requirement of any governmental or quasi-governmental authority having jurisdiction over the Premises, (b) the rules and regulations of any applicable governmental insurance authority or any similar body, relative to the Premises and Tenant’s activities therein; (c) provisions of or rules enacted pursuant to any private use restrictions, as the same may be amended from time to time and (d) the Americans with Disabilities Act (42 U.S.C.S. §12101, et seq.) and the regulations and accessibility guidelines enacted pursuant thereto, as the same may be amended from time to time. Landlord and Tenant agree, however, that if in order to comply with such requirements the cost to Tenant shall exceed a sum equal to one (1) year’s rent, then Tenant may terminate this Lease by giving written notice of termination to Landlord in accordance with the terms of this Lease, which termination shall become effective sixty (60) days after receipt of such notice and which notice shall eliminate the necessity of compliance with such requirements, unless, within thirty (30) days of receiving such notice, Landlord agrees in writing to be responsible for such compliance, at its own expense, and commences compliance activity, in which case Tenant’s notice given hereunder shall not terminate this Lease.

CONDEMNATION

16.(a) If the entire Premises shall be appropriated or taken under the power of eminent domain by any governmental or quasi- governmental authority or under threat of and in lieu of condemnation (hereinafter, “taken” or “taking”), this Lease shall terminate as of the date of such taking, and Landlord and Tenant shall have no further liability or obligation arising under this Lease after such date, except as otherwise provided for in this Lease.

(b)If more than twenty-five percent (25%) of the floor area of any building of the Premises is taken, or if by reason of any taking, regardless of the amount so taken, the remainder of the Premises is not one undivided space or is rendered unusable for the Permitted Use, either Landlord or Tenant shall have the right to terminate this Lease as of the date Tenant is required to vacate the portion of the Premises taken, upon giving notice of such election within thirty (30) days after receipt by Tenant from Landlord of written notice that said Premises have been or will be so taken. In the event of such termination, both Landlord and Tenant shall be released from any liability or obligation under this Lease arising after the date of termination, except as otherwise provided for in this Lease.

(c)Landlord and Tenant, immediately after learning of any taking, shall give notice thereof to each other.

(d)If this Lease is not terminated on account of a taking as provided herein above, then Tenant shall continue to occupy that portion of the Premises not taken and the parties shall proceed as follows: (i) at Landlord’s cost and expense and as soon as reasonably possible, Landlord shall restore (or shall cause to be restored) the Premises remaining to a complete unit of like quality and character as existed prior to such appropriation or taking, and (ii) the annual rent provided for in paragraph 3 and other sums due under the Lease shall be reduced on an equitable basis, taking into account the relative values of the portion taken as compared to the portion remaining. Tenant waives any statutory rights of termination that may arise because of any partial taking of the Premises.

(e)Landlord shall be entitled to the entire condemnation award for any taking of the Premises or any part thereof. Tenant’s right to receive any amounts separately awarded to Tenant directly from the condemning authority for the taking of its merchandise, personal property, relocation expenses and/or interests in other than the real property taken shall not be affected in any manner by the

Page 7 of 11 |

|

|

STANDARD FORM 592-T |

Tenant Initials ______ _______ Landlord Initials ______ ______ |

Revised 7/2008 |

|

© 7/2011 |

provisions of this paragraph 16, provided Tenant’s award does not reduce or affect Landlord’s award and provided further, Tenant shall have no claim for the loss of its leasehold estate.

ASSIGNMENT AND SUBLETTING

17.Tenant shall not assign this Lease or any interest hereunder or sublet the Premises or any part thereof, or permit the use of the Premises by any party other than the Tenant, without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Consent to any assignment or sublease shall not impair this provision and all later assignments or subleases shall be made likewise only on the prior written consent of Landlord. No sublease or assignment by Tenant shall relieve Tenant of any liability hereunder.

EVENTS OF DEFAULT

18.The happening of any one or more of the following events (hereinafter any one of which may be referred to as an “Event of Default”) during the term of this Lease, or any renewal or extension thereof, shall constitute a breach of this Lease on the part of the Tenant: (a) Tenant fails to pay when due the rental as provided for herein; (b) Tenant abandons or vacates the Premises; (c) Tenant fails to comply with or abide by and perform any non-monetary obligation imposed upon Tenant under this Lease within thirty (30) days after written notice of such breach; (d) Tenant is adjudicated bankrupt; (e) A permanent receiver is appointed for Tenant’s property and such receiver is not removed within sixty (60) days after written notice from Landlord to Tenant to obtain such removal;

(f) Tenant, either voluntarily or involuntarily, takes advantage of any debt or relief proceedings under any present or future law, whereby the rent or any part thereof is, or is proposed to be, reduced or payment thereof deferred and such proceeding is not dismissed within sixty (60) days of the filing thereof; (g) Tenant makes an assignment for benefit of creditors; or (h) Tenant’s effects are levied upon or attached under process against Tenant, which is not satisfied or dissolved within thirty (30) days after written notice from Landlord to Tenant to obtain satisfaction thereof.

REMEDIES UPON DEFAULT

19.Upon the occurrence of Event of Default, Landlord may pursue any one or more of the following remedies separately or concurrently, without prejudice to any other remedy herein provided or provided by law: (a) Landlord may terminate this Lease by giving written notice to Tenant and upon such termination shall be entitled to recover from Tenant damages as may be permitted under applicable law; or (b) Landlord may terminate this Lease by giving written notice to Tenant and, upon such termination, shall be entitled to recover from the Tenant damages in an amount equal to all rental which is due and all rental which would otherwise have become due throughout the remaining term of this Lease, or any renewal or extension thereof (as if this Lease had not been terminated); or (c) Landlord, as Tenant’s agent, without terminating this Lease, may enter upon and rent the Premises, in whole or in part, at the best price obtainable by reasonable effort, without advertisement and by private negotiations and for any term Landlord deems proper, with Tenant being liable to Landlord for the deficiency, if any, between Tenant’s rent hereunder and the price obtained by Landlord on reletting, provided however, that Landlord shall not be considered to be under any duty by reason of this provision to take any action to mitigate damages by reason of Tenant’s default and expressly shall have no duty to mitigate Tenant’s damages. No termination of this Lease prior to the normal ending thereof, by lapse of time or otherwise, shall affect Landlord’s right to collect rent for the period prior to termination thereof.

EXTERIOR SIGNS

20.Tenant shall place no signs upon the outside walls, doors or roof of the Premises, except with the express written consent of the Landlord in Landlord’s sole discretion. Any consent given by Landlord shall expressly not be a representation of or warranty of any legal entitlement to signage at the Premises. Any and all signs placed on the Premises by Tenant shall be maintained in compliance with governmental rules and regulations governing such signs and Tenant shall be responsible to Landlord for any damage caused by installation, use or maintenance of said signs, and all damage incident to removal thereof.

LANDLORD’S ENTRY OF PREMISES

21.Landlord may advertise the Premises “For Rent” or “For Sale” _______________ days before the termination of this Lease.

Landlord may enter the Premises upon prior notice at reasonable hours to exhibit same to prospective purchasers or tenants, to make repairs required of Landlord under the terms hereof, for reasonable business purposes and otherwise as may be agreed by Landlord and Tenant. Landlord may enter the Premises at any time without prior notice, in the event of an emergency or to make emergency repairs to the Premises. Upon request of Landlord, Tenant shall provide Landlord with a functioning key to the Premises and shall replace such key if the locks to the Premises are changed.

QUIET ENJOYMENT

22.So long as Tenant observes and performs the covenants and agreements contained herein, it shall at all times during the Lease term peacefully and quietly have and enjoy possession of the Premises, subject to the terms hereof.

Page 8 of 11 |

|

|

STANDARD FORM 592-T |

Tenant Initials ______ _______ Landlord Initials ______ ______ |

Revised 7/2008 |

|

© 7/2011 |

HOLDING OVER

23.If Tenant remains in possession of the Premises after expiration of the term hereof, Tenant shall be a tenant at sufferance and there shall be no renewal of this Lease by operation of law. In such event, commencing on the date following the date of expiration of the term, the monthly rental payable under Paragraph 3 above shall for each month, or fraction thereof during which Tenant so remains in possession of the Premises, be twice the monthly rental otherwise payable under Paragraph 3 above.

ENVIRONMENTAL LAWS

24.(a) Tenant covenants that with respect to any Hazardous Materials (as defined below) it will comply with any and all federal, state or local laws, ordinances, rules, decrees, orders, regulations or court decisions relating to hazardous substances, hazardous materials, hazardous waste, toxic substances, environmental conditions on, under or about the Premises or soil and ground water conditions, including, but not limited to, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, the Resource Conservation and Recovery Act, the Hazardous Materials Transportation Act, any other legal requirement concerning hazardous or toxic substances, and any amendments to the foregoing (collectively, all such matters being “Hazardous Materials Requirements”). Tenant shall remove all Hazardous Materials from the Premises, either after their use by Tenant or upon the expiration or earlier termination of this Lease, in compliance with all Hazardous Materials Requirements.

(b)Tenant shall be responsible for obtaining all necessary permits in connection with its use, storage and disposal of Hazardous Materials, and shall develop and maintain, and where necessary file with the appropriate authorities, all reports, receipts, manifest, filings, lists and invoices covering those Hazardous Materials and Tenant shall provide Landlord with copies of all such items upon request. Tenant shall provide within five (5) days after receipt thereof, copies of all notices, orders, claims or other correspondence from any federal, state or local government or agency alleging any violation of any Hazardous Materials Requirements by Tenant, or related in any manner to Hazardous Materials. In addition, Tenant shall provide Landlord with copies of all responses to such correspondence at the time of the response.

(c)Tenant hereby indemnifies and holds harmless Landlord, its successors and assigns from and against any and all losses, liabilities, damages, injuries, penalties, fines, costs, expenses and claims of any and every kind whatsoever (including attorney’s fees and costs) paid, incurred or suffered by, or asserted against Landlord as a result of any claim, demand or judicial or administrative action by any person or entity (including governmental or private entities) for, with respect to, or as a direct or indirect result of, the presence on or under or the escape, seepage, leakage, spillage, discharge, emission or release from the Premises of any Hazardous Materials caused by Tenant or Tenant’s employees, agents, invitees or contractors. This indemnity shall also apply to any release of Hazardous Materials caused by a fire or other casualty to the premises if such Hazardous Materials were stored on the Premises by Tenant, its agents, employees, invitees or successors in interest.

(d)For purposes of this Lease, “Hazardous Materials” means any chemical, compound, material, substance or other matter that: (i) is defined as a hazardous substance, hazardous material or waste, or toxic substance pursuant to any Hazardous Materials Requirements, (ii) is regulated, controlled or governed by any Hazardous Materials Requirements, (iii) is petroleum or a petroleum product, or (iv) is asbestos, formaldehyde, a radioactive material, drug, bacteria, virus, or other injurious or potentially injurious material (by itself or in combination with other materials).

(e)The warranties and indemnities contained in this paragraph 24 shall survive the termination of this Lease.

SUBORDINATION; ATTORNMENT; ESTOPPEL

25.(a) This Lease and all of Tenant’s rights hereunder are and shall be subject and subordinate to all currently existing and future mortgages affecting the Premises. Within ten (10) days after the receipt of a written request from Landlord or any Landlord mortgagee, Tenant shall confirm such subordination by executing and delivering Landlord and Landlord’s mortgagee a recordable subordination agreement and such other documents as may be reasonably requested, in form and content satisfactory to Landlord and

Landlord’s mortgagee. Provided, however, as a condition to Tenant’s obligation to execute and deliver any such subordination agreement, the applicable mortgagee must agree that mortgagee shall not unilaterally, materially alter this Lease and this Lease shall not be divested by foreclosure or other default proceedings thereunder so long as Tenant shall not be in default under the terms of this Lease beyond any applicable cure period set forth herein. Tenant acknowledges that any Landlord mortgagee has the right to subordinate at any time its interest in this Lease and the leasehold estate to that of Tenant, without Tenant’s consent.

(b)If Landlord sells, transfers, or conveys its interest in the Premises or this Lease, or if the same is foreclosed judicially or nonjudicially, or otherwise acquired, by a Landlord mortgagee, upon the request of Landlord or Landlord’s successor, Tenant shall attorn to said successor, provided said successor accepts the Premises subject to this Lease. Tenant shall, upon the request of Landlord

Page 9 of 11 |

|

|

STANDARD FORM 592-T |

Tenant Initials ______ _______ Landlord Initials ______ ______ |

Revised 7/2008 |

|

© 7/2011 |

or Landlord’s successor, execute an attornment agreement confirming the same, in form and substance acceptable to Landlord or Landlord’s successor and Landlord shall thereupon be released and discharged from all its covenants and obligations under this Lease, except those obligations that have accrued prior to such sale, transfer or conveyance; and Tenant agrees to look solely to the successor in interest of Landlord for the performance of those covenants accruing after such sale, transfer or conveyance. Such agreement shall provide, among other things, that said successor shall not be bound by (a) any prepayment of more than one (1) month’s rental (except the Security Deposit) or (b) any material amendment of this Lease made after the later of the Lease Commencement Date or the date that such successor’s lien or interest first arose, unless said successor shall have consented to such amendment.

(c)Within ten (10) days after request from Landlord, Tenant shall execute and deliver to Landlord an estoppel certificate (to be prepared by Landlord and delivered to Tenant) with appropriate facts then in existence concerning the status of this Lease and

Tenant’s occupancy, and with any exceptions thereto noted in writing by Tenant. Tenant’s failure to execute and deliver the Estoppel Certificate within said ten (10) day period shall be deemed to make conclusive and binding upon Tenant in favor of Landlord and any potential mortgagee or transferee the statements contained in such estoppel certificate without exception.

ABANDONMENT

26.Tenant shall not abandon the Premises at any time during the Lease term. If Tenant shall abandon the Premises or be dispossessed by process of law, any personal property belonging to Tenant and left on the Premises, at the option of Landlord, shall be deemed abandoned, and available to Landlord to use or sell to offset any rent due or any expenses incurred by removing same and restoring the Premises.

NOTICES

27.All notices required or permitted under this Lease shall be in writing and shall be personally delivered or sent by U.S. certified mail, return receipt requested, postage prepaid. Notices to Tenant shall be delivered or sent to the address shown at the beginning of this Lease, except that upon Tenant taking possession of the Premises, then the Premises shall be Tenant’s address for such purposes. Notices to Landlord shall be delivered or sent to the address shown at the beginning of this Lease and notices to Agent, if any, shall be delivered or sent to the address set forth in Paragraph 3 hereof. All notices shall be effective upon delivery. Any party may change its notice address upon written notice to the other parties, given as provided herein.

GENERAL TERMS

28.(a) “Landlord” as used in this Lease shall include the undersigned, its heirs, representatives, assigns and successors in title to the Premises. “Agent” as used in this Lease shall mean the party designated as same in Paragraph 3, its heirs, representatives, assigns and successors. “Tenant” shall include the undersigned and its heirs, representatives, assigns and successors, and if this Lease shall be validly assigned or sublet, shall include also Tenant’s assignees or sublessees as to the Premises covered by such assignment or sublease. “Landlord”, “Tenant”, and “Agent” include male and female, singular and plural, corporation, partnership or individual, as may fit the particular parties.

(b)No failure of Landlord to exercise any power given Landlord hereunder or to insist upon strict compliance by Tenant of its obligations hereunder and no custom or practice of the parties at variance with the terms hereof shall constitute a waiver of

Landlord’s right to demand exact compliance with the terms hereof. All rights, powers and privileges conferred hereunder upon parties hereto shall be cumulative and not restrictive of those given by law.

(c)Time is of the essence in this Lease.

(d)This Lease constitutes the sole and entire agreement among the parties hereto and no modification of this Lease shall be binding unless in writing and signed by all parties hereto.

(e)Each signatory to this Lease represents and warrants that he or she has full authority to sign this Lease and such instruments as may be necessary to effectuate any transaction contemplated by this Lease on behalf of the party for whom he or she signs and that his or her signature binds such party.

(f)Upon request by either Landlord or Tenant, the parties hereto shall execute a short form lease (memorandum of lease) in recordable form, setting forth such provisions hereof (other than the amount of annual rental and other sums due) as either party may wish to incorporate. The cost of recording such memorandum of lease shall be borne by the party requesting execution of same.

Page 10 of 11 |

|

|

STANDARD FORM 592-T |

Tenant Initials ______ _______ Landlord Initials ______ ______ |

Revised 7/2008 |

|

© 7/2011 |

SPECIAL STIPULATIONS

qIf this box is checked, additional terms of this Lease are set forth on Exhibit B attached hereto and incorporated herein by reference. (Note: Under North Carolina law, real estate agents are not permitted to draft lease provisions.)

THIS DOCUMENT IS A LEGAL DOCUMENT. EXECUTION OF THIS DOCUMENT HAS LEGAL CONSEQUENCES THAT COULD BE ENFORCEABLE IN A COURT OF LAW. THE NORTH CAROLINA ASSOCIATION OF REALTORS® MAKES NO REPRESENTATIONS CONCERNING THE LEGAL SUFFICIENCY, LEGAL EFFECT OR TAX CONSEQUENCES OF THIS DOCUMENT OR THE TRANSACTION TO WHICH IT RELATES AND RECOMMENDS THAT YOU CONSULT YOUR ATTORNEY.

IN WITNESS WHEREOF, the parties hereto have hereunto caused this Lease to be duly executed.

LANDLORD: |

|

Individual |

Business Entity |

_________________________________________(SEAL) |

_________________________________________________ |

|

|

(Name of Firm) |

_________________________________________(SEAL) |

By:_________________________________________(SEAL) |

|

|

Title:______________________________________________ |

Date: |

|

|

TENANT: |

|

Individual |

Business Entity |

_________________________________________(SEAL) |

__________________________________________________ |

|

|

(Name of Firm) |

_________________________________________(SEAL) |

By:_________________________________________(SEAL) |

|

|

Title:______________________________________________ |

Date: |

|

|

Page 11 of 11

STANDARD FORM 592 -T Revised 7/2008 © 7/2011