The 601 Sales Tax form serves as a vital document for professionals seeking enrollment as sales tax practitioners under the Gujarat Value Added Tax Act, 2003. Aimed at individuals desiring to represent clients before tax authorities, this application necessitates a detailed account of qualifications and experiences. Applicants must demonstrate their competency through specified accountancy and educational prerequisites recognized by authoritative bodies like the Central Board of Revenue. Furthermore, a comprehensive disclosure of any government service history, including positions held and the reasons for departure, is required to ensure transparency and integrity in the enrolment process. By presenting both copies and originals of relevant documents for verification, individuals affirm their truthfulness and completeness in the declarations made. This meticulous approach underscores the commitment to maintaining professional standards and ensuring only qualified practitioners can undertake the responsibilities of a sales tax practitioner in Gujarat.

| Question | Answer |

|---|---|

| Form Name | Form 601 Sales Tax |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | 8l, Gujarat, tl, commissioner of commercial tax gujarat |

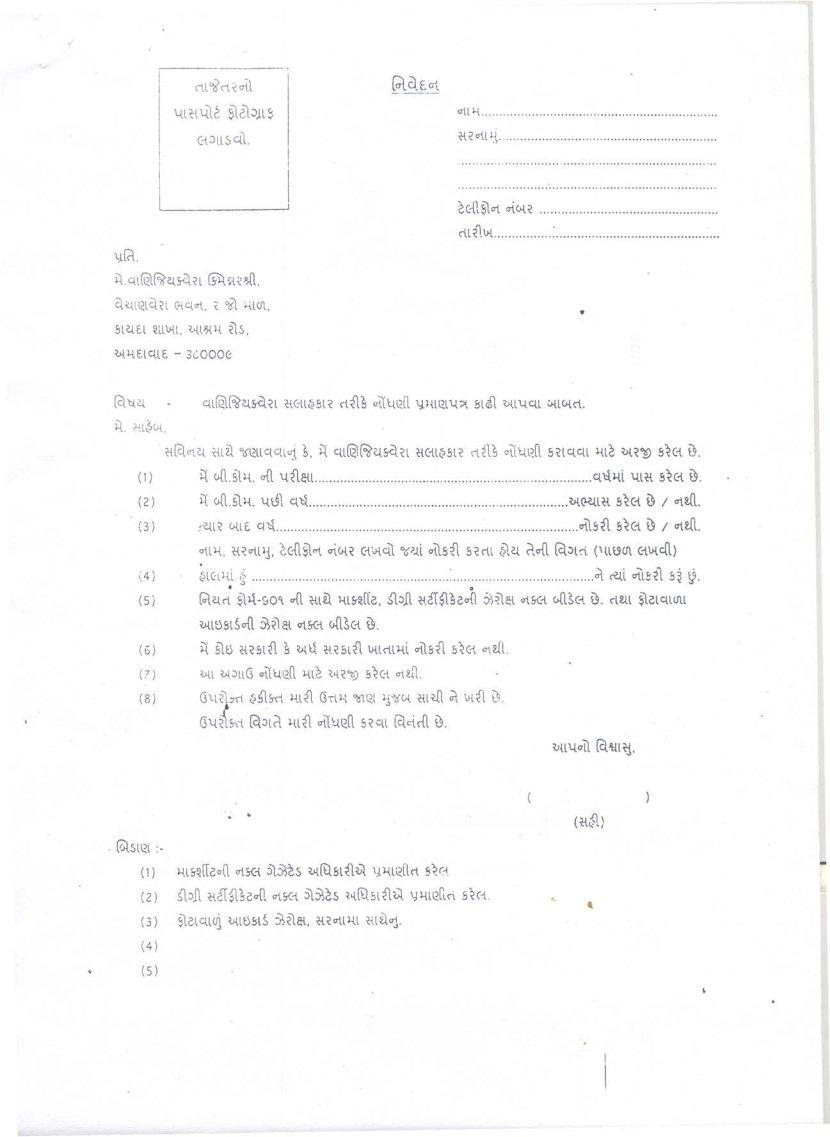

FORM 601

(SEE

Application for enrolment as a sales tax practitioner under the Gujarat Value Added Tax Act, 2003.

To,

The Commissioner of Commercial Tax,

Gujarat State,

Ahmedabad.

I,_______________________________________________(a partner of the firm known

as

_____________________________________)of________________________________

______

___________________________________________________________(address)

hereby apply for enrolment of my name in the list of Sales Tax Practitioners under rule 59 of the Gujarat Value Added Tax Rules,2006.

I declare that I am qualified to attend before any tax authority under section 81 of the Gujarat Value added Tax Act, 2003 in accordance with rule 59 of the said rules, in that,-

(a)I have passed the necessary accountancy examination viz______________ held at___________________ in the month of___________________ of the year_____________ which examination is recognized by the Central Board of Revenue constituted under the Central Board of Revenue Act, 1924 for the purpose of clause(v) of

(b)I have acquired the necessary educational qualification viz_____________ of

___________________ in examination held at_______________in the month of

___________________ in the year______________which is one of the qualifications prescribed by the Central Board of Revenue, constituted under the Central Board of Revenue Act, 1924 for the purpose of clause(vi) of

(2) In respect of Government service in any Department.

Serial |

Name of all Department |

Address. |

Period. |

No. |

served in. |

3. |

4. |

|

|

||

1. |

2. |

|

|

|

|

|

|

|

|

|

|

|

Post held |

Reason for leaving the service |

|

|

|

|

|

|

|

|

|

State whether the applicant resigned from service or that applicant was removed from services of he was dismissed, and reasons therefore. A true copy of the order accepting resignation/ of removal of dismissal is sent here with for your record alongwith original thereof for perusal and return.

The above statements are true and complete.

Place :

Date : |

Signature___________________ |

*Strike out which is not applicable.

Acknowledgement

Received an application in Form 601 ________________________ for an

enrolment under rule 59 of the Gujarat Value Added Tax Rules, 2006.

Date______________ |

Receiving Officer. |

\tl ot ci ;: aU

\.tl~tU~ ~il:>Jl~

\l (rt.

rata.Eat

aUloot |

... |

......... |

~ i?aUI} |

|

............. |

....................................................................... |

|

|

........................................................................ |

|

|

~cit$1. 01. |

cri. V{i? |

................... |

ci.l~.Vt |

: |

............... |

.

(q~i?{ - ql@~~5<ti?l ~Kll<?8l( 1i~1 "Ult12(l\l1U12l\.l?lBl~ Qtl\.lCU"tlv{li. ii. ~.l&v{.

|

~(Q01.~ ~lV. °o12llqQl1 5. i{ |

~(~ |

|||||

(1) |

i{ V{l.Sl~. aD.\.l~~l |

|

Cl~~l |

\.ll~ |

B~({ ~. |

||

(2) |

it |

vil.5l~. \.J,Jl Ct~ |

|

/ o1.Ut. |

|||

(3) |

f.~li? V{l£ CI~ |

|

aU8~ |

||||

|

o1.l~. ~(o1.l1j. ~({t~<1 a\V{( |

~,AD.(CtJlct (\ll~(J\ |

({wc(l) |

||||

|

. |

.. |

. |

""I . |

~ |

n . . |

|

(4) |

<?l0l~l g |

0 |

"1 ~l |

o1.l&~lS~ tiI. |

|||

|

|

t |

|

|

|

|

|

(5 i |

fol~1i |

||||||

~leslsaD. ~~I~

(6)i{ 5l~ ~i?Sl~ 1 Q{tt ~(Sl~ Wllil~i at\.~dl 5~C{ 01.~1.

(?)~l oPllG oUtt12(l~l~ ~Ai?':0S~C1o1.~l

(8)

.StSlQl :-

-

(1)

(2) |

SlJll ~.&~Bca{1,o1.SC{5l~~s ~1{(B.~8l~ \I |

. |

|

|

(3)$tclCtluj We8lS ~~~. ~i?o1.l~l ~UUoj.