When using the online PDF tool by FormsPal, you're able to fill in or modify kentucky 1 765 form here and now. FormsPal development team is constantly working to enhance the editor and help it become even easier for clients with its multiple features. Unlock an endlessly revolutionary experience today - take a look at and find new possibilities along the way! To get the ball rolling, take these easy steps:

Step 1: Click on the "Get Form" button above on this page to access our PDF tool.

Step 2: With the help of this state-of-the-art PDF editor, you'll be able to do more than simply fill in blanks. Express yourself and make your docs seem perfect with custom textual content put in, or adjust the file's original content to perfection - all that accompanied by the capability to insert almost any photos and sign the file off.

This document requires some specific details; in order to ensure accuracy, you need to pay attention to the following suggestions:

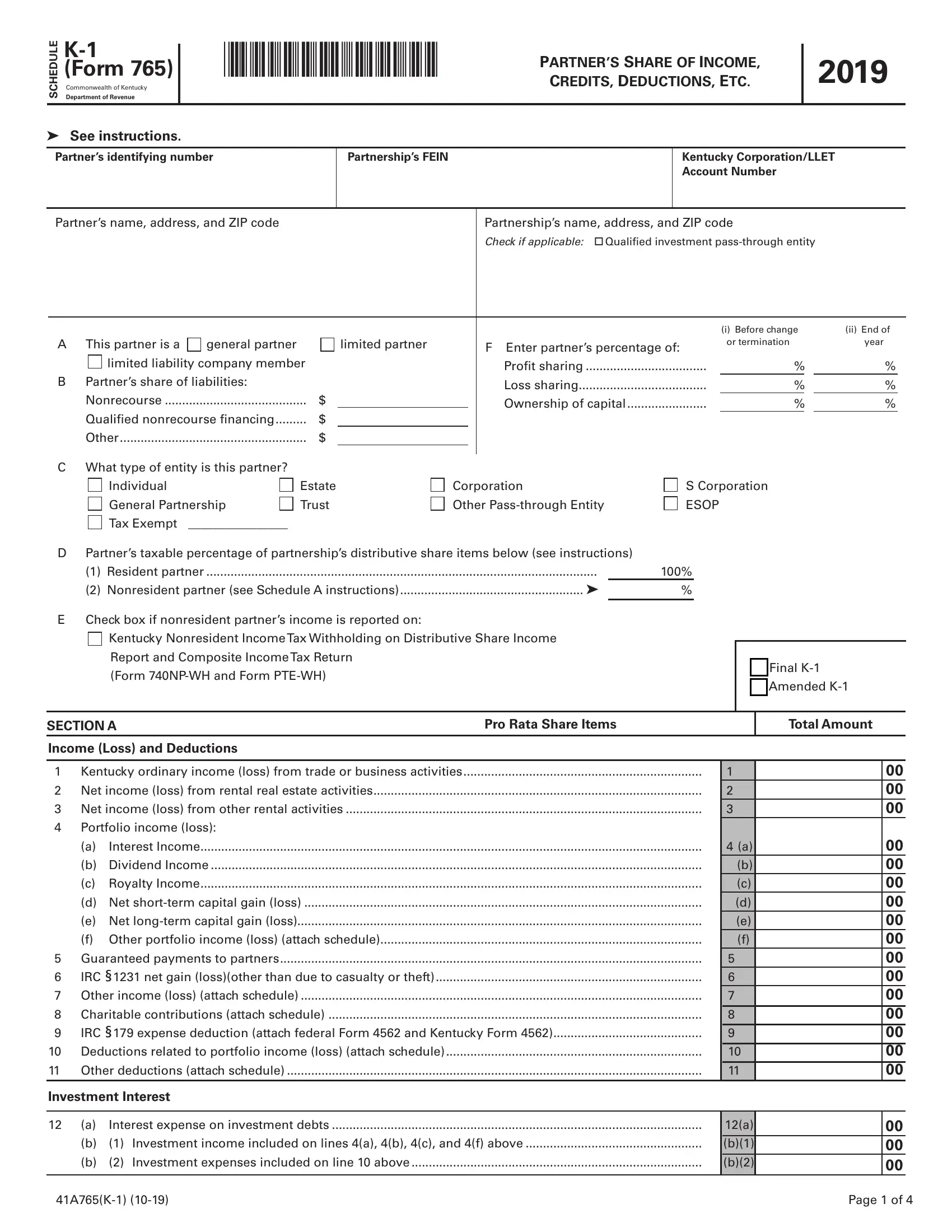

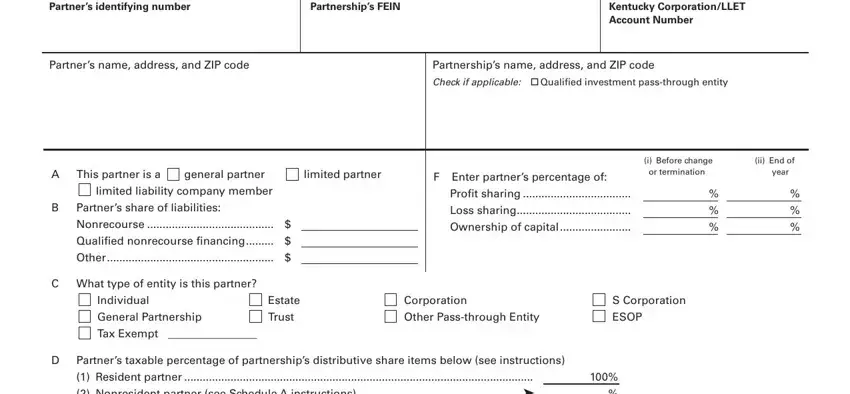

1. The kentucky 1 765 form needs certain details to be inserted. Ensure that the following fields are filled out:

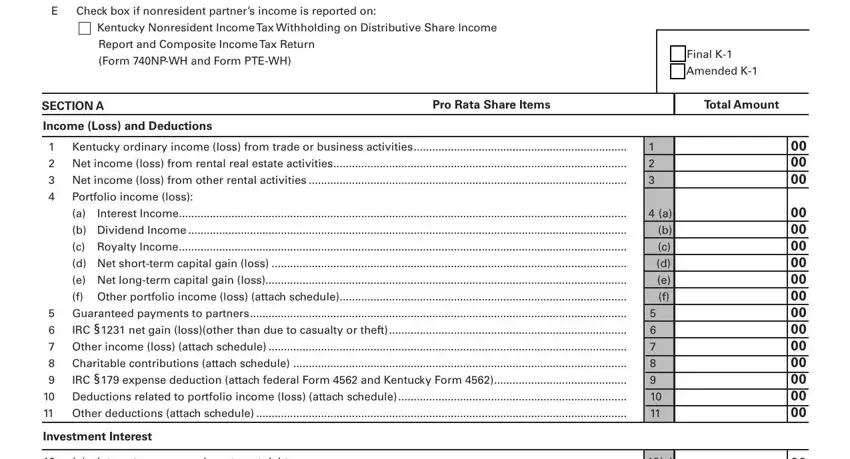

2. After filling out this part, head on to the subsequent stage and fill in the essential particulars in all these blanks - Check box if nonresident partners, Kentucky Nonresident Income Tax, Report and Composite Income Tax, Form NPWH and Form PTEWH, Final K Amended K, SECTION A, Income Loss and Deductions, Pro Rata Share Items, Total Amount, Kentucky ordinary income loss, Net income loss from rental real, Net income loss from other rental, Portfolio income loss, Interest Income, and b Dividend Income.

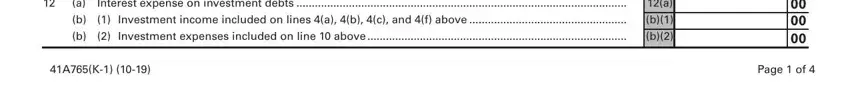

3. Completing Interest expense on investment, Investment income included on, Investment expenses included on, and Page of is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

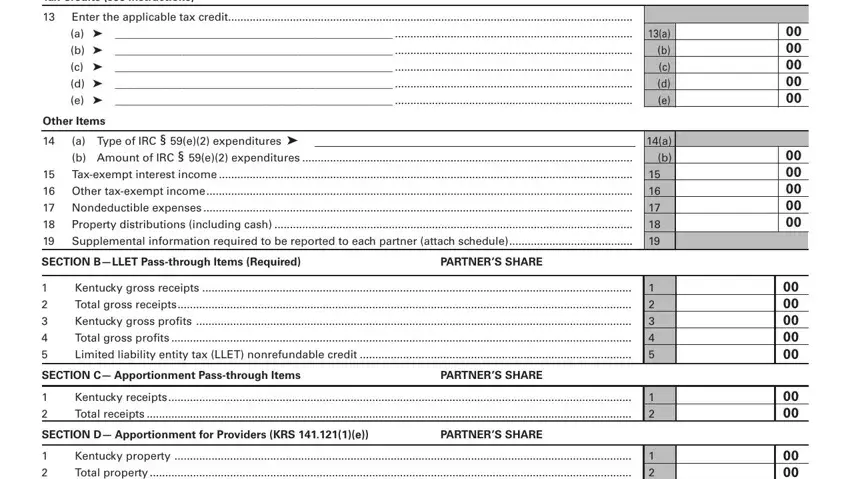

4. The subsequent paragraph needs your information in the following areas: Tax Credits see instructions, Enter the applicable tax credit a, Other Items, a Type of IRC e expenditures b, Other taxexempt income, Nondeductible expenses, Property distributions including, Supplemental information required, SECTION BLLET Passthrough Items, PARTNERS SHARE, Kentucky gross receipts, Total gross receipts, Kentucky gross profits, Total gross profits, and Limited liability entity tax LLET. Remember to provide all of the requested information to go further.

It's very easy to make an error while filling out your Kentucky gross profits, hence make sure you go through it again prior to when you submit it.

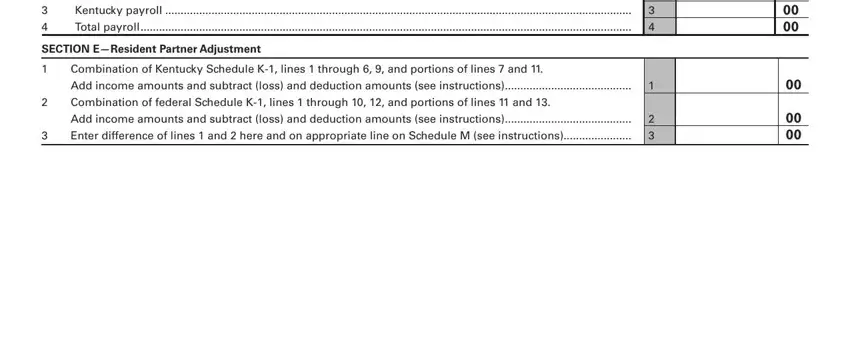

5. When you reach the final sections of the file, there are a few more things to complete. Specifically, Total property, Kentucky payroll, Total payroll, SECTION EResident Partner, Combination of Kentucky Schedule K, Add income amounts and subtract, Combination of federal Schedule K, Add income amounts and subtract, and Enter difference of lines and should be filled in.

Step 3: Before getting to the next stage, it's a good idea to ensure that all blanks are filled out correctly. As soon as you are satisfied with it, click on “Done." Right after setting up afree trial account with us, it will be possible to download kentucky 1 765 form or email it without delay. The document will also be readily available in your personal account with your every single modification. FormsPal guarantees protected document editor devoid of data recording or any sort of sharing. Be assured that your details are safe here!