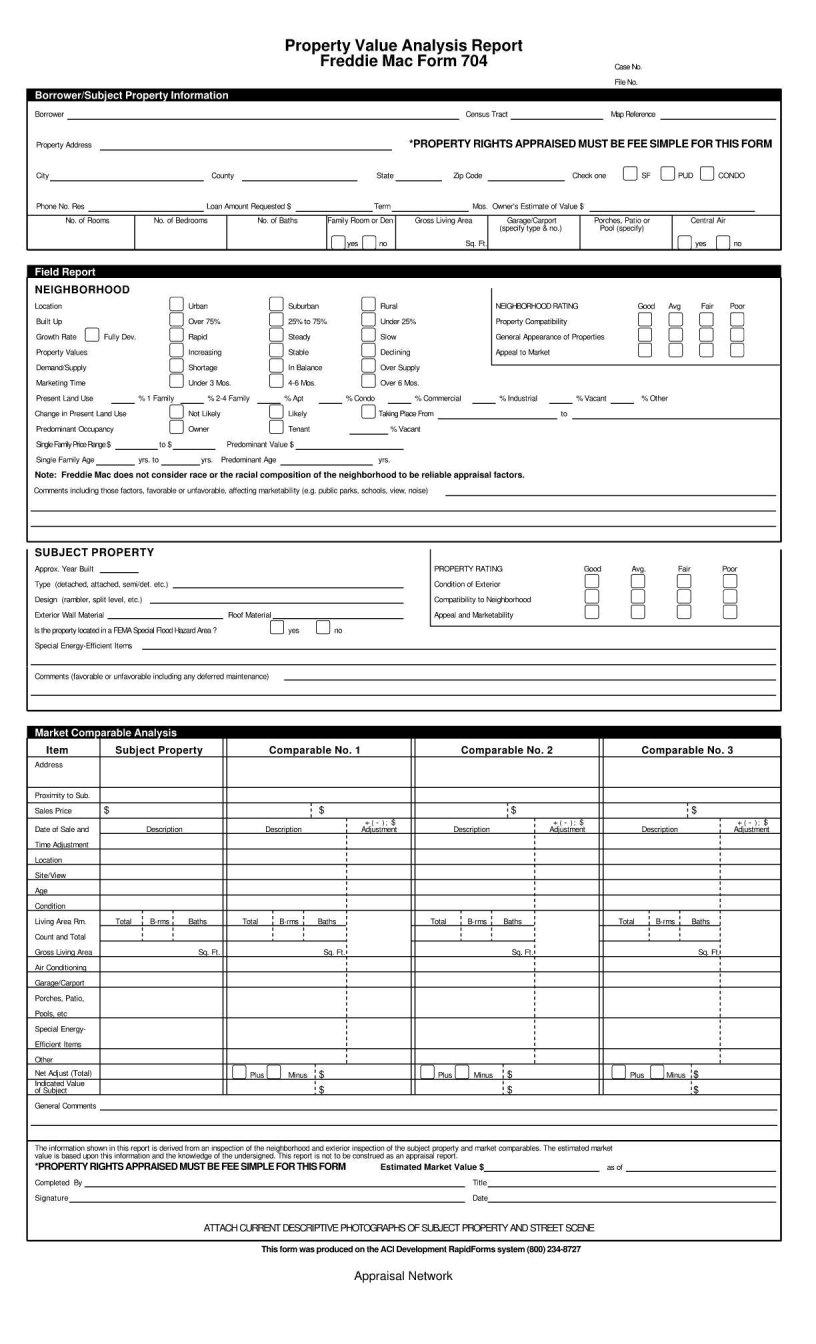

When partners come together to form a business, understanding how profits, losses, and capital accounts are allocated is crucial for transparency and fairness. The 704 B form plays a pivotal role in this aspect, serving as a foundational document that outlines the agreements between partners in a partnership or members of a limited liability company (LLC) treated as a partnership for tax purposes. This form, guided by Section 704(b) of the Internal Revenue Code, helps ensure that allocations of these items are recognized by the IRS, provided they are consistent with the underlying economic arrangement of the partners. In essence, the 704 B form sets the stage for how economic benefits and burdens are shared among partners, influencing decisions and expectations. Its importance cannot be overstated, as it not only affects the tax obligations of the partners but also reflects the fairness and equity of the partnership's operations, making it a crucial document for both new and existing partnerships.

| Question | Answer |

|---|---|

| Form Name | Form 704 B |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | form freddie 704b form, form 704 704b form, freddie 704b form, appraisal 704 b |