form 8027 can be filled out without any problem. Just open FormsPal PDF editing tool to do the job without delay. Our tool is consistently developing to grant the very best user experience possible, and that is due to our dedication to continual enhancement and listening closely to testimonials. Here is what you'll want to do to get started:

Step 1: Hit the "Get Form" button in the top area of this webpage to open our editor.

Step 2: Once you launch the file editor, you will see the document made ready to be filled out. Aside from filling out different blanks, you can also do various other things with the PDF, including writing custom text, editing the initial textual content, adding images, putting your signature on the form, and more.

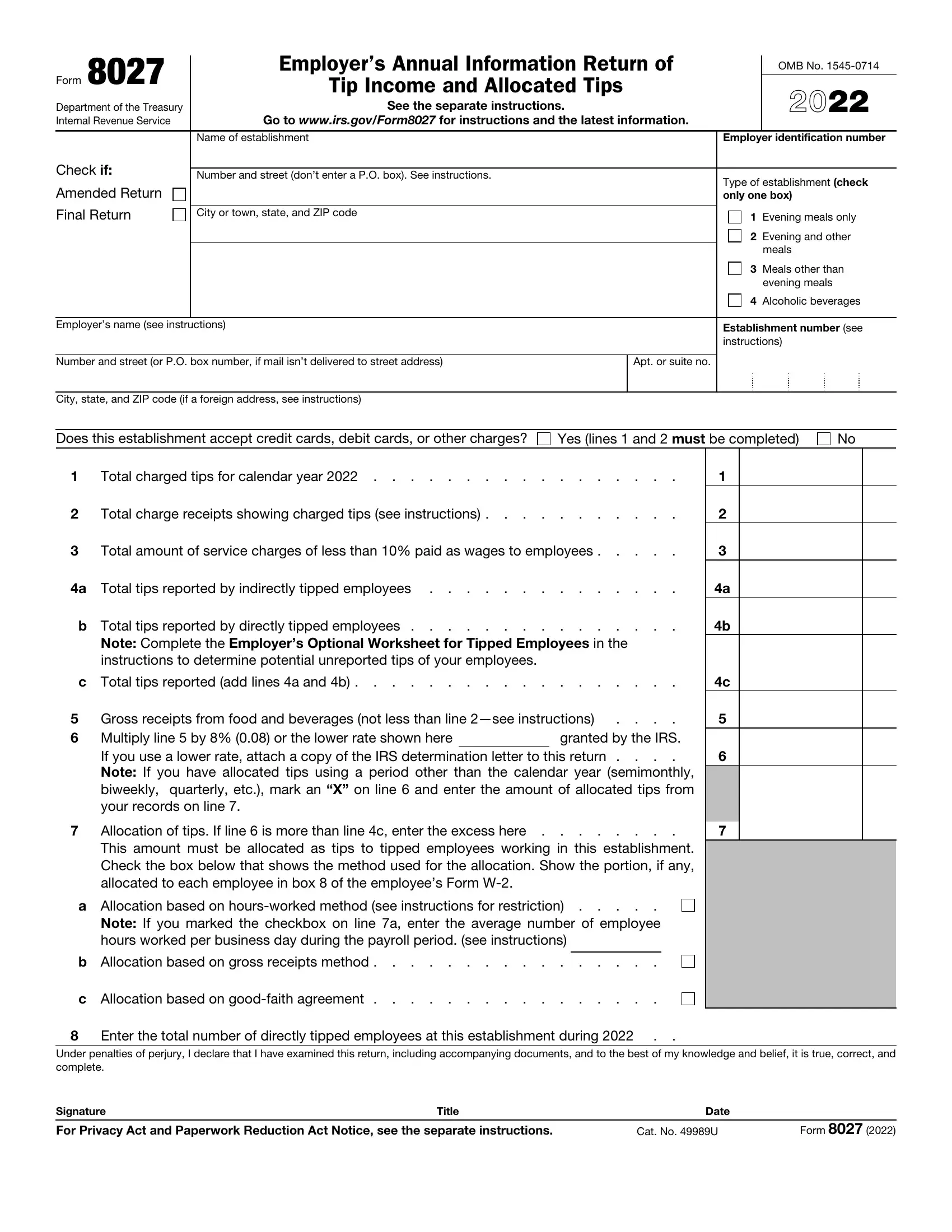

As for the blanks of this specific document, here is what you should know:

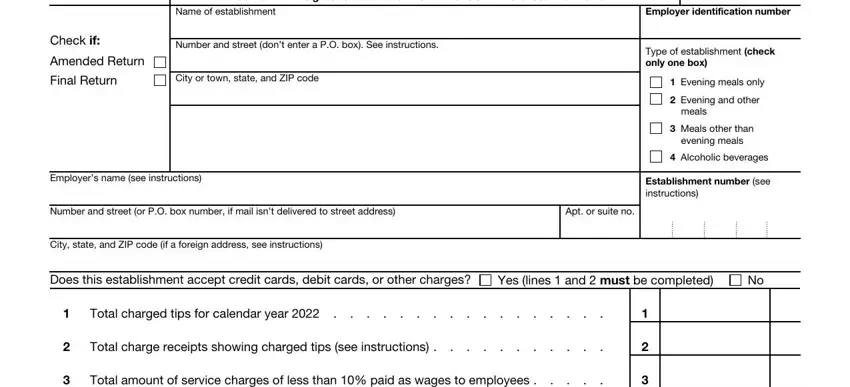

1. You have to complete the form 8027 accurately, therefore be mindful when filling in the sections comprising these particular blanks:

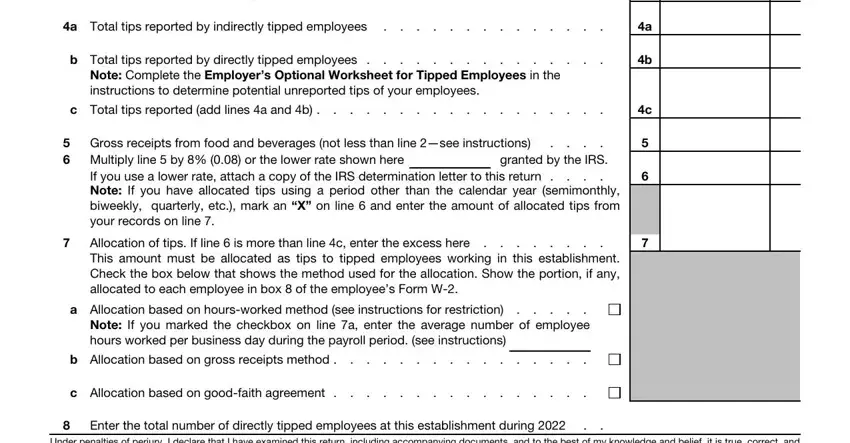

2. Once your current task is complete, take the next step – fill out all of these fields - Total amount of service charges of, a Total tips reported by, b Total tips reported by directly, Note Complete the Employers, c Total tips reported add lines a, Gross receipts from food and, granted by the IRS, If you use a lower rate attach a, Allocation of tips If line is, a Allocation based on hoursworked, Note If you marked the checkbox on, b Allocation based on gross, c Allocation based on goodfaith, Enter the total number of directly, and Under penalties of perjury I with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Lots of people generally make errors while filling in Gross receipts from food and in this part. Ensure that you read again what you enter here.

3. This third part is normally easy - fill in every one of the blanks in Signature, Title, Date, For Privacy Act and Paperwork, Cat No U, and Form in order to finish the current step.

Step 3: Once you've reviewed the details in the file's blank fields, simply click "Done" to complete your form at FormsPal. Grab the form 8027 once you register here for a 7-day free trial. Conveniently use the form in your FormsPal account, together with any modifications and adjustments being conveniently preserved! We do not sell or share any information that you provide while filling out documents at FormsPal.