Making use of the online PDF editor by FormsPal, you can fill in or change fnma form 629 right here. FormsPal professional team is relentlessly working to develop the tool and enable it to be even faster for users with its handy features. Take your experience to another level with constantly developing and interesting opportunities we offer! If you're seeking to get started, here's what it's going to take:

Step 1: Hit the "Get Form" button above. It'll open up our pdf tool so you could start filling in your form.

Step 2: With the help of our online PDF tool, it is possible to do more than just complete blank form fields. Express yourself and make your forms seem perfect with custom textual content added in, or optimize the original input to excellence - all that backed up by an ability to insert any kind of images and sign the PDF off.

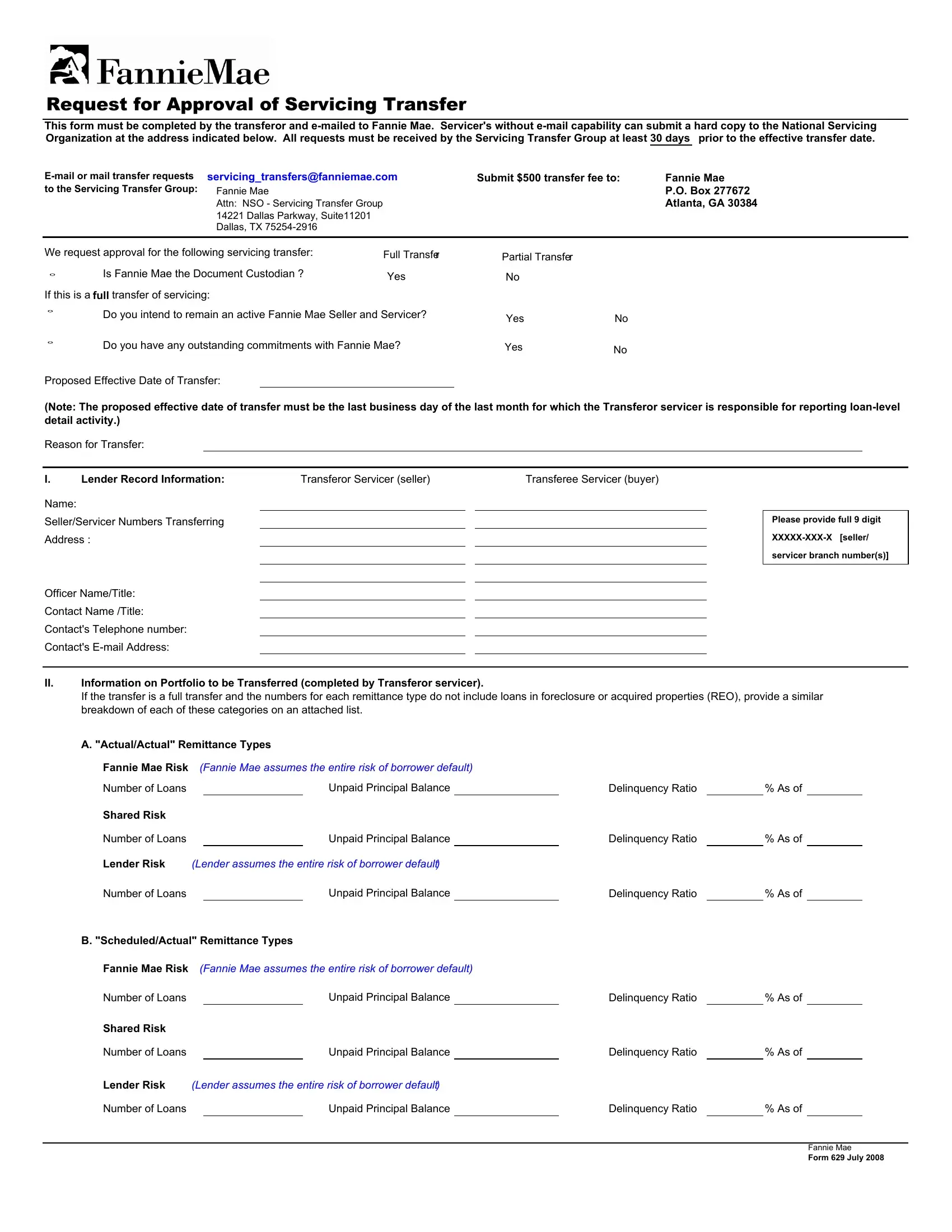

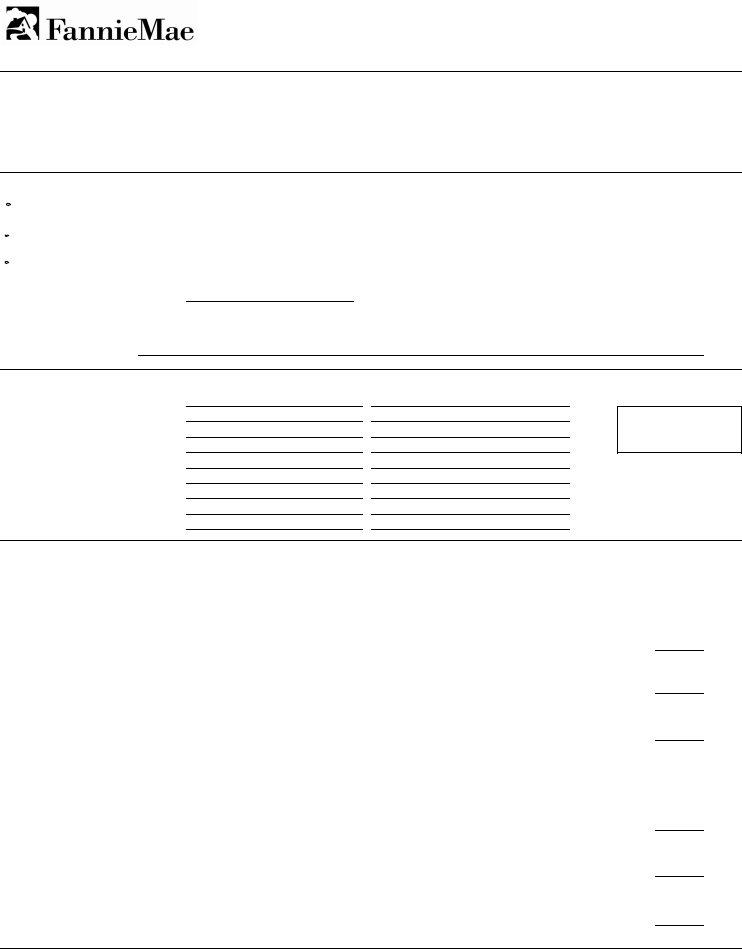

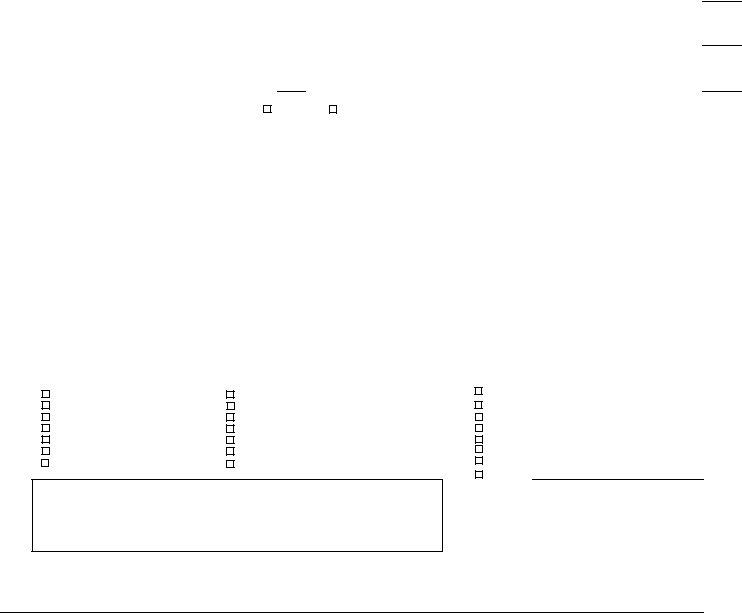

In an effort to finalize this PDF form, ensure you enter the information you need in each blank:

1. Begin filling out your fnma form 629 with a number of necessary blank fields. Collect all the important information and make certain there is nothing missed!

Step 3: Right after you have reviewed the details you filled in, click "Done" to complete your document creation. Get the fnma form 629 the instant you join for a free trial. Immediately access the pdf form from your personal account, together with any edits and adjustments being automatically preserved! FormsPal provides risk-free form editing with no personal information record-keeping or distributing. Feel safe knowing that your data is secure with us!