Using PDF files online is actually quite easy with our PDF editor. You can fill in SSN here and use many other functions available. To make our editor better and more convenient to work with, we constantly design new features, with our users' suggestions in mind. With some basic steps, you may start your PDF editing:

Step 1: Click the "Get Form" button above on this page to get into our tool.

Step 2: This editor provides you with the capability to change nearly all PDF forms in a variety of ways. Modify it by adding your own text, adjust existing content, and put in a signature - all when it's needed!

It is actually straightforward to fill out the document adhering to this helpful tutorial! Here is what you must do:

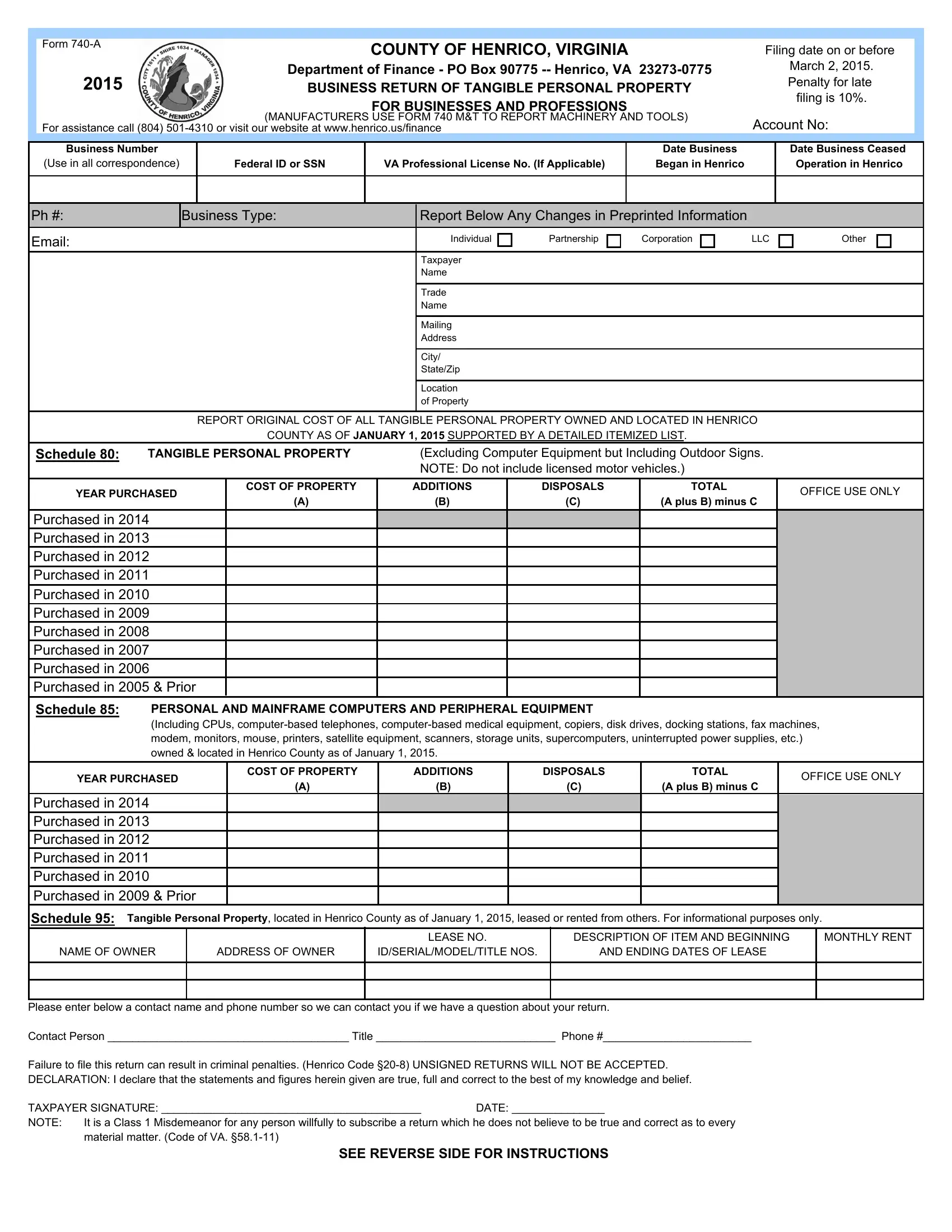

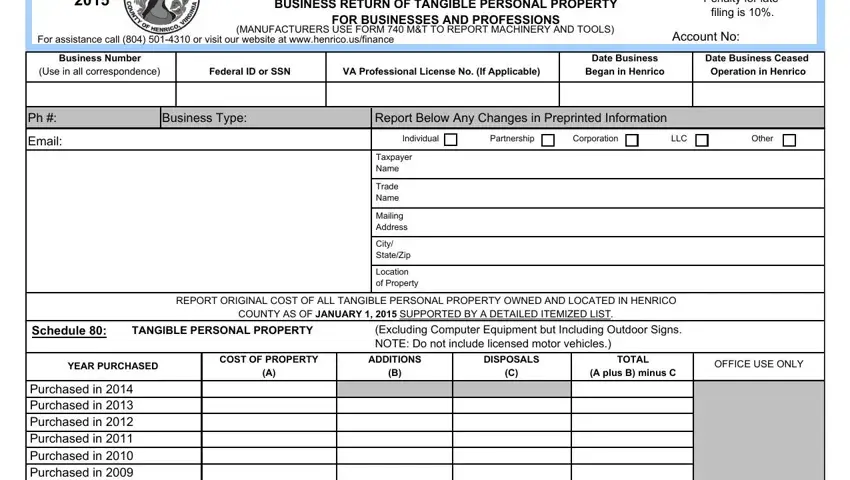

1. Complete the SSN with a group of major blank fields. Get all of the necessary information and make sure absolutely nothing is left out!

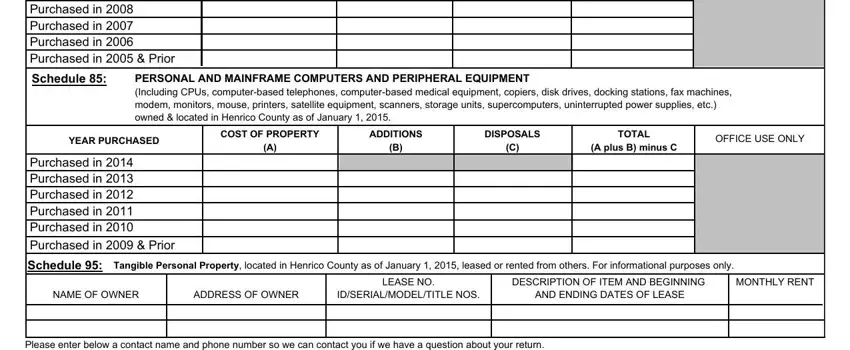

2. Just after this selection of blank fields is completed, go on to type in the applicable information in these - Purchased in Purchased in, Schedule, PERSONAL AND MAINFRAME COMPUTERS, YEAR PURCHASED, COST OF PROPERTY, ADDITIONS, DISPOSALS, TOTAL, A plus B minus C, OFFICE USE ONLY, Purchased in Purchased in, Purchased in Prior, Schedule, Tangible Personal Property located, and NAME OF OWNER.

Many people often get some things wrong while filling out Schedule in this part. Be certain to re-examine whatever you enter here.

Step 3: Right after you've glanced through the information in the document, click "Done" to finalize your document creation. After creating afree trial account here, you'll be able to download SSN or email it right away. The PDF form will also be accessible in your personal cabinet with all of your changes. FormsPal is committed to the personal privacy of all our users; we make sure all personal data handled by our editor is confidential.