The Form 80-320-12-8-1-000, revised on August 2, 2012, is an essential document for Mississippi taxpayers that serves to calculate interest and penalties associated with individual income tax filings. This form is specifically designed for situations where a taxpayer's Mississippi Income Tax Liability for the year 2012 exceeds $200, necessitating a detailed calculation of interest due on underpayments of estimated tax, alongside late payment interest and penalties. Taxpayers, including both residents and non-residents or part-year residents filing a Resident Individual Income Tax Return (Form 80-105) or a Non-Resident/Part-Year Resident Return (Form 80-205), find this worksheet indispensable for ensuring compliance with state tax regulations. Detailed instructions enable taxpayers to accurately enter their 2012 income tax liability, apply the necessary multipliers, and deduct withholdings to compute the estimated tax shortfall. Subsequent sections guide the calculation of interest on these underpayments, factoring in the various due dates throughout the fiscal year, and the application of penalties for late filings and payments. The incorporation of both fixed minimum penalties and percentage-based charges underscores the importance of timely and accurate tax payment and reporting. The form culminates in the consolidation of all interest and penalties, including those on underpayments, into a total amount due— a critical figure to be transferred to the main tax return forms, thereby streamlining the process for both taxpayers and the Mississippi Department of Revenue.

| Question | Answer |

|---|---|

| Form Name | Form 80 320 12 8 1 000 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 80 320, Subtract, 4th, aggregate |

Form

Mississippi

Individual Income Tax

Interest and Penalty Worksheet

Taxpayer Last Name |

First Name |

|

|

Middle Initial |

|

|

|

|

|

|

|

Spouse Last Name |

Spouse First Name |

|

|

Middle Initial |

|

|

|

|

|

|

|

Mailing Address (Number & Street, Including Rural Route) |

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

YOU MUST ENTER SSN

SSN __ __ __ - __ __ - __ __ __ __

Spouse

SSN __ __ __ - __ __ - __ __ __ __

Residence County Code |

__ __ |

See Instructions Form |

|

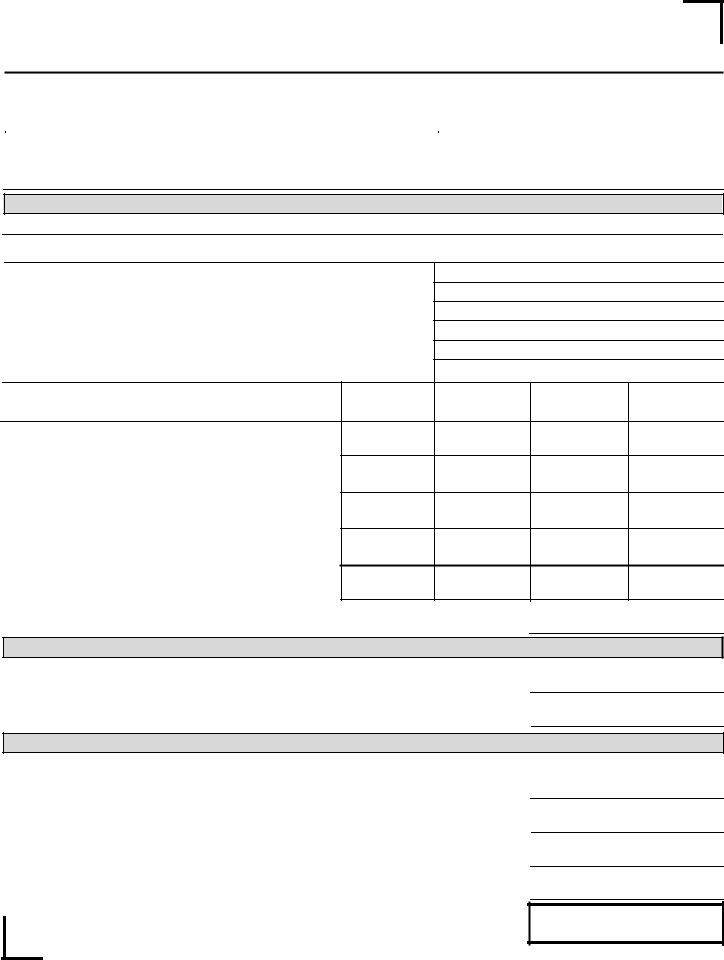

INTEREST OF UNDERPAYMENT OF ESTIMATED TAX

If 2012 Mississippi Income Tax Liability is $200 or less, do not complete this section. Go to Line 13. See specific line instructions.

CALCULATION OF ESTIMATE PAYMENT

1.2012 Mississippi Income Tax Liability (See Instructions)

2.Multiply the amount on Line 1 by 80% and enter the result.

3.2011 Mississippi Income Tax Liability (See Instructions)

4.Enter the Lesser of Line 2 or Line 3 (See Instructions).

5.Enter the amount of your 2012 Mississippi Withholding.

6.Subtract Line 5 from Line 4 and enter the result.

|

(a) |

(b) |

(c) |

(d) |

|

INTEREST CALCULATION |

15th of 4th month of |

15th of 6th month of |

15th of 9th month of |

15th day of 1st month |

|

year |

year |

year |

after close of year |

||

|

7.Enter 25% of Line 6 in Column (a), (b), (c) and (d).

8.Enter TOTAL estimated tax paid as of payment due dates.

9.Underestimate subject to interest.

Subtract Line 8 from Line 7. (If negative amount, enter zero).

10.Enter percentage of interest in each column.

Compute interest at the rate of 1% per month from payment due date until paid or next payment due date, whichever is earlier.

11.Interest Due Multiply Line 9 by Line 10 and enter the result.

12.Total Underestimate Interest Due

Enter the total of Line 11, Columns (a), (b), (c), and (d).

LATE FILING PENALTY CALCULATION

13. Enter Total Income Tax Due

From Page 1, Line 22, Form

14.Late Filing Penalty (See Instructions) Compute penalty at the rate of 5% per month not to exceed 25% in the aggregate from the extended due date of the return on the amount of tax due (Line 13). Minimum $100.

LATE PAYMENT INTEREST AND PENALTY CALCULATION

15.Enter Balance Due

From Page 1, Line 36, Form

16. Late Payment Interest (See Instructions)

Compute interest at the rate of 1% per month from the original due date of the return on the amount of tax due (Line 15).

17.Late Payment Penalty (See Instructions) Compute penalty at the rate of 1/2% per month not to exceed 25% in the aggregate from the original due date of the return on amount of tax due (Line 15).

18.Total Late Payment Interest and Penalty

Sum of Lines 16 and 17.

19. Total Interest and Penalty Including Interest on Underpayment of Estimated Tax

Sum of Lines 12, 14 and 18. Enter total here and on Form

Page 1, Line 36 (Non- Resident /

Form

Mississippi

Individual Income Tax

Interest and Penalty Worksheet Instructions

Use Form

Specific Line Instructions

Underestimate

Line 1 Enter Your 2012 Mississippi Income Tax Liability from Form

Line 3 Enter Your 2011 Mississippi Income Tax Liability from Form

Line 4 Enter the lesser of Line 2 or Line 3. If Line 3 is zero and your 2012 Mississippi Income Tax Liability (Line 2) exceeds $200 and no estimate payments for the 2012 tax year were made, enter the amount from Line 2.

Late Filing Penalty

Line 14 Enter Late Filing Penalty Due. Add penalty of 5% per month, not to exceed 25% in the aggregate, from the extension due date of the return, October 15th, on the amount of tax due in Line 13. The penalty shall not be less than $100.

Late Payment Interest and Penalty

Line 16 Enter Late Payment Interest Due. Add interest of 1% per month from the original due date of the return, April 15th, on the amount of tax due from Line 15.

Line 17 Enter Late Payment Penalty Due. Add penalty of 1/2% per month, not to exceed 25% in the aggregate, from the original due date of the return, April 15th, on the amount of tax due from Line 15.