You could complete form 8082 aar effortlessly with the help of our PDFinity® editor. FormsPal team is ceaselessly working to improve the editor and ensure it is much easier for people with its extensive features. Take full advantage of the latest innovative opportunities, and discover a heap of emerging experiences! With some simple steps, you'll be able to start your PDF journey:

Step 1: Firstly, open the editor by pressing the "Get Form Button" at the top of this site.

Step 2: Using our state-of-the-art PDF editor, it is easy to accomplish more than merely complete blank form fields. Edit away and make your documents look high-quality with customized text added, or tweak the original content to perfection - all that comes with the capability to add stunning graphics and sign the PDF off.

Filling out this form requires attention to detail. Make sure that every single blank is filled in correctly.

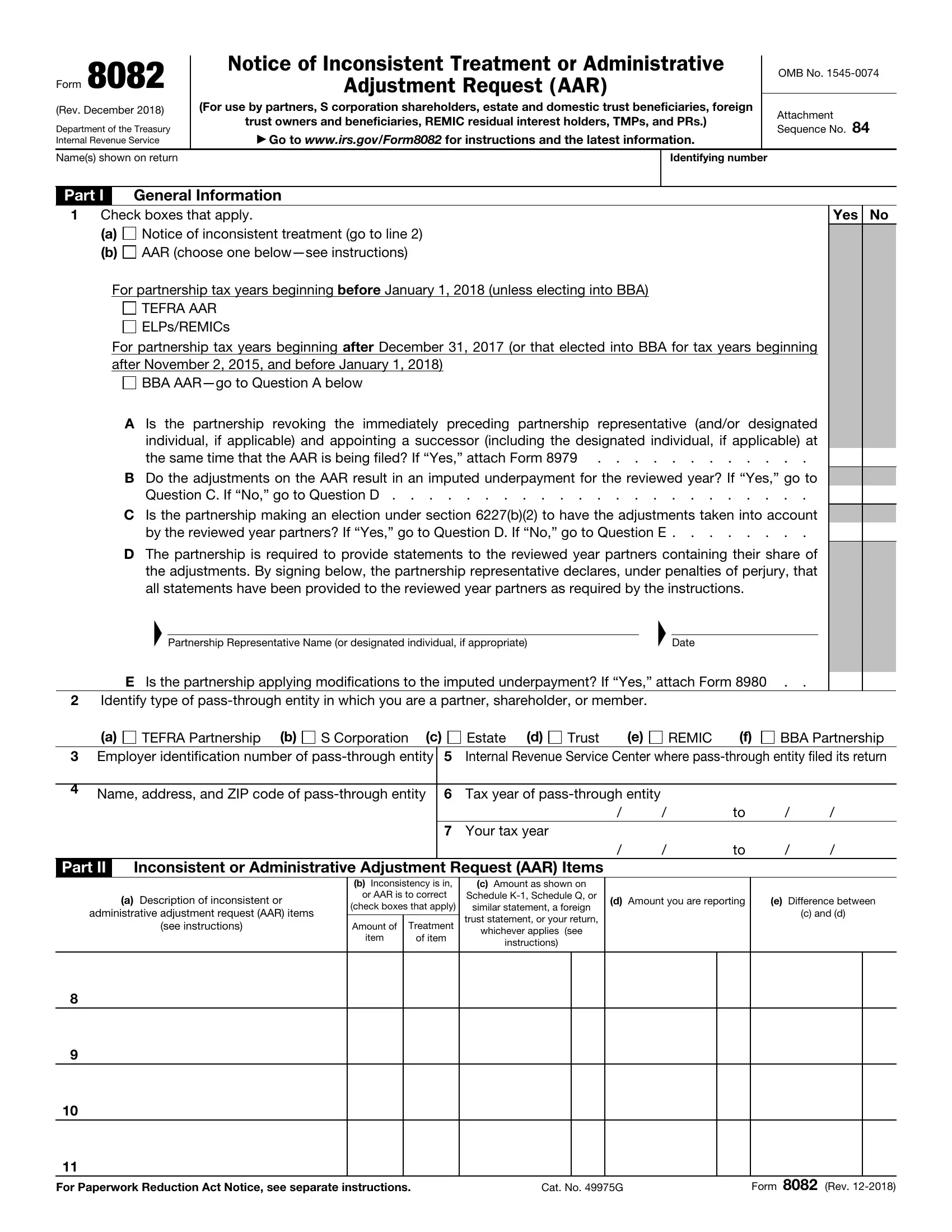

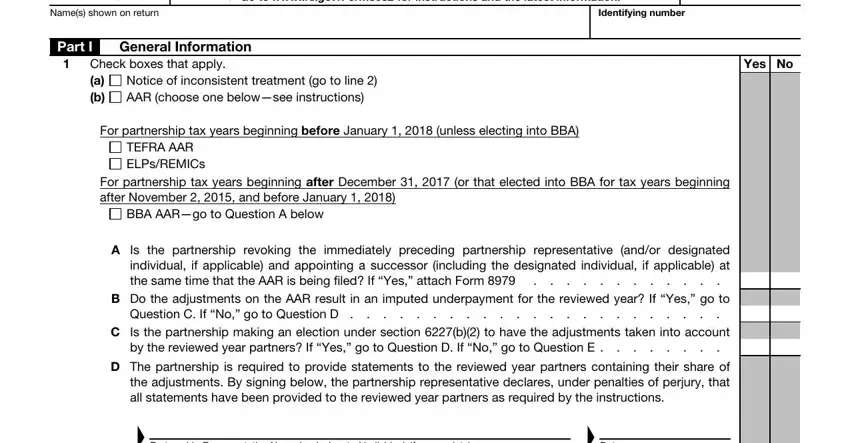

1. When submitting the form 8082 aar, be sure to complete all of the important blank fields within the corresponding section. This will help to speed up the work, enabling your details to be processed without delay and appropriately.

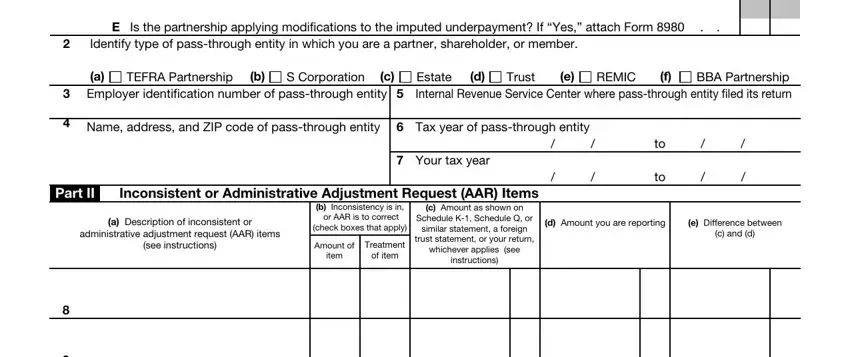

2. After this part is complete, you're ready include the needed details in E Is the partnership applying, Identify type of passthrough, TEFRA Partnership, a Employer identification number, S Corporation, Estate, BBA Partnership Internal Revenue, REMIC, Trust, Name address and ZIP code of, Tax year of passthrough entity, Your tax year, Part II, Inconsistent or Administrative, and b Inconsistency is in so you're able to go further.

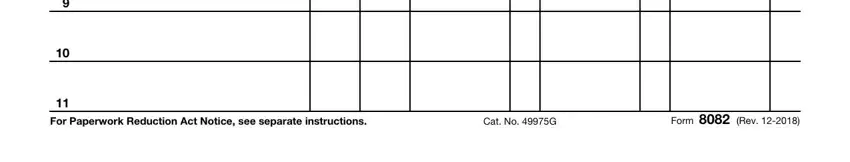

3. The following section is all about For Paperwork Reduction Act Notice, Cat No G, and Form Rev - fill out all of these blank fields.

It's easy to make a mistake while completing the Cat No G, hence you'll want to go through it again before you finalize the form.

4. Filling out ExplanationsEnter the Part II item is essential in this next section - you should definitely take the time and take a close look at each and every blank area!

5. The pdf should be finalized with this particular segment. Below there can be found a detailed set of blank fields that require accurate information in order for your form submission to be faultless: .

Step 3: Always make sure that the information is correct and press "Done" to finish the task. After starting a7-day free trial account here, it will be possible to download form 8082 aar or email it right off. The form will also be readily available from your personal account with your each and every modification. At FormsPal.com, we endeavor to make certain that all your information is stored secure.