Whenever you desire to fill out Form 8385, you don't have to download and install any kind of software - just use our online tool. In order to make our editor better and less complicated to work with, we consistently implement new features, with our users' feedback in mind. By taking some basic steps, it is possible to start your PDF journey:

Step 1: Open the PDF in our editor by clicking the "Get Form Button" in the top area of this page.

Step 2: After you start the editor, you'll see the form ready to be completed. Aside from filling out various fields, you may also do many other things with the Document, including adding custom textual content, editing the initial text, adding images, affixing your signature to the document, and much more.

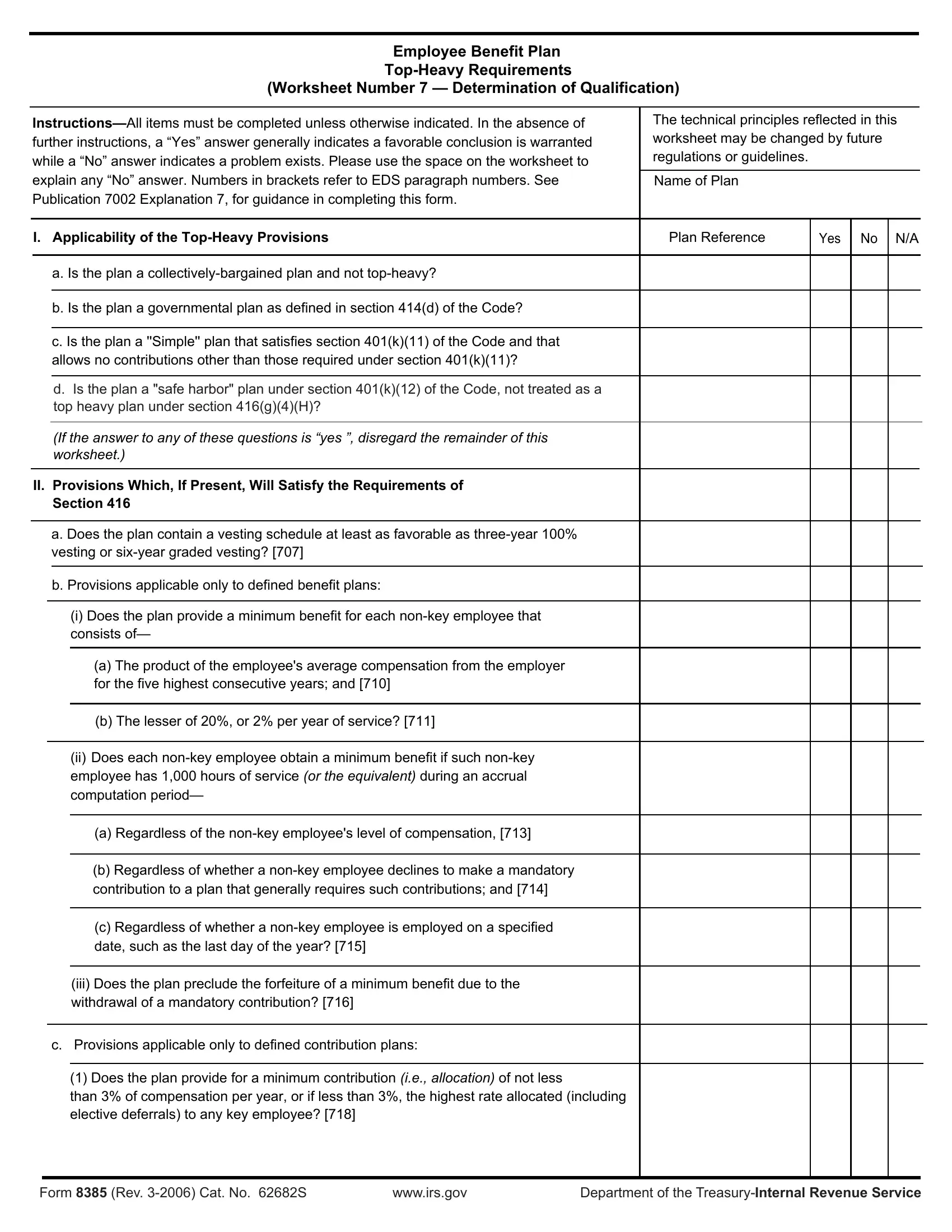

As for the blank fields of this particular PDF, here's what you should do:

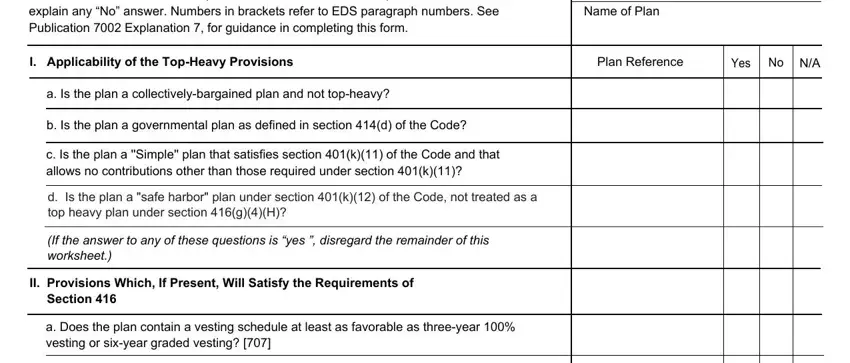

1. Before anything else, while completing the Form 8385, start in the section that includes the following blanks:

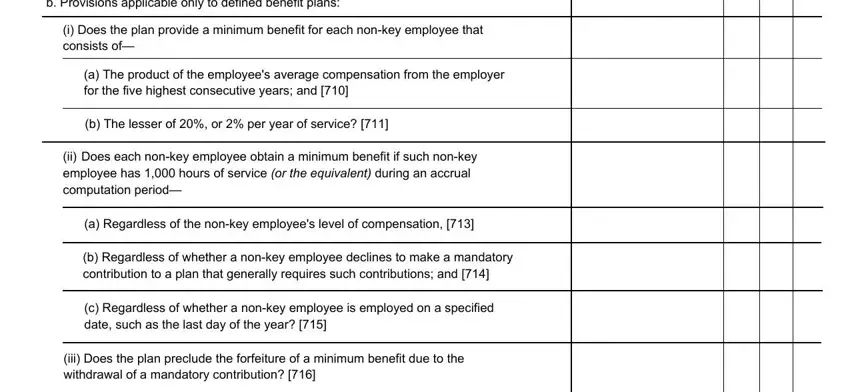

2. Right after the first section is completed, go on to enter the relevant information in all these: b Provisions applicable only to, i Does the plan provide a minimum, a The product of the employees, b The lesser of or per year of, ii Does each nonkey employee, a Regardless of the nonkey, b Regardless of whether a nonkey, c Regardless of whether a nonkey, and iii Does the plan preclude the.

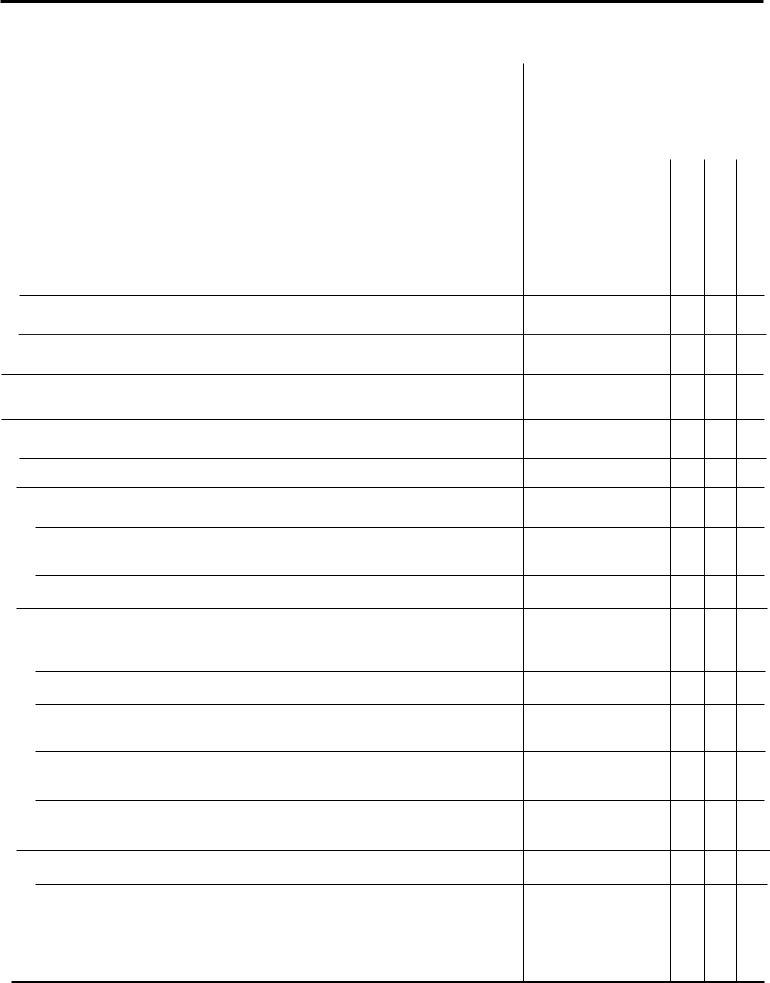

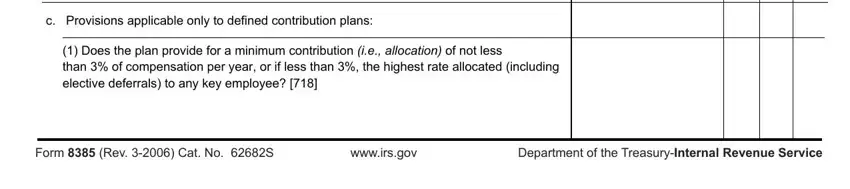

3. Completing c Provisions applicable only to, Does the plan provide for a, and Form Rev Cat No S wwwirsgov is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

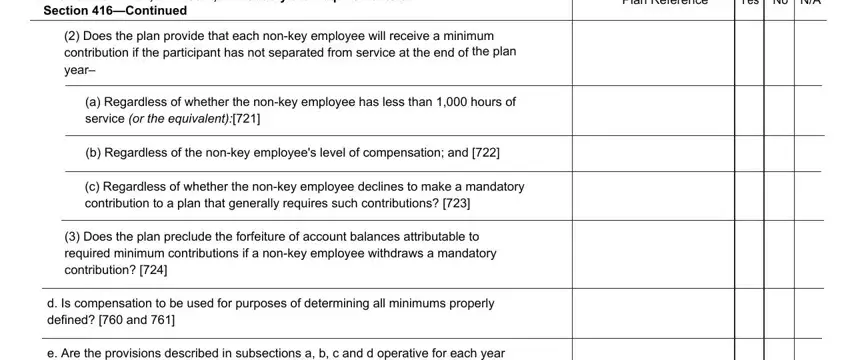

4. Completing II Provisions Which If Present, Section Continued, Plan Reference, Yes No, Does the plan provide that each, a Regardless of whether the nonkey, b Regardless of the nonkey, c Regardless of whether the nonkey, Does the plan preclude the, d Is compensation to be used for, and e Are the provisions described in is paramount in this next part - make sure you spend some time and take a close look at each and every empty field!

It's easy to make a mistake while filling in your Section Continued, therefore be sure to reread it before you decide to submit it.

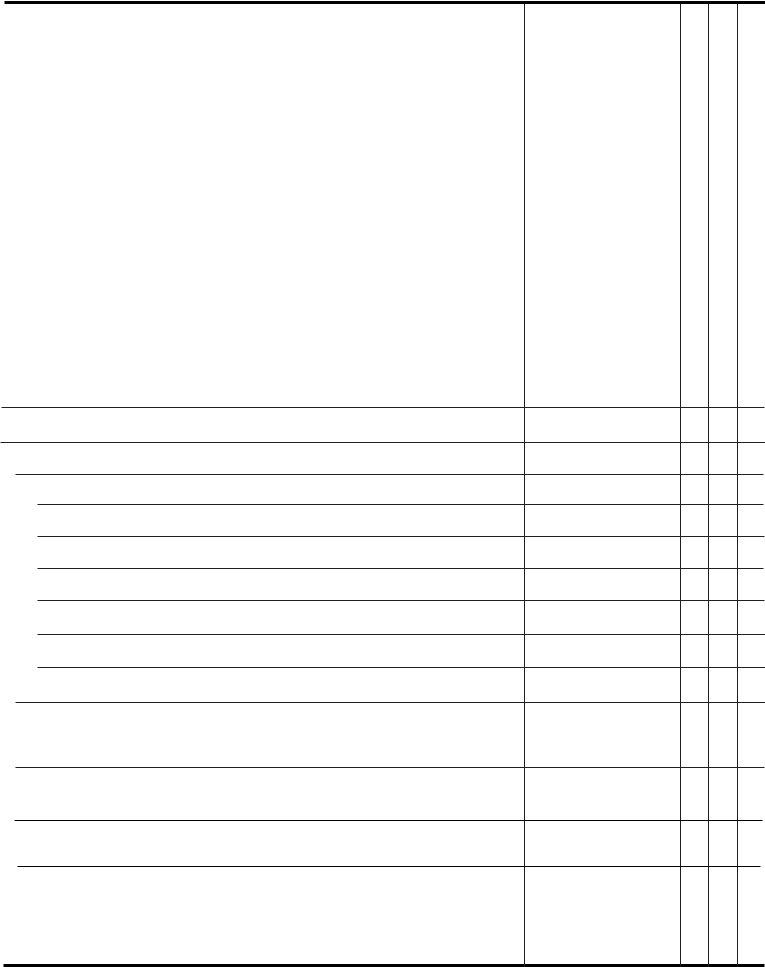

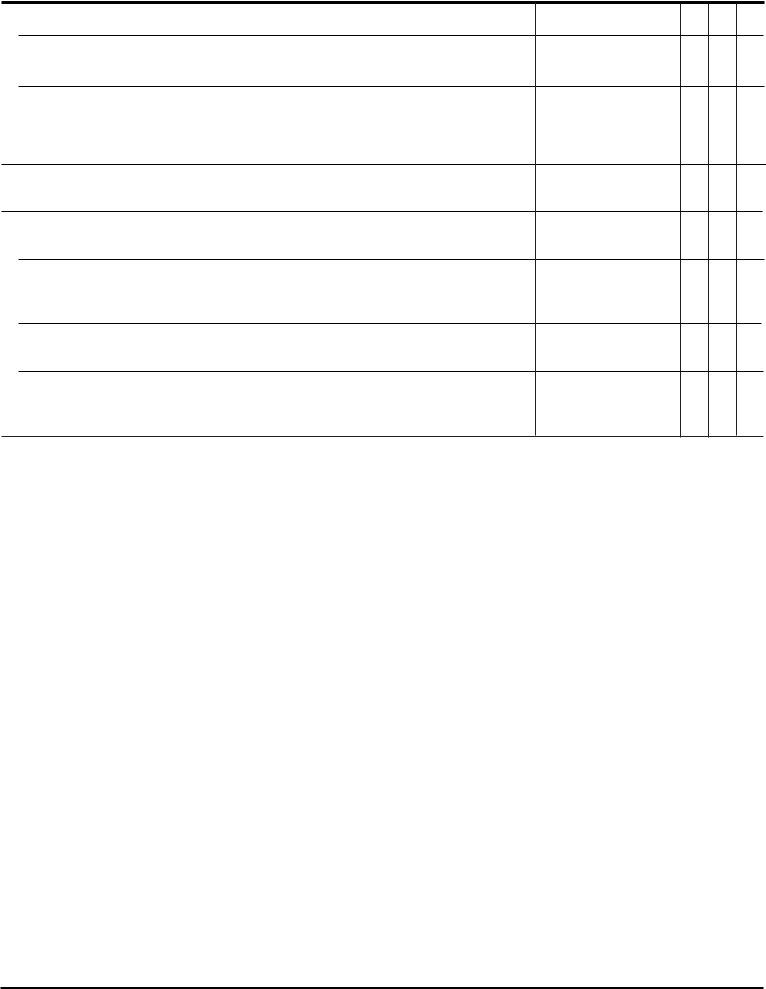

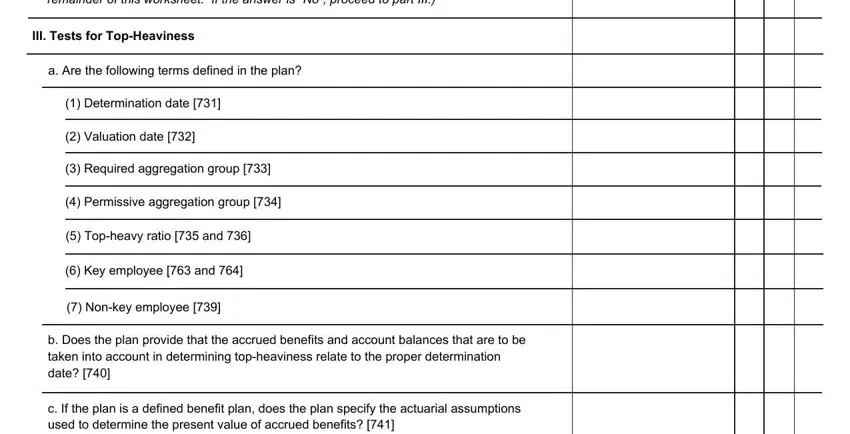

5. As a final point, this final subsection is what you should wrap up prior to using the form. The blank fields here are the next: e Are the provisions described in, If the answer is No proceed to, III Tests for TopHeaviness, a Are the following terms defined, Determination date, Valuation date, Required aggregation group, Permissive aggregation group, Topheavy ratio and, Key employee and, Nonkey employee, b Does the plan provide that the, and c If the plan is a defined benefit.

Step 3: Soon after looking through your fields and details, hit "Done" and you are good to go! Go for a free trial option at FormsPal and acquire direct access to Form 8385 - downloadable, emailable, and editable inside your FormsPal account page. Here at FormsPal.com, we strive to ensure that all of your information is kept private.