Form 801—General Information

(Application for Reinstatement and Request to Set Aside Tax Forfeiture)

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant code provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist.

Commentary

This form may be used to complete the final step for reinstating a domestic or foreign filing entity that has been forfeited or revoked by the secretary of state under chapter 171, Tax Code. Before submitting this form, an entity seeking reinstatement must: (1) file with the comptroller of public accounts each delinquent report that is required by chapter 171; and (2) pay the tax, penalty, and interest imposed by the Tax Code and due at the time the request to set aside forfeiture is made.

Do Not Use This Form If:

クThe entity was voluntarily terminated. See Form 811.

クThe existence or registration was terminated or revoked by the secretary of state for a reason other than tax forfeiture. See Forms 811, 814.

クThe entity was terminated or revoked by court order.

ン Time Frame for Reinstatement ン

The request to set aside forfeiture may be submitted at any time after forfeiture so long as the entity would otherwise have continued to exist.

Persons Authorized to Submit Application for Reinstatement

クFor-profit or professional corporation: shareholder, director, or officer at the time of forfeiture.

クProfessional association: shareholder, member, director, or officer at the time of forfeiture.

クNonprofit corporation: director, officer, or member at the time of forfeiture.

クLimited liability company: member or manager at the time of forfeiture.

クLimited partnership: partner at the time of forfeiture.

クStatutory or business trust: trustee or beneficial owner at the time of forfeiture.

Registered Agent & Office Updates

Filing entities must maintain accurate registered agent and office information on file with the secretary of state. Neither tax filings nor this application for reinstatement can be used to update the registered agent and office information; rather updates to the registered agent and office require an additional filing. See Form 401.

Instructions for Form

クItem 1—Entity Name: Set forth the legal name of the entity as stated in its certificate of formation or registration. If the entity is a foreign filing entity that was granted authority to transact business under a different name, then also set forth the assumed name under which the foreign filing entity was registered to transact business.

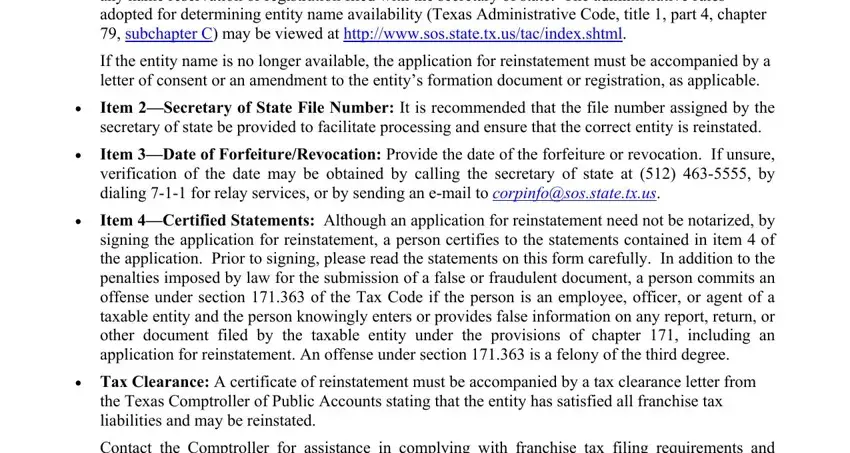

クEntity Name Availability: The reinstatement cannot be filed if the name of the entity is the same as, deceptively similar to, or similar to the name of any existing domestic or foreign filing entity, or

any name reservation or registration filed with the secretary of state. The administrative rules adopted for determining entity name availability (Texas Administrative Code, title 1, part 4, chapter 79, subchapter C) may be viewed at http://www.sos.state.tx.us/tac/index.shtml.

If the entity name is no longer available, the application for reinstatement must be accompanied by a letter of consent or an amendment to the entity’s formation document or registration, as applicable.

クItem 2—Secretary of State File Number: It is recommended that the file number assigned by the secretary of state be provided to facilitate processing and ensure that the correct entity is reinstated.

クItem 3—Date of Forfeiture/Revocation: Provide the date of the forfeiture or revocation. If unsure, verification of the date may be obtained by calling the secretary of state at (512) 463-5555, by dialing 7-1-1 for relay services, or by sending an e-mail to corpinfo@sos.state.tx.us.

クItem 4—Certified Statements: Although an application for reinstatement need not be notarized, by signing the application for reinstatement, a person certifies to the statements contained in item 4 of the application. Prior to signing, please read the statements on this form carefully. In addition to the penalties imposed by law for the submission of a false or fraudulent document, a person commits an offense under section 171.363 of the Tax Code if the person is an employee, officer, or agent of a taxable entity and the person knowingly enters or provides false information on any report, return, or other document filed by the taxable entity under the provisions of chapter 171, including an application for reinstatement. An offense under section 171.363 is a felony of the third degree.

クTax Clearance: A certificate of reinstatement must be accompanied by a tax clearance letter from the Texas Comptroller of Public Accounts stating that the entity has satisfied all franchise tax liabilities and may be reinstated.

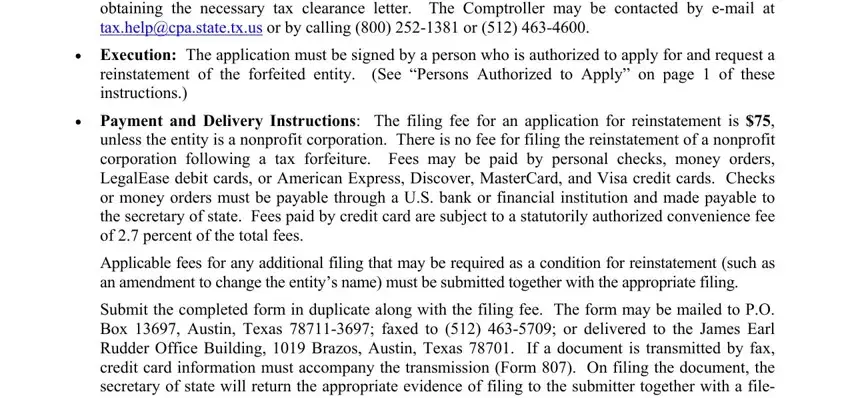

Contact the Comptroller for assistance in complying with franchise tax filing requirements and obtaining the necessary tax clearance letter. The Comptroller may be contacted by e-mail at tax.help@cpa.state.tx.us or by calling (800) 252-1381 or (512) 463-4600.

クExecution: The application must be signed by a person who is authorized to apply for and request a reinstatement of the forfeited entity. (See “Persons Authorized to Apply” on page 1 of these instructions.)

クPayment and Delivery Instructions: The filing fee for an application for reinstatement is $75, unless the entity is a nonprofit corporation. There is no fee for filing the reinstatement of a nonprofit corporation following a tax forfeiture. Fees may be paid by personal checks, money orders, LegalEase debit cards, or American Express, Discover, MasterCard, and Visa credit cards. Checks or money orders must be payable through a U.S. bank or financial institution and made payable to the secretary of state. Fees paid by credit card are subject to a statutorily authorized convenience fee of 2.7 percent of the total fees.

Applicable fees for any additional filing that may be required as a condition for reinstatement (such as an amendment to change the entity’s name) must be submitted together with the appropriate filing.

Submit the completed form in duplicate along with the filing fee. The form may be mailed to P.O. Box 13697, Austin, Texas 78711-3697; faxed to (512) 463-5709; or delivered to the James Earl Rudder Office Building, 1019 Brazos, Austin, Texas 78701. If a document is transmitted by fax, credit card information must accompany the transmission (Form 807). On filing the document, the secretary of state will return the appropriate evidence of filing to the submitter together with a file- stamped copy of the document, if a duplicate copy was provided as instructed.

Revised 05/11

Form 801 (Revised 05/11)

Submit in duplicate to: Secretary of State P.O. Box 13697 Austin, TX 78711-3697

512463-5555 FAX: 512 463-5709

Filing Fee: See instructions

This space reserved for office use.

Application for Reinstatement

And Request to Set Aside

Tax Forfeiture

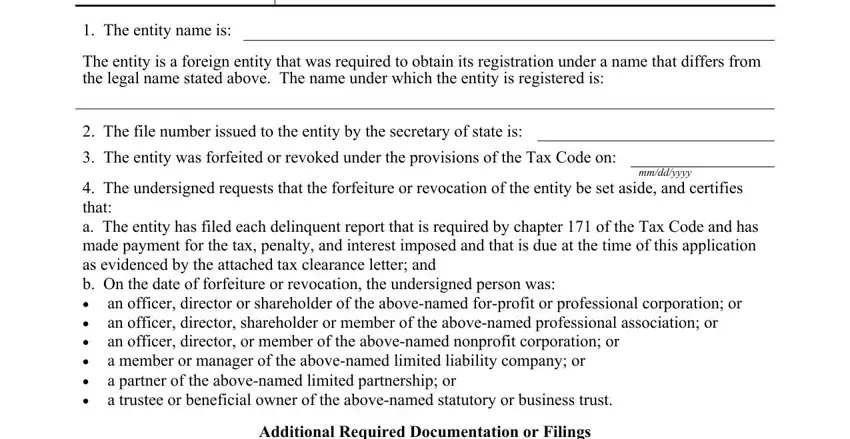

1. The entity name is:

The entity is a foreign entity that was required to obtain its registration under a name that differs from the legal name stated above. The name under which the entity is registered is:

2.The file number issued to the entity by the secretary of state is:

3.The entity was forfeited or revoked under the provisions of the Tax Code on:

mm/dd/yyyy

4.The undersigned requests that the forfeiture or revocation of the entity be set aside, and certifies that:

a. The entity has filed each delinquent report that is required by chapter 171 of the Tax Code and has made payment for the tax, penalty, and interest imposed and that is due at the time of this application as evidenced by the attached tax clearance letter; and

b. On the date of forfeiture or revocation, the undersigned person was:

ク an officer, director or shareholder of the above-named for-profit or professional corporation; or ク an officer, director, shareholder or member of the above-named professional association; or

ク an officer, director, or member of the above-named nonprofit corporation; or ク a member or manager of the above-named limited liability company; or

ク a partner of the above-named limited partnership; or

ク a trustee or beneficial owner of the above-named statutory or business trust.

Additional Required Documentation or Filings

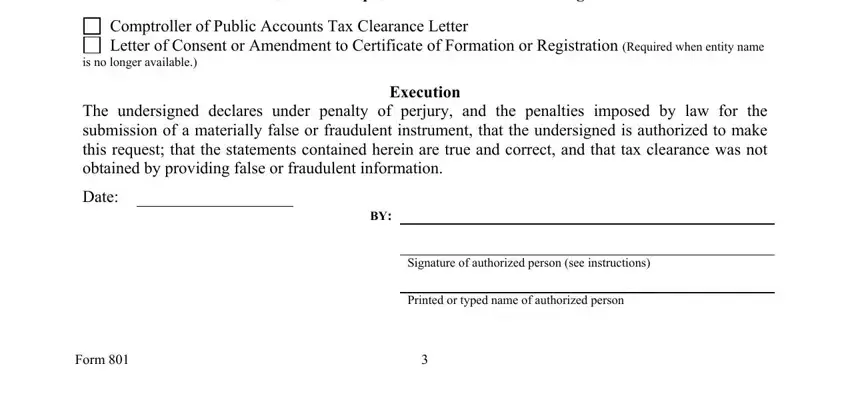

Comptroller of Public Accounts Tax Clearance Letter

Letter of Consent or Amendment to Certificate of Formation or Registration (Required when entity name

is no longer available.)

Execution

The undersigned declares under penalty of perjury, and the penalties imposed by law for the submission of a materially false or fraudulent instrument, that the undersigned is authorized to make this request; that the statements contained herein are true and correct, and that tax clearance was not obtained by providing false or fraudulent information.

Date:

BY:

Signature of authorized person (see instructions)

Printed or typed name of authorized person