When you need to fill out assistance form 710, you don't have to download any sort of software - simply try using our PDF tool. Our tool is continually evolving to provide the best user experience possible, and that is because of our resolve for continuous enhancement and listening closely to user feedback. Here is what you would want to do to start:

Step 1: Just press the "Get Form Button" at the top of this page to start up our pdf file editor. This way, you will find all that is needed to work with your document.

Step 2: This editor enables you to work with the majority of PDF documents in a range of ways. Modify it by writing your own text, adjust what's originally in the file, and place in a signature - all doable in no time!

Filling out this PDF will require attention to detail. Ensure all necessary areas are filled out properly.

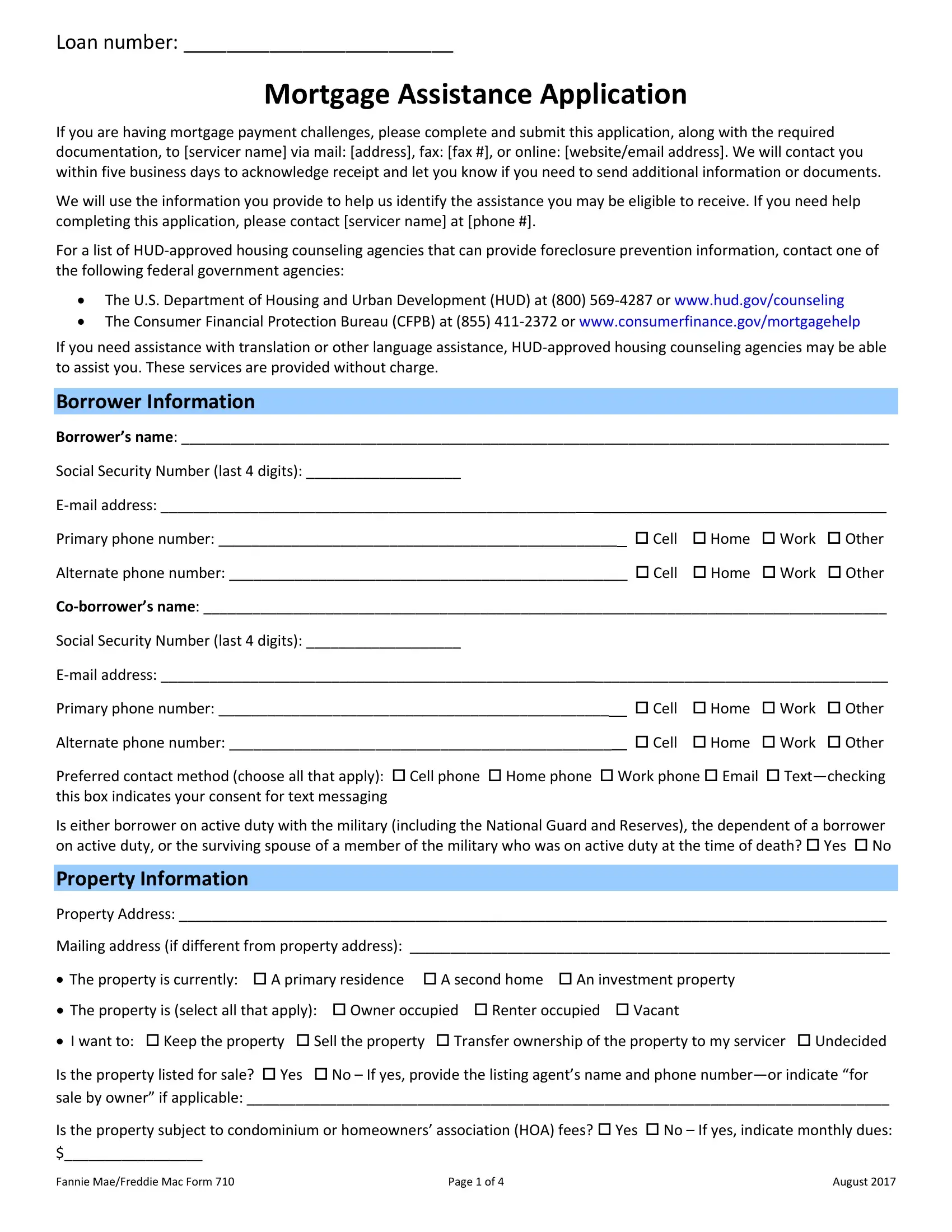

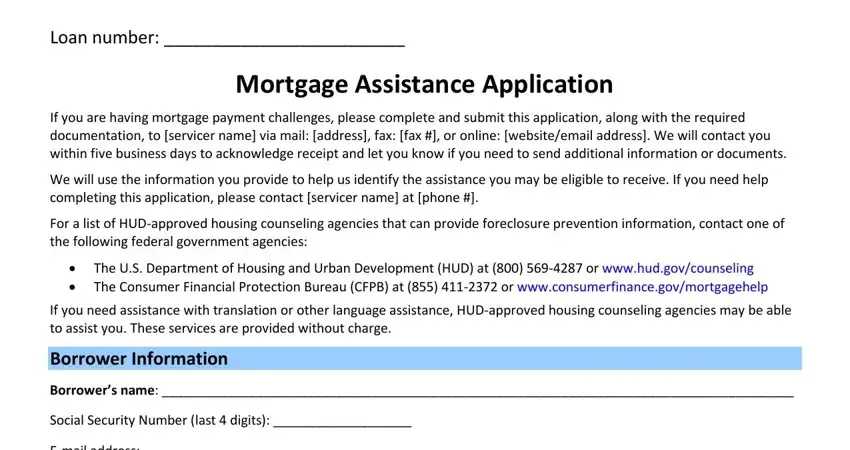

1. The assistance form 710 necessitates certain details to be entered. Ensure the following blanks are completed:

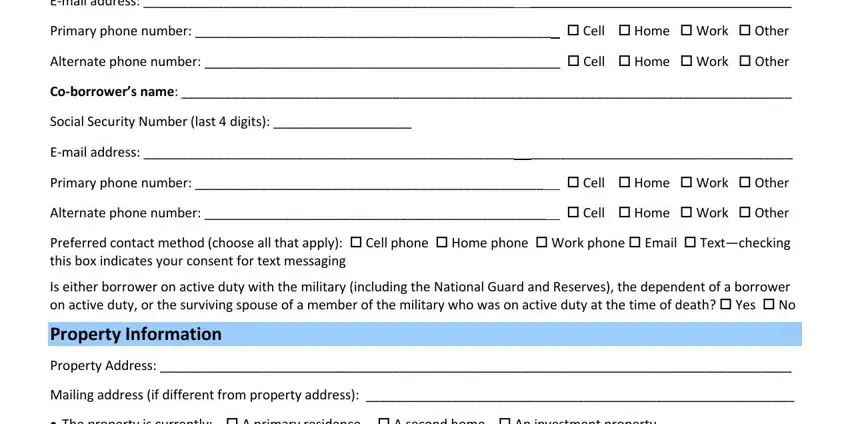

2. Once your current task is complete, take the next step – fill out all of these fields - Email address, Primary phone number Cell Home, Alternate phone number Cell, Coborrowers name, Social Security Number last, Email address, Primary phone number, Cell Home Work Other, Alternate phone number, Cell Home Work Other, Preferred contact method choose, Is either borrower on active duty, Property Information, Property Address, and Mailing address if different from with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

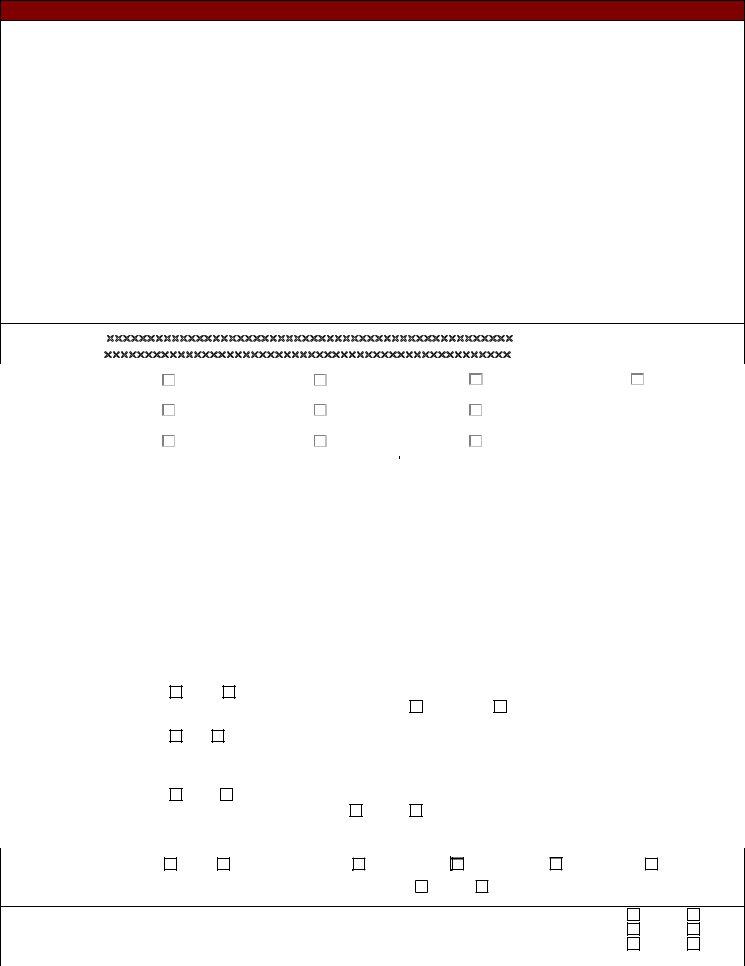

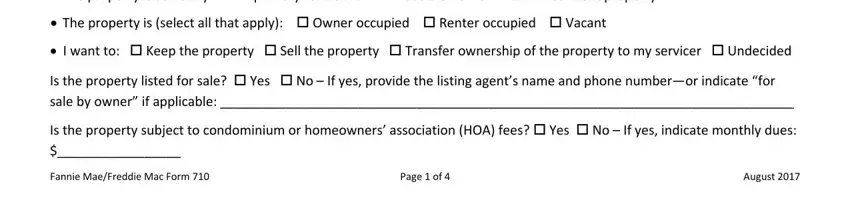

3. This next step is all about The property is currently A, The property is select all that, I want to Keep the property, Is the property listed for sale, Is the property subject to, Fannie MaeFreddie Mac Form, Page of, and August - fill in each one of these empty form fields.

People frequently make some mistakes while filling out The property is select all that in this area. You need to go over whatever you enter right here.

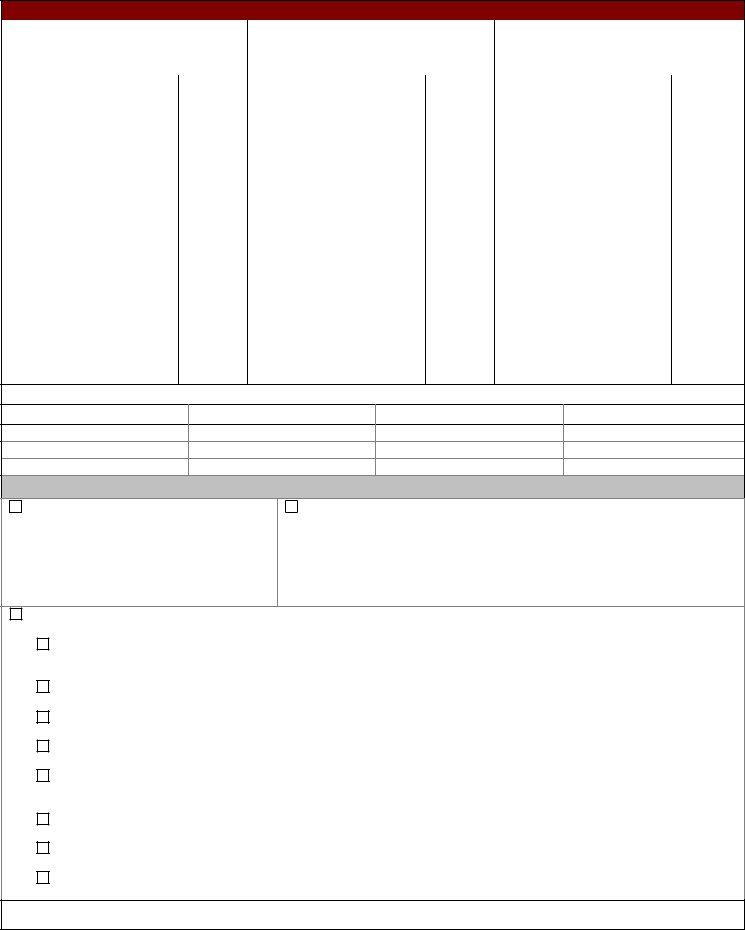

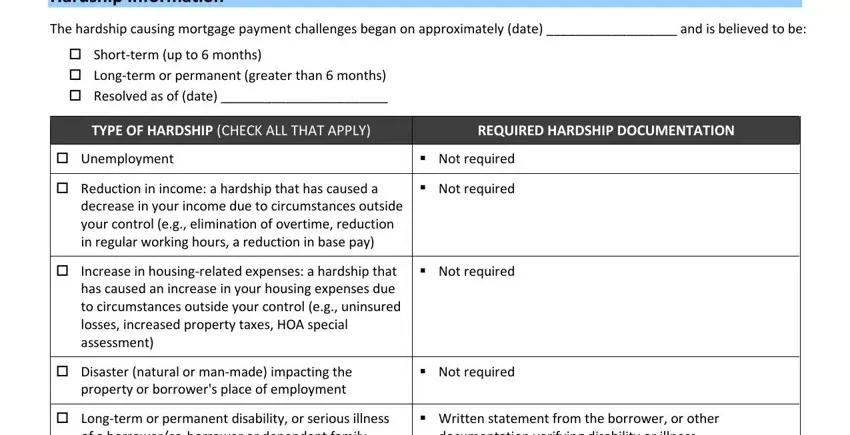

4. This next section requires some additional information. Ensure you complete all the necessary fields - Hardship Information, The hardship causing mortgage, Shortterm up to months Longterm, TYPE OF HARDSHIP CHECK ALL THAT, REQUIRED HARDSHIP DOCUMENTATION, Unemployment, Not required, Reduction in income a hardship, Not required, decrease in your income due to, Increase in housingrelated, Not required, Disaster natural or manmade, Not required, and Longterm or permanent disability - to proceed further in your process!

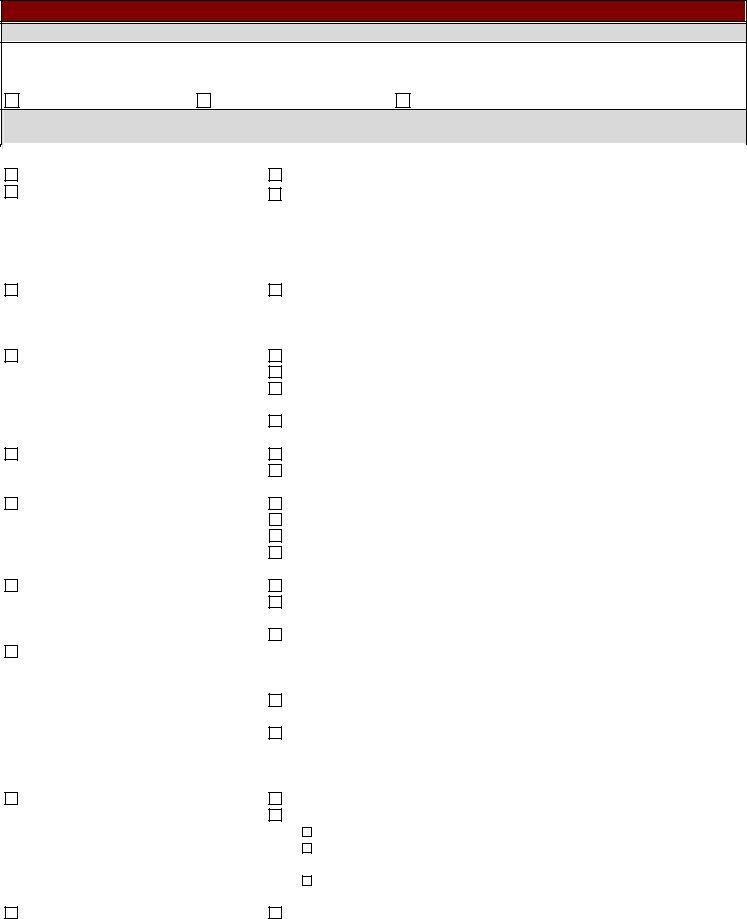

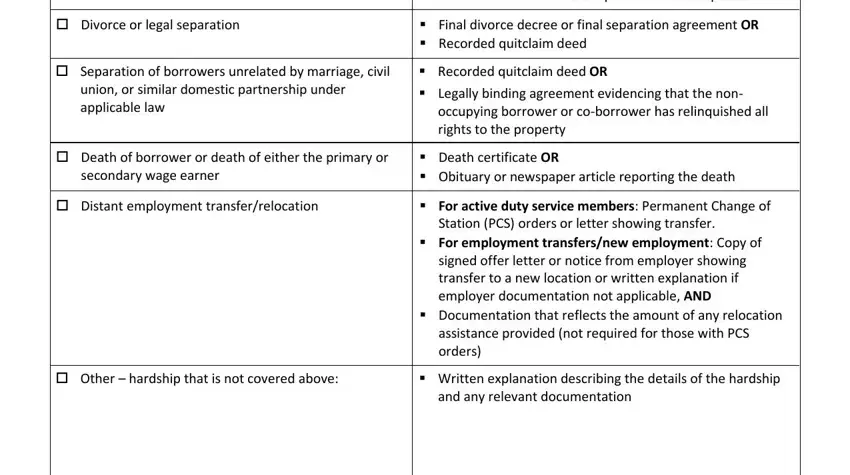

5. While you near the completion of your form, there are actually a few more requirements that should be satisfied. Particularly, Divorce or legal separation, Separation of borrowers unrelated, union or similar domestic, Note Detailed medical information, Final divorce decree or final, Recorded quitclaim deed OR, occupying borrower or coborrower, Death of borrower or death of, secondary wage earner, Death certificate OR Obituary or, Distant employment, For active duty service members, Station PCS orders or letter, For employment transfersnew, and signed offer letter or notice from should be filled in.

Step 3: Right after you have reviewed the information you filled in, click on "Done" to complete your document creation. Obtain the assistance form 710 when you join for a 7-day free trial. Instantly get access to the pdf form from your personal cabinet, with any edits and changes conveniently saved! We do not sell or share any information that you enter whenever dealing with forms at our website.