Handling PDF files online is always a piece of cake using our PDF editor. You can fill in alaska form use declaration here within minutes. To make our tool better and less complicated to use, we continuously work on new features, taking into consideration feedback from our users. With just several basic steps, you may begin your PDF editing:

Step 1: Click on the "Get Form" button above. It's going to open up our pdf editor so that you could begin filling out your form.

Step 2: This editor will let you customize your PDF document in a variety of ways. Change it with your own text, adjust what's already in the document, and put in a signature - all possible within minutes!

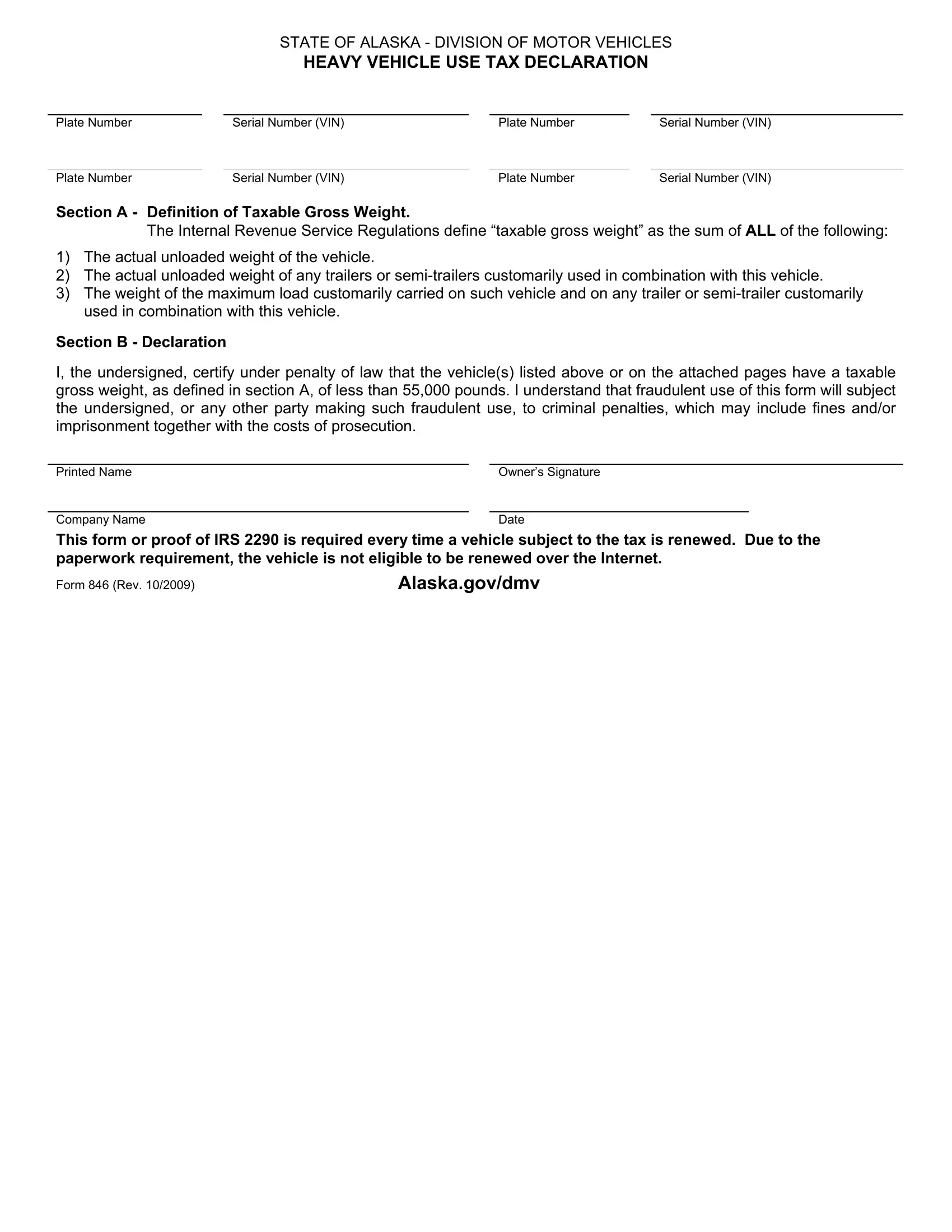

As for the fields of this specific PDF, here is what you should do:

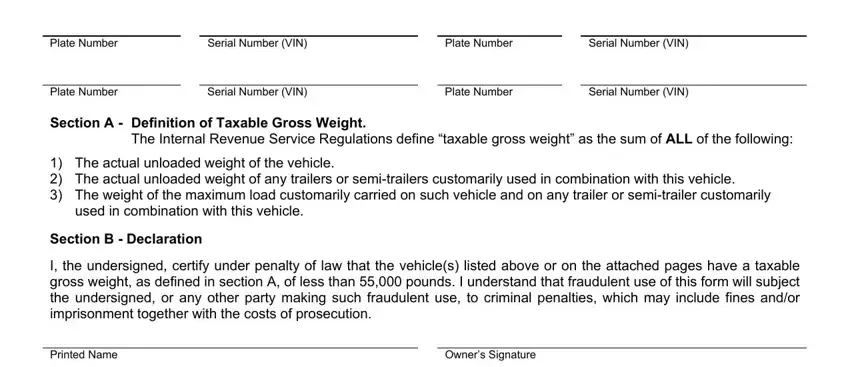

1. For starters, while filling in the alaska form use declaration, start in the area that includes the subsequent blanks:

2. The subsequent part is usually to fill out these particular blank fields: Section B Declaration I the, Date, and Form Rev Alaskagovdmv.

You can easily get it wrong when filling in the Date, and so make sure to look again before you'll submit it.

Step 3: Before finishing your document, make sure that all blanks were filled in the right way. Once you confirm that it is fine, click “Done." Sign up with us today and easily access alaska form use declaration, ready for downloading. Every change made is conveniently preserved , letting you modify the pdf at a later stage as needed. We don't share or sell the information you enter while working with documents at our site.