In California, the heart of a diverse agricultural sector, the sale of nursery stock is a crucial part of the industry, requiring strict compliance and regulation. The 64 029 form, sourced from the State of California Department of Food and Agriculture, specifically under the Pest Exclusion/Nursery, Seed, and Cotton Programs, acts as a vital cog in this wheel. Designed for nurseries operating within the County of Santa Barbara, this comprehensive form is primarily an application for a license to sell nursery stock, either as a fresh application or a renewal. Nurseries have to navigate through various details such as firm name, sales location, and ownership information, alongside specifying the type of business—ranging from producers to retailers and everything in between. The form delves into the specifics, requiring applicants to list nursery stock types and provides a fee structure based on acreage, with exemptions available under certain conditions. It addresses unique business models, including sales at Farmers’ Markets and the specification of growing grounds, reflecting the wide array of nursery operations across the region. Moreover, it hints at industry specifics, including assessments for the sale of certain types of nursery stock. By ensuring all these details are meticulously filled, the form not only adheres to regulatory requirements but also paves the way for a structured and compliant nursery business environment in California.

| Question | Answer |

|---|---|

| Form Name | Form 64 029 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | NurseryApplicat ion07 application for license to sell nursery stock in santa barbara ca form |

State of California, DEPARTMENT OF FOOD AND AGRICULTURE Pest Exclusion/Nursery, Seed and Cotton Programs

|

County of Santa Barbara |

|

Departmental Use Only |

||

Agricultural Commissioner’s Office |

||

|

||

Lic. No. _____________________ |

263 Camino del Remedio |

|

Santa Barbara, CA 93110 |

||

Temp. Lic. __________________ |

||

APPLICATION FOR |

||

|

||

Annual Lic.__________________ |

LICENSE TO SELL NURSERY STOCK |

|

|

Please print or type information in spaces where indicated. Complete ALL sections.

New Renewal

Previous License#___________

Branch

Change of Ownership

Change of Address Only

Growing Ground Addition

|

FIRM NAME OR DBA & MAILING ADDRESS (AS IT WILL APPEAR ON YOUR LICENSE): |

|

SALES LOCATION (GIVE SPECIFIC ADDRESS, NOT P. O. BOX): |

COUNTY: |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SANTA BARBARA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY: |

|

|

|

|

|

|

|

|

ZIP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

CONTACT PERSON: |

|

|

TELEPHONE: |

|

|

|

|

|

FAX: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

TELEPHONE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

OWNER’S NAME(S) OR PARENT CORPORATION NAME: |

|

|

|

|

|

|

|

# OF ACRES FOR THIS LOCATION: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

PART I CALCULATE YOUR FEES HERE |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. BASIC LICENSE FEE |

|

|

|

|

|

|

|

|

1a. |

|

$ 125.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. ACREAGE FEE: Required for land in excess of one |

0.00 |

- |

1.00 |

acres . . . $ |

0 |

|

2a |

Please check this box if you |

|||||||

|

|

|

|

|

|

|

|

|

||||||||

|

acre used in the production, sale or storage of nursery stock |

1.01 |

- |

1.99 |

acres . . . $ |

100 |

|

|||||||||

|

|

qualify for the acreage fee exemption AND |

||||||||||||||

|

(Include growing grounds acreage from reverse side in this |

2.00 |

- |

5.99 |

acres . . . $ |

250 |

|

|||||||||

|

|

enter zero fees in box 2b below |

||||||||||||||

|

calculation) |

6.00 |

- |

10.99 |

acres . . . $ |

400 |

|

|||||||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

List total # acres to assist in calculating the fee |

11.00 |

- |

20.99 |

acres . . . $ |

600 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||||||||

|

ACREAGE FEE EXEMPTION*: If greater than 75% of |

21.00 |

- |

50.99 |

acres . . . $ |

800 |

|

2b. |

Calculate your acreage fees due and |

|||||||

|

51.00 |

- |

+ |

acres . . . $ |

900 |

|

enter amount here |

|

|

|||||||

|

your nursery’s gross income comes from sales of cut |

|

|

|

||||||||||||

|

flowers/cut ornamentals, you do not need to pay the acreage |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

||

|

fee. Check box 2a and enter zero fees in box 2b. List total # |

LIST |

TOTAL |

# ACRES |

= |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||||||

|

acres in box to right (examples:0.25, 1.5, 12) → |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

3. TOTAL FEES DUE (Add total of 1a and 2b and enter in 3a) |

|

|

|

|

|

|

|

3a. TOTAL DUE |

$ |

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

SEND THIS APPLICATION ALONG WITH CHECK OR MONEY ORDER PAYABLE TO: CDFA |

|

|

||||||||||||

|

|

|

|

|

CASHIER |

|

|

|

|

|

|

|

|

|

||

|

|

California Department of Food and Agriculture |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

1220 N Street |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Sacramento, California 95814 |

|

|

|

|

|

|

|

|

|

|||

|

NOTE: Allow six to eight weeks for license processing. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

PART II TYPE OF BUSINESS (Check one or more and answer questions below. See reverse for business descriptions.) |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cut Flowers/Cut Ornamentals |

|

Jobber/Broker/Commission Merchant |

|

|

|

|

Producer |

|

|

|||||

|

|

Incidental Retailers |

|

Landscaper |

|

|

|

|

|

|

Retailer |

|

|

|||

Do you have growing grounds? |

YES |

NO |

If yes, please fill in Part IV on reverse side. |

|

|

Do you intend to sell at Farmers’ Markets? |

YES |

NO |

If yes, please fill in Part V on reverse side. |

|

|

PART III TYPE OF NURSERY STOCK (Check as many as applicable. Commercial producers must complete this section.)

|

1. |

Coniferous evergreens |

|

7. |

Bulbs, corms, rhizomes, etc. |

|

D. Other subtropical & tropical |

|

|

|

fruit trees, including avocado |

||||

|

|

|

|

|

|

|

|

|

2. |

|

8. |

Decorative plants, foliage or florist’s |

|

E. Strawberry, bushberry, etc. |

|

|

|

|

potted plants, including orchids |

|

|||

|

|

|

|

|

|

|

|

|

3. |

Deciduous shade trees |

|

9. |

Cacti and succulents |

|

F. Vegetable plants |

|

|

|

|

|

|

|

|

|

4. |

Deciduous shrubs |

|

A. Deciduous fruit & nut trees**(see reverse) |

|

G. Sod (turfgrass) |

|

|

|

|

|

|

|

|

|

|

5. |

Rose plants |

|

B. Grapevine and kiwi plants**(see reverse) |

|

H. Ground covers |

|

|

|

|

|

|

|

|

|

|

6. |

Herbaceous ornamental annuals and |

|

C. Citrus trees**(see reverse) |

|

J. Palms |

|

|

|

perennials and aquatics |

|

|

|||

|

|

|

|

|

|

|

|

I hereby certify that the information submitted in this application is true and correct to the best of my knowledge and belief.

SIGNATURE OF AUTHORIZED REPRESENTATIVE

OFFICIAL TITLE

DATE

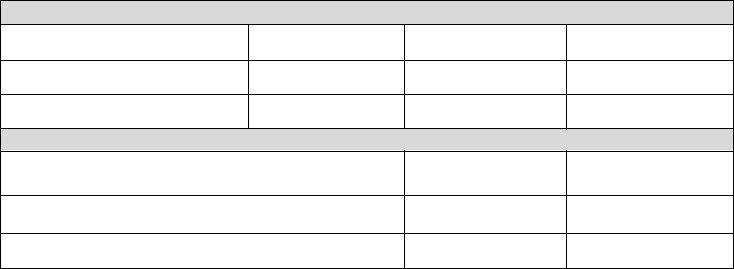

PART IV GROWING GROUNDS (List locations where nursery stock is grown but neither sold nor delivered directly to customers)

ADDRESS (LOCATION)

CITY

COUNTY

# ACRES

PART V FARMERS’ MARKETS (List locations where you will be selling your stock)

ADDRESS (DESCRIPTION OF LOCATION OK)

CITY

COUNTY

TYPE OF BUSINESS DESCRIPTION

Cut Flowers/Cut Ornamentals – Wholesale sales only

Incidental Retailers - An operator of a retail sales outlet for nursery stock, which is handled incidental to other merchandise Jobber/Broker/Commission Merchant - A dealer, not a producer, who buys and resells nursery stock at wholesale Landscaper - A landscape contractor who maintains a sales yard or holding yard for the nursery stock handled Producer - A commercial producer who grows and sells a total of $1,000 or more of nursery stock in one year

Retailer - An operator of a retail sales outlet which has no growing grounds except small areas devoted to the production of plants for local distribution and those producing less than $1,000

* ACREAGE FEE EXEMPTION

A change in the law, effective January 1, 2000, exempts licensees from paying acreage fees if their gross income from the production of cut flowers and/or cut ornamentals is 75% or greater of their gross income for their nursery. If qualified for this exemption, licensees must still list total acreage on the front page, however, in the adjacent acreage fee block, please enter zero fees.

** ASSESSMENTS FOR CITRUS, FRUIT OR NUT TREES AND GRAPEVINES

If a licensed nursery sold citrus trees, deciduous pome and stone fruit trees or grapevine nursery stock this past fiscal year it may owe an assessment. Sections

ALTERNATIVE FORMATS

This application can be made available in alternative formats for visual or hearing impaired individuals. Please allow

TIME PERIODS

The Department of Food and Agriculture has established time periods for the processing of permit applications, in compliance with Government Code Section

If you have additional questions, please contact: |

Pest Exclusion Branch |

|

Nursery, Seed and Cotton Program |

|

1220 N Street, Room |

|

Sacramento, CA 95814 |

|

(916) |

|

FAX: (916) |