SENIOR CITIZEN/DISABLED PERSONS PROPERTY TAX EXEMPTION

APPLICATION

AND REFUND FORM FOR

TAXES DUE IN 2013

Attached is a 2013 property tax exemption application and refund form. Eligibility is based on your 2012 income.

Please be aware the laws governing the property tax reduction were revised for the 2009 tax year forward. If you are applying for reduction of prior tax years, the laws that were in force for those years are still applicable. If you believe you may qualify for refund for the three (3) prior years, please call our office for additional applications and instructions. NEW for the 2009 tax year forward: If you received VA disability benefits in 2012, you must include that documentation; however, it will not be included in calculation of disposable 2012 income.

This exemption program reduces your property taxes. Please complete the PINK COLORED application with your 2012 income & your personal information. Instructions are attached to help complete the application.

The second sheet (attached to the application) is a “petition for property tax refund”. You

must sign & return this form with your application or it will not be processed. (If the tax has been paid before the Treasurer’s office adjusts the tax, any over-payment of tax will be

refunded. If there is a tax balance due, the Treasurer will issue a corrected tax statement.)

The petition for refund form needs only your signature, mailing address and date. Do not write on the other side of the petition for refund form. The Treasurer’s office will

complete the reverse side of the document.

DOCUMENTATION REQUIRED

You must provide documentation for all income and/or expenses listed, or this application will be returned to you.

If you file a tax return, this documentation must include a full copy of your tax return, and all documents used to prepare your return, such as Social Security statements, retirement or pension statements, disability payments, W-2 forms and 1099 forms.

If you do not file a tax return, this documentation must include copies of your Social Security statement, retirement or pension statement, W-2 form and any 1099 forms.

You must also include documentation for any allowed out-of-pocket expenses you are deducting from your income.

If you have any questions, please contact the Snohomish County Assessor’s Office at (425) 388-3433.

2013 INSTRUCTIONS

This claim is being filed with the Snohomish County Assessor’s office for taxes payable in 2013 under the requirements of RCW 84.36. Please be aware the laws governing the property tax reduction were revised for the 2009 tax year. For the 2009 tax year forward, you will not have to include VA disability benefits received as part of your disposable income. If you are applying for reduction of prior tax years, the laws that were in force for those years are still applicable. If you believe you may qualify for a refund for the three (3) prior years, please call our office for additional applications and instructions. State law only allows refund for up to three (3) prior years.

IF YOUR APPLICATION IS INCOMPLETE, OR IF YOU HAVE NOT INCLUDED ALL REQUIRED 2012 DOCUMENTATION, YOUR APPLICATION WILL BE RETURNED TO YOU FOR COMPLETION OR ADDITIONAL DOCUMENTATION.

NUMBERS LISTED BELOW CORRESPOND TO THE NUMBER ON THE APPLICATION

1.Type of Residence: Mark the box that applies to you. If your residence is a mobile home, enter the year and the make or model of your mobile home.

2.Type of Ownership: Mark the box that applies to you. If you have a life estate or a lease for life, you must attach a copy of that portion of the deed, lease or trust that shows the life estate.

3.Property Size and Number of Residences: If your home is on a parcel of land that is more than one acre, or you have more than one residence on your property, we are required to split your property tax bill to allow the exemption on the qualifying residence and allowable land. Law allows tax reduction on your primary residence and up to five (5) acres of land, dependant upon your zoning.

4.Applicant Information:

a. If you are transferring your exemption from your former residence, within Washington State, you must provide

the former address and/or tax account number for verification.

b. Enter the claimant’s full name. Enter spouse/co-tenant/domestic partner’s full name. (A state registered domestic partner has the same rights & responsibilities as those of a spouse. A co-tenant is a person who has ownership interest in the residence and lives with you in the residence.)

c. Enter the physical address of the residence.

d. Enter the claimant’s mailing address if different than the physical address with a brief explanation of why the mailing address is different.

5.Parcel or Account Number: You can find your parcel or account number in the upper left corner of your most recent tax statement.

6.Income and Expenses of Claimant/Spouse/Co-tenant/Domestic Partner:

DOCUMENTATION REQUIRED.

Maximum allowed $35,000. You must report from all income sources – Taxable and Non-Taxable. (Co-tenant income information must be provided if they reside with the claimant.)

Please provide the following documentation to verify INCOME:

Complete copies of your IRS tax returns including all schedules and statements attached, Retirement income statements, Bond statements, Annuity disbursal statements, Social Security statements, monies contributed or paid to you by others residing with you, unemployment compensation, public assistance, disability payments from any source, alimony, VA benefits, investments, capital gains (you may NOT reduce the gains with any losses), trust or royalty disbursements, IRA disbursements, partnership disbursements, business income (before depreciation) and rental income (before depreciation). Depreciation is not an allowed expense for purposes of this exemption. NO LOSSES TO INCOME MAY BE USED TO OFFSET DISPOSABLE INCOME.

Note: VA disability benefits will not be used in the calculation of disposable income, but will be considered with regards to the claimant’s ability to meet household expenses should no other income or very minimal income be

reported.

PLEASE CONTINUE ON REVERSE

13 Instructions.doc

Instructions continued

Please provide the following documentation to verify EXPENSES:

1.Social Security Benefit statements or Insurance Provider statements for Medicare Premiums.

2.Invoices, bills, statements or receipts from Nursing Homes, Boarding Homes, Adult Family Homes.

3.The lower section of the front page of your IRS 1040 will have adjustments to your income, such as self- employment tax or insurance or qualified IRA contributions.

4.Receipts for non-reimbursed in-home care. Items may include oxygen, Meals on Wheels, special needs furniture, attendant care for health and hygiene or medical care received in the home. In-home care providers are not required to have specialty licenses.

5.Documentation from your pharmacist or your prescription drug supplemental insurance provider for your portion of your prescription drug expense.

7.Certification of age and/or disability: Mark the boxes that apply to you. (If you are disabled and under 61 years of age, you MUST supply this office with either a copy of your Social Security award of disability letter, your Veterans Administration award of disability letter, or a current, physician signed, disability form noting the year the disability occurred and whether the disability is temporary or permanent.

8.Fill in the applicant’s birth date, the spouse or domestic partner’s birth date, the year you purchased your property and the year you first occupied your property.

THE CLAIMANT MUST SIGN THE APPLICATION AND INCLUDE A PHONE NUMBER. THE CLAIMANT’S SIGNATURE MUST BE WITNESSED. (You must have two people witness your signature. If you have no one to witness your signature, you may present your application in person and an Employee of the Assessor’s

Office will be witness to your signature.) If someone other than the claimant is signing this document, please attach proof of authority, such as Power of Attorney.

REFUND FORM: Please sign your name on the Petition for Property Tax Refund form under “STATEMENT BY TAXPAYER” area, along with your mailing address and the date. The opposite side of this form will be completed for you by the Treasurer’s Office. If you are due a refund, it will come from the Treasurer’s Office. If there is a tax

balance due, the Treasurer will issue a corrected tax statement.

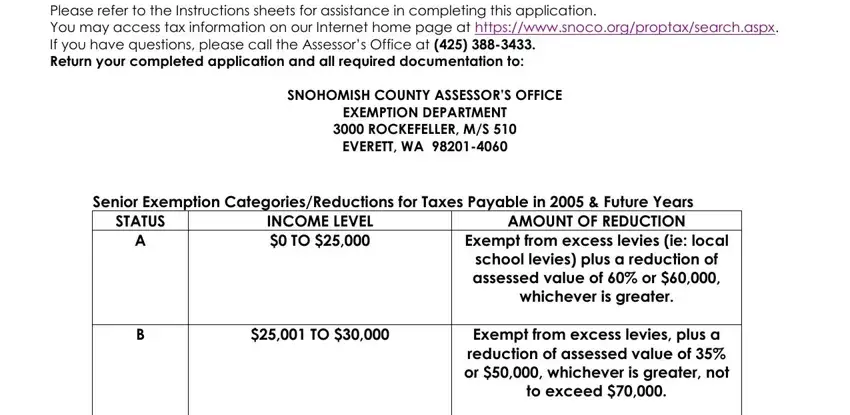

Senior Exemption Income Categories/Reductions

FOR TAX YEARS 2005 & FORWARD

(BASED UPON 2004 INCOME YEAR & FUTURE YEARS)

STATUS |

INCOME |

AMOUNT OF REDUCTION |

|

LEVEL |

|

A |

$0 TO |

Exempt from excess levies (ie: local school levies) plus a reduction of |

|

$25,000 |

assessed value of 60% or $60,000, whichever is greater. |

|

|

|

B |

$25,001 TO |

Exempt from excess levies, plus a reduction of assessed value of 35% |

|

$30,000 |

or $50,000, whichever is greater, not to exceed $70,000. |

|

|

|

C |

$30,001 TO |

Exempt from excess levies. |

|

$35,000 |

|

For assistance please call the Assessor’s Office 425.388.3433

SENIOR CITIZEN AND DISABLED PERSONS EXEMPTION FROM REAL PROPERTY TAXES

Use 2012 Income to Determine Eligibility for Reduction on Taxes Payable in 2013

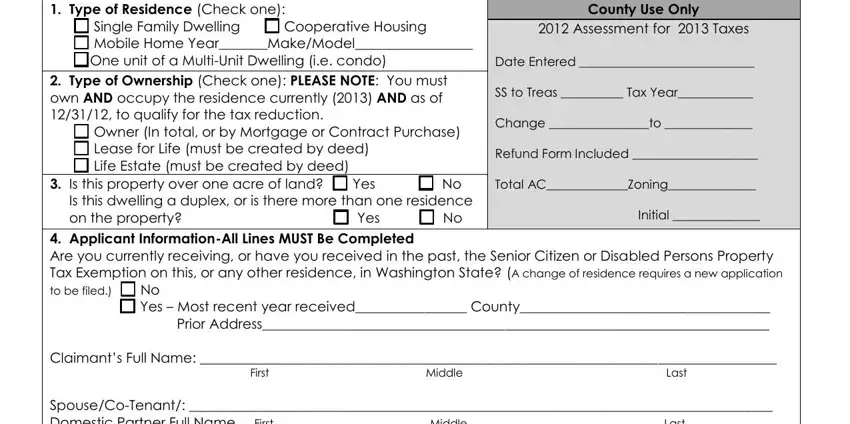

1. Type of Residence (Check one):

Single Family Dwelling |

Cooperative Housing |

Mobile Home Year_______Make/Model_________________

One unit of a Multi-Unit Dwelling (i.e. condo)

2.Type of Ownership (Check one): PLEASE NOTE: You must own AND occupy the residence currently (2013) AND as of

12/31/12, to qualify for the tax reduction.

Owner (In total, or by Mortgage or Contract Purchase)

Lease for Life (must be created by deed)

Life Estate (must be created by deed)

3. Is this property over one acre of land? |

Yes |

No |

Is this dwelling a duplex, or is there more than one residence

County Use Only

2012 Assessment for 2013 Taxes

Date Entered ____________________________

SSto Treas __________ Tax Year____________

Change ________________to ______________

Refund Form Included ____________________

Total AC_____________Zoning______________

Initial ______________

4. Applicant Information-All Lines MUST Be Completed

Are you currently receiving, or have you received in the past, the Senior Citizen or Disabled Persons Property Tax Exemption on this, or any other residence, in Washington State? (A change of residence requires a new application

to be filed.) |

No |

|

Yes – Most recent year received________________ County____________________________________ |

Prior Address_________________________________________________________________________

Claimant’s Full Name: ___________________________________________________________________________________

FirstMiddleLast

Spouse/Co-Tenant/: ____________________________________________________________________________________

Domestic Partner Full Name FirstMiddleLast

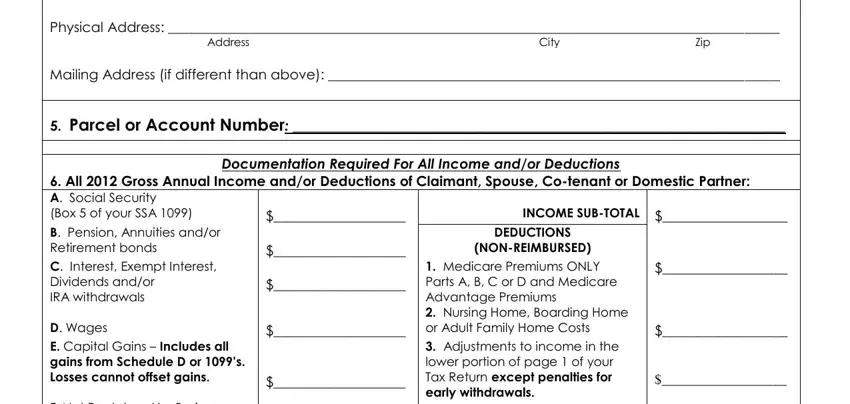

Physical Address: ________________________________________________________________________________________

AddressCityZip

Mailing Address (if different than above): _________________________________________________________________

5.Parcel or Account Number: _______________________________________________________________________

Documentation Required For All Income and/or Deductions

6. All 2012 Gross Annual Income and/or Deductions of Claimant, Spouse, Co-tenant or Domestic Partner:

A. Social Security

(Box 5 of your SSA 1099)

B. Pension, Annuities and/or Retirement bonds

C. Interest, Exempt Interest, Dividends and/or

IRA withdrawals

D. Wages

E. Capital Gains – Includes all gains from Schedule D or 1099’s.

Losses cannot offset gains.

F. Net Rental and/or Business

Income – Excluding Depreciation

Expense– No Losses allowed G. Disability Income

(other than VA Benefits or Social Security payments)

H.Any other income (such as gross unemployment

$___________________

$___________________

$___________________

$___________________

$___________________

$___________________

$___________________

$___________________

INCOME SUB-TOTAL

DEDUCTIONS

(NON-REIMBURSED)

1.Medicare Premiums ONLY

Parts A, B, C or D and Medicare Advantage Premiums

2.Nursing Home, Boarding Home or Adult Family Home Costs

3.Adjustments to income in the lower portion of page 1 of your Tax Return except penalties for early withdrawals.

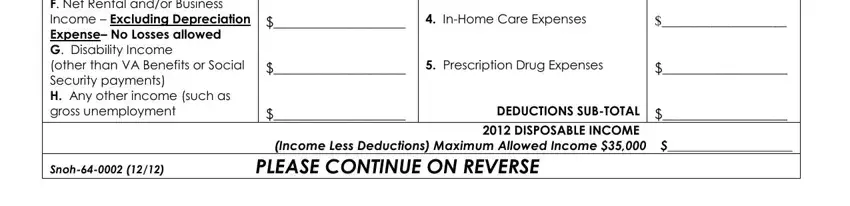

4.In-Home Care Expenses

5.Prescription Drug Expenses

DEDUCTIONS SUB-TOTAL

$__________________

$__________________

$__________________

$__________________

$__________________

$__________________

$__________________

2012 DISPOSABLE INCOME |

|

(Income Less Deductions) Maximum Allowed Income $35,000 |

$____________________ |

Snoh-64-0002 (12/12) |

PLEASE CONTINUE ON REVERSE |

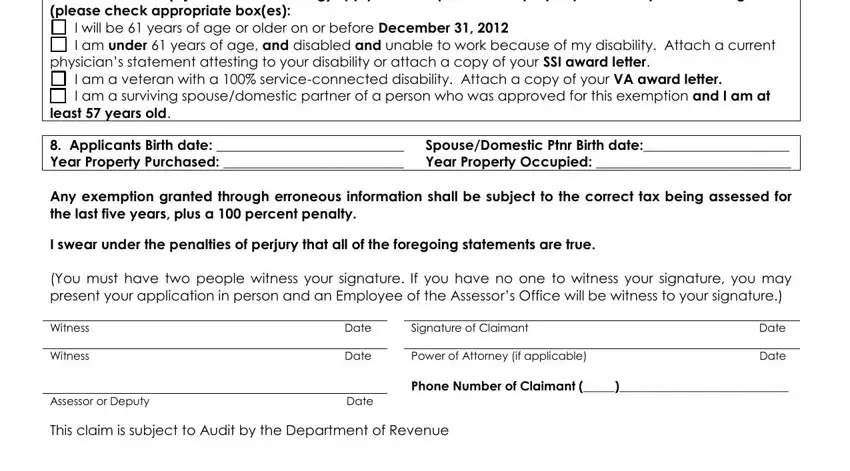

7.I, or each of us (if joint owners are filing) apply for exemption on this property and certify the following

(please check appropriate box(es):

I will be 61 years of age or older on or before December 31, 2012

I am under 61 years of age, and disabled and unable to work because of my disability. Attach a current

physician’s statement attesting to your disability or attach a copy of your SSI award letter.

I am a veteran with a 100% service-connected disability. Attach a copy of your VA award letter.

I am a surviving spouse/domestic partner of a person who was approved for this exemption and I am at

least 57 years old.

8. Applicants Birth date: ___________________________ |

Spouse/Domestic Ptnr Birth date:_____________________ |

Year Property Purchased: __________________________ |

Year Property Occupied: ____________________________ |

Any exemption granted through erroneous information shall be subject to the correct tax being assessed for the last five years, plus a 100 percent penalty.

I swear under the penalties of perjury that all of the foregoing statements are true.

(You must have two people witness your signature. If you have no one to witness your signature, you may present your application in person and an Employee of the Assessor’s Office will be witness to your signature.)

Witness |

Date |

|

Signature of Claimant |

Date |

|

|

|

|

|

Witness |

Date |

|

Power of Attorney (if applicable) |

Date |

Phone Number of Claimant (_____)___________________________

This claim is subject to Audit by the Department of Revenue

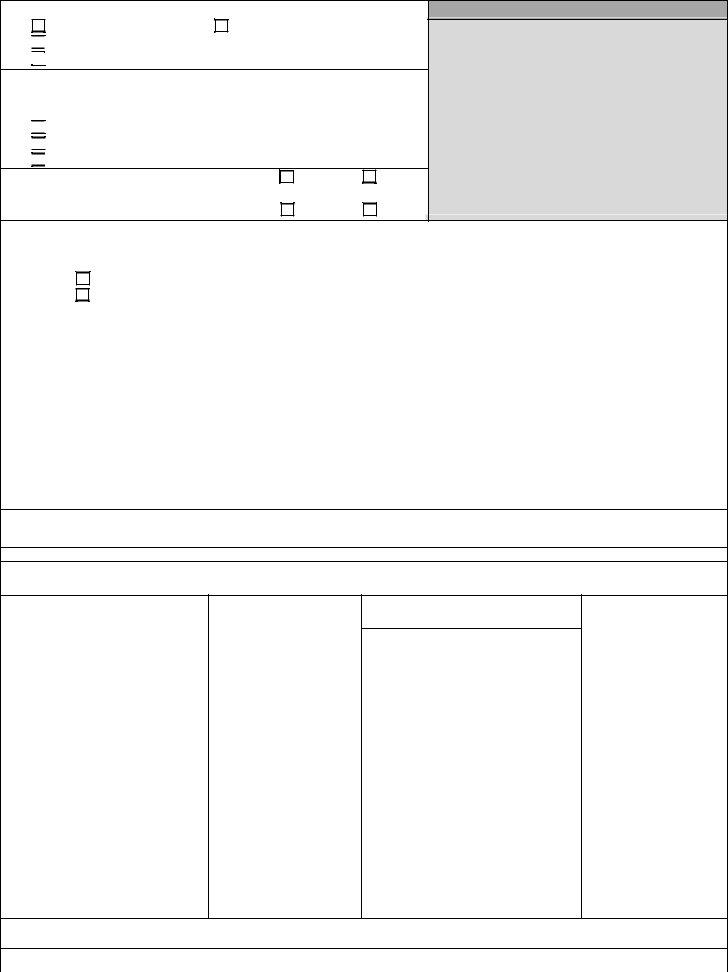

Please refer to the Instructions sheets for assistance in completing this application.

You may access tax information on our Internet home page at https://www.snoco.org/proptax/search.aspx.

If you have questions, please call the Assessor’s Office at (425) 388-3433.

Return your completed application and all required documentation to:

SNOHOMISH COUNTY ASSESSOR’S OFFICE

EXEMPTION DEPARTMENT

3000 ROCKEFELLER, M/S 510

EVERETT, WA 98201-4060

Senior Exemption Categories/Reductions for Taxes Payable in 2005 & Future Years

STATUS |

INCOME LEVEL |

AMOUNT OF REDUCTION |

A |

$0 TO $25,000 |

Exempt from excess levies (ie: local |

|

|

school levies) plus a reduction of |

|

|

assessed value of 60% or $60,000, |

|

|

whichever is greater. |

|

|

|

B |

$25,001 TO $30,000 |

Exempt from excess levies, plus a |

|

|

reduction of assessed value of 35% |

|

|

or $50,000, whichever is greater, not |

|

|

to exceed $70,000. |

|

|

|

C |

$30,001 TO $35,000 |

Exempt from excess levies. |

Snoh-64-0002 (12/12)

B. Under the Provisions of RCW 84.60.050

Pro rata refund due on taxes previously paid on real property which was subsequently acquired by or placed under immediate possession and use of State of Washington, and county or any municipal corporation.

|

Said tax should be reduced from |

|

to |

|

. |

|

|

Refund should be made to taxpayer for |

|

plus interest, if applicable (RCW 84.69.100). |

|

|

|

|

|

|

|

Explain briefly the reason for the refund claim:

SENIOR CITIZEN/DISABLED PERSONS PROPERTY TAX EXEMPTION

Statement By Taxpayer

I hereby state that the contents of the foregoing petition are true and correct to the best of my knowledge and belief, and request that the said tax be refunded in conformity with this petition.

|

|

Date |

|

|

|

Signature of Taxpayer or Agent |

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Determination By County Assessor

After due consideration of the facts contained in the taxpayer’s signed petition knowing them to be true and accurate, I have determined that the request for refund be:

θ Approved and the County Treasurer is authorized |

θ Denied because the claim does not qualify under RCW |

|

to make a refund. |

84.69.020, RCW 84.60.050 or RCW 84.69.030 for the |

|

|

|

|

following reason: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certification By County Treasurer

After due consideration of the facts contained in the taxpayer’s signed petition and the decision of the County Assessor, I have determined that the request for refund be:

θ Approved and I am refunding the following amount, θ Denied because the claim does not qualify under

|

$ _____________________, plus applicable interest |

RCW 84.69.020, RCW 84.60.050 or RCW 84.69.030 |

|

for the following reason: |

|

at the amount specified in RCW 84.69.100 from the |

|

|

|

date of collection of the portion refundable. |

|

|

|

|

|

|

|

|

|

|

To ask about the availability of this publication in an alternate format for the visually impaired, please call (360) 705-6715. Teletype (TTY) users, please call (360) 705-6718. For tax assistance, call (360) 534-1400.

Petition For Property Tax Refund

RCW 84.60.050 or 84.69.020

File With The County Treasurer

Claim for refund must be made within three years of the date the taxes were due.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The petitioner, |

|

|

|

|

|

, under the provisions of RCW 84.69.020 or |

RCW 84.60.050 hereby petitions for a refund of taxes extended upon the tax rolls of |

|

|

|

County for the year |

|

, with respect to the following described property. |

|

|

Parcel number or legal description of property: |

|

|

|

|

|

|

|

|

|

|

* Petitioner alleges the following to be facts: The assessed value of said property made in the year |

|

|

, |

for taxes becoming due in the year |

|

|

, and the tax extended upon said total valuation were as follows: |

|

|

Real Property Personal Property

Date Due

Entire Tax

First Half

Second Half

*If claim is for abated taxes under RCW 84.70.010, attach REV 64 0003, disregard this section, and complete the remainder of this form.

Refund Is Hereby Claimed For The Following Reason:

A. Under the provisions of RCW 84.69.020 (Check appropriate box(es))

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

(13)

(14)

(15)

(16)

Paid more than once; or

Paid as a result of manifest error in description; or

Paid as a result of a clerical error in extending the tax rolls; or Paid as a result of other clerical errors in listing property; or

Paid with respect to improvements which did not exist on assessment date; or Paid under levies or statutes adjudicated to be illegal or unconstitutional; or

Paid as a result of mistake, inadvertence, or lack of knowledge by any person exempted from paying real property taxes or a portion thereof pursuant to RCW 84.36.381 through 389; or

Paid or overpaid as a result of mistake, inadvertence, or lack of knowledge by either a public official or employee or by any person paying the same or paid as a result of mistake, inadvertence, or lack of knowledge by either a public official or employee, or by any person paying the same with respect to real property in which the person paying the same has no legal interest; or

Paid on the basis of an assessed or appraised valuation which was appealed to the county board of equalization and ordered reduced by the board; or

Paid on the basis of an assessed or appraised valuation which was appealed to the state board of tax appeals and ordered reduced by the board: PROVIDED that the amount refunded under subsections (9) and (10) shall

only be for the difference between the tax paid on the basis of the appealed valuation and the tax payable on the valuation adjusted in accordance with the board’s order; or

Paid as a state property tax levied upon county assessed property, the assessed value of which has been established by the state board of tax appeals for the year of such levy: PROVIDED, HOWEVER, that the amount refunded shall only be for the difference between the state property tax paid and the amount of state property tax which would, when added to all other property taxes within the one percent limitation of Article VII, section 2 (Amendment 59) of the state constitution, equal one percent of the assessed value established by the board; or

Paid on the basis of an assessed valuation which was adjudicated to be unlawful or excessive: PROVIDED, that the amount refunded shall be for the difference between the amount of tax which was paid on the basis of the valuation adjudged unlawful or excessive and the amount of tax payable on the basis of the assessed valuation determined as a result of the proceeding.

Paid on property acquired under RCW 84.60.050, and canceled under RCW 84.60.050(2). Paid on the basis of an assessed valuation that was reduced under RCW 84.48.065.

Paid on the basis of an assessed valuation that was reduced under RCW 84.40.039. Abated under RCW 84.70.010