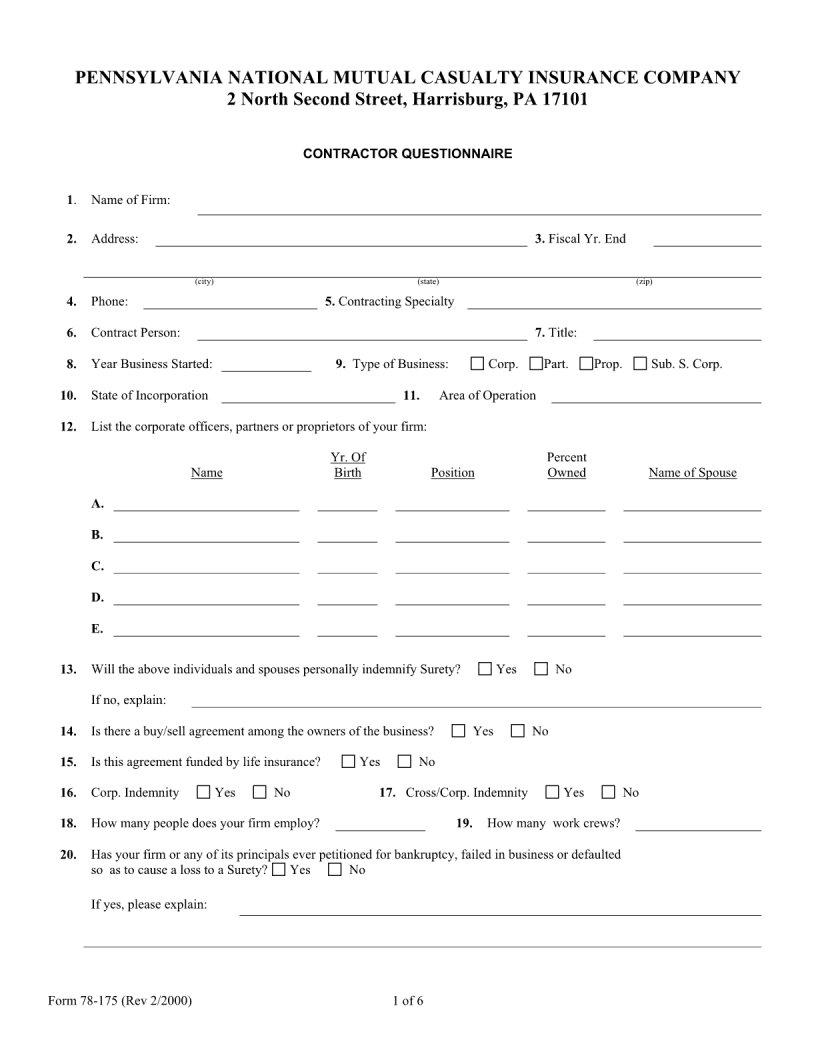

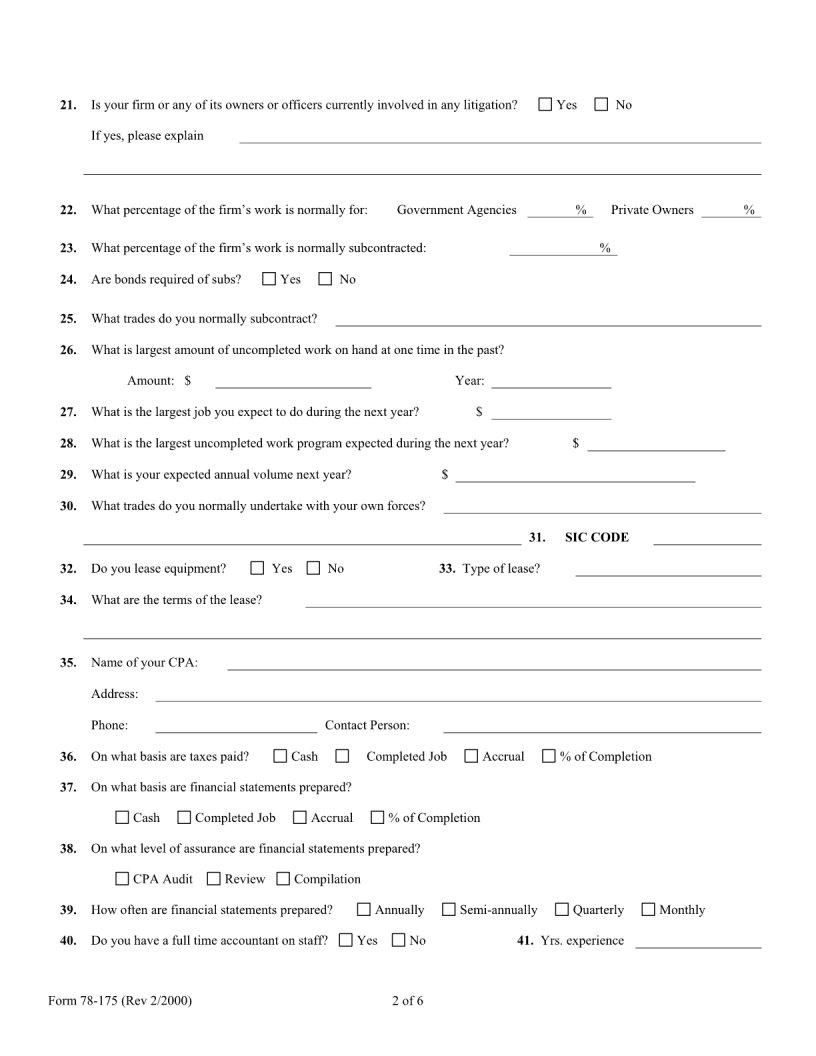

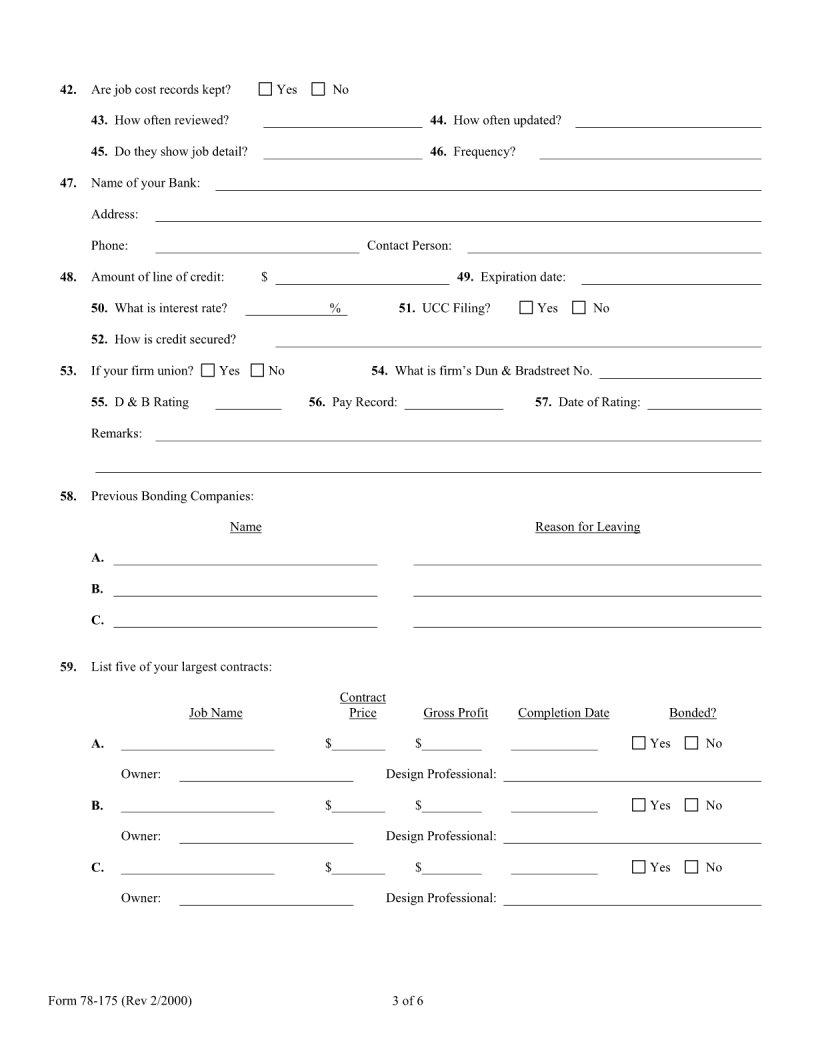

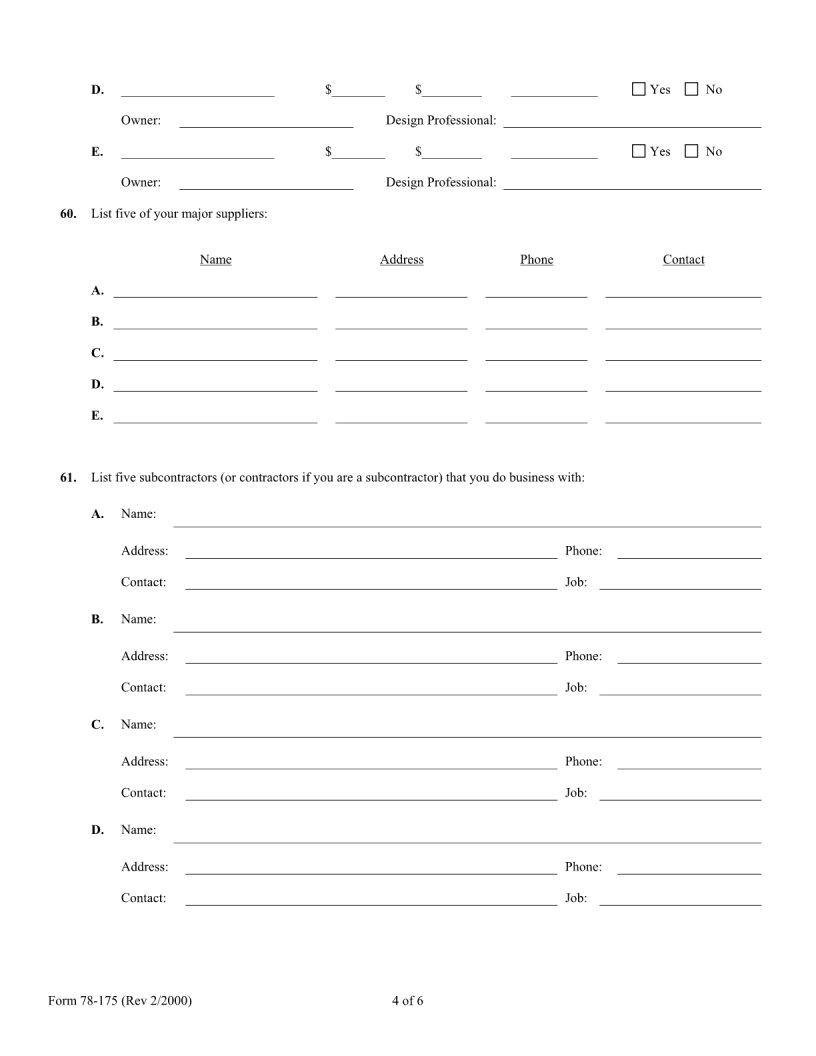

For individuals seeking approval for certain activities or transactions, the 78 175 form serves as a crucial document, facilitating a seamless process in achieving compliance with specific regulatory requirements. This document, while might appear daunting at first, is designed to ensure that all necessary information is collected efficiently to aid in the evaluation process. Covering a range of questions and sections, the form demands meticulous attention to detail from the applicant, ensuring that every relevant piece of data is accurately captured and presented. With its comprehensive structure, the form acts as a bridge between the applicant and the authoritative body, streamlining the approval process by setting a standardized protocol for the submission of information. Understanding and completing the 78 175 form accurately not only expedites the assessment process but also significantly enhances the chances of obtaining the desired approval, making it an indispensable tool in navigating the complexities of regulatory compliance.

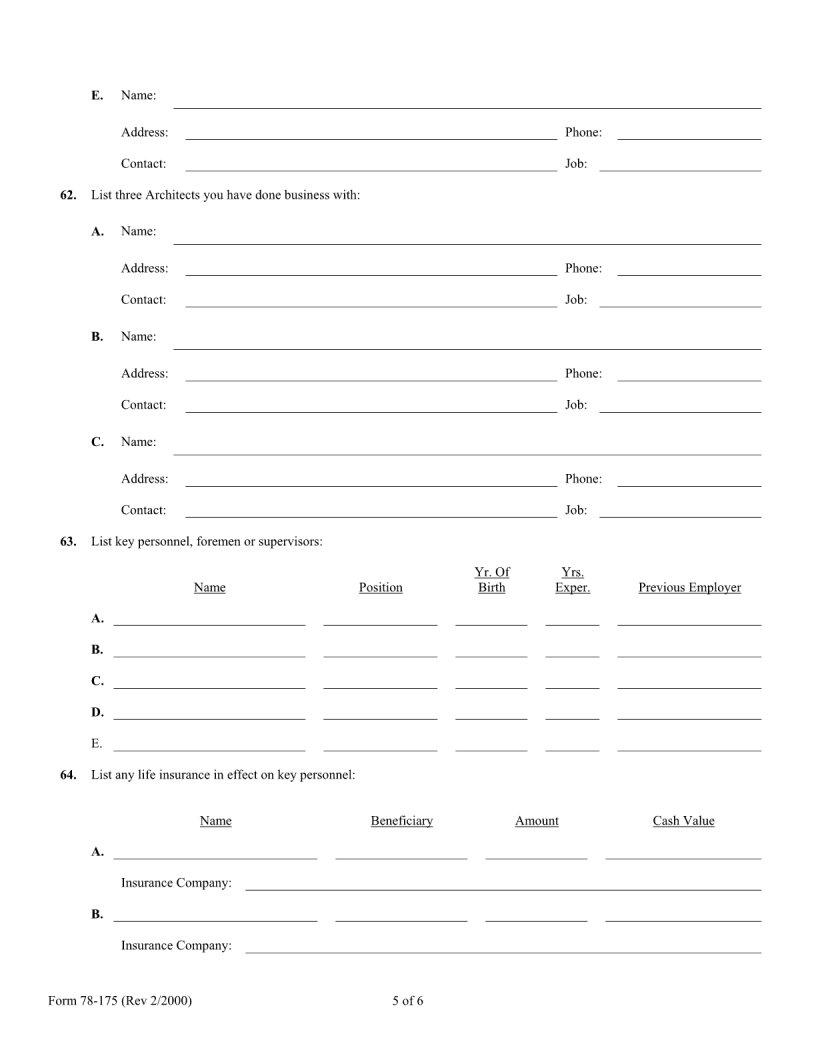

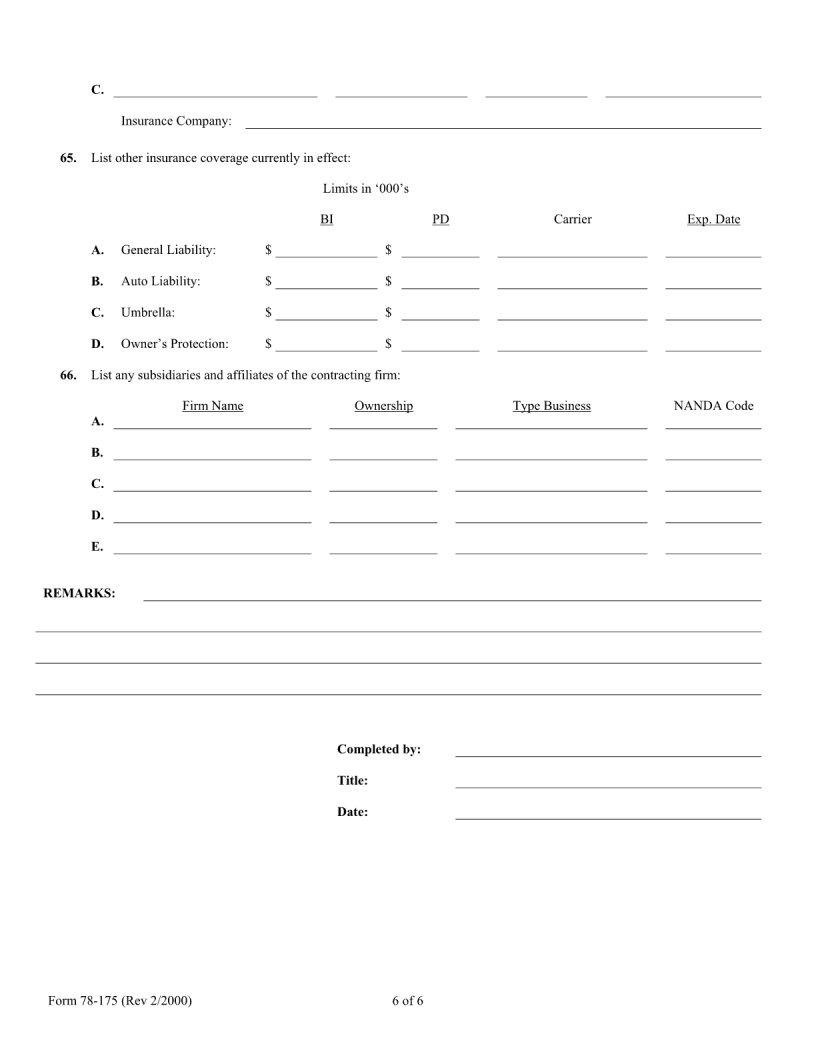

| Question | Answer |

|---|---|

| Form Name | Form 78 175 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | CPA, UCC, Bradstreet, Exp |