You are able to complete entry summary template without difficulty in our PDFinity® online tool. Our editor is consistently evolving to grant the very best user experience attainable, and that's thanks to our dedication to continuous development and listening closely to feedback from users. With some simple steps, you'll be able to begin your PDF journey:

Step 1: Press the "Get Form" button above. It'll open our pdf editor so that you could start completing your form.

Step 2: Once you open the file editor, you will find the form all set to be filled out. Besides filling out different blanks, it's also possible to perform several other actions with the form, namely putting on your own words, editing the original textual content, adding images, placing your signature to the form, and much more.

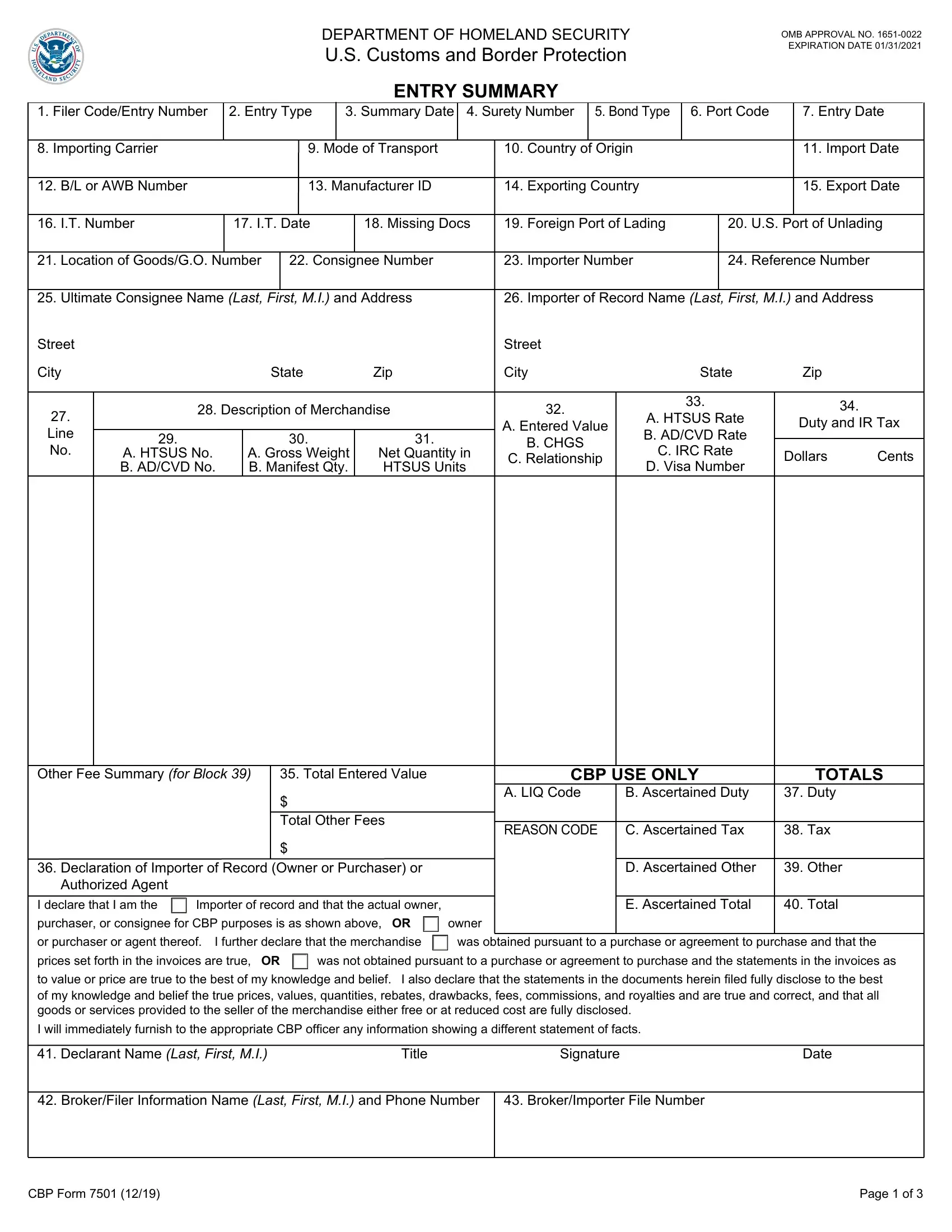

In order to complete this PDF form, make sure that you type in the necessary details in every single field:

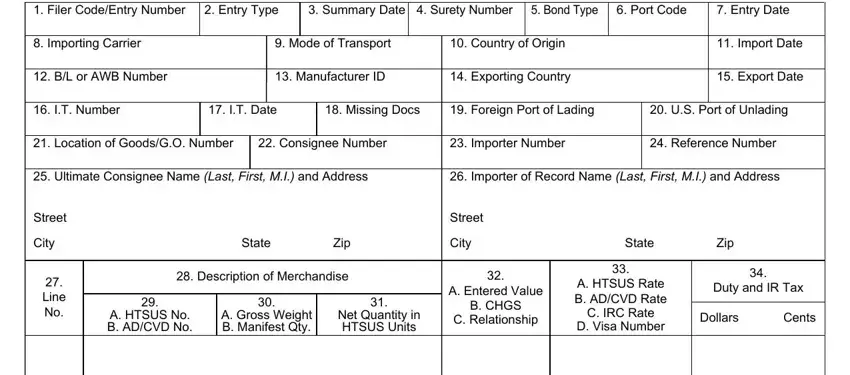

1. The entry summary template necessitates specific details to be inserted. Make certain the next blanks are complete:

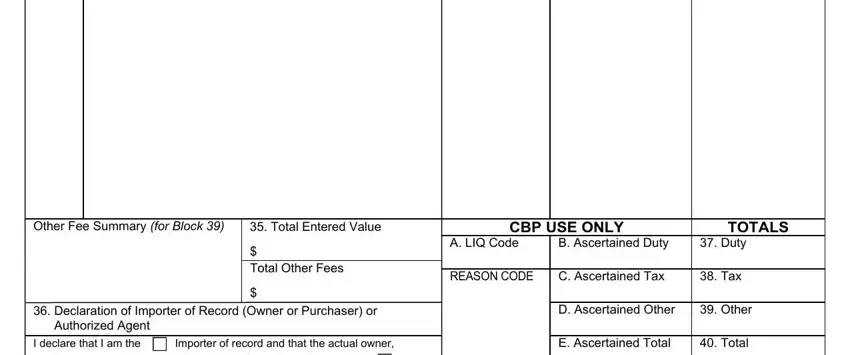

2. After filling out this step, go to the subsequent part and fill in the necessary particulars in these blank fields - Other Fee Summary for Block, Total Entered Value, Total Other Fees, CBP USE ONLY, TOTALS, A LIQ Code, B Ascertained Duty, Duty, REASON CODE, C Ascertained Tax, Tax, Declaration of Importer of Record, D Ascertained Other, Other, and Authorized Agent.

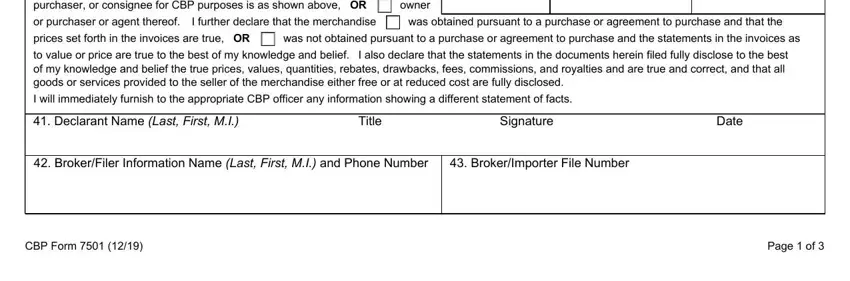

3. This 3rd section is usually quite uncomplicated, purchaser or consignee for CBP, owner, or purchaser or agent thereof, I further declare that the, was obtained pursuant to a, prices set forth in the invoices, was not obtained pursuant to a, I also declare that the statements, I will immediately furnish to the, Declarant Name Last First MI, Title, Signature, Date, BrokerFiler Information Name Last, and BrokerImporter File Number - all of these empty fields must be filled in here.

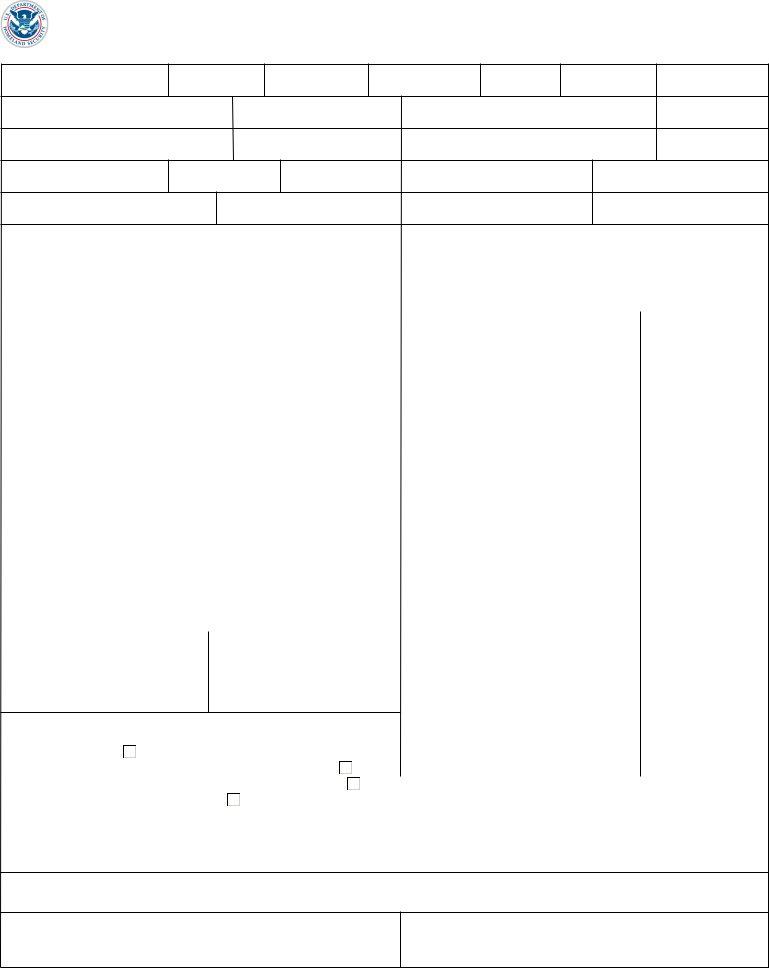

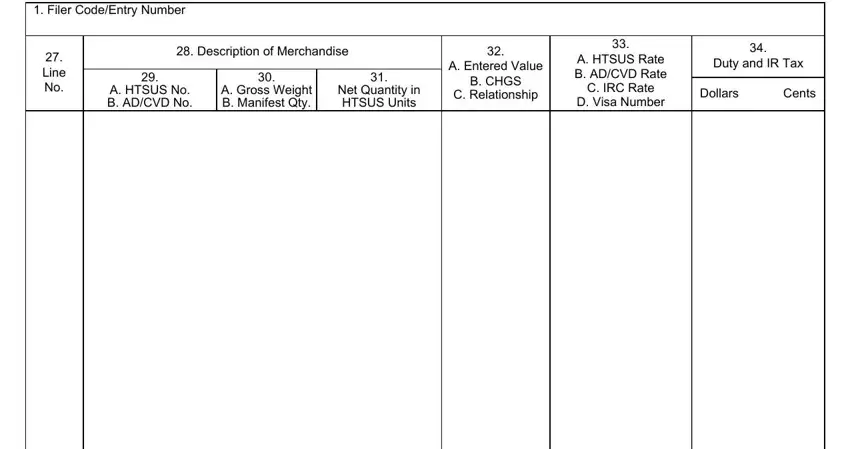

4. Filling in ENTRY SUMMARY CONTINUATION SHEET, Filer CodeEntry Number, Line No, Description of Merchandise, A HTSUS No B ADCVD No, A Gross Weight B Manifest Qty, Net Quantity in HTSUS Units, A Entered Value, B CHGS, C Relationship, A HTSUS Rate B ADCVD Rate, C IRC Rate, D Visa Number, Duty and IR Tax, and Dollars is paramount in this step - be sure to devote some time and fill out each empty field!

Concerning Net Quantity in HTSUS Units and Filer CodeEntry Number, be certain that you don't make any mistakes in this section. Both these are certainly the most significant ones in this file.

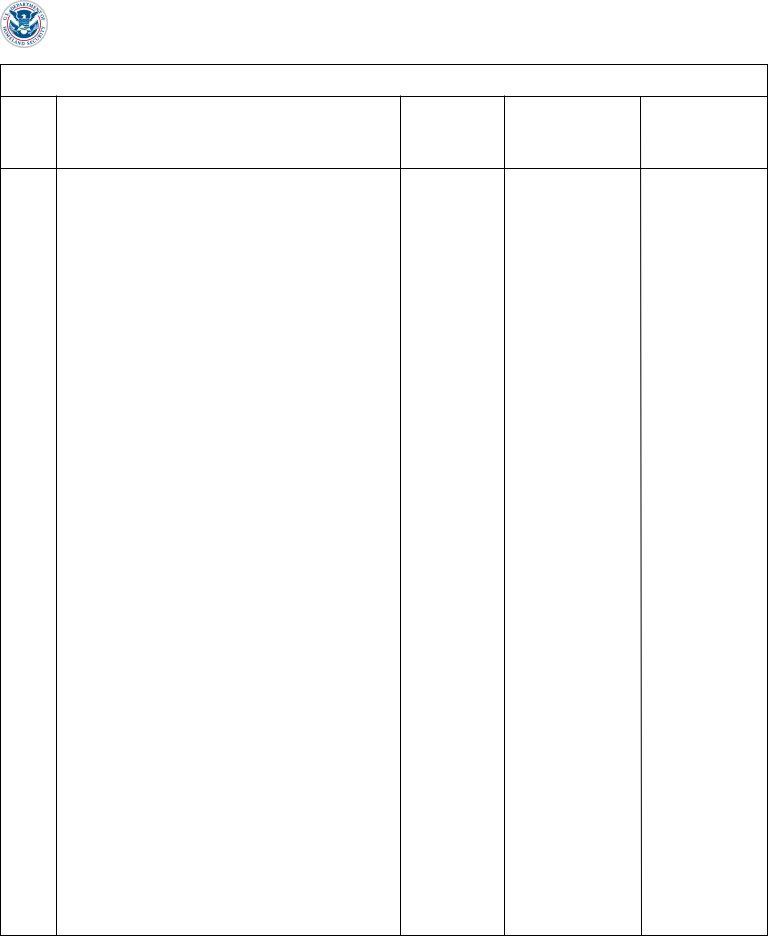

5. This very last section to finish this document is integral. Be sure you fill in the required fields, and this includes , before using the file. Neglecting to do this might generate a flawed and possibly invalid paper!

Step 3: Prior to finishing this file, it's a good idea to ensure that all blanks are filled in properly. When you’re satisfied with it, click “Done." Try a free trial subscription at FormsPal and acquire direct access to entry summary template - which you are able to then work with as you want inside your FormsPal account page. FormsPal guarantees your information privacy by using a protected method that never records or shares any kind of sensitive information used in the PDF. You can relax knowing your files are kept safe any time you use our services!